categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

A DeFi Renaissance

by Quinn Papworth

A DeFi Renaissance

The “DeFi Summer” the crypto industry witnessed in 2020 was the first time decentralised finance became more than just a theoretical idea but an actual working product, with protocols such as Aave, Uniswap and Maker leading the charge. As a result, by late 2021 the total DeFi total value locked (TVL) had reached a level of over US $200 billion as the size of many crypto assets swelled concurrently. As of today the total DeFi TVL sits at approximately US$105 billion with many calling for the resurgence of DeFi and a return to the strong fundamentals it offers. As such we wanted to explore the catalysts behind possible growth in the sector amid the mixed market conditions we have seen throughout the year.

Parallels With The Dot-Com Bubble?

It can be argued the initial hype surrounding the 2017 ICO craze and 2020’s “DeFi Summer” draws parallels to the 2000 dotcom boom and bust. Similar to the dotcom boom that preceded, lots of experimentation occurred during the 2017 ICO boom in a low interest rate environment, with very few projects surviving afterwards, however those that did emerge are now highly successful. We believe that analogous to companies that emerged successful from the dotcom crash such as Microsoft, Amazon and Ebay – DeFi protocols Aave, Maker and Uniswap have emerged as DeFi’s industry leaders having achieved proven market fit.

In the aftermath of the dotcom crash there was very affordable access to high-speed internet and low connectivity charges due to overcapacity of infrastructure resources, similarly there has been a focus on building infrastructure in crypto over the last few years allowing for dApps to access an abundance of cheap block space with more performant speeds. As such we believe this has been an advantageous factor fueling revenue growth for the survivors of the 2020 DeFi boom.

Fueling The Fire

Recently there has undoubtedly been swelling sentiment around the resurgence of DeFi and a return to fundamentals grounded in protocol revenue. But what are the catalysts supporting this movement?

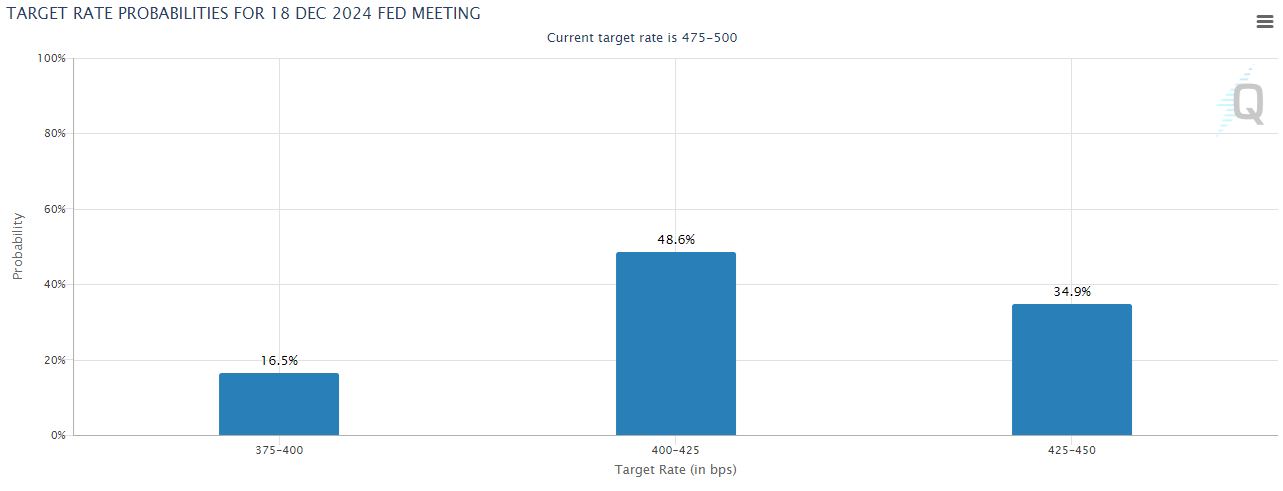

US Rate Cuts – On September 18 the US Federal Reserve cut interest rates by 50 bps from 5.5-5.25% to 4.75-5% signifying a more suitable environment for risk-on assets such as crypto. Additionally due to the US Federal Reserve’s normal response to elevated levels of bond market volatility they will usually continue cutting rates until near 0% rates are achieved. According to CME FedWatch the market has already predicted further easing by the end of year with a 48.6% probability of a 75 bps cut, a 34.9% probability of a 50 bps cut and a 16.5% probability of 100 bps cut These rate cuts bolster the environment for crypto assets while making the rates offered by DeFi markets look increasingly attractive.

