categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Understanding Yield Basis

by Quinn Papworth

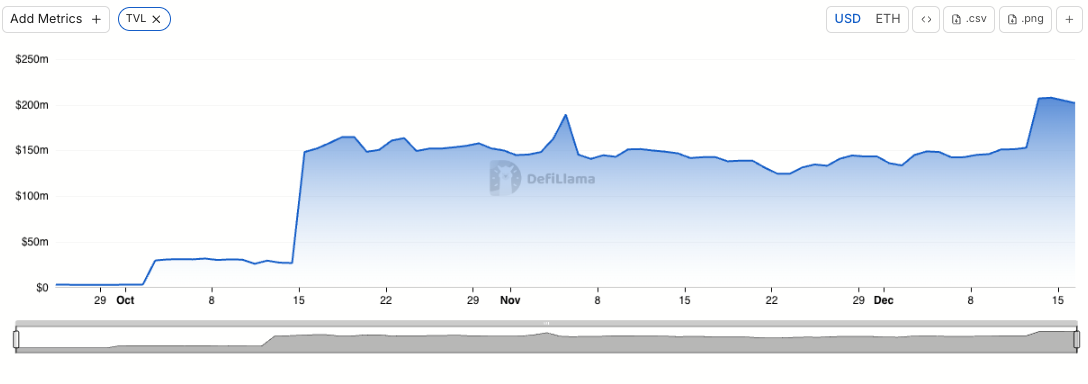

At the beginning of October, Michael Egorov, the founder of Curve finance, launched a new DeFi protocol, Yield Basis, which aims to provide sustainable onchain yield for BTC holders. Since its inception it has seen significant momentum with any capacity on the platform being filled quickly. As of today the protocol holds ~US$200m in Bitcoin deposits and provides depositors with impressive Bitcoin native yields of up to 30%+. The Yield Basis token, YB, launched in mid October and has quickly achieved a market cap in the ~$US40-60 million range. There has recently been more discussion around the token after it activated its fee switch in December 2025 in order to direct protocol revenue to tokenholders.

The problem Yield Basis is solving for (Impermanent Loss)

So, you might be wondering: What exact problem is Yield Basis solving, and why does it even need to exist?

Yield Basis targets impermanent loss (IL), a core issue for liquidity providers (LPs) in traditional automated market maker (AMM) pools in DeFi. Let’s break it down step by step with a clear example.

What is Impermanent Loss?

Impermanent loss is the opportunity cost LPs face when the relative prices of the tokens in a pool change after deposit. In short, the dollar value of your withdrawn assets ends up lower than if you’d simply held them outside the pool (ignoring trading fees for now).

A Simple Example

Imagine an ETH/USDC pool using the classic constant-product formula (x × y = k), where prices are set by the token ratio.

- Alice deposits 1 ETH and 100 USDC when 1 ETH = $100. Her deposit is worth $200 total.

- The total pool has 10 ETH and 1,000 USDC total (so Alice owns a 10% share).

Now, the price of ETH rises to $400 (a 4× increase).

- Arbitrage traders buy ETH from the pool (removing ETH, adding USDC) until the ratio matches the new external price.This is because AMMs don’t have order books but that prices are determined by the ratio of tokens in the pool (x*y=k).

- The pool rebalances to approximately 5 ETH and 2000 USDC

Alice’s 10% share: 0.5 ETH + 200 USDC = value $400

But if Alice had just held her original 1 ETH + 100 USDC?

- 1 ETH now worth $400 + 100 USDC = $500.

That’s a $100 shortfall, her pool position grew to $400, but just holding would have reached $500. This difference is the impermanent loss.

*The above calculation is simplified, a more accurate reflection of value growth is using sqrt p where p is ETH price.

The loss is “impermanent” because if prices return to the original ratio, it disappears. But in volatile pairs like ETH/USDC or BTC/USDC prices rarely stay flat.

Why This is a Big Problem

For volatile assets like BTC or ETH, price ratios almost always shift over time. This means LPs often underperform simple holding. If trading fees don’t fully offset the loss, providing liquidity becomes less profitable compared to just HODLing.

Impermanent loss can be calculated as: Impermanent Loss = 2 * sqrt(price_ratio) / (1+price_ratio) – 1

(Where the price ratio is the ratio between the token price at allocation and withdrawal. )

This discourages deep, sustainable liquidity in DeFi, especially for major assets like Bitcoin, leaving much of the crypto ecosystem unproductive.

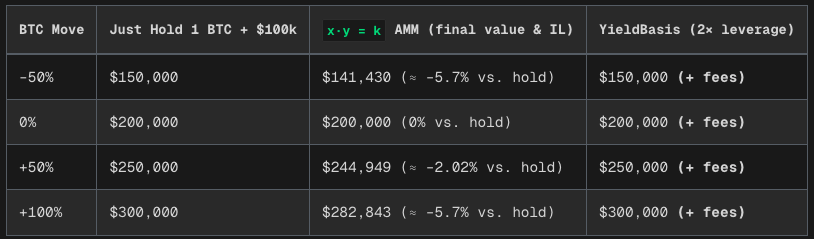

Yield Basis solves this root issue by redesigning the pool mechanics to eliminate impermanent loss entirely, giving LPs full 1:1 exposure to the underlying asset’s price movements while still earning amplified trading fees.

