categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

The Hype Behind Hyperliquid

by Quinn Papworth

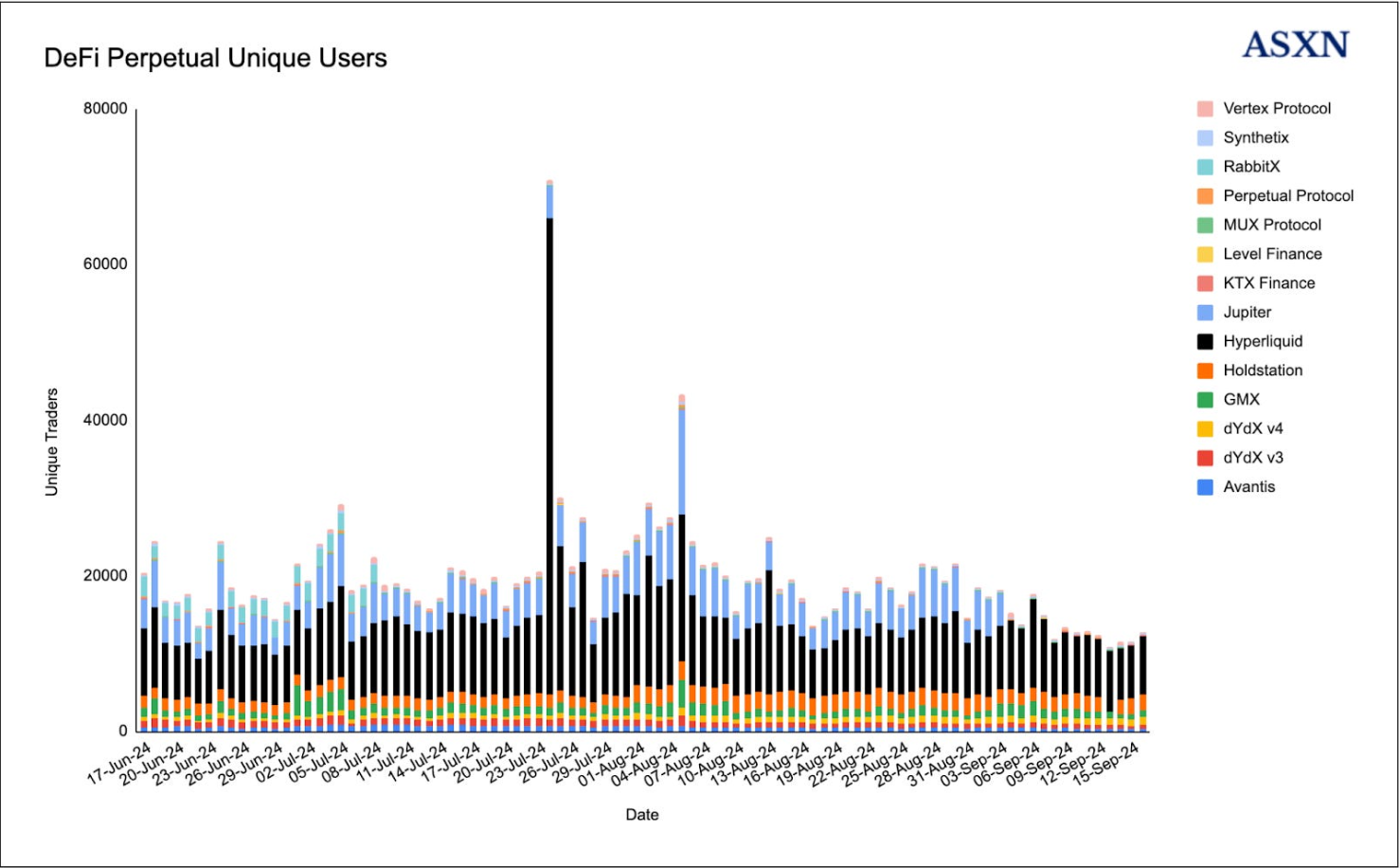

DeFi project, Hyperliquid, a perpetual trading exchange, has seen considerable growth over the last 6 months and has now emerged as a dominant player among its DeFi and centralised competitors. This blog investigates the story of Hyperliquid and why it has been able to find such great success in a relatively short time frame.

Hyperliquid’s History

Hyperliquid first launched its mainnet in Q1 of 2023 with integration on Arbitrum for bridging USDC to the Hyperliquid L1. It proceeded to find great momentum with its vision of replicating the user experience of centralised exchanges (CEX) while offering a fully onchain order book.

