categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Layer 2 Update

by David Angliss

Introduction

Layer 2’s total value locked (TVL) has consistently been an uptrend, showing steady adoption of these technologies while broader asset prices in the crypto market remain stagnant. As it has been some time since we last provided an overview of the Layer 2 ecosystem, we thought it was timely to provide an update.

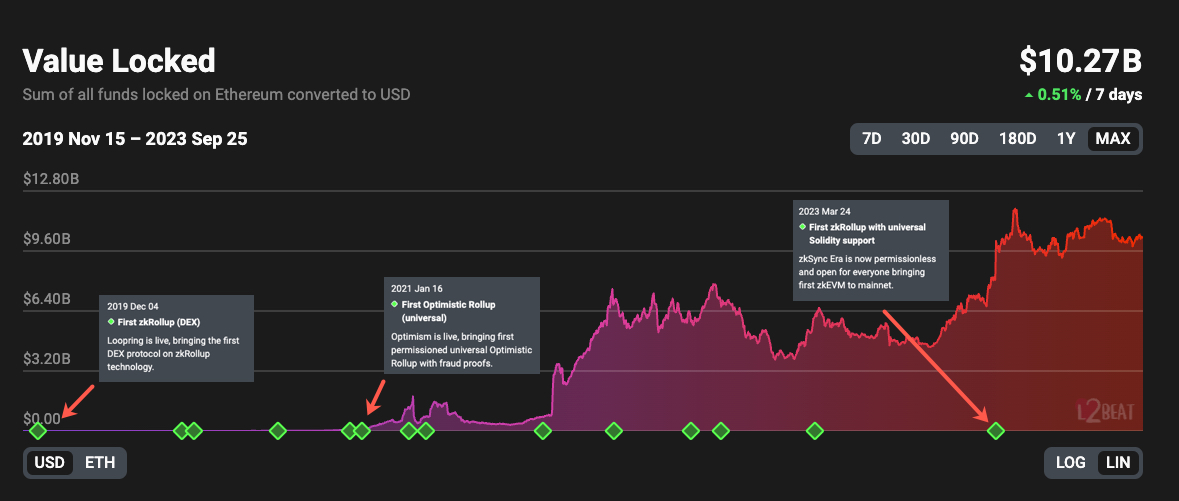

To provide a refresher on the advancements in Layer 2 development over the past four years, we present a detailed chart below. This visualisation captures the pivotal milestones achieved over this period. It also underscores the sustained increase in capital redirected from the Ethereum mainnet to Layer 2 platforms. Remarkably, within a timeframe of just under four years, the Total Value Locked (TVL) on Layer 2s has escalated to a notable $US 10.27 billion.

Layer 2 TVL Lifecycle

https://l2beat.com/scaling/summary

What are Layer 2s, and Why the Uptick in Layer 2 activity?

Layer 2 solutions function as sophisticated blockchain frameworks layered at Ethereum, designed to aggregate transactions and anchor them to the Ethereum mainnet in a streamlined and cost-efficient manner. Layer 2 aims to mitigate congestion within the Ethereum mainnet. Executing transactions off the primary network presents a swifter and more economically viable option. These off-chain transactions are then seamlessly integrated with the primary Ethereum network through a methodology often called ‘rollups’.

Layer 2 Categories

Layer 2s can be broadly classified into Optimistic Rollups and Zero-Knowledge Rollups.

Optimistic Rollup: This Layer 2 variant operates under the ‘optimistic’ assumption that off-chain transactions are correct unless shown otherwise. It permits more rapid transaction processing, albeit with a provision for challenging any questionable transactions, which lasts roughly seven days. For developers, building on an Optimistic Rollup requires a similar code base knowledge to building on the main Ethereum chain.

Zero-Knowledge Rollup (zk-Rollup): This Layer 2 model leverages zero-knowledge proofs to instantaneously confirm and consolidate off-chain transactions, marrying scalability with heightened privacy. For developers, most zk-Rollups require knowledge of a different coding language to the main Ethereum chain, raising the barriers to entry at this current stage in the market.

