categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

The MicroStrategy Playbook

by Quinn Papworth

Introduction to Microstrategy

MicroStrategy (MSTR), originally a cloud software company, has undergone a remarkable transformation into a de facto investment vehicle for Bitcoin. While its core business in enterprise analytics software persists, the Bitcoin treasury strategy it launched in 2020 has become the company’s hallmark. By utilizing debt and equity issuance to amass Bitcoin, MicroStrategy has effectively positioned its stock as a publicly traded proxy for Bitcoin exposure. This bold strategy has delivered extraordinary results, with an unrealized gain of approximately $15 billion on its Bitcoin holdings. Consequently, MSTR has recently reached new all-time highs, earning the distinction of being the top-performing US stock year-to-date—a development that warrants closer examination.

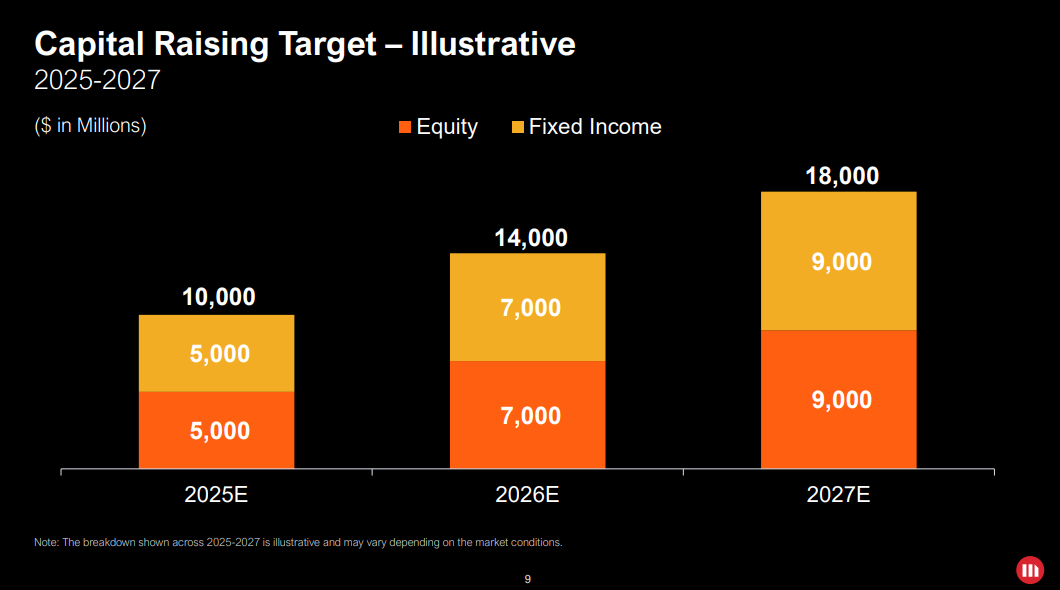

At MicroStrategy’s Q3 earnings call on October 30, 2024, they announced plans to raise US$42 billion over the next three years to continue its Bitcoin acquisition strategy—a figure nearly equivalent to its entire market cap at the time. In the weeks following the announcement, MicroStrategy wasted no time, aggressively accumulating US$5 billion worth of Bitcoin driving its market cap up to roughly US$70 billion as of the time of writing. This accumulation was funded through a combination of at-the-market share offerings and zero-percent convertible senior notes maturing in 2029, issued at a 55% conversion premium (US$672.40). These are sizeable inflows for Bitcoin that we have yet to see from an institutional player.

The MSTR Strategy

MicroStrategy’s Bitcoin acquisition strategy has solidified its position as one of the largest holders of Bitcoin, with 402,100 BTC purchased (1.9% of total supply), as a result it has emerged as a significant driver of Bitcoin’s market dynamics. This Bitcoin treasury strategy exemplifies how consistent institutional flows can lock up large quantities of a highly scarce asset, when combined with ETF flows and potential sovereign level adoption this could act as a significant future catalyst. Crucially, MicroStrategy’s commitment to holding Bitcoin indefinitely and “never selling” reinforces the asset’s narrative as a long-term store of value. As such MicroStrategy’s Bitcoin treasury acts as a supportive force to the scarcity of Bitcoin.