Hyperliquid then began a highly successful ‘points’ program in November 2023 which saw its user base climb dramatically as users used the platform in order to farm points for a potential reward in HYPE tokens. However, often with airdrop programs we see a short term peak in users and then a large fall off in activity after users have completed actions deemed to be worthy of an airdrop. This simply wasn’t the case with Hyperliquid, it saw stable and continued usage leading up to its token generation event (TGE) one year later at the end of November 2024, but why is this?

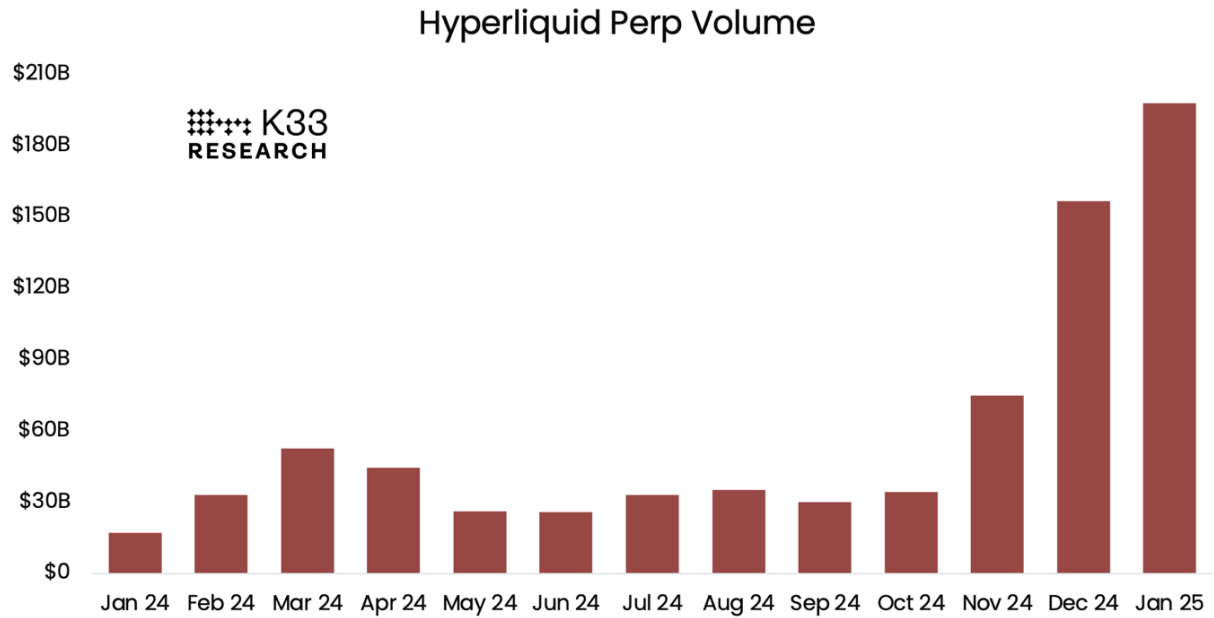

Then one of the most consequential events for Hyperliquid occurred, their TGE. However, things were done a little differently to the typical TGE this time around. The HYPE token didn’t deploy on any centralised exchange and instead was launched fairly on the Hyperliquid exchange with 31% of the total supply being deployed to the community via the genesis airdrop. At its peak price the total value of the Hyperliquid airdrop grew to more than US$7.5 billion making it the most valuable airdrop in crypto history. It is also astounding to consider the token was trading in pre-markets at $5 and then proceeded to rip to more than $30 in an atmosphere where most token generation events (80%+) are down only for the price action, it is undeniably the most successful TGE in recent crypto history. This spurred significant excitement around the project and saw trading activity reach continual new all time highs in the months to come.

What Makes Hyperliquid So Popular?

Ok so circling back to a point made earlier, why is it that users on Hyperliquid remain so sticky and continue to use the platform post their initial airdrop interest? First the user experience on Hyperliquid is unmatched, it far exceeds any other DeFi alternative and in my opinion has a better trading experience/user interface than any CEX. This largely stems from the fact that Hyperliquid’s architecture is highly performant being able to handle up to 200,000 orders a second while offering a median latency of 0.2 seconds which feels extremely fluid/instantaneous when executing trades. Besides user experience alone Hyperliquid has a few additional unique advantage: it offers highly competitive fees which are cheaper than the majority of competitors (3.5bps to 1.9 bps taker fee and 1bps to 0bps maker fee), it doesn’t require any KYC allowing new traders to use the platform in a manner of minutes and finally their decentralised structure allows them to onboard long-tail assets in a rapid fashion that CEXs cannot keep pace with in their permissioned environments.

The HYPE Token

Ok so this is all great but how does the HYPE token actually tie into all of this and what is its utility? The underlying utility of the HYPE token is that it can be staked to help secure the network for a share in emissions and it is also used as the gas token in the HyperEVM. Beyond this it is currently being suggested that HYPE may also be used in the future as a way to get further discounted trading fees.

