categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

The State of Layer 2s in 2024

by Quinn Papworth

We last provided an update on the state of Layer 2 Networks in September 2023, and since then, the value and adoption of the L2 Ethereum ecosystem has increased tremendously.

What are Layer 2s?

Layer 2s are networks that operate on top of a primary network, such as Ethereum, and their specific value propositions are varied. However, they all have the general value proposition of lowering fees and increasing scalability while maintaining the security assumptions of the underlying Ethereum network. This is immediately valuable to users and builders as it hugely reduces the cost of transacting on the Ethereum network, helping to expand use cases for builders, and to improve the user experience for consumers.

The State of Layer 2s

Growth of the Ecosystem:

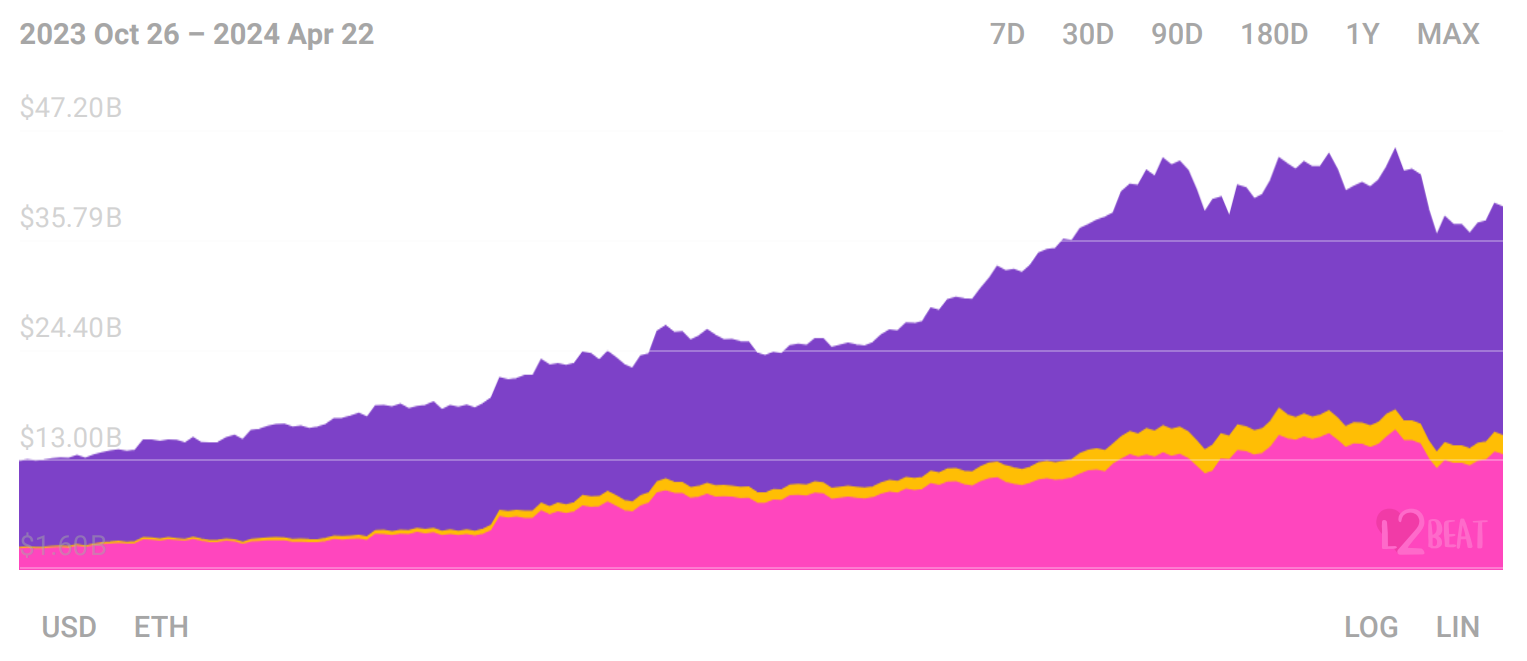

At the time of our last report, the total value locked (TVL) on Ethereum L2s was sitting at US$10.27 billion. Seven months later the TVL now sits at US$43.14 billion, a staggering 323% increase.

