categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Developer Activity Report

by David Angliss

Introduction

This article will cover developer activity’s fastest and largest growing smart contract ecosystems. Apollo Capital uses these metrics to help understand which ecosystems are the most collaborative, vibrant and committed to building long-lasting blockchains that can withstand the various crypto market cycles and external macroeconomic factors.

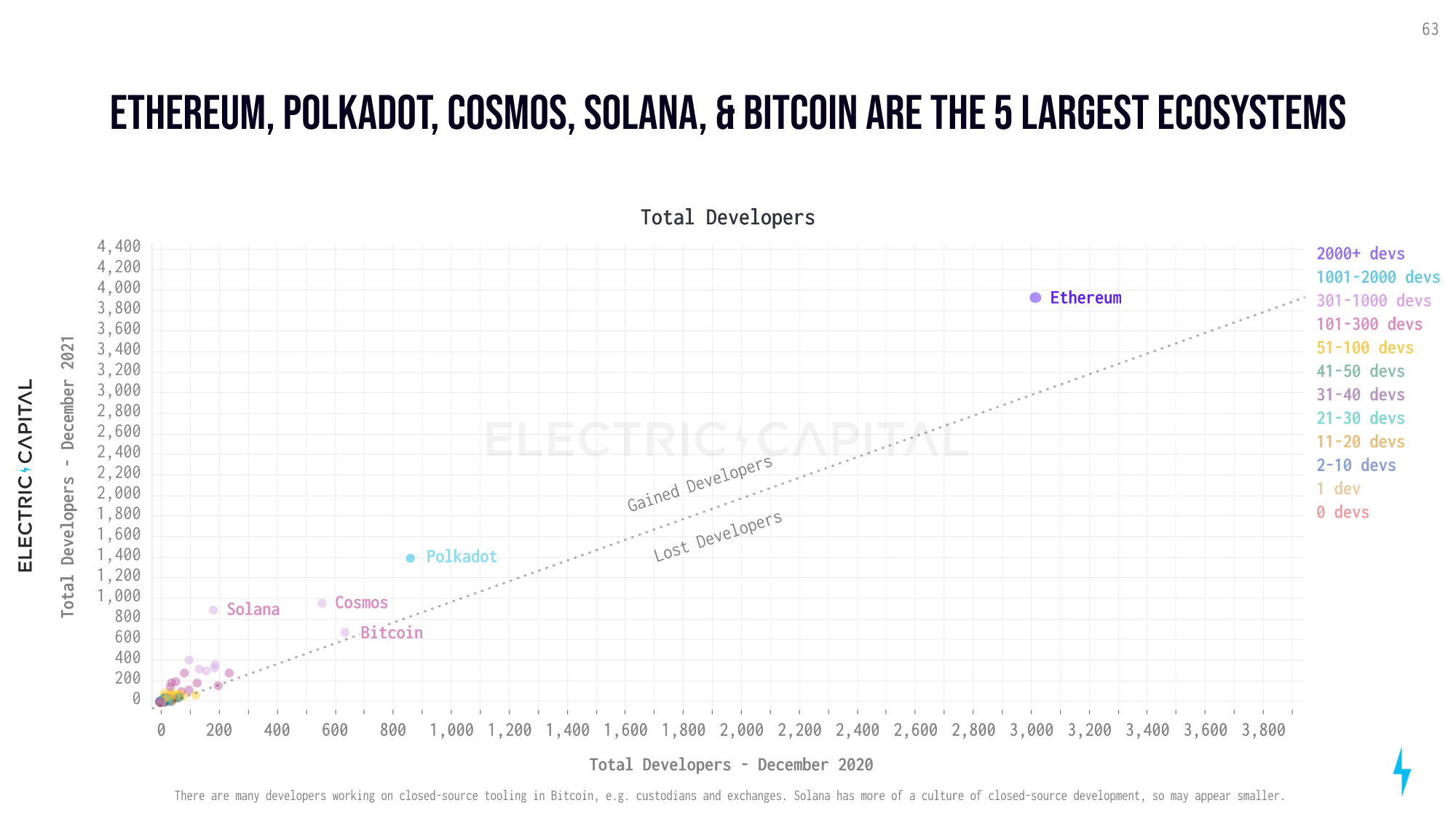

Below are the five largest smart contract platforms by total developers and a summary of their metrics. The y-axis indicates the average monthly Full-Time developers in 2021 and the x-axis indicates the average monthly Full-Time developers in 2020. All five of the largest ecosystems grew over the course of 2021.

Ethereum (ETH)

Ethereum is the number one blockchain when looking into layer one developer activity. The network enables users and developers to interact with smart contracts, digital assets and decentralised finance applications. It is currently the leading chain regarding non-fungible token (NFT) volume and TVL in its decentralised finance sector.

