The Apollo Crypto Fund is an award-winning multi-strategy fund that invests in the crypto assets that are powering a new financial infrastructure. The Apollo Crypto Fund is led by a team with a rare combination of traditional funds management and crypto asset experience.

Multi-Strategy Approach

Apollo Crypto offers three funds that vary in risk / return. Investors can choose to invest in the Apollo Crypto Fund, which has exposure to Bitcoin, Ethereum and the sub-funds, or invest in one of the sub-funds directly.

Portfolio Allocations

- Bitcoin & Ethereum

- Early Stage Projects

- Smart Contract Platforms

- DeFi Projects

- AI Infrastructure

- Market Neutral Strategies

Portfolio Allocations

- Bitcoin & Ethereum

- Early Stage Projects

- Smart Contract Platforms

- DeFi Projects

- AI Infrastructure

- Market Neutral Strategies

Portfolio Allocations

- Bitcoin & Ethereum

- Early Stage Projects

- Smart Contract Platforms

- DeFi Projects

- AI Infrastructure

- Market Neutral Strategies

Portfolio Allocations

- Bitcoin & Ethereum

- Early Stage Projects

- Smart Contract Platforms

- DeFi Projects

- AI Infrastructure

- Market Neutral Strategies

Fund 01

The Funds

Crypto assets act as a hedge against macroeconomic uncertainty.

Money as we know it has only existed for 50 years. For the thousands of years prior, money was always tied to scarce resources such as gold and other commodities.

The global economy has amassed record levels of debt.

Governmental response around the world has been to print more and more money. Historically, this has resulted in a reduction in value of the existing money. The response from central banks around the world to print more money is an experiment.

The next financial crisis may drive significant crypto adoption given its lack of correlation with existing assets and its seizure and inflation resistant properties.

Open and permissionless innovation on a global scale.

Crypto assets leverage the technological possibilities of the digital age to create decentralised applications that aim to empower the individual and take away control from third party intermediaries.

Decentralised Finance (DeFi) represents the first time in human history that we have open and permissionless innovation in finance on a global scale.

Over the coming years, blockchain developers will continue to build a more efficient, fair and open financial system. We believe that there will be many opportunities to participate in projects that will be the first of their kind and shape the future financial system.

Bitcoin will act as a pillar of value to this new and modern financial system that is fundamentally superior to the slower moving legacy financial system.

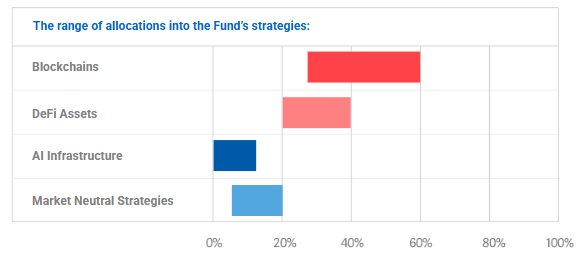

The fund’s strategies include:

.01 Blockchains

Actively managed core positions in key blockchains with long term potential to foster a thriving defi ecosystem.

.02 DeFi Assets

Select investments in the market leading platforms and in promising, early stage projects.

.03 AI Infrastructure

Liquid investments in the crossover between AI and DeFi that will power the future of agentic finance and intents based user experiences in financial applications.

.04 Market Neutral Strategies

An investment in the Apollo Capital Opportunities Fund, an absolute return fund designed to capture price-insensitive opportunities in inefficient crypto markets.

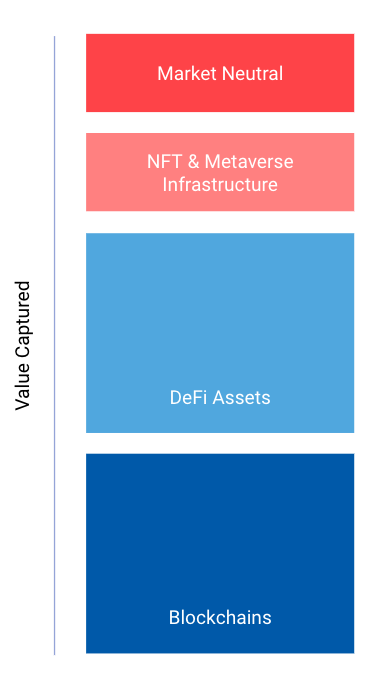

We believe tremendous long-term value will be created in the crypto assets running core blockchains, DeFi applications and AI infrastructure.

- A select number of blockchains will comprise the core of the next generation of computing infrastructure.

These currently include Bitcoin, Ethereum, Binance Smart Chain, Polkadot, Solana, and Avalanche. - Middleware infrastructure are built on top of blockchains. Our middleware assets portfolio is focused on Decentralised Finance (DeFi), this infrastructure is currently built mostly on Ethereum.

- As innovation occurs and applications are built on top of these building blocks, demand for crypto assets will increase.