How it achieves this (technical architecture)

Now that we have a better understanding of the underlying issue we can explore the technical architecture Yield Basis is using in order to prevent IL

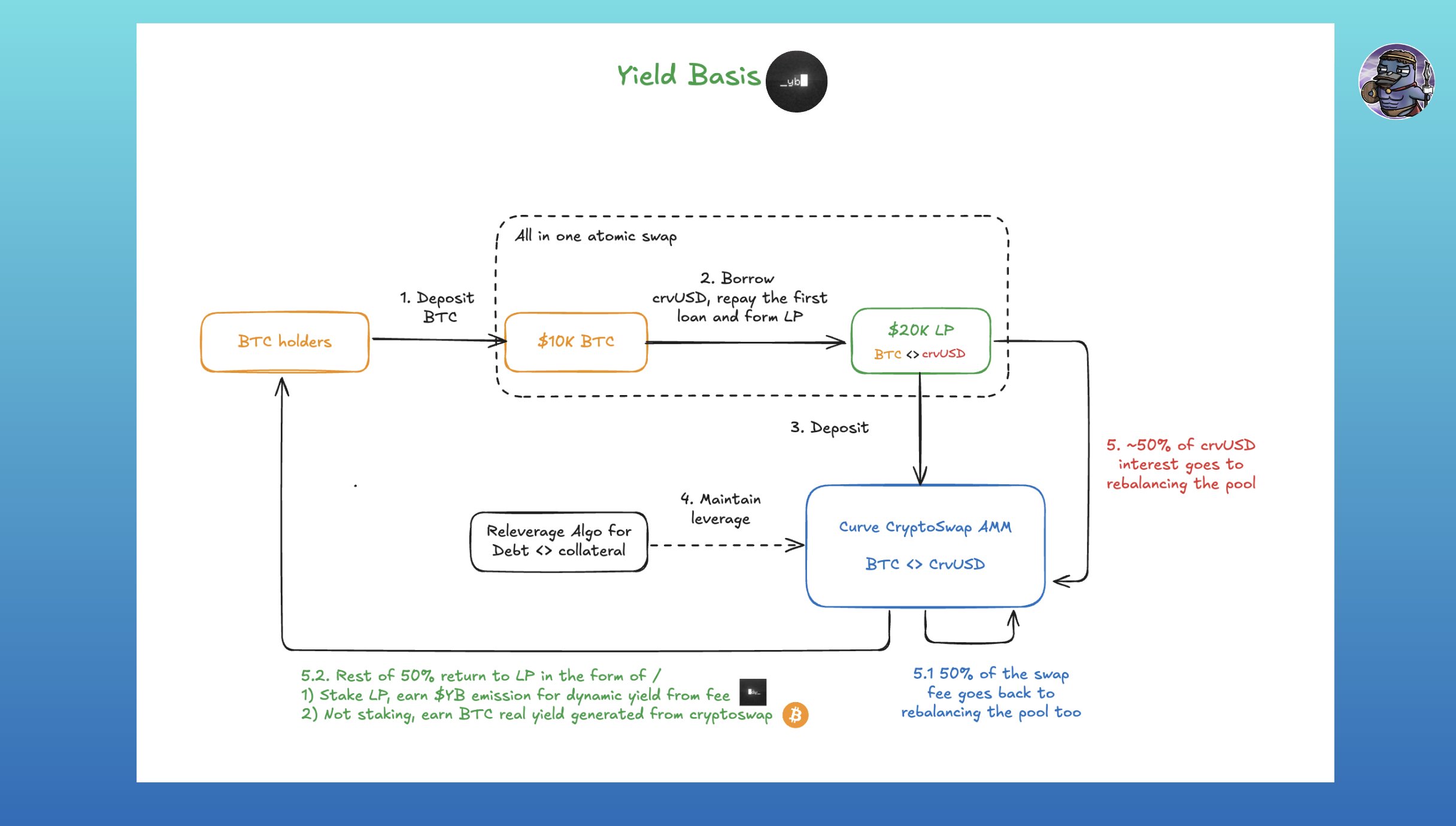

In simple terms since we know that your value in a traditional volatile AMM grows at sqrt p where p is the price of the volatile asset, we can get rid of this behaviour by keeping the position at a constant 2x compounding leverage in order to have your position scale 1:1 with p instead. Thereby eliminating IL. While this might sound okay in theory it can be difficult to understand in practice, so let’s take a look at what this actually looks like for Yield Basis.

- User deposits BTC ($10)

- YB borrows $10 in crvUSD against your BTC in a flashloan

- Form a $20 liquidity pool to borrow another $10 of crvUSD

- Repay the first loan of $10 crvUSD

The resultant outcome is a 2x leveraged liquidity pool at a 50% loan-to-value ratio.