- Over 4000 total monthly active developers

- Frontier for development in defi

- 42% increase of total monthly active developers from December 2020 to December 2021

Polkadot (DOT)

Polkadot is the second-largest layer one blockchain in regards to development activity. The network provides high energy efficiency, economic scalability, and an innovative opportunity for their parachain developers to gain complete control over the underlying blockchain instead of only via smart contracts. This unique feature allows for a more secure, faster and enhanced service across the entire ecosystem.

- Approximately 1400 total monthly active developers

- 50% increase of total monthly active developers from December 2020 to December 2021

Solana (SOL)

Solana is a high speed, low-cost layer one blockchain that supports smart contract interactions for decentralised applications and non-fungible tokens (NFTs). Solana’s security and scalability solution ensures the chain is censorship-resistant and transactions never exceed $0.01 per transaction.

- Approximately 1000 total monthly active developers

- 385% increase of total monthly active developers from December 2020 to December 2021

Cosmos (ATOM)

Cosmos is a decentralised ecosystem of blockchains with its solutions to problems, including scalability, usability and interoperability. The network makes blockchain development easy and powerful with high application scalability through its horizontal and vertical scalability solutions. Cosmos aims to break barriers between blockchains and allow them to communicate with each other in a decentralised way.

- Approximately 1000 total monthly active developers

- 70% increase of total monthly active developers from December 2020 to December 2021

Bitcoin (BTC)

Bitcoin is a decentralised digital currency that uses peer to peer technology to eliminate central control. Bitcoin’s network is open-sourced and is used as a unique payment network with fast peer-to-peer transactions, low processing fees and security.

- Over 650 total monthly active developers

- 10% increase of total monthly active developers from December 2020 to December 2021