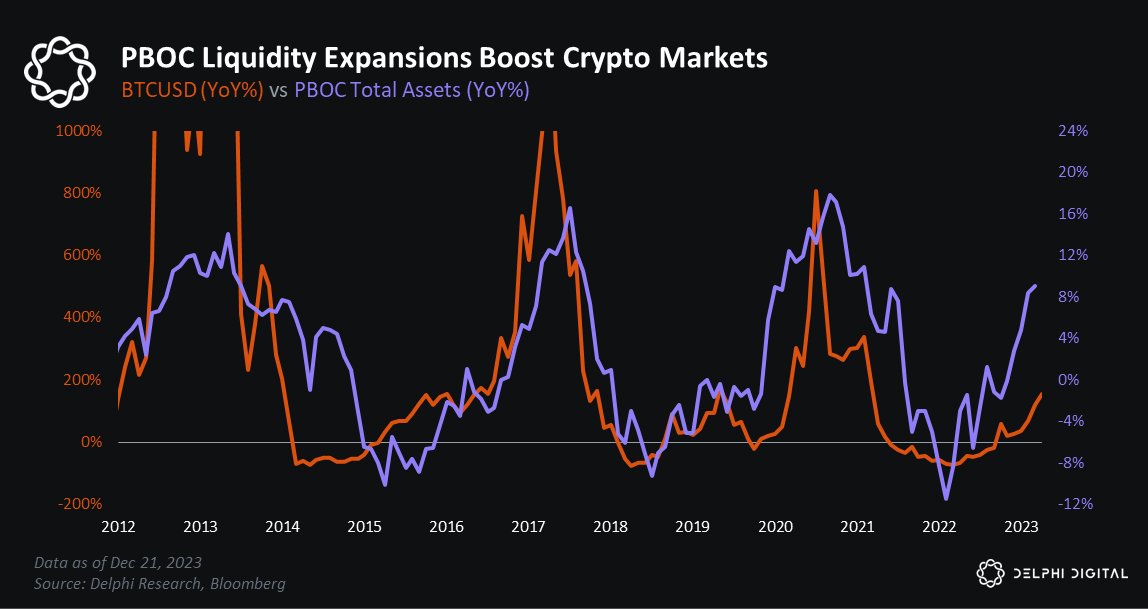

China Credit Expansion – Following the US Fed rate cuts, China has predictably begun easing through credit expansion due to the fact that Fed lowering rates caused the US dollar to weaken allowing the Chinese government to also act while keeping a stable USD-Yuan exchange rate. As such the People’s Bank of China (PBOC) has already enacted an array of easing policies, including: lowering the short term interest rate from 1.7% to 1.5%, lowering the minimum down payment required for second-time house buyers to 15%, allowing mortgage rate cuts of up to 0.5% for existing mortgages and reduced the commercial bank reserve rate by 0.5%. The PBOC also recently announced that it is offering more supportive lending measures to developers and trust loans up to the end of 2026. Historically the performance of Bitcoin has been positively correlated with the PBOC’s total asset growth (as shown below) and as such this proves to be another possible bullish catalyst.