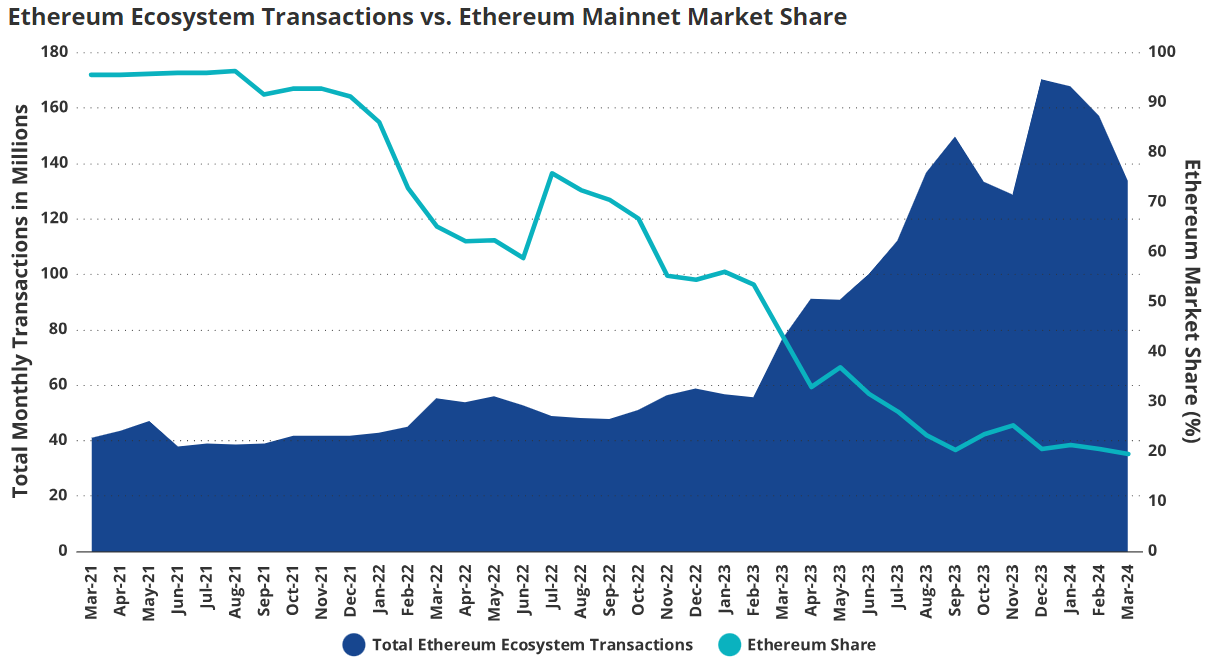

So, what has been the cause of this significant growth? We believe this growth is because of the inherent advantages L2s provide when compared to the Ethereum mainnet. In comparison, L2s offer enhanced scalability and lower fees resulting in an improved user experience. As the overall DeFi TVL has grown, L2s have become the natural host for DeFi protocols as they allow builders to easily scale their operations and accommodate a larger user base, thereby increasing innovation and profitability. This shift towards L2s has been further supported by the Ethereum Foundation as they embrace these networks in their move to a rollup-centric roadmap as part of the Ethereum endgame. As such, the Ethereum community is now actively supporting and promoting L2 solutions as they are viewed as the key future scaling solution for Ethereum.

The Dencun Upgrade:

On 13 March 2024, Ethereum’s highly anticipated Dencun upgrade went live, introducing a new form of memory with its own dedicated fee market, called ‘Blobs’. Blobs are a temporary form of memory that are only retained for four weeks before deletion, and therefore reduce Ethereum’s data overhead. This has resulted in a reduction of transaction fees for Layer 2s by roughly 96%. Instead of verifying each transaction within the block, the network will now only have to confirm that the ‘Blob’ attached to the block carries the correct data. This means that the amount of work to verify data on the Ethereum network is significantly cheaper and faster. As a result of this transformative shift in fees, recent growth within the Layer 2 ecosystem has been explosive with new all time highs being set for activity as on-chain transactions per second (TPS) scaled enormously. The chart below shows the transaction fee comparison between Ethereum mainnet, Solana (a competing L1), and the leading L2 networks.

