categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Turning of Tides on the U.S. Capitol Hill

by Matthew Harcourt

Whether you love him or you hate him, there is no denying that Donald Trump is one of the most influential men on the planet. In a time when the state of U.S. politics is having a significant impact on the crypto industry through an anti-crypto stance from members of the Democratic Party, Donald Trump has recently established his stance as pro-crypto.

“If you’re in favour of crypto, you better vote for Trump.” – Donald Trump, 9 May 2024.

The Democratic Party Position

Throughout Joe Biden’s presidency there have been a number of Democratic Party members that have taken a very active approach to their anti-crypto stance, namely Gary Gensler (SEC Commissioner) & Elizabeth Warren (Senator from Massachusetts).

Gary Gensler’s contributions to taking down crypto includes; repeatedly stating the majority of digital assets are securities, making it almost impossible for businesses to comply with registration rules, suing many of the large crypto businesses within the U.S. and providing little to no regulatory clarity or oversight to the crypto industry. Elizabeth Warren has been the main driver of the anti-crypto crusade in the Senate by introducing anti-crypto bills and building an “anti-crypto army”.

Democrats Break With Warren & Biden

In a move that may turn out to be a watershed moment for digital assets in the U.S., both the House of Representatives and the Senate have voted to overturn a Securities and Exchange Commission (SEC) regulation known as Staff Accounting Bulletin No. 121 (SAB 121).

SAB 121, issued by the SEC in 2022, mandated that companies holding customers’ cryptocurrencies must treat these assets as liabilities, requiring them to be recorded at fair value on their balance sheets. This rule was designed to prevent banks and financial institutions from participating in the industry due to excessive capital requirements to hold crypto assets on behalf of customers.

In both the House and the Senate, a number of Democrats voted alongside Republicans to overturn the overreaching SAB 121, indicating a distinct turning of tides within U.S. politics. It is now up to Joe Biden to either sign or veto the measure; both options will have important flow on implications.

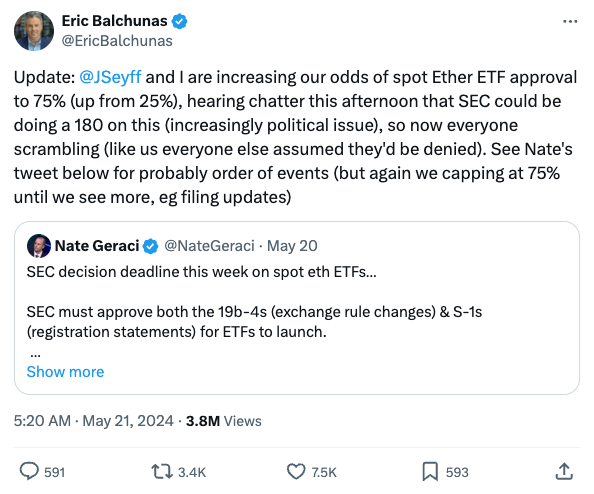

Ethereum ETF Expectations Surprise

In a move that very few industry participants and onlookers anticipated, it is now probable that Ethereum ETFs will be approved in the United States according to Eric Blachunas of Bloomberg. This comes after reports that “Exchanges are being asked to update 19b-4 filings on an accelerated basis by the U.S. Securities and Exchange Commission”. Updating 19b-4 is a necessary step to ETF approval and the urgency in which the SEC have engaged with exchanges means it is likely that approval may be imminent.

We believe that this sudden change in the SEC’s willingness to approve the Ethereum ETF is a direct response to the growing political pressure surrounding crypto, demonstrated by the SAB 121 overturn and Trump’s public comments.

The Trump Effect

While crypto may appear to be a minor topic within the U.S. political landscape, we believe that it will be an important component of the 2024 election. It is hard to know the exact percentage of the U.S. population actively investing in crypto, although conservative estimates range from 10-20%. With such a strong political divide within the country, crypto may become a key issue for swing voters due to the strong financial incentives involved for these individuals who invest in and believe in crypto. With Trump sitting at around 50-55% chance to win the presidency, he will undoubtedly aim to win votes through supporting issues like crypto.

Further to this, the recent success of the U.S. Bitcoin ETFs demonstrate that traditional financial institutions are not always at odds with crypto, and powerful synergies are able to be created through thoughtful adoption and innovation. The overturning of SAB 121 is likely to have been aided by financial institutions and banks looking to make strides into crypto.

Implications For The Democrats

With the vote to overrule SAB 121 and Trump’s outspoken support for crypto, the tide seems to be turning at Capitol Hill. We are at a pivotal moment for Joe Biden and the Democratic Party with two major decisions to be made in the coming days.

If the SEC approves an Ethereum ETF on the 23rd of May, the last minute rush to make exchanges update their 19b-4 filings indicates that the overrule of SAB 121 was a key moment. If the SEC had previously intended to approve the ETF, they would not have waited until days before the deadline.

The President also has a considerable decision to make on whether to sign or veto SAB 121. This will send a strong message to his party leaders as to the direction the party will take going forward.