categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

A New Dawn: Crypto’s Regulatory Boost

by Quinn Papworth

A New Dawn

Our last insight on the regulatory front was in November 2024. Since then we have seen countless positive developments in the regulatory landscape for digital assets following the Trump administration and yet price action has not been as encouraging. As such I thought it would be timely to provide an update on the positive fundamental boosts for crypto and take a look back at how far we have come from a previously hostile and uncertain political environment. This blog will break down some of the key developments, their execution so far and the implications for the crypto ecosystem.

Executive Order on Crypto Working Group and Digital Asset Stockpile

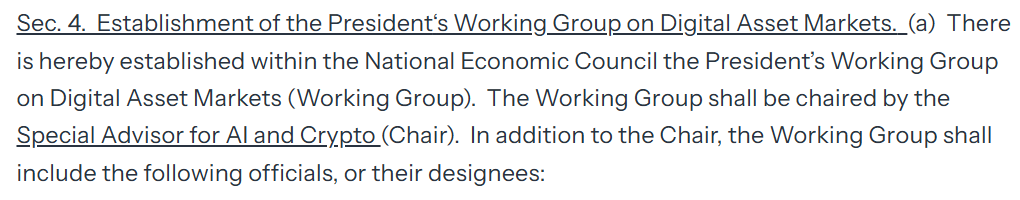

On January 23, 2025, President Trump signed an executive order creating the President’s Working Group on Digital Asset Markets, chaired by David Sacks. Its dual mandate: propose a federal regulatory framework for crypto including stablecoins and evaluate a national digital asset stockpile.

The group, comprising Treasury Secretary Scott Bessent, SEC Chair Paul Atkins, and other agency heads, is tasked with delivering recommendations by mid-2025.

A clear regulatory framework would end the era of “regulation by enforcement,” fostering innovation and attracting crypto businesses back to the US without arbitrary fear of enforcement for unknown reasons. I mean under the previous administration it got so bad for US based crypto businesses that they even stopped showing up to & hosting US based conferences out of fear of being served by the SEC.

SAB 121 Repeal: Unleashing Institutional Participation

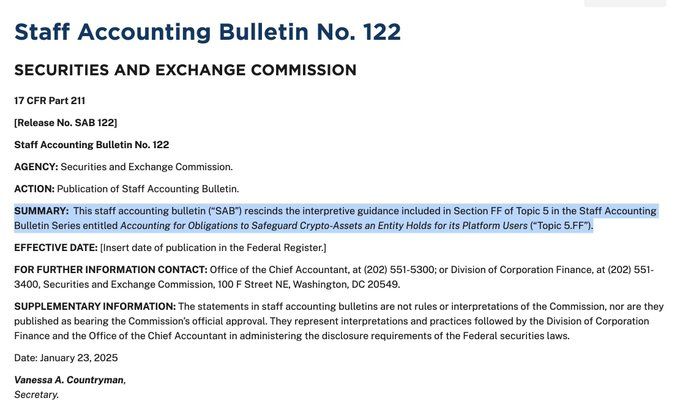

In January, the Securities and Exchange Commission (SEC) rescinded Staff Accounting Bulletin No. 121 (SAB 121), a controversial rule introduced in 2022 that required custodians of digital assets—like banks and financial institutions—to record customer-held crypto as liabilities on their balance sheets. This imposed burdensome capital requirements, deterring traditional institutions from offering crypto custody services at any scale to customers.

The SEC’s reversal came swiftly after President Trump’s inauguration and under new leadership replaced SAB 121 with SAB 122, allowing custodians to assess liabilities under broader accounting standards (GAAP and IFRS), rather than mandating an automatic liability classification.

This move dismantles a major barrier to institutional adoption. Banks and brokers can now custody cryptocurrencies like Bitcoin and Ethereum without tying up excessive capital, paving the way for deeper integration of digital assets into traditional finance.

Pro-Crypto SEC: From Foe to Friend

Under new Chairman Paul Atkins and Commissioner Hester “Crypto-Mum” Peirce, who now leads the rebooted Crypto Task Force, the SEC is undergoing a dramatic transformation from its enforcement-heavy days under Gary Gensler to a more crypto-friendly regulator. This shift, evident since January 2025, prioritizes clarity over confrontation.

Beyond repealing SAB 121, the SEC has signaled its new direction by dropping high-profile enforcement actions. In February 2025, it withdrew its case against Uniswap, the decentralized exchange, ending a years-long battle over unregistered securities claims. Similarly, the agency halted its lawsuit against OpenSea, the leading NFT marketplace, reversing Gensler-era assertions that NFTs constituted securities. Other cases, including probes into Ethereum staking and smaller DeFi projects, have also been quietly shelved. Atkins announced a “sensible” approach to registration and disclosure rules, with Peirce’s Task Force drafting frameworks to accommodate innovation rather than stifle it.