This leaves us with a $20 liquidity pool which is composed of 50% BTC and 50% crvUSD as well as a debt position of $10 crvUSD. This means we actually only have a net exposure equal to the initial $10 BTC while still collecting 2x liquidity pool fees. This results in outcomes where we follow the underlying BTC move but still receive trading fees.

To maintain this 2x leverage, YB uses another specialized AMM to automatically adjust the position by managing debt against your LP, in this way your loan-to-value ratio is kept constant at 50% and impermanent loss is entirely eliminated.

Of the total fees that are collected 50% go back to subsidise the budget for rebalancing the liquidity while the other 50% of fees are distributed to LPs. LPs that provide BTC have two options

- Don’t stake your LP and receive real BTC yield

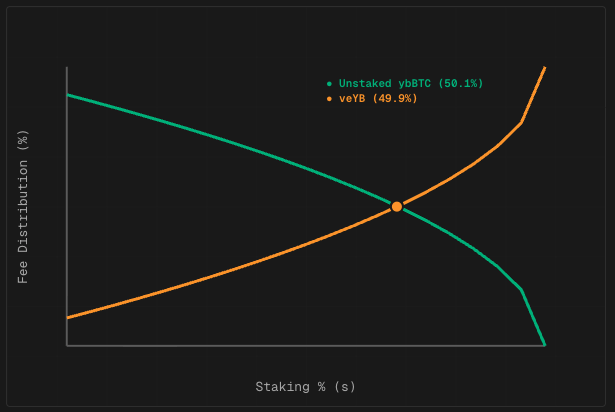

- Stake your LP position (ybBTC) and receive YB emissions instead (emissions increase as more ybBTC gets staked. This creates a natural balance where higher staking leads to higher emissions, but with diminishing returns.)

How this relates to the YB token/ how value is accrued

Ok so DeFi innovation put aside, why should we care about the YB token and how does it accrue any value?

The YB token is valuable due to the fact that it can be locked in order to capture a share of the protocol fees, this is referred to as the admin fee. The fee distribution towards YB lockers (veYB) increases as more ybBTC gets staked. This creates a relationship where as emissions increase so do the fees going toward veYB holders. This creates a natural equilibrium between both staked and unstaked LP positions regardless of market conditions.

So the fee flow looks like this:

- Trading activity in the BTC/crvUSD pools generates fees

- The protocols harvests these fees

- The dynamic admin fee determines the fee split between ybBTC and veYB

- Distribution occurs based on the staking levels

How should we value the YB token?

At a glance the tokenomics for YB are considerably more complex than the average token so it also begs the question: what is a reasonable model we can use in order to put a value on the YB token?

I see there being 4 key metrics

- Protocol TVL

- One of two factors in determining the protocols total revenue, today protocol TVL sits at $US150 million and a credit line from Curve for $1 billion crvUSD has been approved by Curve governance. Allowing for a significant potential increase in TVL

- Organic Yield

- Second key factor in determining the protocols total revenue, I believe using the backtest average of 15% is a fair figure to use here (although current yields at $150m TVL are closer to 20-30%).

- YB Lock rate

- The YB lock rate determines how high the yield is for YB token lockers.

- Min Yield veYB investors demand

- This figure should be determined by comparing to other tokens with veTokenomics and seeing what the average yield veToken holders demand. I found this to be ~30% on average by comping to industry leaders.

With these metrics considered I believe there could be significant potential upside for more value to be directed towards veYB lockers and thereby increase the value of YB tokens overall.

The future outlook for Yield Basis

It is still early days for Yield Basis both as a protocol and a token, however we are seeing significant interest from BTC holders to generate yield with Yield Basis’s solution as it solves the longstanding issue of impermanent loss and provides a sustainable source of yield for BTC that is frankly leagues beyond any other offering. This solution can potentially be rolled out to support tokens other than BTC in the future as well such as ETH and various other assets. I look forward to watching the protocol continue to scale and become more battletested over time while delivering value to veYB holders.

Disclaimer: Apollo Crypto holds YB

This report (‘Report’) has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security of financial product or service. This Report does not constitute a part of any Offer Document issued by Apollo Crypto Management Pty Ltd (ACN 623 059 227, AFSL 525760) or Non Correlated Capital (ACN 143 882 562, AFSL 499882), the Trustee of the Apollo Crypto Fund. Past performance is not necessarily indicative of future results and no person guarantees the performance of any Apollo Crypto financial product or service or the amount or timing of any return from it. This material has been provided for general information purposes and must not be construed as investment advice. Neither this Report nor any Offer Document issued by Apollo Crypto or Non Correlated Capital takes into account your investment objectives, financial situation and particular needs. The information contained in this Report may not be reproduced, used or disclosed, in whole or in part, without prior written consent of Apollo Crypto. This Report has been prepared by Apollo Crypto. Apollo Crypto nor any of its related parties, employees or directors, provides and warrants accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. You should obtain a copy of the Information Memorandum, issued by Non Correlated Capital before making a decision about whether to invest in the Apollo Crypto Fund.