categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

2022 Predictions Review

by Henrik Andersson

I have reviewed my predictions from last year and provided commentary against all five. Some of these predictions did not come to fruition in 2022 due to the various black swan events. However, I am still confident in these predictions eventuating into 2023 and beyond.

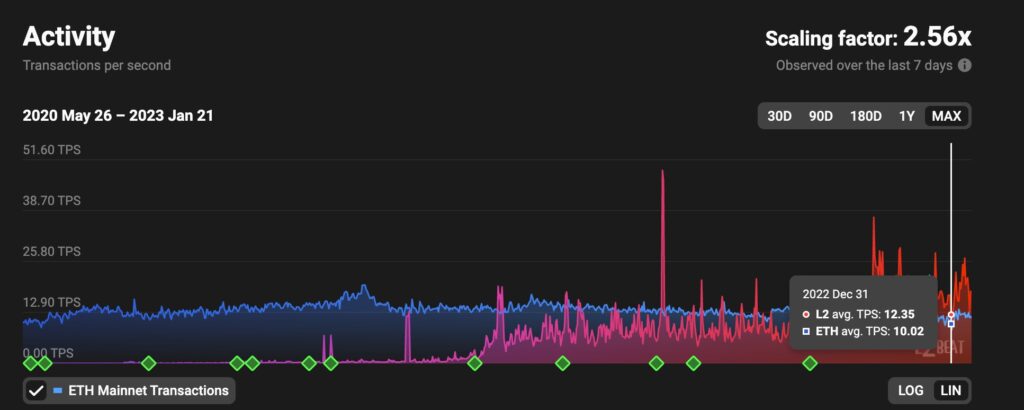

Scaling

2022 will be the year of scaling Ethereum. Together with alternative Layer 1s, my prediction is that Ethereum Layer 1 will become less than 50% of total DeFi TVL in 2022. By the end of 2022, the majority of TVL will be on Ethereum Layer 2s and alternative L1s. This would be a huge shift in the market, accelerated by the launch of L2 tokens on Arbitrum and Optimism. For the first time, blockchains will be able to onboard 100’s of millions of users.

This prediction did not play out in 2022. However, I am still confident in the total Layer 2 TVL outgrowing Ethereum’s as they continue to thrive, and serve their purpose as a home for applications and users whilst mainnet transitions into the ‘settlement’ layer for transactions.

Total TVL in DeFi ended the year with US$29.12 billion, and Ethereum’s total TVL is still above 50% at US$23.17 billion. Total TVL on Layers 2s ended the year at US$4.11 billion, with the top two performers being Arbitrum (ARB) and Optimism (OP), at US$1.02 billion and US$0.55 billion, respectively.

Layer 2 platforms took slightly longer than anticipated to develop on their mainnets. A promising milestone we saw at the end of 2022 was the activity on L2s averaged higher than activity on the Ethereum mainnet, measured in Average transactions per second.

https://l2beat.com/scaling/activity

DeFi/Derivatives

While the general market rallied in 2021, a surprising number of DeFi assets underperformed, some even posting negative fiat-denominated returns for the full year. I think we will see a resurgence in DeFi assets in 2022, partly helped by scaling that will enable things like on-chain derivatives to a much larger extent. My prediction is for $1 trillion in DeFi TVL by the end of the year.

Unfortunately, the highest total TVL in DeFi peaked at US$171.44 billion in early January before slowly rolling into a Bear Market by mid-2022. The price of crypto assets dropped significantly, which means the fiat dollar value of TVL also dropped significantly.

While total TVL dropped significantly throughout the year, derivatives protocols had a breakout year in 2022. The biggest standout performer in this category is GMX, a perpetual derivatives protocol on Arbitrum and Avalanche. Over the past 15 months, GMX has achieved almost US$78 billion in volume and generated over US$110 million in fees.

https://defillama.com/

Multi-Chain

2021 was the year that cemented the thesis that we are moving into a multi-chain world. Infrastructure projects enabling this future, things like multi-chain DEXes and bridges, will significantly increase in value in 2022. My prediction is that we will see at least one of these multi-chain infrastructure projects enter the top 20 most valuable crypto assets.

With the bearish conditions dominating 2022, there was a decrease in activity across all chains translating into a decrease in demand for multi-chain DEXes and bridge infrastructure. While absolute volumes and TVL for cross-chain bridges has not increased significantly, we are seeing promising early stage development in natively cross-chain DeFi applications, of which we have made investments in.

Cosmos Hub (ATOM) is a multichain asset that currently sits within the top 20 crypto assets. Cosmos is known as a Layer-0 chain and utilises Inter-Blockchain Communication Protocol (IBC) to enable seamless transactions across chains. Throughout 2022 we saw Cosmos achieve greater market traction and added ATOM to the Apollo portfolio.

Regulatory Headwinds

We didn’t see many regulatory developments in 2021. Perhaps the biggest development was the approval of the first Bitcoin ETF in the US (unfortunately, futures based). My prediction is that we will see negative regulatory developments out of the US in 2022. Influential senators like Elizabeth Warren (who Ryan Selkis of Messari refers to as Satan) have recently expressed deeply flawed and negative bias against crypto. My hope is that any negative development out of the US will not spill over to the rest of the world.

For better or worse, there was little positive movement on the crypto regulatory front in the US Congress, nor was a spot Bitcoin ETF approved by the SEC, which remains very disappointing The SEC, under Gary Gensler, seems to have a bias towards after-the-fact enforcement rather than proactive regulatory clarity.

PwC has recently published its PwC Global Crypto Regulation Report for 2023, which covers the current state of crypto regulation jurisdictions around the world. For a summary of selected jurisdictions, please read from page 18.

PwC Global Crypto Regulation Report 2023

Web3/Metaverse

A mega-trend in 2021 was NFTs going mainstream. Currently, NFTs are mostly used for art, collectibles, and for in-game items. All these areas will continue to grow rapidly. Another potentially huge growth area of NFTs is the metaverse. My prediction is that we will see another mega-corporation, the likes of Google or Apple, follow Meta (formerly Facebook) and launch products/services to support metaverse.

The most notable mega-brand adopting the metaverse for 2022 was Walt Disney. Their chief executive officer, Bob Chapek, announced in November last year future plans for his entertainment company, which include adopting blockchain technology and the metaverse to enhance storytelling for the next 100 years. As for arguably the top, too, most recognisable brands in clothing, Louis Vuitton and Nike for launched their own NFT collections and began building out their own metaverse games with ‘Louis: The Game’ and ‘Nikeland’ in 2022.

Feature Image Source: https://cryptoslate.com/