This pivot could unlock a wave of U.S.-based crypto activity—Uniswap and OpenSea’s reprieve may embolden DeFi and NFT platforms to expand domestically, while Ethereum’s ecosystem breathes easier without regulatory overhang.

Hasta La Vista Operation Chokepoint 2.0

The termination of Operation Chokepoint 2.0, a regulatory campaign to restrict cryptocurrency businesses’ access to banking services, marked a significant victory for the crypto industry under the Trump administration and a shift in the tides. Investigations, spurred by figures like attorney John Deaton and Congressional hearings in February 2025, uncovered evidence of coordinated federal efforts—most notably through FDIC documents —showing regulators had pressured banks to sever ties with crypto firms under vague “reputational risk” pretexts, echoing the original Operation Chokepoint’s tactics. The House Financial Services Committee, led by voices like Rep. French Hill, condemned these actions as overreach, as they stifled innovation and violated due process, with testimony from crypto executives and even Federal Reserve Chairman Jerome Powell acknowledging widespread debanking complaints. The backlash culminated in President Trump’s announcement at the Digital Assets Summit to end Chokepoint 2.0, followed by the OCC’s rescission of Interpretive Letter 1179, which had barred banks from crypto activities—drawing widespread industry praise and condemnation of the Biden-era policy as an unconstitutional assault on free markets.

The Stablecoin Act: Cementing Dollar Dominance

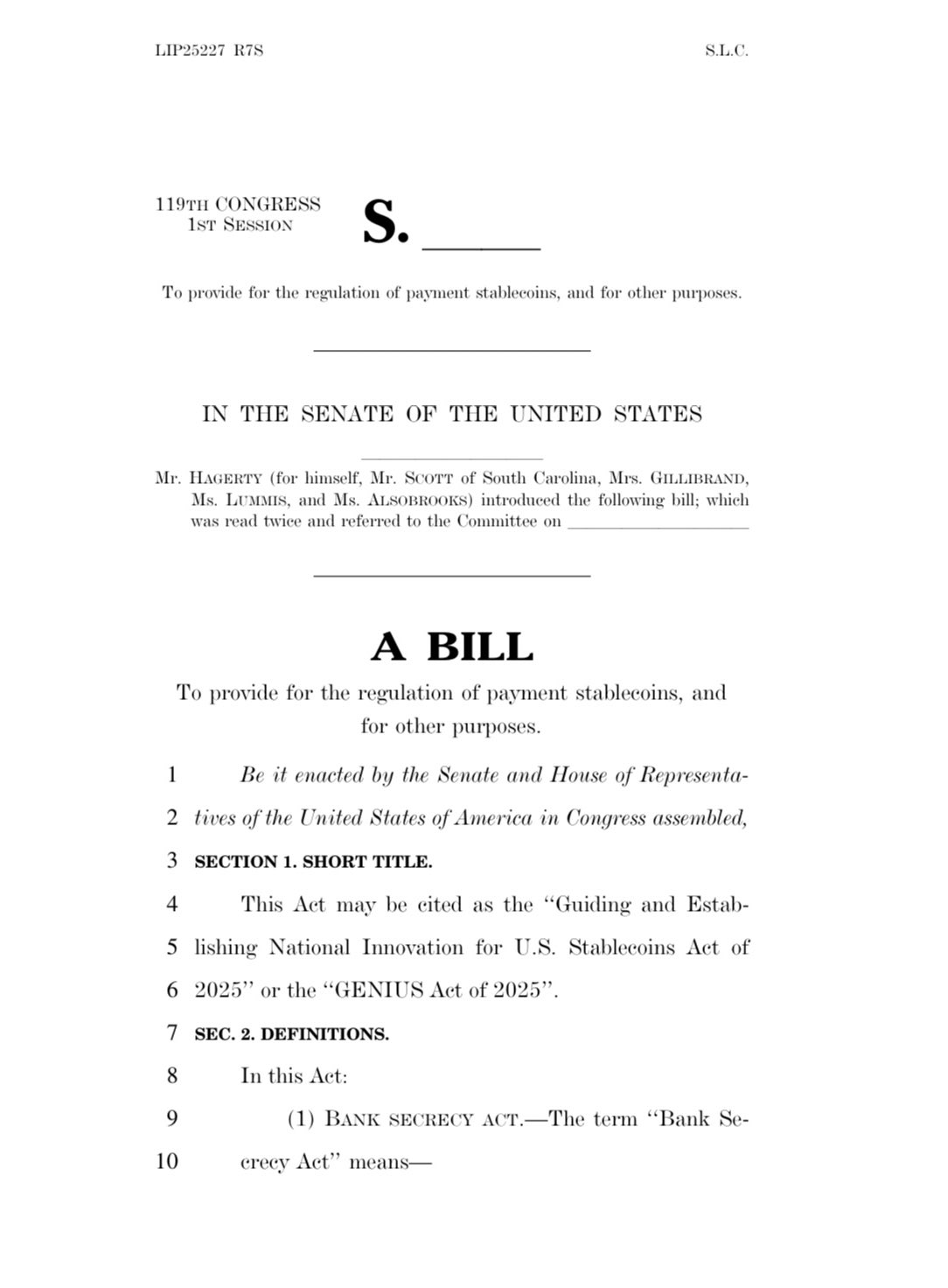

Stablecoins have long operated in a regulatory gray area. The proposed Stablecoin Act, gaining traction in early 2025, aims to provide a clear framework for their issuance and operation.