The implications extend beyond MicroStrategy. The company’s success has spurred other corporations, such as Metaplanet, Semler Scientific, and Marathon Digital, to explore Bitcoin as a treasury asset. Additionally, the Financial Accounting Standards Board (FASB)’s upcoming shift to fair value accounting for crypto assets marks a pivotal moment. This change allows companies like MicroStrategy to reflect the market value of Bitcoin on their balance sheets, moving gains or losses to the corporate treasury instead of operating income. For MicroStrategy, this adjustment could eventually facilitate its inclusion in the S&P 500, providing passive Bitcoin exposure accessible to millions of index investors.

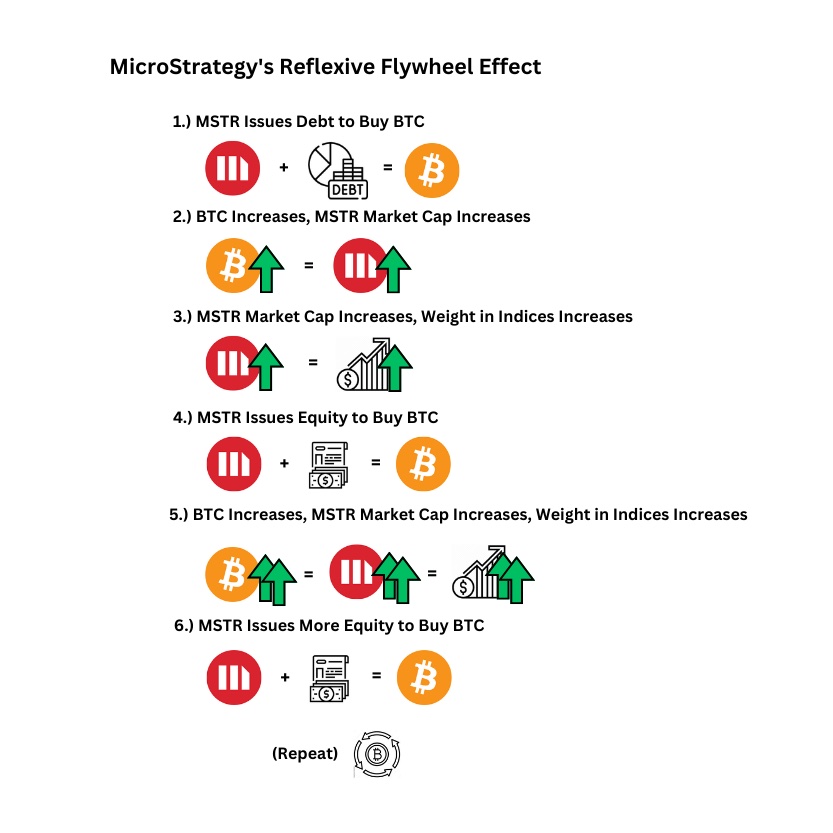

MicroStrategy’s strategic approach—issuing at-the-market (ATM) equity and long-term convertible notes—capitalises on Bitcoin’s historical trend of delivering positive returns over four-year time horizons. This strategy creates a reflexive feedback loop between Bitcoin’s price and MicroStrategy’s stock performance. As the company’s Bitcoin purchases contribute to upward pressure on Bitcoin’s price, the resulting increase in MicroStrategy’s stock value further fuels investor demand for its equity and debt offerings, enabling continued acquisitions. This dynamic flywheel effect strengthens both the company’s position and Bitcoin’s market momentum.

With all its Bitcoin holdings currently unencumbered, MicroStrategy is well-positioned to weather short-term volatility, ensuring its buying activity remains a strong positive catalyst for Bitcoin. However the future health of MicroStrategy does rely on Bitcoin’s price continuing to trend upwards.

