categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Understanding FLUID’s Innovation

by Quinn Papworth

Background

Fluid, formerly known as Instadapp, has experienced strong growth in platform adoption over the last 3 months as it offers the DeFi market innovative new solutions. What many might not know is that this pattern of innovation is not something new to the Fluid team, founders Samyak & Sowmay Jain have been steadily building innovative products in DeFi for years. Most notably they are known for their key work on flash-loan architecture and the introduction of DeFi smart accounts responsible for the state of account abstraction as we know it today.

Fluid today offers two key products: its lending market and DEX which both use a shared liquidity layer. While this may not sound exciting, they have quickly been gaining impressive traction due to their innovative architecture allowing for incredibly high capital efficiency—a topic we’ll dive into later in this piece.

Recent traction

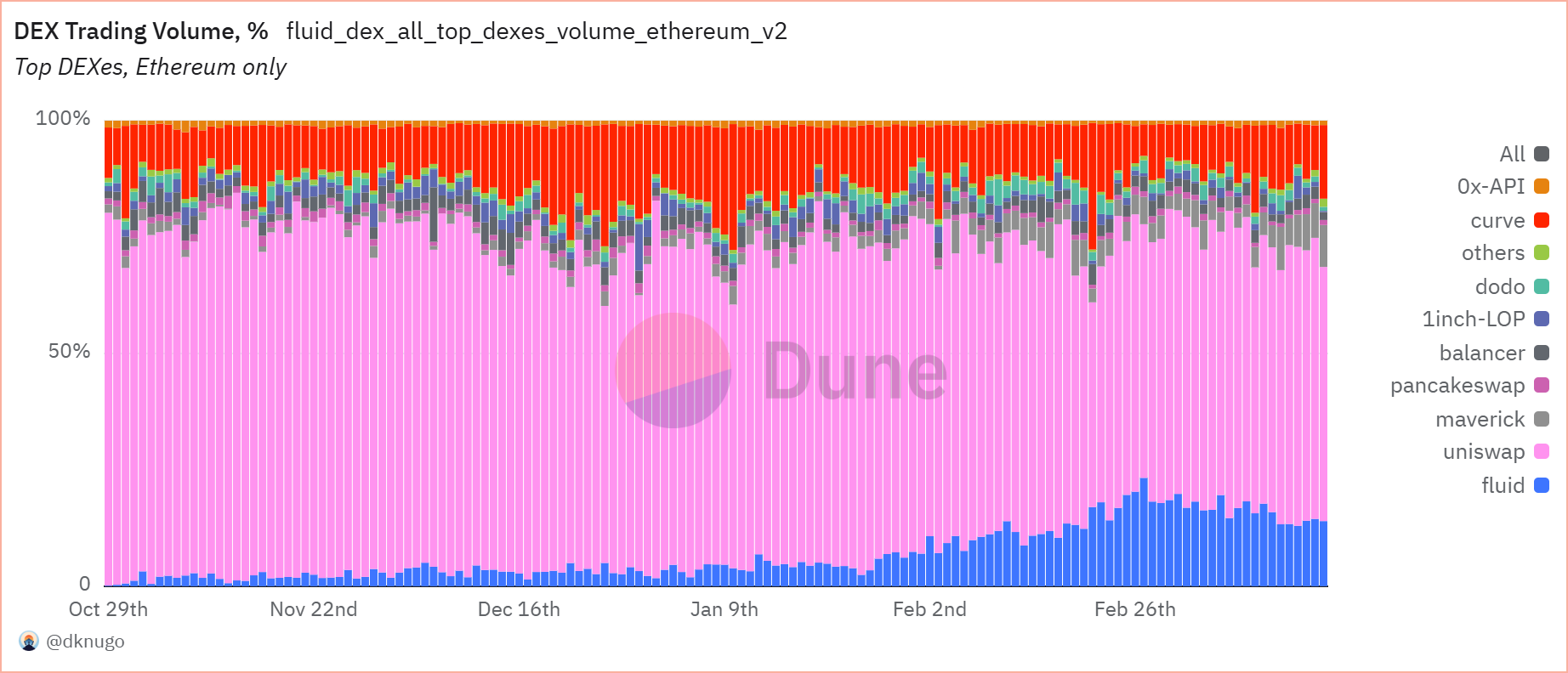

In the past 3 months, Fluid has witnessed a remarkable surge in activity, this can be seen clearly below when put into the context of the total DEX trading volume being captured. At the beginning of the year Fluid accounted for a modest 1.8% of the market share whereas as of the time of writing it now accounts for 14.5% of the total market, an eightfold increase in less than a quarter.

