categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Opposition to Opportunity: The Emerging U.S. Crypto Regulatory Landscape

by Quinn Papworth

Previously, in mid-May, we explored the regulatory landscape of cryptocurrency in the U.S. and hinted at a potential shift in Democratic sentiment towards crypto. With Kamala Harris now replacing Joe Biden as the Democratic candidate, and several key regulatory developments, we thought it was appropriate to revisit the state of crypto politics in the U.S.

Key Developments Since Our Last Update

Trump’s Continued Support for Crypto

In early May, Trump expressed support for Bitcoin and the broader crypto industry. Since then, he has consistently spoken positively about crypto assets, engaging with key industry partners and outlining his crypto strategy.

SAB121 Overturn Vetoed by Biden

The overturning of the SEC’s regulation SAB121 by the House of Representatives and the Senate showcased bipartisan support for crypto. Despite this, Biden vetoed the measure, maintaining his anti-crypto stance and ensuring that banks and financial institutions remain unable to hold crypto assets on behalf of customers.

Ethereum ETFs Approval

Ethereum ETFs saw their approval likelihood increase from 25% to 75% in May. Subsequently, these ETFs gained approval, cementing Ethereum’s status as a commodity alongside Bitcoin and are now trading live.

Biden’s Continued Anti-Crypto Stance

Throughout his term, Biden supported Gary Gensler’s anti-crypto stance and failed to advocate for any pro-crypto regulation. With Biden now out of the U.S. election race, it is unlikely there will be any change in his position until his term concludes. As such the SEC has continued to go after crypto companies with lawsuits and notices.

Harris’ Entry Tightens the Election Race, Crypto Emerges as an Election Issue

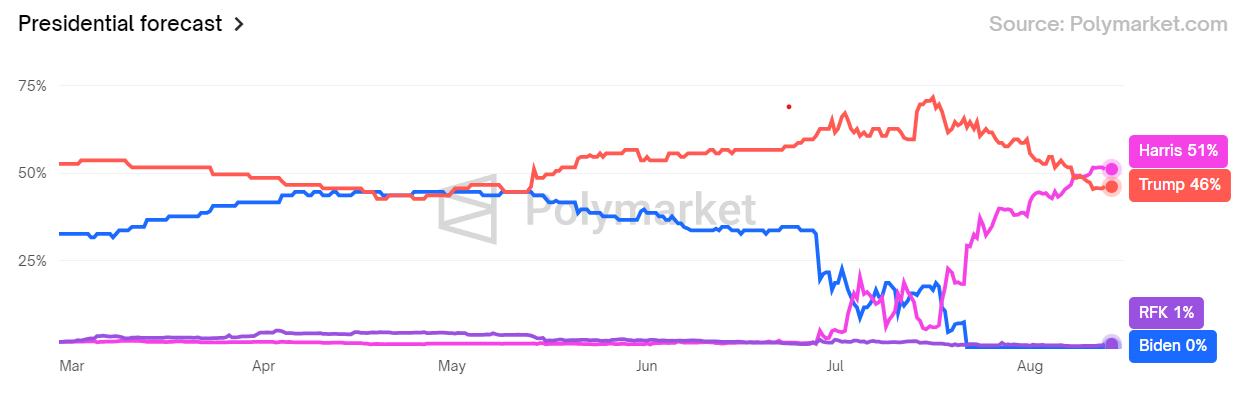

Prediction markets now indicate a much closer race with Kamala Harris as the Democratic Party candidate. Previously, Trump was heavily favoured, boasting peak odds of 72% against Biden. However, his odds have now dropped to 46% against Harris, whose chances have surpassed Trump’s at 51%. With 52 million Americans (15.6%) owning crypto and 45% indicating they would not support an anti-crypto candidate, it’s evident that cryptocurrency could become a pivotal issue in the November election.

Harris Signals a Softer Stance on Crypto, But Is It Too Late?

Although Kamala Harris has yet to explicitly state her position on cryptocurrency, her approach is expected to be less stringent than President Biden’s. Harris’ team has proactively engaged with major crypto industry players, including Coinbase, Ripple, and Circle, recently convening in a roundtable discussion that included Deputy Secretary of the Treasury Wally Adeyemo, National Economic Council Director Lael Brainard, and Harris’ director of legislative affairs, Kristine Lucius. This level of engagement represents a notable departure from the Biden administration’s largely inaccessible stance toward the crypto sector. However some feel that this attempt to rebuild relationships may come too late for many in the crypto community, who are looking for tangible actions before considering support for the Democratic campaign, especially in light of the Biden administration’s strong anti-crypto policies.

Insights from Policies on Emerging Technologies

Examining Trump and Harris’ actions towards other emerging technologies, such as artificial intelligence (AI), can offer clues about their potential crypto policies. Trump has shown a preference for deregulation to foster innovation, as evidenced by his criticism of Biden’s AI executive order, this is likely to carry over towards his stance on crypto. In contrast, Harris is likely to emphasise regulation to protect consumers, reflecting her broader focus on mitigating risks associated with emerging technologies. Harris’ statements on AI, where she emphasised the importance of balancing public protection with innovation, suggest she may support a regulatory framework akin to the European Union’s Market in Crypto Assets (MiCA) regulations.

