categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

DeFi’s Resilience

by Quinn Papworth

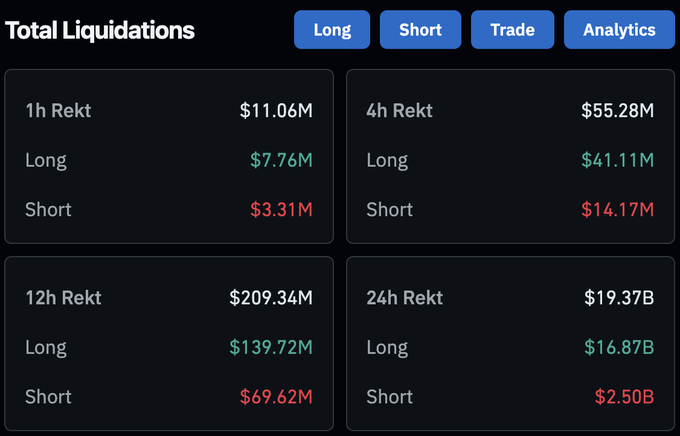

Over the weekend we saw the largest liquidation event in crypto history with over US$20B+ in liquidations, primarily in CeFi (centralised finance). President Donald Trump’s announcement of a 100% tariff on all Chinese goods was the primary macro event that triggered these massive crypto liquidations on Friday. This surprise policy shift, ignited a global risk-off sentiment, leading to a sharp sell-off across equities, commodities, and crypto assets.

This resulted in Bitcoin falling 13% in a single hour, while losses in many long-tail tokens were far steeper (however comparatively bluechip DeFi tokens outperformed the majority of alternatives). As a result we saw $65 billion in open interest erased quickly which saw centralised venues with severe price dislocations after their order books had been thinned and measures such as auto deleveraging taking place resulting in market wide impact.

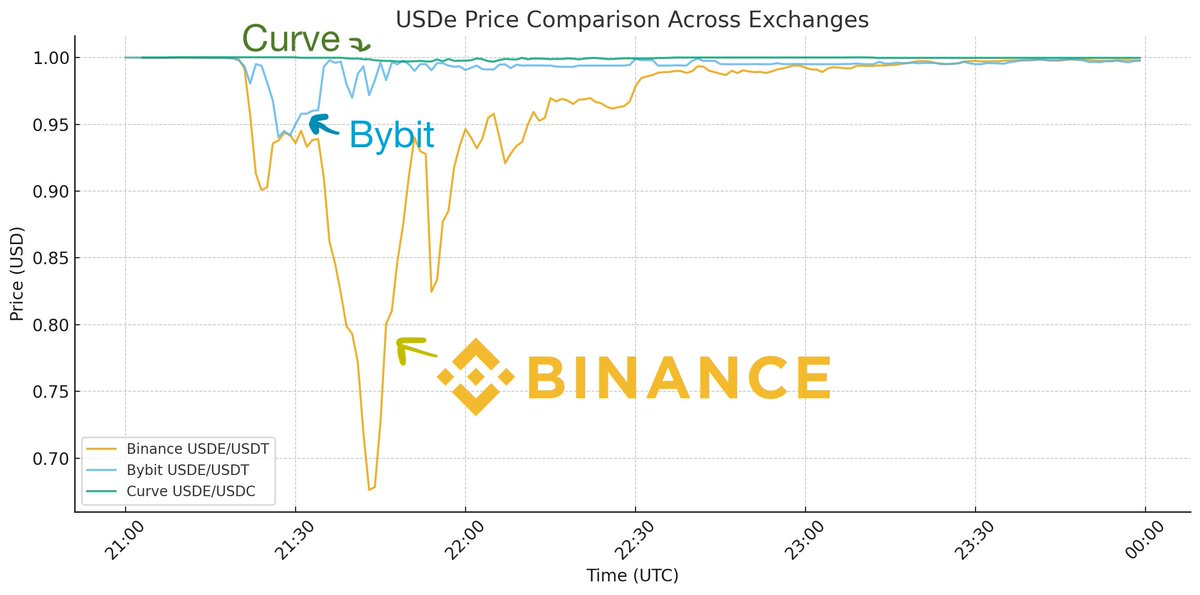

Crypto’s largest centralised exchange, Binance, saw severe price dislocations over the volatility event and have resultantly apologised to users stating ‘there are no excuses’ and now plan to distribute US$283 million in compensation to users affected by depegs in USDE, BNSOL or WBETH. This was an issue with Binance struggling to keep up during the period of volatility as well as issues with their market architecture rather than any issues with the underlying assets.