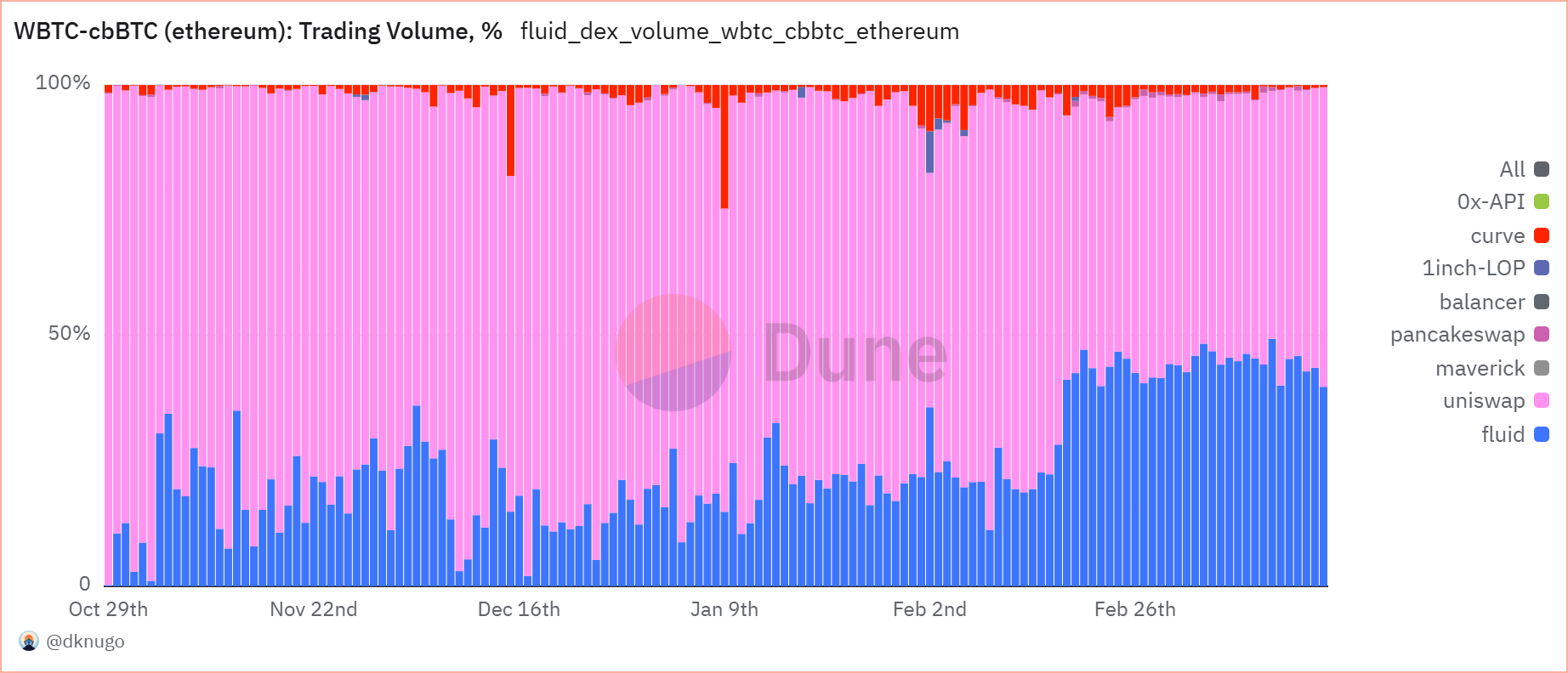

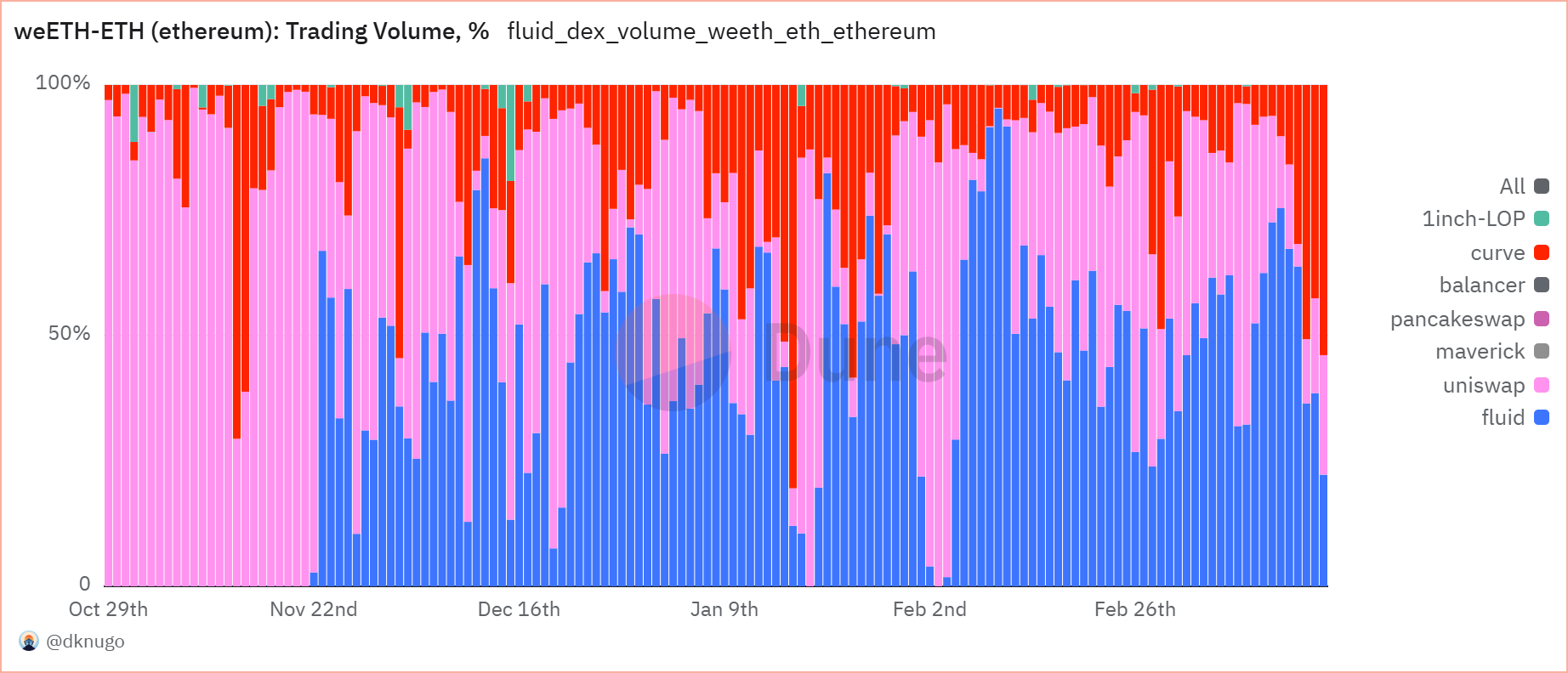

Currently, Fluid focuses exclusively on trading ‘blue-chip’ assets and doesn’t offer any long tail assets. Yet within this niche it is starting to become increasingly more dominant. In DEX pools such as wBTC/cbBTC and weETH/ETH we are seeing this play out clearly. But this begs the question, what are the mechanisms/technical advantages that are driving this growth?

The Secret Sauce

Fluid has optimised for many factors to offer a compelling and efficient product, however its greatest innovation is arguably the introduction of ‘smart collateral’ and ‘smart debt’.

Smart collateral:

Smart Collateral is a single range order that enables users to multipurpose their capital, using it as collateral to borrow against it, lend it, and deploy it as AMM liquidity on the DEX to earn trading and lending fees simultaneously. In plain english it essentially allows you to submit collateral not as one asset but an LP position in the Fluid DEX.

Smart debt:

Smart Debt allows the debt to be turned into a productive asset by using debt as trading liquidity, therefore earning trading fees that offset the cost of capital incurred by borrowing (APR). Smart debt can be considered as the inverse of any AMM pool.

Allowing collateral and debt to be turned into productive assets is a key unlock that yields extremely high LP capital efficiency when combined with the high LTV rates we see offered on the Fluid protocol.

Lets take a look at the math with an example:

wstETH<>ETH Vault at 95% LTV

Initial Deposit: You deposit 1 ETH.

