categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Ethereum’s Turnaround Against Bitcoin

by Quinn Papworth

The ETH/BTC ratio was in a multi year downtrend this cycle, hitting lows not seen since 2017. This placed the narrative of Ethereum as the “underperformer” versus Bitcoin’s “Digital Gold” narrative. The reasons for this seemed to be that Bitcoin ETFs were initially much more dominant and taking the large majority of flows and that there was uncertainty/narrative fatigue around ETH’s rollup-centric scaling roadmap (scaling through the use of layer 2 networks).

However, recently, we have started to see a reversal of this trend with a significant bounce in the ETH/BTC ratio, up ~100% in the last 6 months. This has shifted Ethereum’s market cap ratio seeing its dominance share creep up to 13% of the total crypto market cap as of the time of writing. This positive price action has of course seen sentiment around Ethereum start to shift in a positive direction once again.

What’s Driving the Momentum?

So what’s been driving the momentum behind Ethereum’s recent surge? I would break it down into three categories; flows, ecosystem growth, ETH’s supply dynamics.

Flows:

The first 6 months of flows for the ETH spot ETFs were relatively slow compared to the flows captured by BTC with roughly US$2.4 billion in net inflows, however in the last 6 months we have seen the pace of the ETH ETFs increase greatly with total net inflows reaching US$14.6 billion as of the time of writing. This has resulted in the ETH ETF flows having actually seen an outsized amount of flows compared to Bitcoin on a relative market cap basis. To us this is signalling significant institutional interest in ETH.

