categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Crypto ETF Flows Pick Up

by Quinn Papworth

ETF Momentum

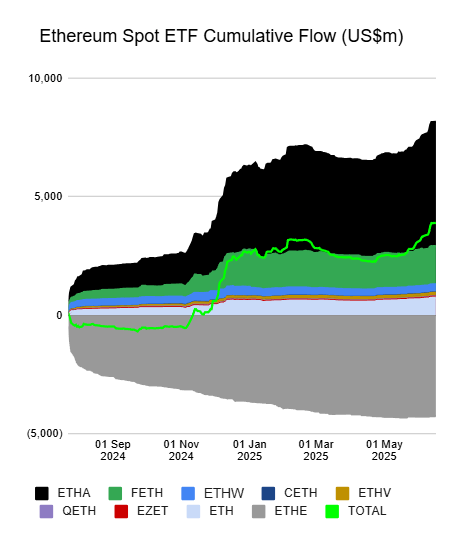

Recent months have brought significant net inflows into U.S. BTC and ETH spot ETFs. The total cumulative flows for the BTC ETFs has increased by roughly $US10 billion in the last 3 months while for ETH cumulative flows have increased by ~$US1.3 billion. This surge is especially notable for ETH which has struggled with inflows since its launch, but has now gained momentum, with flows aligning roughly with its 15% market cap weight relative to BTC. This signals growing institutional comfortability with crypto ETFs.

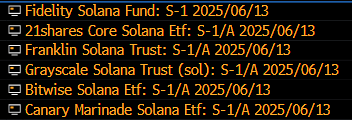

Solana ETFs & Staking

With crypto ETF momentum growing, Solana (SOL) ETF discussions are gaining traction as the next widely accepted ‘major asset’. Early last week the SEC reached out to the seven prospective SOL ETF issuers (now eight with CoinShares joining the race as of yesterday) asking them to submit their updated documents, notably the SEC also requested that they include staking in these submissions. While it is not yet definitive that the ETFs will have staking this is a very positive sign and I would personally be surprised at a complete reversal from here. This decision will have important implications for the existing Ethereum ETFs as well which so far have been unable to stake the ETH held in them. I expect that ETH and SOL ETFs will see increased flows related to the hedged basis trade if staking is included as the return of the trade will instantly improve with staking yield being introduced on the spot holdings side.