LTV: 95% (you can borrow up to 0.95 ETH worth of wstETH per ETH deposited).

Leverage Calculation:

Total collateral leverage = 1/(1−0.95)=20x

With 1 ETH, looping allows you to build up 20 ETH worth of collateral.

Total debt = 20×0.95=19

19 ETH worth of wstETH borrowed.

Liquidity Provided:

The vault uses your 20 ETH (collateral) and 19 wstETH (debt) in the ETH<>wstETH pool.

Since 1 wstETH ≈ 1 ETH in value, this is roughly 39 ETH worth of liquidity.

Result: Your effective LP position is 39x your initial 1 ETH deposit.

Earnings: You earn trading fees on this 39x position—39 times what you’d earn with just 1 ETH unleveraged.

Ok so now that we have completed a breakdown on the math, lets look at a real yield opportunity available on FLUID as of the time of writing.

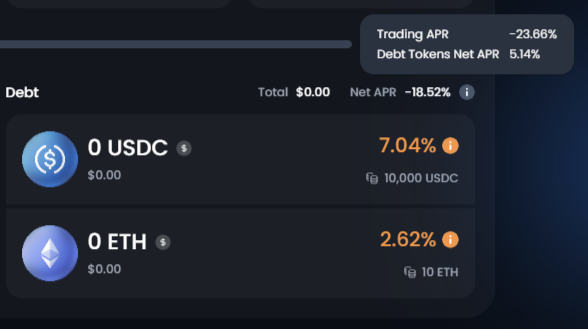

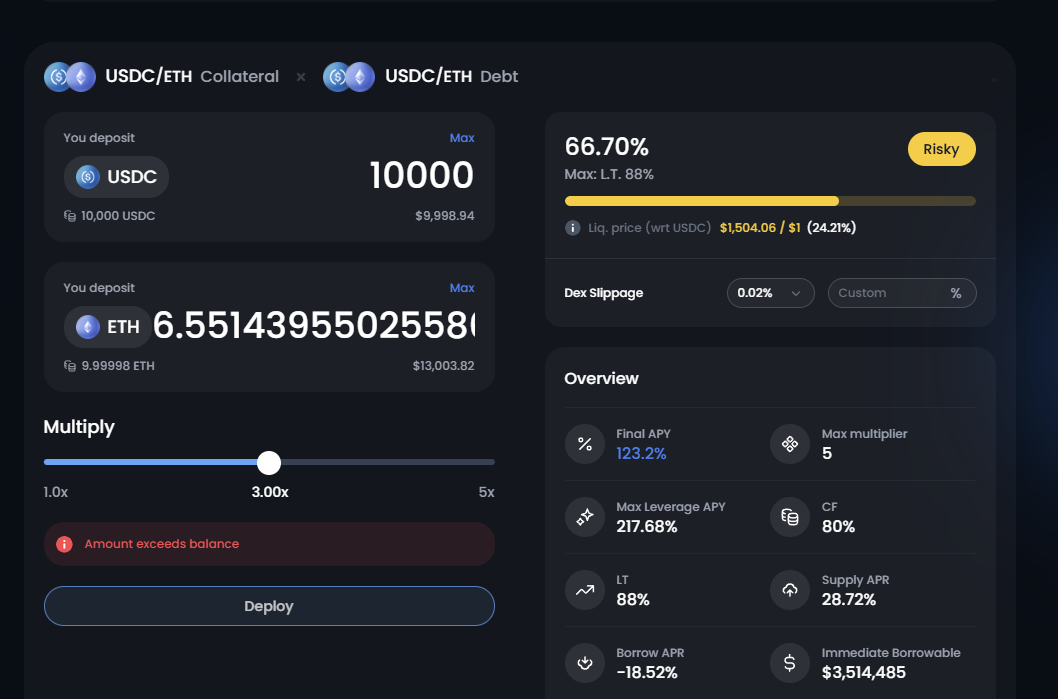

As pictured below we can see that the net APR for providing smart collateral is 28.72% and -18.52% for smart debt. But ‘wait a second’ I can hear you asking, how can it be that the borrow APR is negative?

It is because the trading APR from the smart debt’s use in the DEX is 23.66%, once factoring in for the net cost of borrowing of 5.14% it results in the net APR of -18.52%. Meaning you are actually getting paid to borrow/the debt is paying itself off, this is a first in the entire finance industry, not just DeFi. But as this is DeFi, this position is begging for some looping action here so we can get some absolutely juiced yields.