Market Leaders

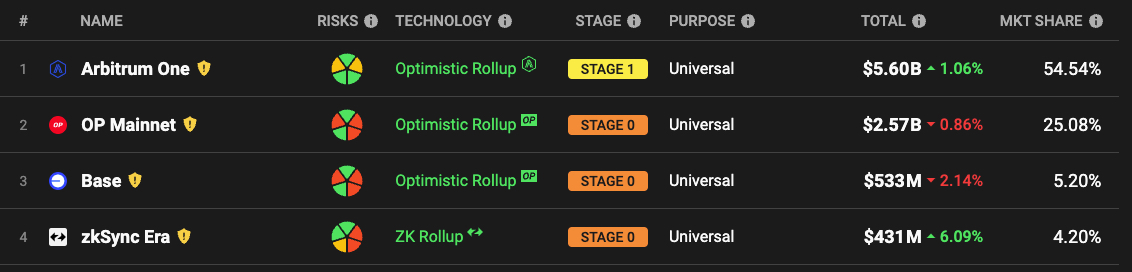

At present, Ethereum’s landscape is distinguished by the prominence of four leading Layer 2 solutions, collectively commanding an impressive 89% of the Total Value-Locked (TVL) market share among all Layer 2s.

Top Four Layer 2s

https://l2beat.com/scaling/summary

Below is an outline of the distinct characteristics and the nuances that set them apart.

Arbitrum

Technology: Optimistic Rollup

Token Presence: Yes (ARB)

Market Capitalisation: $US 1.036 Billion

Fully Diluted Valuation: $US 8.04 Billion

Market Share: 54.54%

Emerging as the second Layer 2 to go fully live on August 31st, 2021, Arbitrum has, over the ensuing years, soared to significant prominence amongst the Layer 2s. Much of its dominance can be attributed to its provision of easy tooling and templates for coding. This innovative approach facilitated developers and existing projects within the EVM ecosystem to seamlessly transition to Arbitrum.

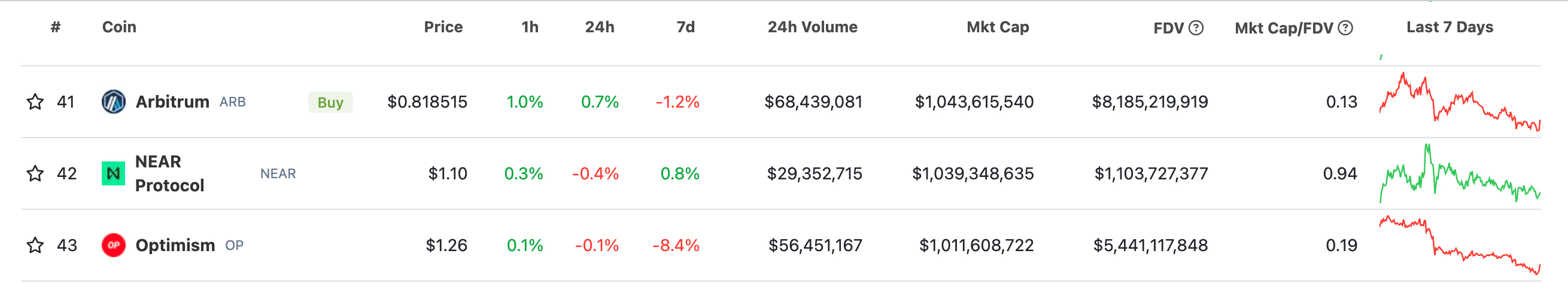

Further bolstering its position, Arbitrum orchestrated a laudable incentive campaign followed by a successful token airdrop and launch on March 23rd of the current year. Its fully diluted market cap is valued higher than Optimism (OP) by roughly $US 2.744 billion million at a staggering $US 8.04 billion.

Metrics: Arbitrum VS Optimism

Coingecko.com

Arbitrum Orbit is Arbitrum’s latest product offering to continue scaling Ethereum. Arbitrum Orbit lets you create a dedicated chain that settles into one of Arbitrum’s Layer 2 chains. These can be thought of as Layer 3 chains.