Additionally by integrating Bitcoin exposure into equity and debt markets, MicroStrategy has created novel avenues for institutional and retail investors to gain access to Bitcoin. This demand reinforces Bitcoin’s appeal as a long-term hedge against fiat depreciation and a compelling diversification tool for long term loans and capital markets, potentially driving further capital into the ecosystem. We have recently seen discussion around Bitcoin potentially serving as an excellent collateral asset to support mortgages due to its nature of outperforming over long term horizons.

Why Has MSTR Outperformed BTC YTD?

MicroStrategy’s stock has outperformed Bitcoin itself YTD due to it effectively acting as a magnified bet on Bitcoin’s price movements. This dynamic is primarily driven by Michael Saylor’s ability to secure low or zero-interest financing for Bitcoin purchases, effectively obtaining highly cost efficient leverage. In contrast, retail or institutional investors relying on centralized exchanges for leverage face borrowing costs exceeding 30% annually, making MicroStrategy’s approach far more cost-efficient. As such it can easily be understood as to why MSTR trades at a premium to its NAV.

At its core, this strategy leverages a classic financial principle: borrowing depreciating assets to acquire appreciating hard assets. Historically, this rationale underpins the historical attractiveness of real estate investments, where debt positions hedge against inflation while building equity over time. Saylor applies this same principle to Bitcoin, which he views as the apex property asset. By capitalizing on Bitcoin’s inherent scarcity and long-term upward trajectory, MicroStrategy is effectively shorting fiat currency while steadily increasing its Bitcoin holdings or as MicroStrategy terms “Bitcoin Yield”.

Over extended time horizons, the strategy of accumulating Bitcoin has proven to be a powerful mechanism for wealth accumulation, making MicroStrategy’s stock a compelling option for investors seeking amplified exposure to Bitcoin’s performance.

What’s the Risk For MicroStrategy?

MicroStrategy’s current financial structure is uniquely resilient due to its reliance on unsecured convertible notes. Unlike traditional secured loans, which demand collateral and are subject to margin calls when asset values decline, these convertible notes are not tied to the company’s Bitcoin reserves. For investors, this structure minimizes downside risk while preserving exposure to Bitcoin’s potential upside and Michael Saylor’s ability to secure additional low-cost debt to grow Bitcoin holdings per share. Effectively, these notes function like an option call on MicroStrategy’s stock—a structure that thrives as long as Bitcoin’s price trends upwards and the company manages its debt maturities effectively with Bitcoin’s cyclical nature.

Should MicroStrategy’s stock trade below the conversion price at the maturity of its convertible notes, the company would face challenges. In such a scenario, the stock could experience significant short-term volatility as the company evaluates its options:

- Paying Off the Debt: The company could rely on cash reserves or operating income to settle the bonds, assuming these resources are sufficient.

- Rolling the Debt: MicroStrategy could issue new bonds to refinance the maturing notes, provided market conditions are favorable.

- Issue Shares: Issuing additional equity to raise capital is another viable route, though it would dilute existing shareholders and potentially weigh on the stock price.

- Selling Bitcoin: While a last resort, selling a portion of its Bitcoin holdings to meet obligations remains a theoretical possibility. However, given Saylor’s adamant stance of “never selling,” this scenario appears improbable.

MicroStrategy has weathered a severe Bitcoin drawdown in the past. During November 2022, the company faced a ~US$2 billion portfolio decline—roughly a 50% drop on its US$4 billion investment—while 37% of its debt was collateralized. Despite these challenges, MicroStrategy emerged intact, and today, all its Bitcoin holdings are unencumbered. This arguably positions the company in a stronger financial state moving forwards compared to the previous cycle.

Looking Ahead

The current playbook for MicroStrategy is robust and will stay that way into the foreseeable future as long as Bitcoin continues to trend upwards. However there is potential for MicroStrategy to face pressures in the future if Bitcoin’s price is not supportive of it’s debt obligations. In the short term however MicroStrategy exists as a deeply positive catalyst for Bitcoin.