What would a position look like here if we were to add some capital and crank up the leverage to 3x or a 66.7% LTV and loop? We would be left with a position of USDC/ETH getting a final APY of 123.2%, ETH would have to move downward by 24.21% to meet our liquidation price and even so the penalty for getting liquidated is only a forgiving 2%. Not bad!

So now that you understand the level up of smart collateral and debt turning idle assets into productive assets earning yield from LPing, it begs the question why are the LP yields so good on these blue chip pairs?

Gas Optimisation

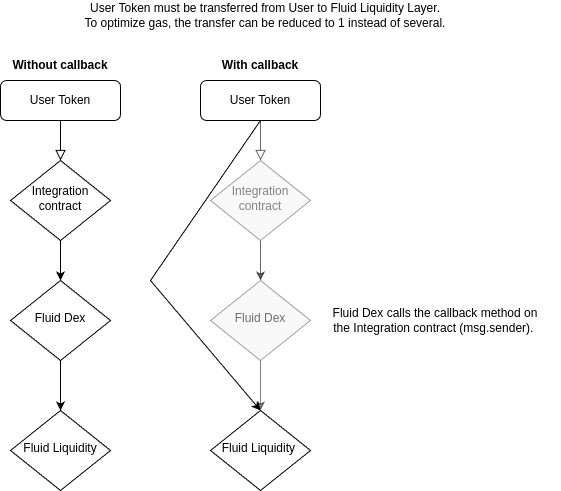

Firstly it is because of the gas optimisation of Fluid. Fluid DEX cuts gas costs through its innovative callback method, swapInWithCallback(), which streamlines token swaps by reducing the number of transfers from three to two. By enabling the integration contract to directly send tokens to the Fluid Liquidity layer—bypassing an intermediate step with the Fluid Dex contract—FLUID minimizes on-chain interactions, saving approximately 15% on gas compared to competitors like Uniswap v4. As such Fluid provides some of the cheapest swaps available and thereby drives volume to its pools.