Harris’ Political Leanings and Implications for Crypto

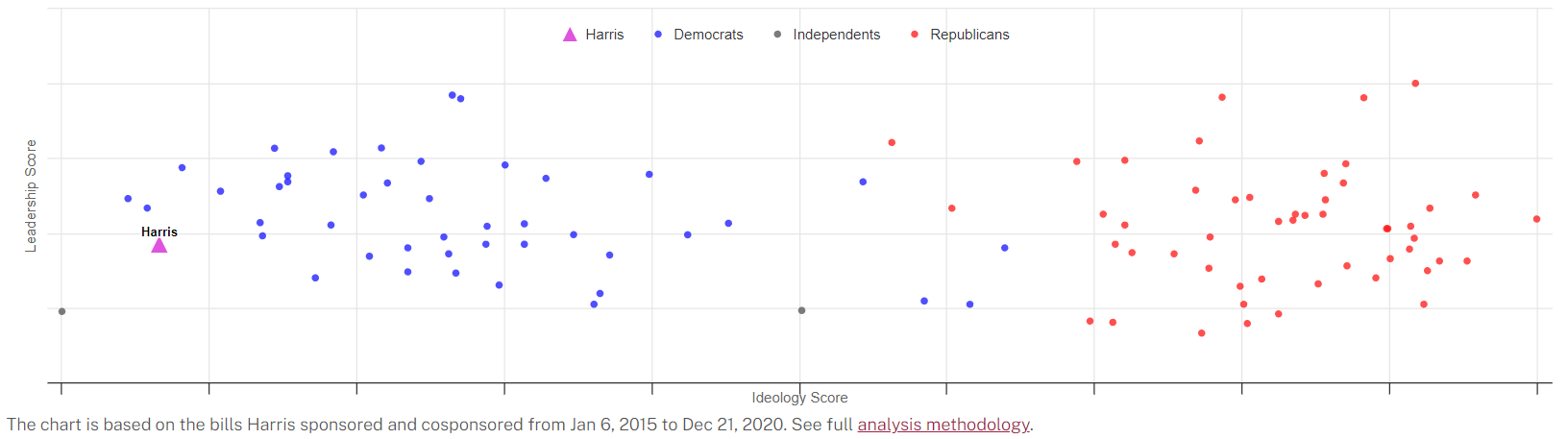

Kamala Harris, based on her legislative record from 2015-2020, is ranked among the most left-leaning members of Congress. This might raise concerns for some, especially after the anti-crypto campaigns led by other progressive senators like Elizabeth Warren. However, it’s crucial to remember that cryptocurrency, at its core, is largely apolitical. While crypto holders are often associated with libertarian values due to the freedom and independence that digital assets provide, this doesn’t imply that left-leaning movements are inherently opposed to crypto. As such, it’s important not to assume that Harris will be dismissive of crypto’s simply because her views don’t align with libertarian ideals. Crypto’s universality means it can be embraced by those across the political landscape in an open opt-in system.

Trump Champions Crypto at Nashville Bitcoin Conference

Donald Trump recently made headlines at the annual Bitcoin Conference in Nashville, where he expressed strong support for Bitcoin and the broader crypto asset class, notably democratic presidential candidate Harris did not attend despite being invited.

Key Takeaways from Trump’s Speech

- SEC Leadership Overhaul: Trump promised to fire the current anti-crypto SEC Chair, Gary Gensler, on his first day in office and appoint a new chair who champions innovation.

- Strategic Bitcoin Reserve: Trump announced plans to prevent the U.S. from selling its 213,000 bitcoins, valued at nearly $14.5 billion, creating a “strategic bitcoin reserve” if elected in November.

- Ending Anti-Crypto Policies: Trump vowed to terminate “Operation Chokepoint 2.0” and other anti-crypto policies to bolster the domestic digital asset industry.

- Stablecoin Framework: Trump outlined a plan to introduce a stablecoin framework to promote the digital US dollar as a global standard and facilitate cross-border payments.

- Bitcoin Mining Superpower: Trump pledged to make the U.S. a “Bitcoin mining superpower,” with increased electricity generation capacity for the industry.

- No CBDC and the Right to Self-Custody: Trump assured that the U.S. would not create a central bank digital currency (CBDC), affirming the right to self-custody and guaranteeing no censorship of crypto transactions.

It is an interesting thought experiment to think about the potential buying pressures for Bitcoin if the U.S. decided to fully embrace Bitcoin as a reserve asset. If the U.S. were to treat Bitcoin on par with gold and purchase it proportional to its market cap relative to gold (currently 7.3%), the government would acquire approximately US$46.4 billion worth of bitcoin. This move would likely exert significant upward pressure on bitcoin’s price, potentially sparking a broader trend incentivising other nations to follow suit. The ripple effect of this could be profound.

Going Forward

While the future of crypto assets in the U.S. remains uncertain, the shifting political landscape offers a glimmer of hope for more favourable regulation of digital assets. With crypto emerging as a key election issue, it’s likely we’ll see a clearer stance on crypto from the Harris campaign in the coming weeks. Whether this will lead to meaningful regulatory change or simply be a case of political pandering remains to be seen. However, the increased attention on crypto in the political arena suggests that the industry is poised for significant developments.

This report (‘Report’) has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security of financial product or service. This Report does not constitute a part of any Offer Document issued by Apollo Crypto Management Pty Ltd (ACN 623 059 227, AFSL 525760) or Non Correlated Capital (ACN 143 882 562, AFSL 499882), the Trustee of the Apollo Crypto Fund. Past performance is not necessarily indicative of future results and no person guarantees the performance of any Apollo Crypto financial product or service or the amount or timing of any return from it. This material has been provided for general information purposes and must not be construed as investment advice. Neither this Report nor any Offer Document issued by Apollo Crypto or Non Correlated Capital takes into account your investment objectives, financial situation and particular needs. The information contained in this Report may not be reproduced, used or disclosed, in whole or in part, without prior written consent of Apollo Crypto. This Report has been prepared by Apollo Crypto. Apollo Crypto nor any of its related parties, employees or directors, provides and warrants accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. You should obtain a copy of the Information Memorandum, issued by Non Correlated Capital before making a decision about whether to invest in the Apollo Crypto Fund.