Optimism Mainnet

Technology: Optimistic Rollup

Token Presence: Yes (OP)

Market Capitalisation: $US 1.010 Billion

Fully Diluted Valuation: $US 5.36 Billion

Market Share: 25.08%

As the inaugural universal optimistic rollup on top of Ethereum and the first to provide a token airdrop for the platform’s early adopters, Optimism Mainnet initially enjoyed being the trailblazer in the Layer 2 space. Yet, over time, it was gradually matched and even overtaken by Arbitrum in terms of TVL and market capitalisation.

Of late, however, the performance of the Optimism token has surpassed expectations. This upswing is largely credited to their open-source, agile tooling, permitting projects to institute an ‘optimism stack’ Layer 2 rapidly. The most illustrious among entities opting for this approach was Coinbase with their “Base” unveiling, now the third-largest Layer 2. This alliance with Coinbase could catalyse Optimism’s continued relevance and position it as Layer 2 of preference for future collaborations. Base will commit a portion of transaction fee revenue to an Optimism Collective treasury.

Optimism intends to build out the ‘Superchain’. This can be thought of as an ecosystem of Layer 2 chains that utilise the Optimism Software Development Kit (SDK) so that they are inherently composable with each other. This approach is different to Arbitrum, as it is horizontal rather than vertical.

Base (Coinbase)

Technology: Optimistic Rollup

Token Presence: No (and unlikely in the foreseeable future)

Market Capitalisation: N/A

Market Share: 5.20%

Base is an Optimistic Rollup that utilises the Optimism SDK and is built by the centralised exchange, Coinbase. Base is an example of a layer 2 rollup that will make up a key part of the aforementioned ‘SuperChain’ that the Optimism team is envisioning. Base only launched on the 9th of August and is already eclipsing the TVL on what was previously the most popular alternative layer 1 blockchain, Solana. While there is no public plan for a publicly traded ‘BASE’ token, it is a possibility Coinbase could airdrop a token once more regulatory clarity is provided from their ongoing disputes with the US Securities and Exchange Commission (SEC).

