categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

A Small Allocation

by Tim Johnston

Please note this article is not personal financial advice. Apollo Capital are not privy to your personal financial circumstance therefore this article is general in its nature. The simulated portfolio weightings included in this article are for illustration purposes and should not be used as a guide for structuring your portfolio. Please do your own research and seek professional advice.

We believe there is a clear and strong case for investors to consider a small allocation to crypto assets in their portfolios.

There are a number of competing tensions for investors to balance. Crypto assets offer enormous return potential, mostly uncorrelated to traditional assets. However, they are not without risk. The asset class is still young and prices are highly volatile.

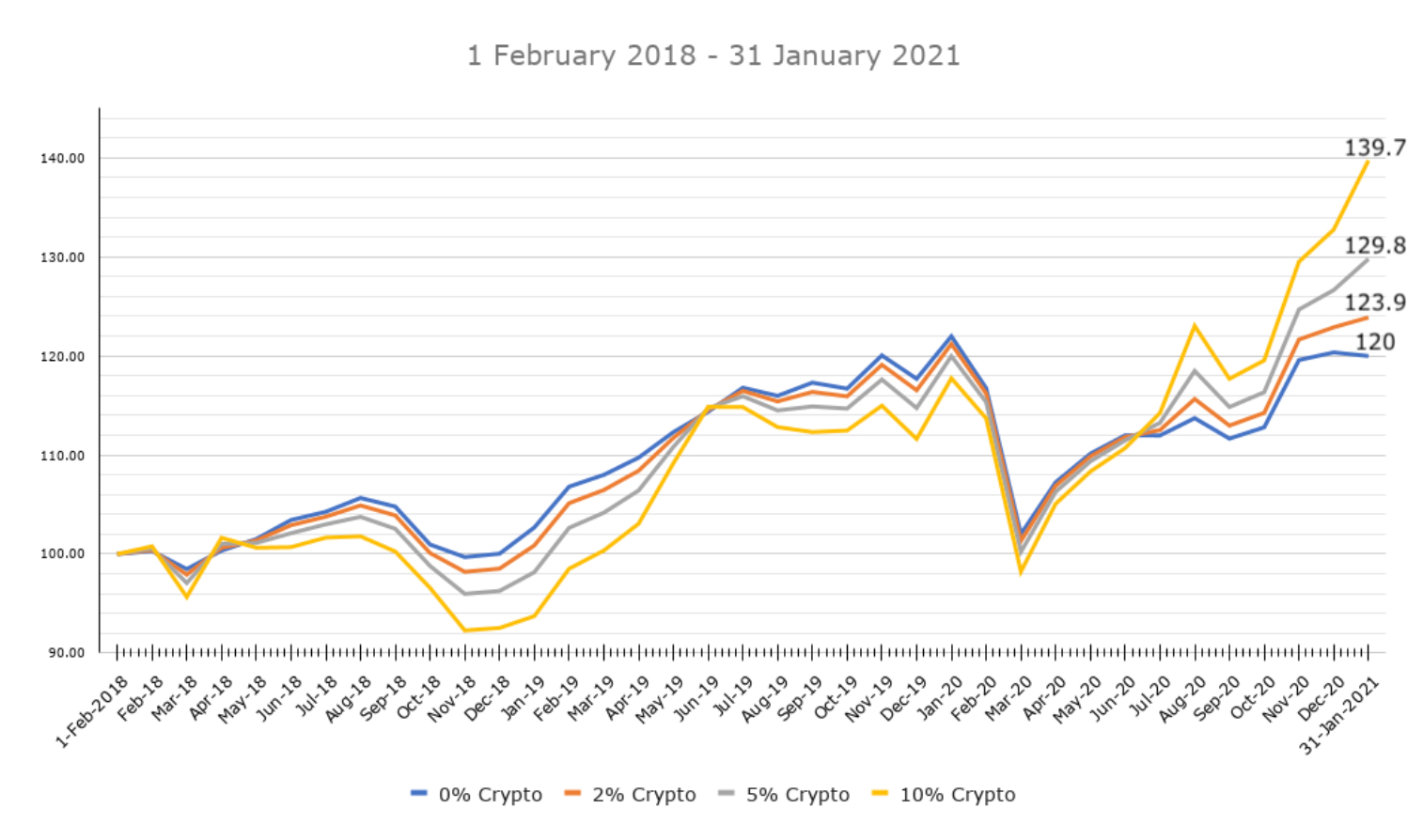

In balancing the risks and return potential, we believe a key consideration is position sizing. We have analysed the impact of various levels of allocation to crypto assets within the context of a broader portfolio. We have simulated three allocation levels: 2%, 5% and 10% and compared the performance to a base portfolio of 60% Australian equities, 40% Australian bonds. In allocating to crypto assets from these portfolios, we decrease equally the allocation to equities and bonds. For example, a 10% crypto allocation results in a portfolio of 55% equities, 35% bonds and 10% in the Apollo Capital Fund.

We performed this analysis over a three year time frame, the same three years Apollo has been managing the Apollo Capital Fund. It is fascinating to analyse the effect on the portfolio at various points in time.

Scenario 1 – Poor Timing

We launched the Apollo Capital Fund on 1 February 2018, the start of a severe 12 month bear market. Analysing the first year’s returns allows us to analyse the impact of highly negative crypto asset performance on the whole portfolio.

The Apollo Capital Fund was down around 68% between February 2018 and February 2019. The effect of different allocations on the overall portfolio is varied. A 2% allocation (the orange line), at the end of the first year, was a portfolio with a 0.9% return compared to a 3% return for the base portfolio. A 5% allocation (silver line) returned -1.8% and a 10% allocation (yellow line) was affected more significantly with a return of -6.3%. The lowest drawdown of the 10% crypto asset portfolio was -7.71% in November 2018 when the fund returned -33%.

Scenario 2 – Excellent Timing