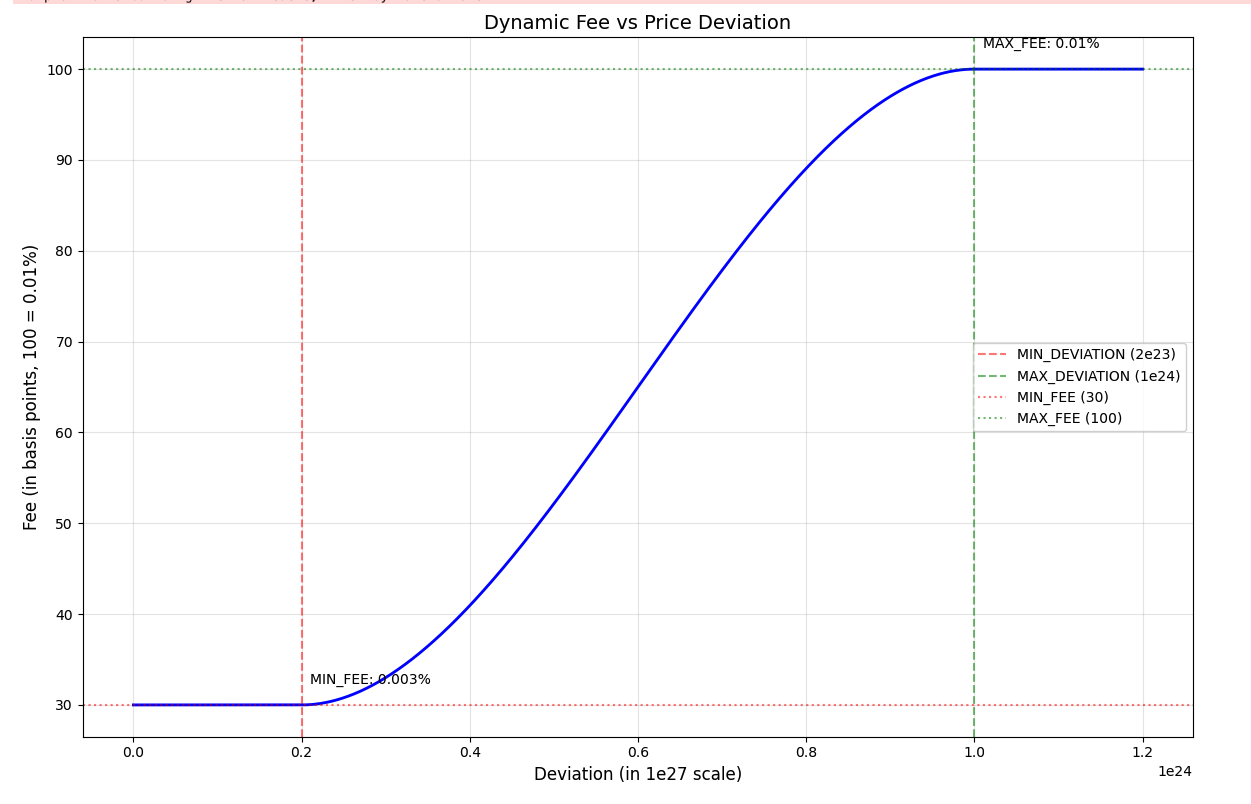

Competitive Fees

Secondly Fluid offers some of the most competitive fees in the market. Fluid can use a dynamic fee model for stable pairs that allows it to offer fees as low as 0.003% during more stable periods where price deviation is low and a max fee of 0.01% during more volatile periods where price deviation is higher. In comparison similar Uniswap pools take a flat fee of 0.01% at all times. As such this relationship encourages volume on Fluid during stable market conditions.