This of course sparked fears of contagion to other aspects of crypto such as decentralised finance (DeFi). However throughout the volatility DeFi liquidations processed as normal and were quite muted as compared to their centralised counterparts. Bluechip DeFi protocols such as Aave, Euler, Morpho, Fluid, Curve, Pendle etc. all worked as intended over the period, displaying the resiliency of DeFi.

Curve, one of the largest decentralised exchanges (DEXs), which primarily focuses on stablecoin liquidity, was a great example of this stability. During the volatility, USDe saw some price depegging on centralised counterparties, however on Curve USDe price remained stable throughout the entire period.

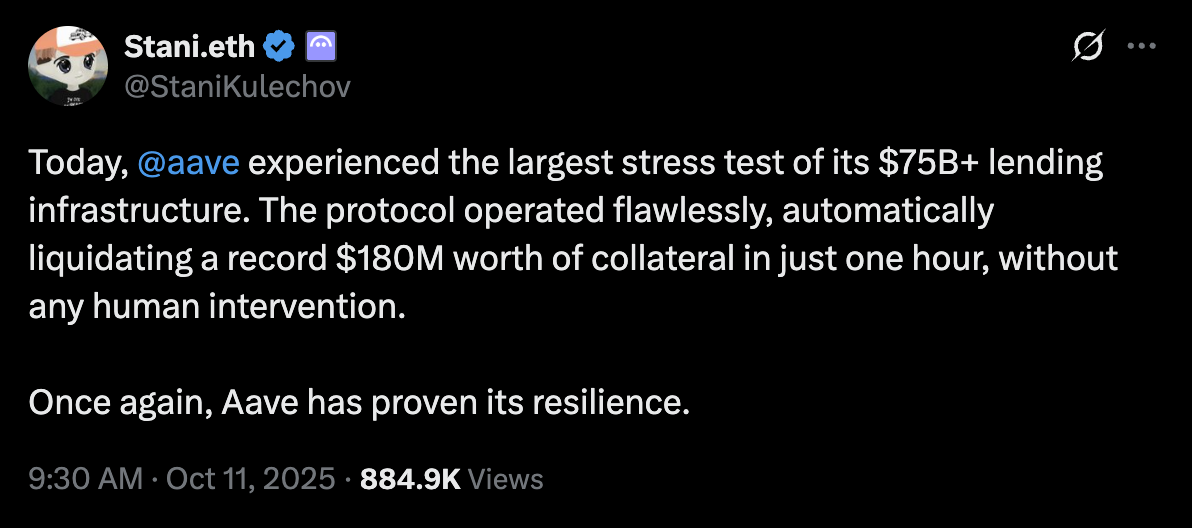

Another case study which functioned flawlessly throughout the weekend are decentralised lending protocols. The largest lending protocol, Aave, liquidated a record US$180m worth of collateral in just one hour without incurring any bad debt.

This means that Aave was actually deeply profitable during this period of volatility and recorded its highest weekly revenue of 2025. All while Aave has more than US$70 billion in deposits placing it at around the size of the 35th largest bank in the United States.

This milestone demonstrates a remarkable truth. A decentralized financial protocol with no physical branches, no central authority, and no intermediaries has reached the scale of a traditional American bank.

Aave is more than just a lending platform. It is living proof that finance can operate autonomously, transparently, and trustlessly, which is a direct answer to centuries of instability rooted in centralized control.

– X / darknight.eth

So why am I highlighting this? Because it is irrefutable proof that the promise of DeFi is playing out on a larger scale than ever before and redefining trust in financial markets.

We no longer need reliance on opaque centralised entities but instead can place our trust in open-source immutable code, executing 24/7 through smart contracts where every transaction is visible in real time. Borrowing and lending are completely automated and liquidity is governed by the community. All of this operating primarily on a blockchain with over 11,000 nodes (Ethereum) and no single point of failure. The value of such a system, especially during a period of high volatility on an illiquid weekend cannot be overstated.

The weekend’s unprecedented $20B+ crypto liquidation event laid bare CeFi’s vulnerabilities, yet it illuminated DeFi’s remarkable resilience, with protocols like Curve and Aave not just surviving but thriving. This turbulence reaffirms DeFi’s core promise: immutable, open-source smart contracts that deliver 24/7 transparent execution, free from single points of failure. It’s irrefutable proof that crypto is redefining financial trust on an unprecedented scale.