In Scenario 2, let’s assume an investor allocates to crypto assets through the Apollo Capital Fund with excellent timing, as far as crypto assets are concerned on 1 February 2020. This analysis is straightforward – if we assume the timing is excellent, clearly a larger allocation to a high performing asset class will have a more positive impact on the overall portfolio.

Where this analysis is interesting is the magnitude of the impact on the overall portfolio, compared to the magnitude of the impact in Scenario 1.

A 2% allocation generated a return of 2.2% while the base portfolio returned around -1.6%. A 5% allocation returned 8.2% and a 10% allocation returned 18.7%.

Scenario 3 – Long Term

The last time frame to analyse is the effect on the portfolio over a longer period of time, the three year period of the Apollo Capital Fund. This time frame includes both periods of severe drawdowns and periods of strong performance. It starts with Scenario 1 and ends with Scenario 2.

Overall the performance of the Apollo Capital Fund has been very strong over the last three years. The 10% allocation has clearly performed very well returning 39.7%, clear evidence of the strong return potential of crypto assets. The 2% allocation has made a material impact on the portfolio, returning 23.9% compared to 20% for the base portfolio.

By analysing the historical returns of an Australian portfolio consisting of equities, bonds and an allocation into the Apollo Capital Fund, we are able to see the potential benefits that crypto asset exposure can have on a traditional portfolio. During a bear market, a drawdown in crypto assets may not have a significantly negative effect on the portfolio. During a bull market, the overall portfolio can benefit greatly. We describe this as crypto asset exposure offering traditional portfolios an asymmetrical return profile – the upside is much larger than the downside.

Hindsight

It is important to remember that this analysis is performed with the benefit of perfect hindsight. While we remain bullish on crypto assets over a long period, it remains to be seen if we are the start of another Scenario 1, another Scenario 2 or something in between.

We think this analysis is important and helpful in quantifying the effect of crypto assets within a broader portfolio. Of course, future returns might be more negative or more positive, and may affect an overall portfolio more drastically. Investors’ portfolios vary, likely containing other assets and not just 60% Australian Equities and 60% Australian Bonds.

While all investors in the Apollo Capital Fund are optimistic crypto assets will continue to perform strongly, they need to be prepared and able to withstand the ups and downs along the way.