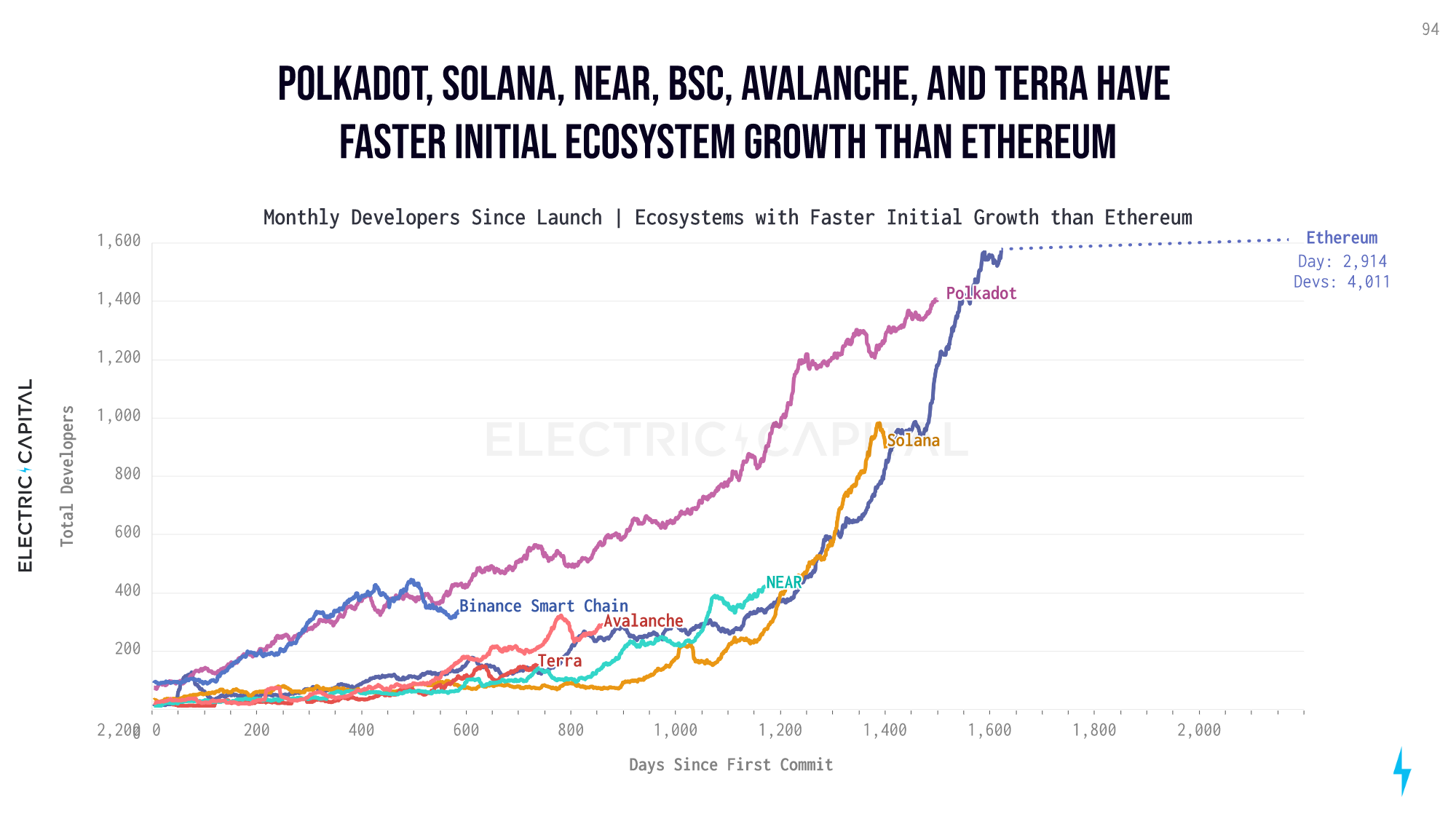

The next graph we displayed shows a comparison of the top smart contract ecosystem’s total developer growth since their inception on the same scale as Ethereum. This graph is another way to visualise the developer’s activity growth rate and in fact, depicts Polkadot, Solana, Near, Avalanche, and BSC as all having faster initial growth in active developers than Ethereum did. Ethereum still leads the field as of December 2021, with a 280% lead in active monthly developers over its top competitor, Polkadot.

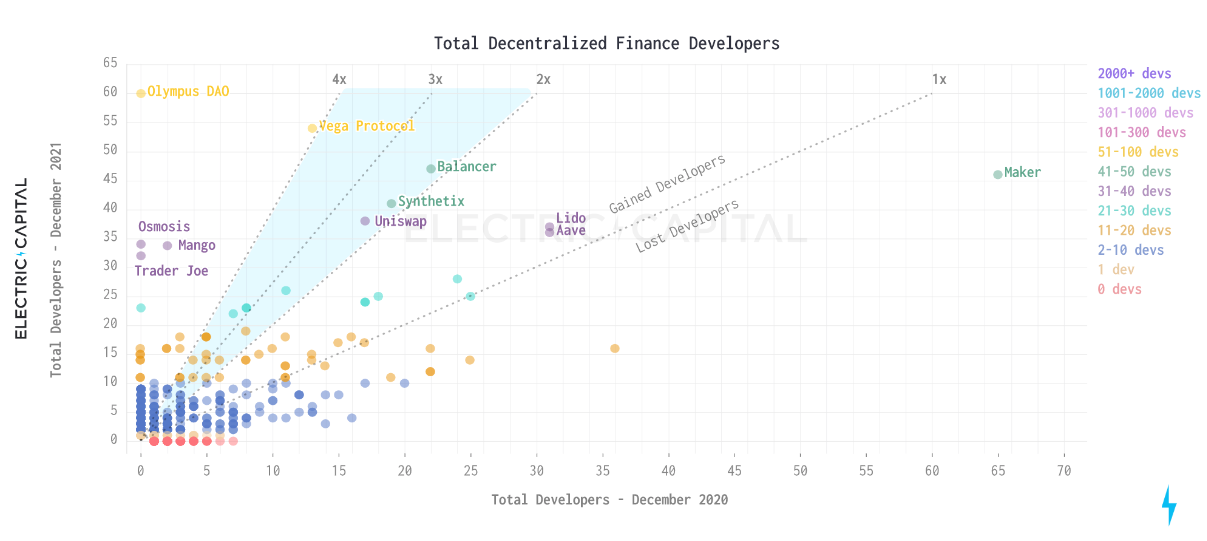

Zooming into the DeFi application level of crypto assets we can observe DeFi had a strong uptick in developer activity over the course of 2021 in the ‘blue-chip’ DeFi protocols.

This graph gives the rate of change in the number of total decentralised finance (DeFi) developers from December 2020 to December 2021. Here we see some of the most reputable DeFi protocols, such as Balancer, Synthetix, Uniswap, Lido and Aave, all experience relatively significant increases in their growth in the DeFi sector. Balancer, Synthtix and Uniswap experienced a substantial shift in the number of Defi developers working on their protocols with an increase of over 100% in the one year. Lido and Aave also continued to grow in Defi development with increases of approximately 16% and 13%, respectively.

The developer engagement and its organic growth are some of the most essential fundamental metrics crypto asset investors will use when making investment decisions. The importance of these metrics is heightened in periods of downward and sideways price action in assets across the industry as it is these periods when the market is fearful when fragile ecosystems tend to decline in developer activity, whilst the strongest developer ecosystems remain robust through periods of uncertainty.

Disclaimer: Apollo Capital has invested in some of the crypto assets mentioned throughout the article. This article should not be misconstrued as investment advice and should be for educational purposes only.

Thank you to Electic Capital for the metrics in our analysis, the images utilized for this article can be found accessed via the following link – Electric Capital Developer Report.