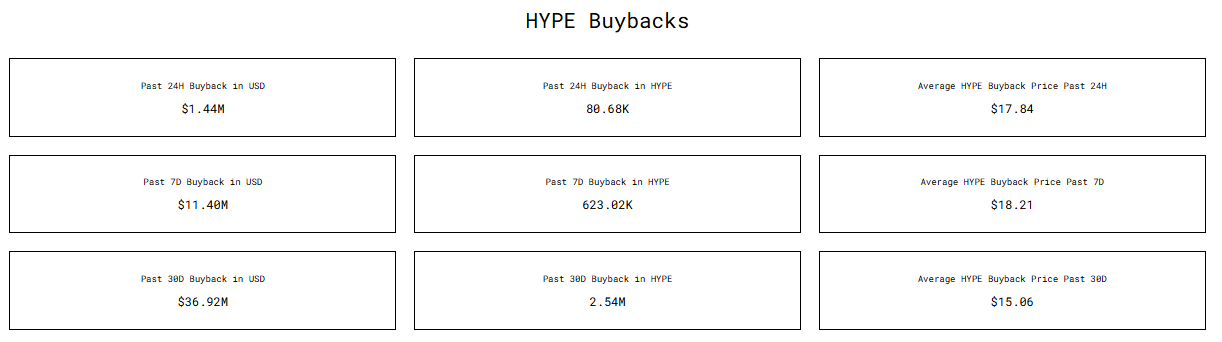

Beyond its utility the HYPE token also accrues significant value from the success of the Hyperliquid exchange as 97% of revenue is used to buyback HYPE tokens from the open market to grow the Hyperliquid Assistance Fund. Due to the sheer amount of volume going through the Hyperliquid exchange (now 1.3 trillion total volume to date) this has resulted in significant HYPE buybacks. If we annualize the last 30 days of buyback activity this results in US$443 million in HYPE token buybacks per year which is currently 7.1% of the current token float. This matters as it aims to ensure HYPE’s scarcity and value and essentially gives users exposure to the performance of the exchange’s usage metrics.

The Future For Hyperliquid

Many still hold the belief that Hyperliquid is just an app or a layer 3 that sits atop Arbitrum however this is not true, Hyperliquid is a dedicated layer-1 with an ecosystem now growing from it after the team launched the mainnet of HyperEVM, enabling ethereum compatible smart contracts to be built on the network.

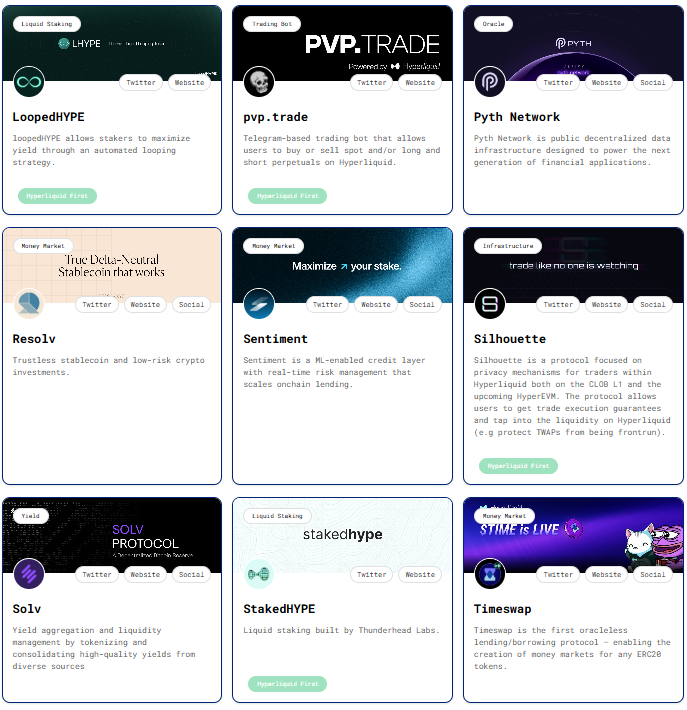

As such we have started to see the emergence of an ecosystem building on the HyperEVM with a range of activity from memecoins and NFT communities arising to DeFi applications like lending markets, liquid staking, Yield protocols, AMM DEXs, trading bots etc. Traction around this ecosystem has started to build recently with Hyperliquid having just introduced a new ‘points’ season that could possibly be for farming 38.88% of the supply still allocated for future rewards. Many speculators are thinking a portion of this supply might be distributed to protocols within the HyperEVM ecosystem.

Personally I am closely watching apps that are looking to interact with the Hyperliquid exchange directly and I am interested to see how the two ecosystems which are somewhat separate as of today will work together in the future as I believe there could be interesting use cases if deeper integrations are made.