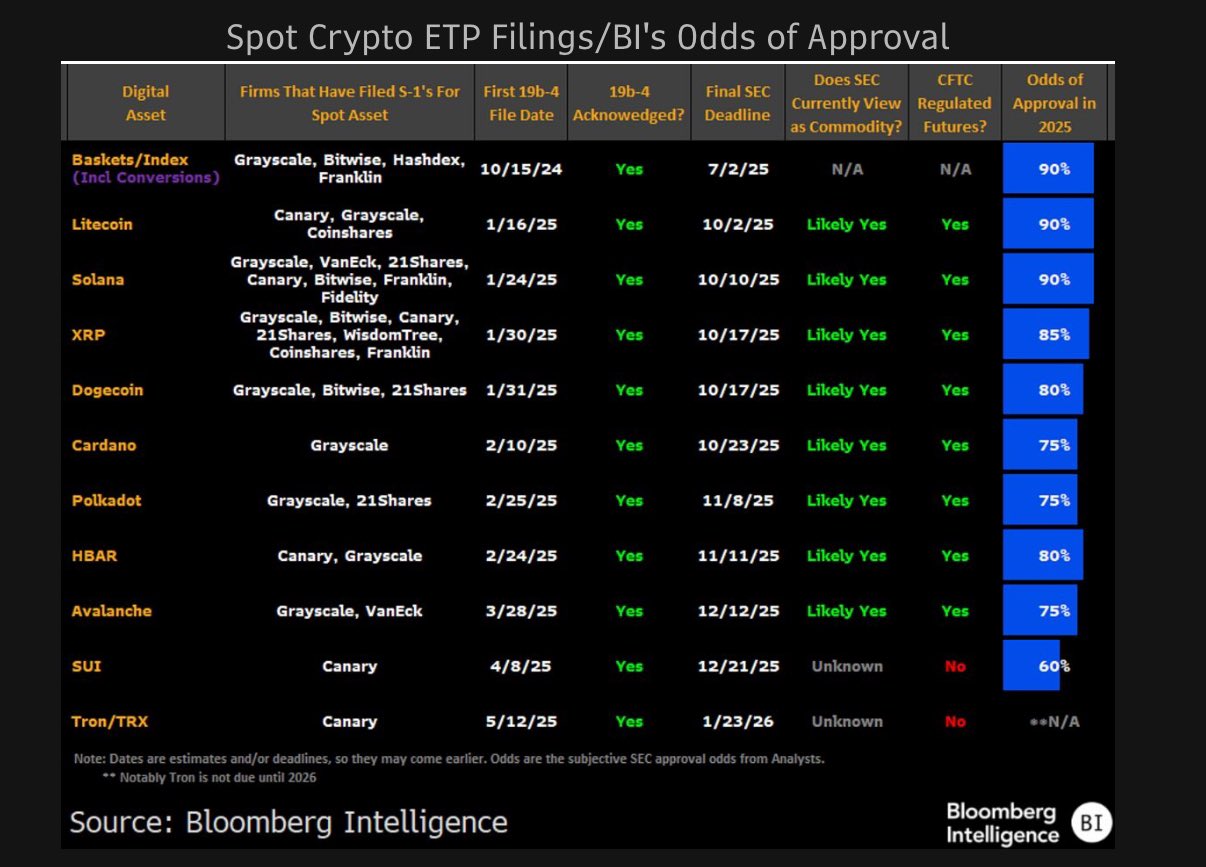

Bloomberg Estimates

Following the success of the BTC and ETH ETFs, a wave of spot crypto ETF filings has emerged. Bloomberg ETF research analyst, James Seyffart recently put forward a table as pictured below detailing the odds of approval in 2025 for a variety of crypto assets. According to the Bloomberg team we could see crypto index ETFs as early as next month, recent filings include Donald Trump’s media & technology group Truth Social who have filed for a mixed BTC and ETH ETF as of yesterday. The Bloomberg team ranks Solana and Litecoin as the next most likely candidates for ETF approval (90% likelihood) with more crypto assets in the pipeline such as XRP & Dogecoin. Interestingly Bloomberg reports that the SEC may push forward the timeline for approval of the Solana ETFs due to Rex-Osprey’s attempts to use regulatory/legal loopholes to launch SOL and ETH staking products. As such we could see SOL ETFs sooner than the deadline in October.

Is CME Hedging Behind The Recent ETH Inflows?

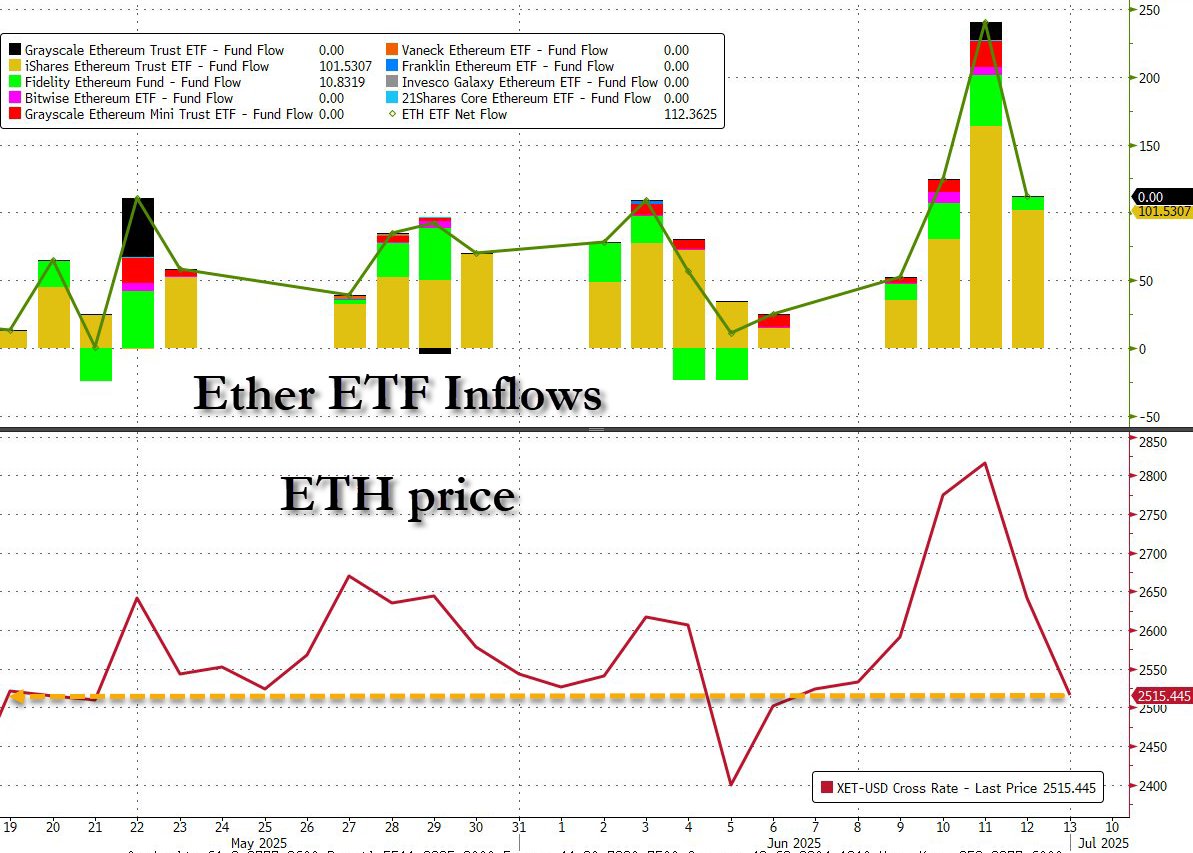

ETH ETFs saw US$1.3 billion in inflows in the last month, almost doubling the total assets under management of all the spot ETH ETF products. However despite these impressive flows the price action for ETH has largely stayed flat ranging sideways, is there another factor at play?

This has sparked speculation that institutional players are leveraging the CME ETH basis trade to capitalise on yield opportunities. In this trade, traders buy ETH in the spot market (e.g., via ETFs) and simultaneously short ETH futures on the CME, this way they get to harvest the annualised basis while having no directional exposure. While not definitive, the open interest (OI) in CME ETH futures has closely tracked the growth in the AUM of the spot ETFs over the last 8 months suggesting a relationship in activity. The fact that the funding rate for ETH (14%) has been notably higher recently than BTC (10%) could also largely explain the increased flows Ethereum has seen in the last month of ~US$1.3 billion while the price has remained relatively flat. This correlation, combined with ETH’s higher basis yield, suggests the basis trade could be a key driver of the US$1.3 billion in inflows.