Spearheaded by pro-crypto lawmakers like Senators Scott, Hagerty, Lummis, and Gillibrand, the legislation outlines licensing requirements, reserve standards, and oversight by federal regulators. It emphasizes dollar-backed stablecoins as tools to maintain U.S. financial sovereignty, with figures like David Sacks (Trump’s “AI and Crypto Czar”) championing their potential to drive demand for U.S. Treasuries.

By legitimising stablecoins, the Act could position the U.S. as a global leader in digital finance, reinforcing the dollar’s dominance in an increasingly digital economy. Trillions in stablecoin transactions could flow through U.S.-regulated entities, boosting economic activity. However, that being said, care needs to be taken that this doesn’t result in a bill being passed that only allows centralised entities to thrive.

Strategic Bitcoin Reserve: Presidential Action for a Crypto Stockpile

On March 6, 2025, President Donald Trump signed the “Establishment of the Strategic Bitcoin Reserve and United States Digital Asset Stockpile” executive order, formalizing a Strategic Bitcoin Reserve (SBR) as a cornerstone of U.S. economic policy. This action builds on his January 23, 2025, order creating the President’s Working Group on Digital Asset Markets and fulfills campaign promises to position America as a crypto leader.

The executive order establishes the SBR as a permanent reserve asset, initially capitalized with Bitcoin forfeited to the Treasury through criminal and civil proceedings—estimated at approximately 200,000 BTC. Federal agencies are directed to account for their digital asset holdings within 30 days and explore transferring Bitcoin to the SBR, with the U.S. committing not to sell these assets. The order also tasks the Secretaries of Treasury and Commerce, under Scott Bessent and Howard Lutnick, with developing budget-neutral strategies for acquiring additional Bitcoin, ensuring no taxpayer burden. Within 60 days, the Treasury must evaluate legal and investment considerations for managing the SBR, including potential legislative needs.

The SBR elevates Bitcoin to a state-sanctioned store of value, akin to a “digital Fort Knox,” potentially stabilizing its price and reinforcing U.S. financial leadership.

Digital Asset Summit

The White House Digital Assets Summit, held on March 7, 2025, convened industry titans, policymakers, and regulators to chart the course for cryptocurrencies in the U.S. Hosted by President Donald Trump, the event underscored America’s ambition to become the “crypto capital of the world.”

Attendees included luminaries like Michael Saylor of MicroStrategy, Ripple CEO Brad Garlinghouse, Chainlink’s Sergey Nazarov, and Coinbase’s Brian Armstrong, alongside administration figures like David Sacks and Howard Lutnick. Discussions honed in on regulatory clarity for digital assets, stablecoin oversight, and integrating crypto protocols and assets into financial infrastructure. The President’s Working Group on Digital Asset Markets, established earlier in 2025, presented preliminary findings, emphasising a pro-innovation stance. Key talking points of the summit included stablecoins as a means to expand the dominance of the US dollar and Trump’s vow to sign stablecoin legislation before August and end crypto debanking definitively.

Conclusion

The U.S. is betting big on crypto as an engine of growth, innovation, and financial leadership. The repeal of SAB 121, stablecoin clarity, and a pro-crypto government could unleash a wave of investment and adoption. Yet in the short term it will take time to build robust risk management systems. If executed well, this regulatory renaissance could redefine the crypto economy in the US.

This report (‘Report’) has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security of financial product or service. This Report does not constitute a part of any Offer Document issued by Apollo Crypto Management Pty Ltd (ACN 623 059 227, AFSL 525760) or Non Correlated Capital (ACN 143 882 562, AFSL 499882), the Trustee of the Apollo Crypto Fund. Past performance is not necessarily indicative of future results and no person guarantees the performance of any Apollo Crypto financial product or service or the amount or timing of any return from it. This material has been provided for general information purposes and must not be construed as investment advice. Neither this Report nor any Offer Document issued by Apollo Crypto or Non Correlated Capital takes into account your investment objectives, financial situation and particular needs. The information contained in this Report may not be reproduced, used or disclosed, in whole or in part, without prior written consent of Apollo Crypto. This Report has been prepared by Apollo Crypto. Apollo Crypto nor any of its related parties, employees or directors, provides and warrants accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. You should obtain a copy of the Information Memorandum, issued by Non Correlated Capital before making a decision about whether to invest in the Apollo Crypto Fund.