EXAMPLE

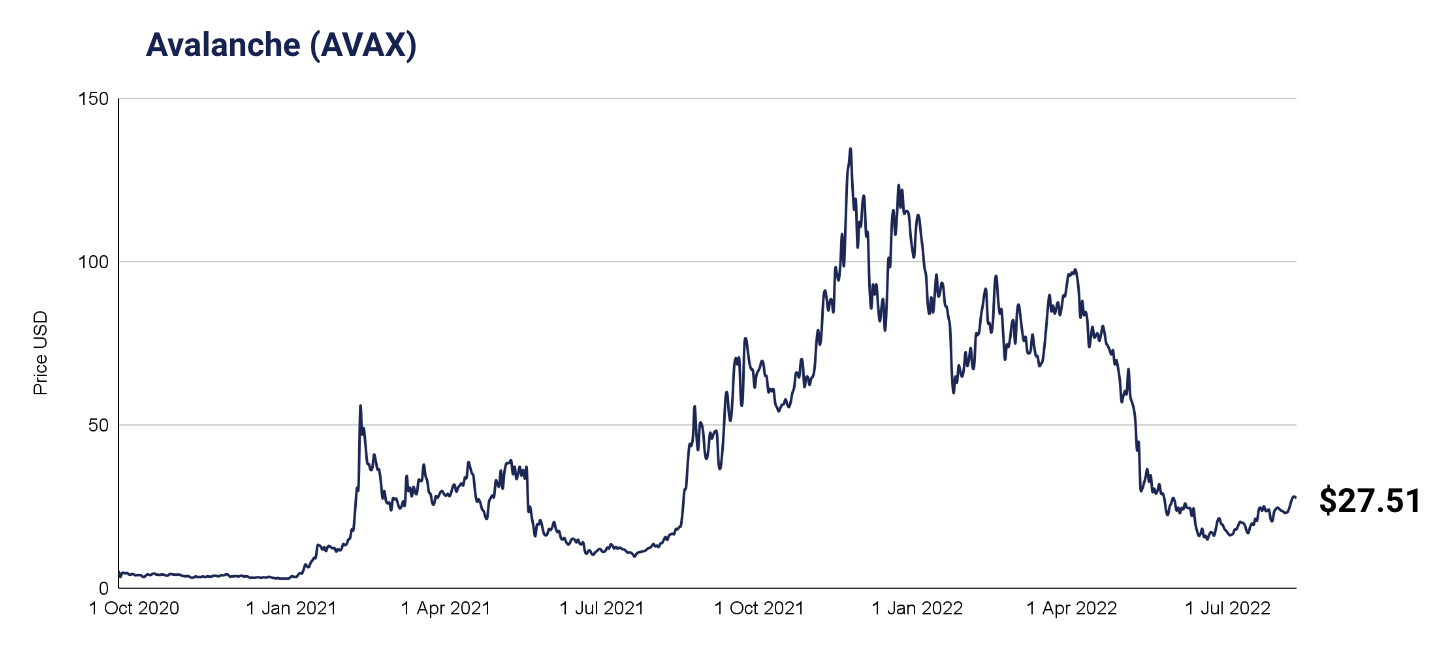

Avalanche (AVAX) is a competing Layer 1 blockchain to Ethereum, and it differentiates itself as the first proof-of-stake blockchain to come to market. Its consensus mechanism currently allows for cheaper and faster transactions than Ethereum.

Avalanche has been one of the most successful primary deals for Apollo Capital to date. Our team can consistently recognise the potential for new Layer 1 smart contract platforms with a DeFi focus, and acquire allocations in the most promising new projects.

We believe in a multi-chain future and that several chains with a strong product-market fit in DeFi will be successful over the long term.

Initial Investment: SAFT investment at $0.50, June 2020.

Mitigation Strategy

By having a strong understanding of the fundamental and economic value of crypto assets, we are able to properly understand the valuations and price action of crypto assets.

Despite short term volatility, over the longer term, we believe our core positions will continue to accrue value. Diversification and position sizing are key risk management tools for this strategy.

Smart Contract Risk

Some of our core positions may involve locking funds into smart contracts for additional yield. Smart contract risk is the risk that a bug or exploit by attackers will result in a loss of funds. To mitigate this risk we critically evaluate the security of any smart contract and make sure that the project is sufficiently audited.

Fund 02

THE APOLLO CRYPTO FRONTIER FUND

The Apollo Crypto Frontier Fund invest in the promising investment opportunities across Blockchains, DeFi Assets and AI Infrastructure, with an emphasis on early-stage projects.

The Fund is domiciled in the Cayman Islands. Under Cayman Law, offers can only be made on a private basis and the information presented here is not intended to being an offering and/or invitation to the public to invest in the Funds.

Get more infoFund 03

THE APOLLO CRYPTO MARKET NEUTRAL FUND

The Apollo Crypto Market Neutral Fund seeks to deliver meaningful returns by exploiting inefficiencies in crypto markets, with a focus on preservation of capital.

The Fund is domiciled in the British Virgin Islands. Under British Virgin Island’s law, offers can only be made on a private basis and the information presented here is not intended to being an offering and/or invitation to the public to invest in the Funds.

Get more info