| Chain | Simple Transfer Cost | On-chain Swap Cost |

| Ethereum (mainnet) | $0.455 | $4.272 |

| Zora | $0.001 | $0.002 |

| Starknet | $0.002 | $0.003 |

| Arbitrum | $0.001 | $0.007 |

| Optimism | $0.002 | $0.009 |

| Base | $0.003 | $0.029 |

| Blast | $0.027 | $0.047 |

| Solana (alt L1) | $0.0008 | $0.001 |

Source: Apollo Crypto, Grow The Pie – Transaction Fee Comparison Chart

The Security of Layer 2s:

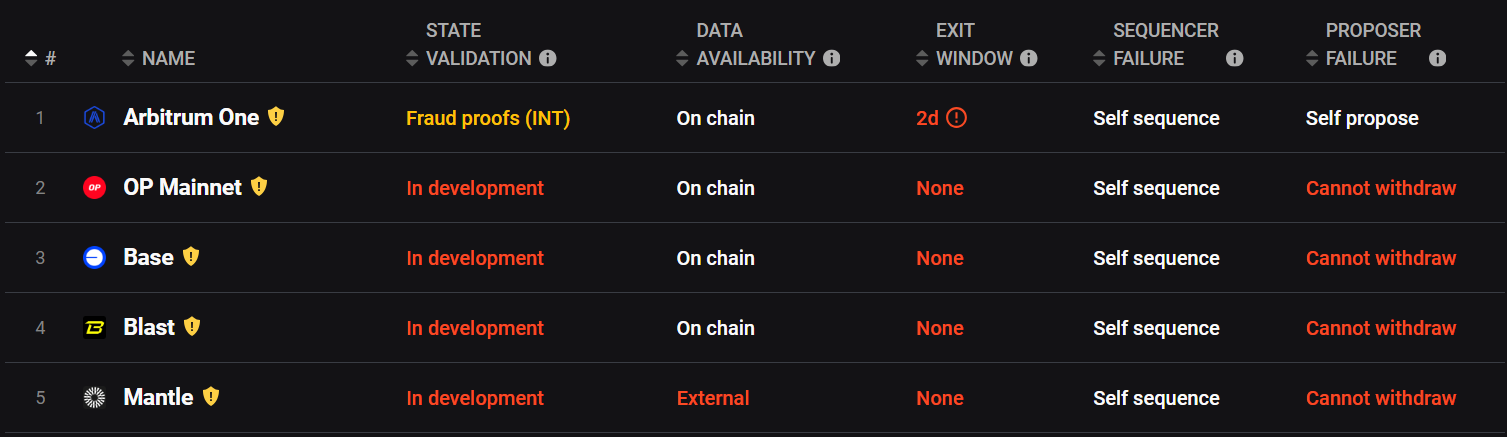

Although Layer 2s have been scaling at a rapid rate, there is still work to be done in increasing the security of Layer 2s so that minimal trust assumptions are introduced when using an L2 compared to the Ethereum Mainnet. Of the major Layer 2 networks, only Arbitrum has achieved what is referred to by L2BEAT as ‘Stage 1 Security’, meaning most Layer 2’s are at ‘Stage 0’ and have ‘Full Training Wheels’. So this strikes the question, what are the key factors contributing to an overall lack of security within the L2 ecosystem?

- Proof systems – For many ‘optimistic’ L2s, the state validation mechanism is still under development, resulting in security concerns around the possibility of invalid state roots being submitted.

- Sequencer failure – A sequencer is responsible for constructing blocks and ordering them. Some L2s have no mechanism to have transactions included if the sequencer is down or censoring; as a result, transactions could fail to be included.

- Proposer failure – A proposer is responsible for submitting state commitments to Ethereum. For the majority of L2s, only whitelisted proposers can publish states to the Ethereum L1. As a result, in the event of proposer failure, withdrawals would be frozen if users are unable to self-propose state commitments.

- Trusted Validators – Most Layer 2 solutions require users to trust a set of somewhat centralised validators, who validate transactions and secure the network. This introduces a level of centralisation and reliance on these validators to act honestly. If a validator becomes compromised or acts maliciously, it could potentially jeopardise the security of the L2.