Comparing Solana and Base TVL

https://defillama.com/

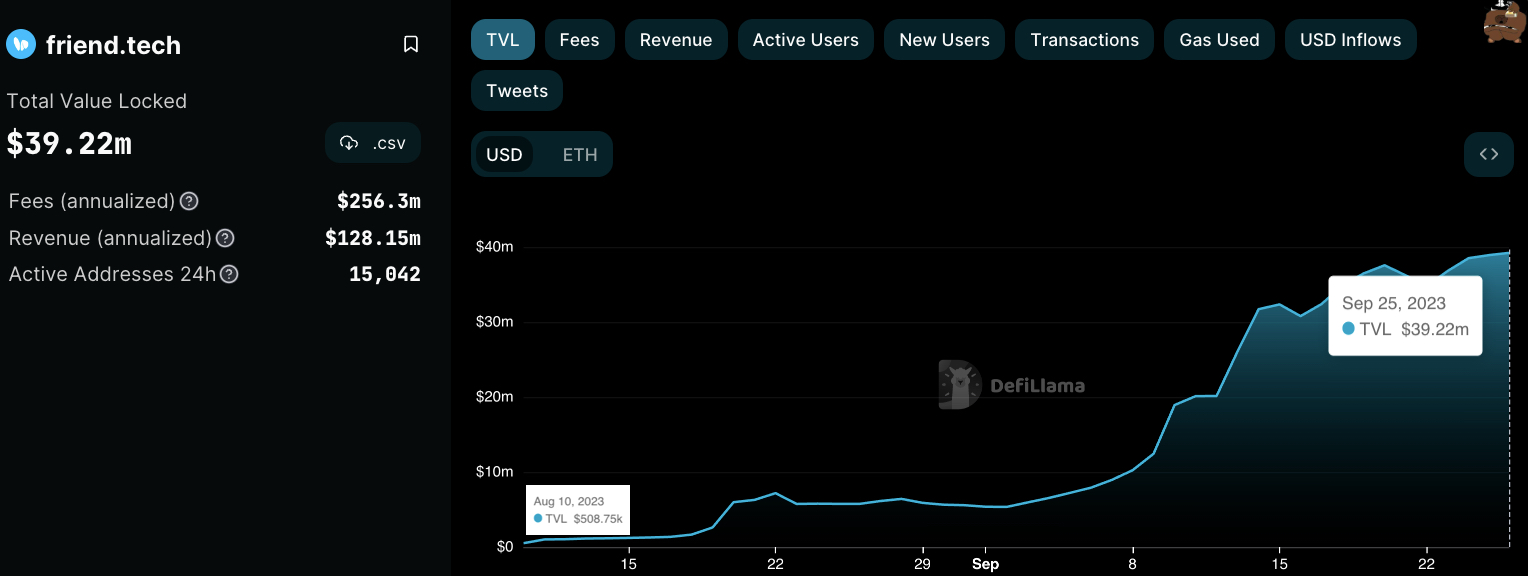

Base has become relevant due to a new social application exclusively available on mobile, Friend.Tech. This popular dApp allows users to buy and sell “keys” linked to Twitter (now X) accounts. The utility of the keys is access to private in-app chatrooms and exclusive content from that X user. The platform markets itself as “the marketplace for your friends.” Friend.Tech has brought in $US 12 million in fees for its more than 160,000 users since its

inception and boasts an impressive TVL of $US 39.22M.

Friend.Tech TVL Growth Over 5 Weeks

Defilama.com

zkSync Era

Technology: Zero Knowledge Rollup

Token Presence: No (likely to airdrop in the future)

Market Capitalisation: N/A

Market Share: 5.20%

zkSync, a Layer 2 protocol by Matter Labs, harnesses zkRollup technology to offer scalable and efficient transactions on Ethereum, emphasising security and user experience. Its Version 1.0, launched on Ethereum mainnet on June 15, 2020, achieved a throughput of nearly 300 TPS.

The zkSync Era, marking its significance on March 24, 2023, introduced the first zkRollup with universal solidity support, setting the stage for numerous zkEVM launches and advancements in the zk-rollup field.

Despite Zero Knowledge Rollups slightly lagging behind Optimistic Rollups, the technology has attracted substantial interest, evidenced by Matter Labs raising $458 million, which includes a $200 million fund for zkSync adoption, ensuring its continual development amid industry uncertainties like FTX’s downturn. One of the key drawbacks to Zero Knowledge Rollups is their requirement to be coded in a programming language that is different to the main Ethereum blockchain, limiting the number of developers able to build on these solutions.

Polygon (MATIC) and Polygon 2.0

Technology: Sidechain & zkEVM

Market capitalisation: US$4.86 Billion

A special mention must go to Polygon. Polygon started as simply a ‘Side-Chain’ for the Ethereum blockchain known as the Matic Network. A side chain is an alternative Layer 1 blockchain with the same programming language as Ethereum (Solidity). However, Polygon has evolved far past just being a side-chain with their recent development of ‘zkEVM’ and the announcement of Polygon 2.0. While struggling to gain traction in the short term, Polygon’s zkEVM allows developers to build applications using solidity on a Zero Knowledge power Layer 2 for Ethereum.

Polygon Labs’ engineering teams recently shared a proposed architecture for Polygon 2.0, designed to provide unlimited scalability and unified liquidity and realise the vision of Polygon as the Value Layer of the Internet. To simplify the ultimate vision, Polygon 2.0 will seek to converge all of the various novel Layer 2 scaling approaches into one unified protocol stack involving 4 layers: staking layer, interop layer, execution layer and proving layer.

While the market is focused on the developments of the well-known Optimistic Rollups and prominent Zero Knowledge solutions, Polygon is not to be discredited in the race to build the underlying infrastructure of the future crypto economy.