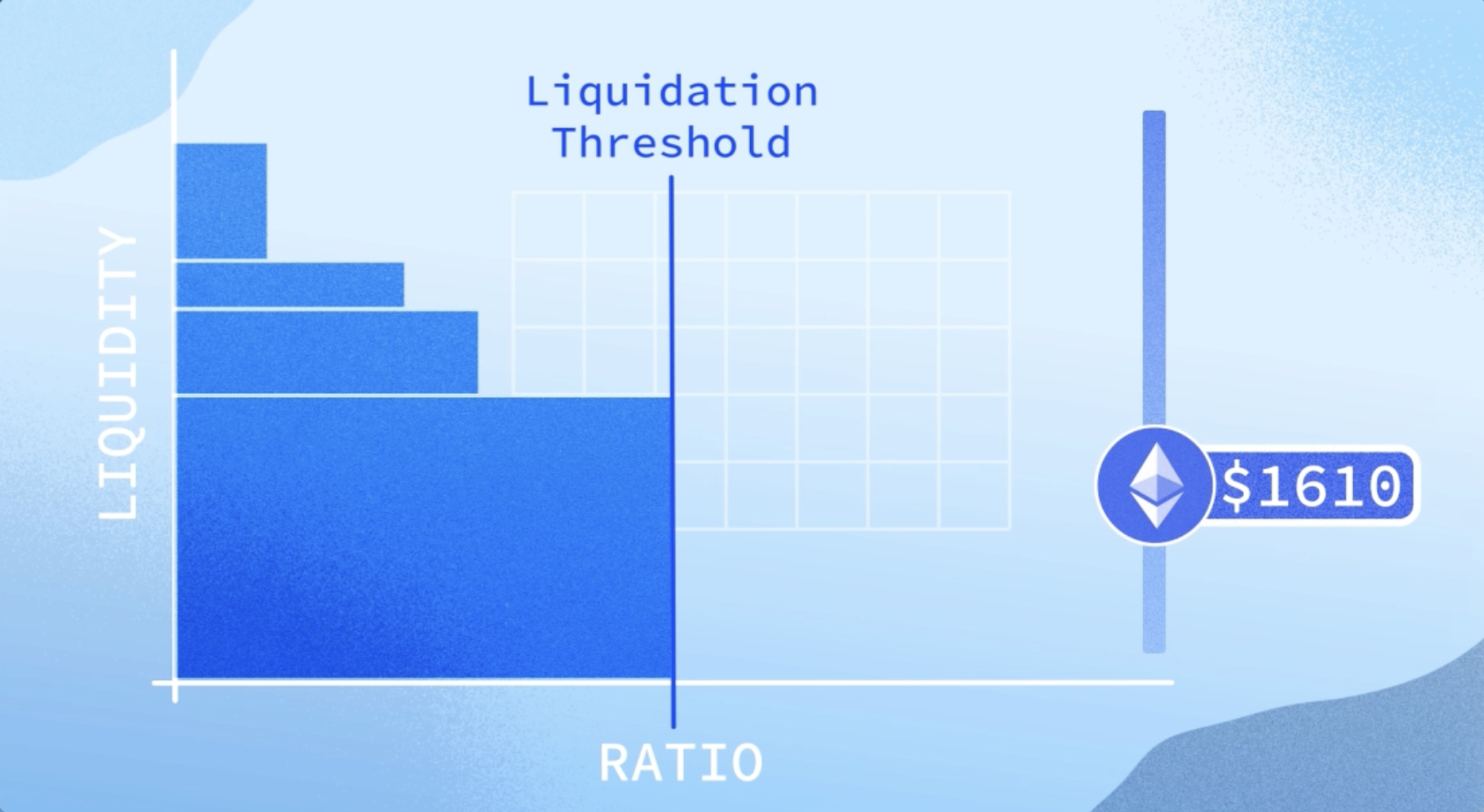

Fluid’s Liquidation Engine

Finally Fluid’s liquidation engine is far and above the most advanced on the market and handles liquidations in a unique way which is highly efficient. Other markets such as Aave treat liquidations as limit orders and liquidate users one at a time often taking a hefty penalty (50-100%) whereas Fluid’s liquidation engine is loosely based on the mechanism of Uniswap’s v3 design of range orders. As such Fluid liquidates users such that all users in the range get liquidated simultaneously instead of one-by-one. This results in a few huge level ups, first it means Fluid can offer much lower liquidation penalties than any of its other competitors (as low as 0.1%). Second, liquidations on Fluid use significantly less gas than competitors, as much as 1/6th of the gas used by other DeFi protocols. Third, it means you don’t need to be a sophisticated player to liquidate positions as no tracking of individual positions is required, it is just a single swap and as such DEX aggregators such as Kyber swap and CoW Swap have been adding it as a route with a simple contract call. These advancements in the liquidation engine is what allows Fluid to offer such high LTV rates to its users while not taking on any bad debt.

This creates an environment where there is high volume going through the Fluid pools resulting in higher yields going towards LPs due to the efficiency of the DEX. Fluid DEX is actually so efficient to the point where Fluid DEX is 20% of the market with only US$386 million in TVL in the DEX market. This is an incredible feat when we consider that Uniswap currently has US$3.9 billion in TVL in order to achieve its 60% market share. This is a result of the depth of liquidity Fluid can offer despite its smaller TVL by sharing a unified liquidity pool with its lending platform.

The Future For Fluid

Beyond their existing innovation the picture continues to look good for Fluid right now, co-founder Samyak Jain stated in Coinshift’s podcast that they plan to launch their v2 product this year and that it will be even more advanced than Uniswap’s recent v4. With this launch Samyak sees Fluid potentially capturing 50% total market share. Beyond improving their existing products the team is also exploring rolling out a perpetuals platform as well as onboarding more RWA assets to the platform. Samyak provided the vision of using your Tesla stock as collateral and being able to then borrow USDC as an example. Continual future upgrades for Fluid remain highly flexible due to the fact that the shared liquidity layer of Fluid sits at the bottom of the stack, as such all of the applications being built on top of it can introduce new versions without asking users to migrate to a completely new stack. This allows for highly capital efficient money legos as well as an enhanced experience for the end user.

Disclaimer: Apollo Crypto holds FLUID

This report (‘Report’) has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security of financial product or service. This Report does not constitute a part of any Offer Document issued by Apollo Crypto Management Pty Ltd (ACN 623 059 227, AFSL 525760) or Non Correlated Capital (ACN 143 882 562, AFSL 499882), the Trustee of the Apollo Crypto Fund. Past performance is not necessarily indicative of future results and no person guarantees the performance of any Apollo Crypto financial product or service or the amount or timing of any return from it. This material has been provided for general information purposes and must not be construed as investment advice. Neither this Report nor any Offer Document issued by Apollo Crypto or Non Correlated Capital takes into account your investment objectives, financial situation and particular needs. The information contained in this Report may not be reproduced, used or disclosed, in whole or in part, without prior written consent of Apollo Crypto. This Report has been prepared by Apollo Crypto. Apollo Crypto nor any of its related parties, employees or directors, provides and warrants accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. You should obtain a copy of the Information Memorandum, issued by Non Correlated Capital before making a decision about whether to invest in the Apollo Crypto Fund.