Moving forward, L2s need to strive towards the decentralisation of their validator set and sequencers, and introduce further fail proofs in order to increase network security and credibility. Otherwise a potential attack on a Layer 2 network could prove to be devastating.

Market share:

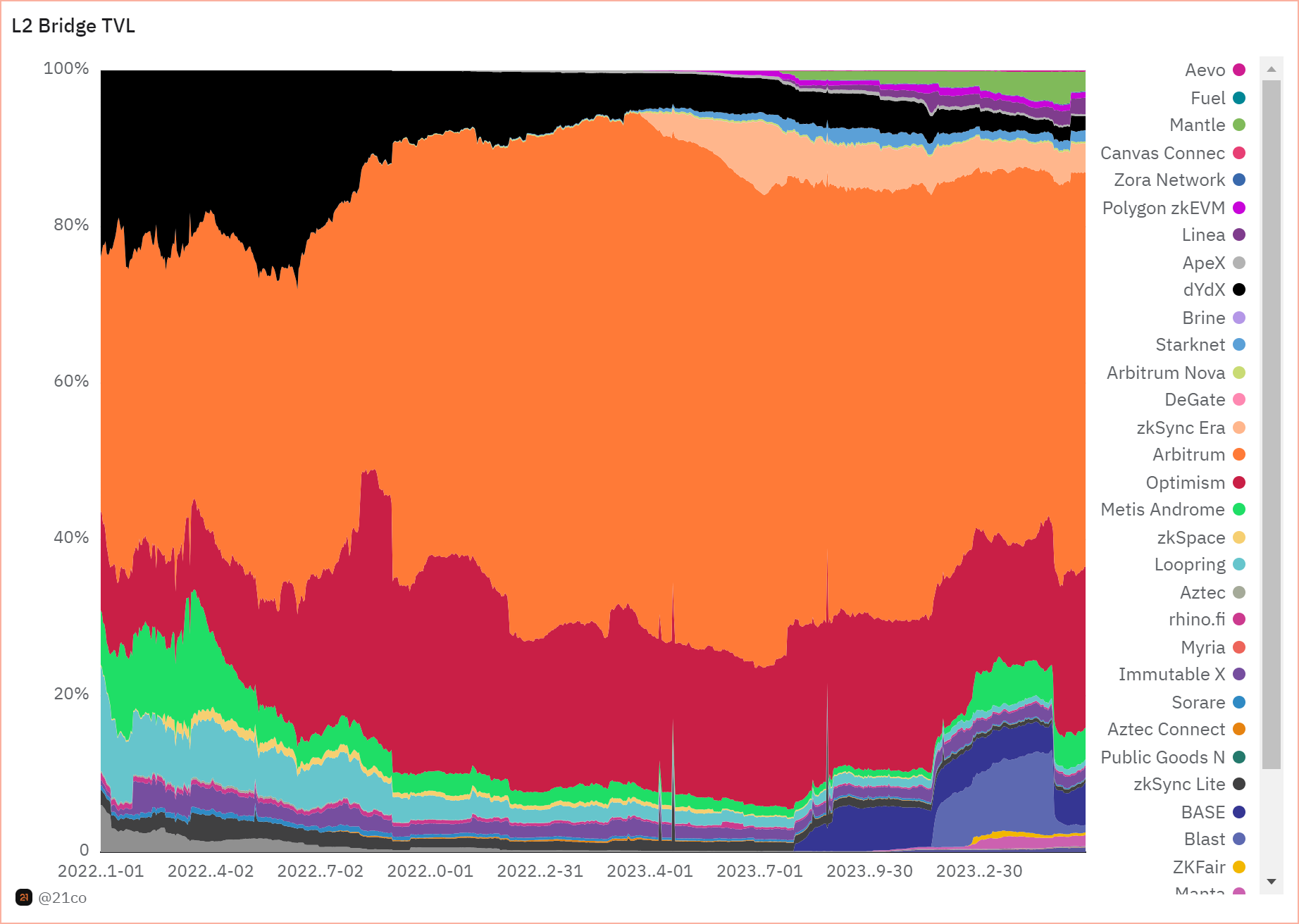

Optimistic rollups Arbitrum and Optimism continue to dominate the market share of L2s with a collective 71% market share despite the existence of many competitors. This growth can be attributed to a few key factors:

- Early Movers: Arbitrum and Optimism were among the first L2 solutions to launch and gain traction, giving them a significant head start in development, testing, and adoption. This has helped them to establish a strong foothold in the market.