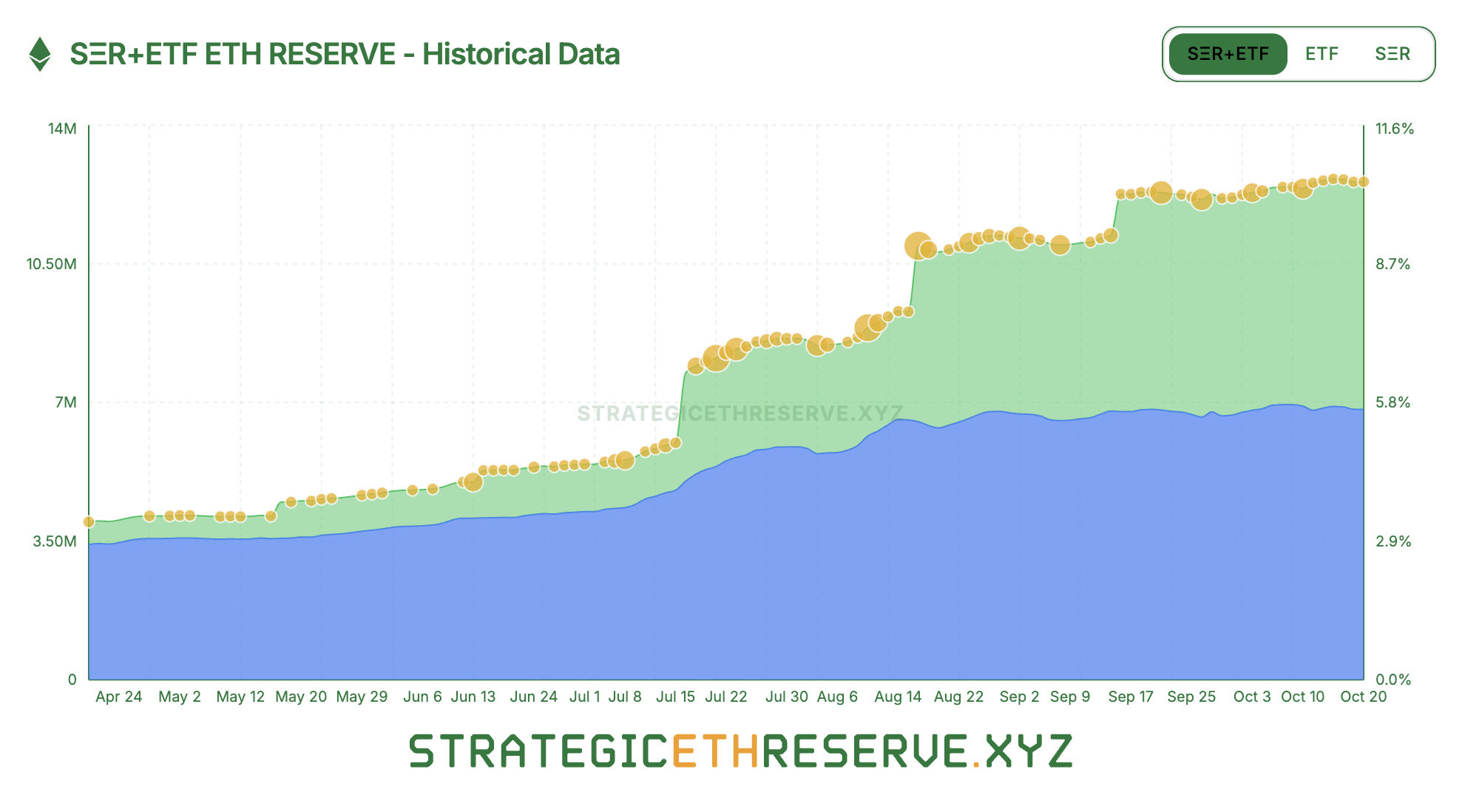

In addition to the large uptake in the ETFs we have seen huge flows coming from digital asset treasury companies (DATs) embracing ETH as a treasury asset. Large DATs have started deploying capital into ETH in the last few months with the likes of Joe Lubin’s (an Ethereum co-founder) Sharplink Gaming (SBET) accumulating US$3.35 billion in ETH 4 months and Tom Lee’s Bitmine Immersion (BMNR) purchasing a massive US$12.1 billion in the span of just 3 months. Strategic ETH reserves and the ETFs combined now hold more than US$47 billion in ETH, accounting for almost 10% of ETH’s total supply.

While institutions have been snapping up ETH so have private buyers with ETH exchange reserves dropping to their lowest levels since 2016. Whale wallets are accumulating more ETH as well with wallets holding > 100k ETH having increased 12% YTD.

Ecosystem Growth:

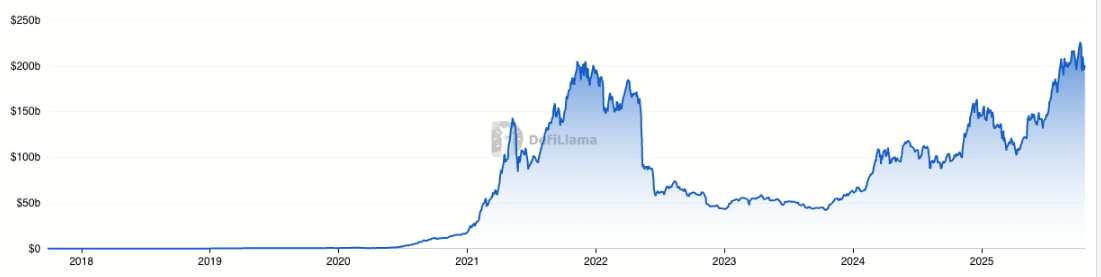

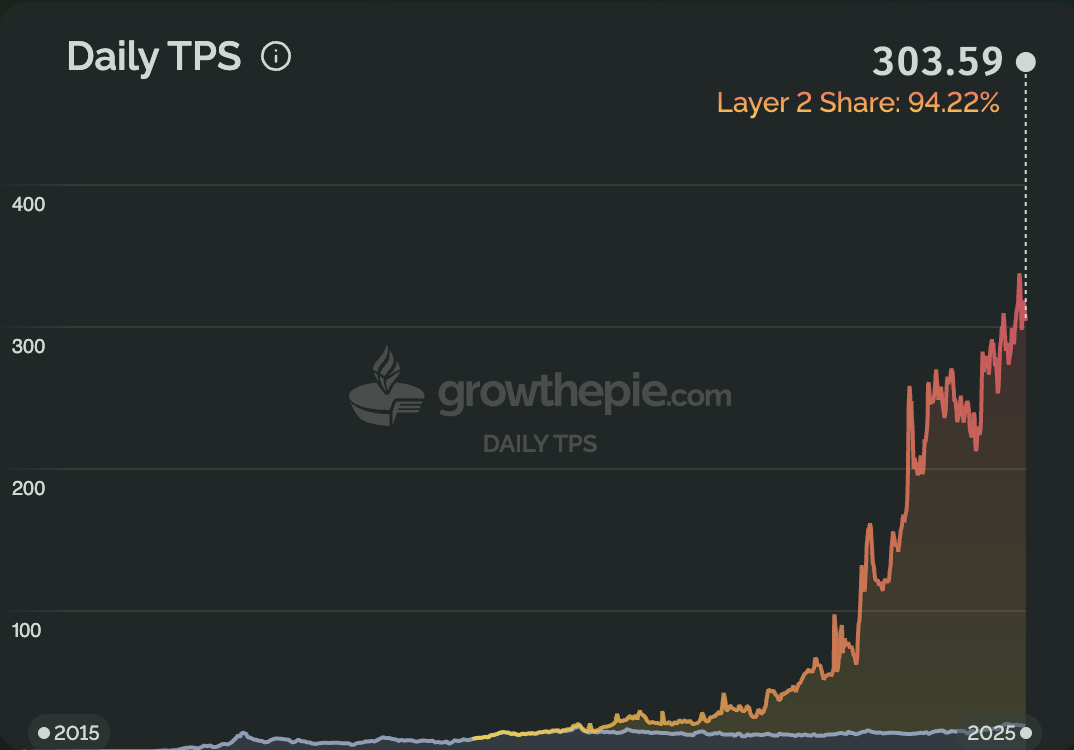

Ethereum’s ecosystem is thriving with its largest use case, decentralised finance (DeFi), making all time highs in activity. Ethereum’s mainnet DeFi total value locked (TVL) has increased ~40% YTD with L2 networks driving significant activity as well, all while providing users with fast low cost transactions. Developers continue to work on Ethereum with the Ethereum ecosystem leading all chains in active developers and code being committed.

ETH supply dynamics:

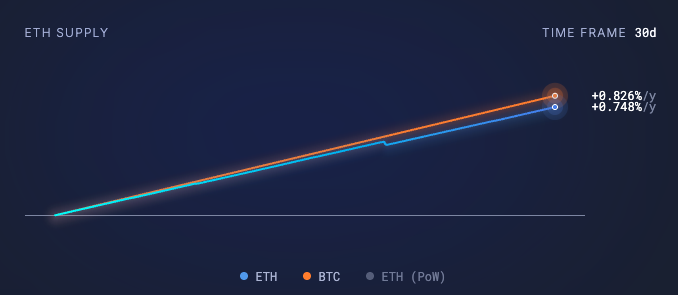

With recent flows snapping up lots of ETH it’s important to consider the supply dynamics of the asset. The net issuance of ETH is actually lower than Bitcoin at 0.75% yearly inflation, this is due to the ETH being pruned as part of transaction activity. ETH is made even more scarce when we consider that 29% of the ETH supply is being staked and 8% of ETH is currently locked in smart contracts.

Why Now?

So this begs the question, why now, why has it been that in the last 6 months investors have started to see the value in Ethereum.

First it is likely due to the pro-crypto sentiment of the Trump administration and the resultant pro-crypto changes that have been made at the SEC and CTFC. We now have CTFC oversight regarding ETH derivatives given its commodity status, this is likely to result in all ETH ETFs to introduce staking in the near future. We have seen the MiCA framework explicitly state ETH as a non-security. Finally we have seen the GENIUS stablecoin bill pass, recognising stablecoins as legitimate financial instruments. This is huge given that the large majority of stablecoins sit within the Ethereum ecosystem.

These positive regulatory changes have caused a significant rise in institutional interest in tokenising products and using onchain markets. This has positioned Ethereum perfectly to capture these flows as the credibly neutral settlement layer that houses the majority of onchain finance and has the largest network effects. We are already seeing this play out with Ethereum far and above becoming the tokenisation leader with more than 70% market share of tokenised products sitting in the Ethereum ecosystem.

Ethereum has also proven its scalability and usability roadmap over the last year with many major scaling upgrades coming to fruition. This has seen the cost of data availability for layer 2s using Ethereum come down by more than 95% enabling significant increases in throughput. This has resulted in a greatly improved user experience for end-users, although critics claim it comes at the cost of fragmentation in its current state.

Finally, reorganisation at the Ethereum Foundation has put business development efforts as a new focus through Etherealize, an institutional product, BD, and marketing arm for the Ethereum ecosystem. This has seen the Etherealize putting out content such as “The Bull Case for ETH”. Every major player is building on Ethereum with the likes of Coinbase, Kraken, Robinhood, Blackrock, etc. the list goes on.

Conclusion

Ethereum’s recent momentum is the culmination of years of building trust, infrastructure and ecosystem. Ethereum’s history from a high level can be marked through three phases

- The pioneering of smart contracts

- DeFi Summer and the explosion of decentralised apps (dApps)

- Scaling wars + L2 maturity

The next phase being played out right now is ‘Ethereum as the base institutional settlement layer for all onchain economic activity’. While Ethereum presents more technical risks than a project like Bitcoin due to its ongoing, changing nature, the upside for Ethereum is far greater as it has the potential to house the future of all of finance.