- Security & Trust: Arbitrum’s dominant market share of 51% can be largely attributed to its best in class security, where it offers higher settlement assurances than its competitors. As such, the protocol has instilled trust, making it more appealing to developers and users. This follows the widely observed ‘protocol sink thesis’, which states that protocols that have the highest settlement assurances sink to the bottom, and form the foundation of tech stacks above. Optimism has achieved similar levels of trust with its close alignment to Ethereum’s values and proven track record security-wise.

- Developer Support: Arbitrum and Optimism have shown strong commitment to engaging with the developer community by introducing comprehensive developer kits. These kits have been instrumental in onboarding builders and providing them with the necessary tools and resources to start building on their respective platforms. In addition, both Arbitrum and Optimism have implemented heavy token incentives to further support and encourage developers. As part of these initiatives, the projects have distributed their governance tokens to builders, creating a powerful incentive structure. This approach has effectively created a flywheel effect, driving significant growth in the networks.

- The Optimism Superchain and Arbitrum Orbit: Both Optimism and Arbitrum have increased their network effect with the launch of their respective unification systems allowing builders to create their own chain utilising their open-source tech stacks. For Optimism, this exists through their ‘Superchain’ where it seeks to integrate otherwise siloed L2s into a single interoperable and composable system. The long term aim of this is to make deploying a L2 as easy as a smart contract while still committing a portion of fee revenue back to the Optimism treasury. Similarly, Arbitrum Orbit allows for the permissionless launch of customs chains utilising ‘Rollup as a service’ providers. This allows builders to inherit Optimism’s security and scalability while maintaining sovereignty and modularity.

Emerging Players

Coinbase’s L2 network BASE, and incentive fueled L2 network BLAST, have both seen significant TVL growth within the last 6 months. Base grew its TVL by roughly 5 billion, while Blast grew from launch to an estimated 2.6 billion. As a result Base now sits at number three in TVL among L2s, while Blast trails at fourth. So why have these projects seen significant growth? Base’s growth can be attributed to rollout of the previously mentioned Dencun upgrade as well as Coinbase’s overall increasing market share as Binance’s market dominance has fallen over the last year. In addition the seamless connection of the Coinbase wallet to the Centralised Exchange has created a somewhat seamless onramp for retail users. Because of this there has been some memecoin mania hosted on the chain as well as the rollout of dApps. Blast has taken a different approach, with its growth stemming from an incentive driven campaign. The network has issued large airdrops of points to dApp builders, that will be redeemable for their token upon launch. This creates a growth flywheel effect where dApps share these points with users in order to grow their TVL and protocols are further incentivized to build and innovate in order to be allocated points from the Blast treasury.

The Future of L2 networks

L2s have seen significant growth and have been embraced as the scaling solution for Ethereum’s future roadmap; so what’s next? As of right now, there is considerable fragmentation of liquidity within the L2 ecosystem, and this is a concern for security, user experience, and the underlying value of Ether the asset.

Accordingly, we believe aggregation in some form is the most viable way forwards for network growth and security. This is because it is able to combine the user experience and unified liquidity of monolithic structures while also offering the scalability, sovereignty, and customisability of modular structures. An ideal implementation of aggregation would result in a unified pool of liquidity, allowing for dApps to reach more users without encountering awkward bridging UX. This will ideally create an experience for the user where it will feel like a single environment. Polygon are currently leading the charge for such a vision with the development of their ‘AggLayer’, which now has live components connected to the Polygon zkEVM. We also believe that modular rollups via EigenLayer’s infrastructure will be able to further scale this aggregation layer and Ethereum’s overall value by allowing non EVM activity to join the network.

Conclusion

Looking forward, the Ethereum ecosystem seems poised to maintain its dominance, facilitated by the continued innovation and integration of L2 solutions. The trajectory suggests that L2s are not only enhancing the capabilities of the Ethereum network but are also crucial to its future scalability and security. With strategic developments aimed at reducing fragmentation and improving user experience, Ethereum, supported by its L2 infrastructure, is likely to remain the leading host for TVL within the DeFi space.