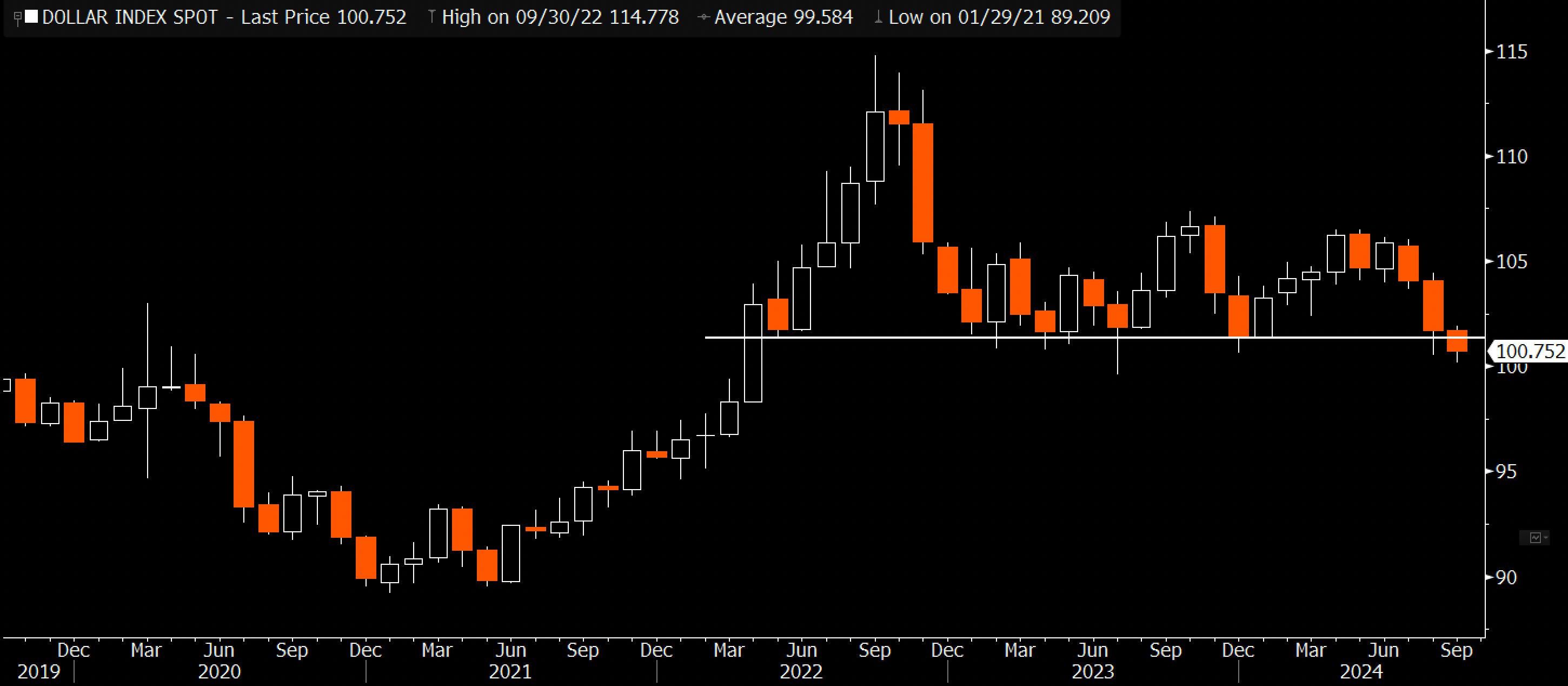

DXY Weakening – The US Dollar Index (DXY) which compares the US Dollar’s relative strength to other currencies just hit its lowest monthly close seen since Q1 2022. Historically there has been a negative correlation between the DXY and Bitcoin’s price. As such this could prove to be another catalyst in favour of crypto assets, especially if interest rate cuts in the US persist into 2025.

Advancements Towards a Second Wave of DeFi – The state of DeFi’s health has continued to advance following the initial “DeFi Summer” where it was still very much an experimental field. Since it’s early days there has been notable advancements in the following fields allowing for an appreciably better DeFi experience.

- User Experience – Account abstraction advancements and wallet improvements allow for more seamless user experiences.

- Interoperability – Onchain interoperability is considerably easier and more secure with the proliferation of bridges.

- Improved scalability – Scaling solutions such as layer 2s allow for cheaper and faster transactions.

- Better smart contract security – Smart contract security importance is placed much higher after many high profile protocol exploits.

- Improved risk management – The industry has matured and learned from high profile cases of poor risk management.

Coinbase’s cbBTC – Perhaps a factor that has been overlooked by the community due to the fact that wrapped BTC is not a new concept. However I hold the opinion that Coinbase’s tokenised BTC product cbBTC could onboard significant capital to Base’s DeFi sector. As cbBTC shares the same custodian/counterparty risk with the majority of the BTC ETF’s I don’t believe it is far fetched to think a proportion of TradFi might rethink holding BTC in ETFs for a fee instead of being able to access all of DeFi for near zero fees. I think this could allow battle tested DeFi protocols such as Aave to attract some of this capital, especially as yields potentially become more attractive compared to rates found in traditional finance. When a user sends bitcoin from their Coinbase account to an address on the Ethereum or Base network, the BTC is now automatically converted into cbBTC at a 1:1 ratio, this will allow users to rotate from BTC into alternative crypto assets with more ease than ever.

The Trinity

Three protocols have emerged from the 2020 DeFi Summer as battle tested blue-chip protocols. They continue to hold relevance in the DeFi sector and are the immediate choices for possible industry leaders.

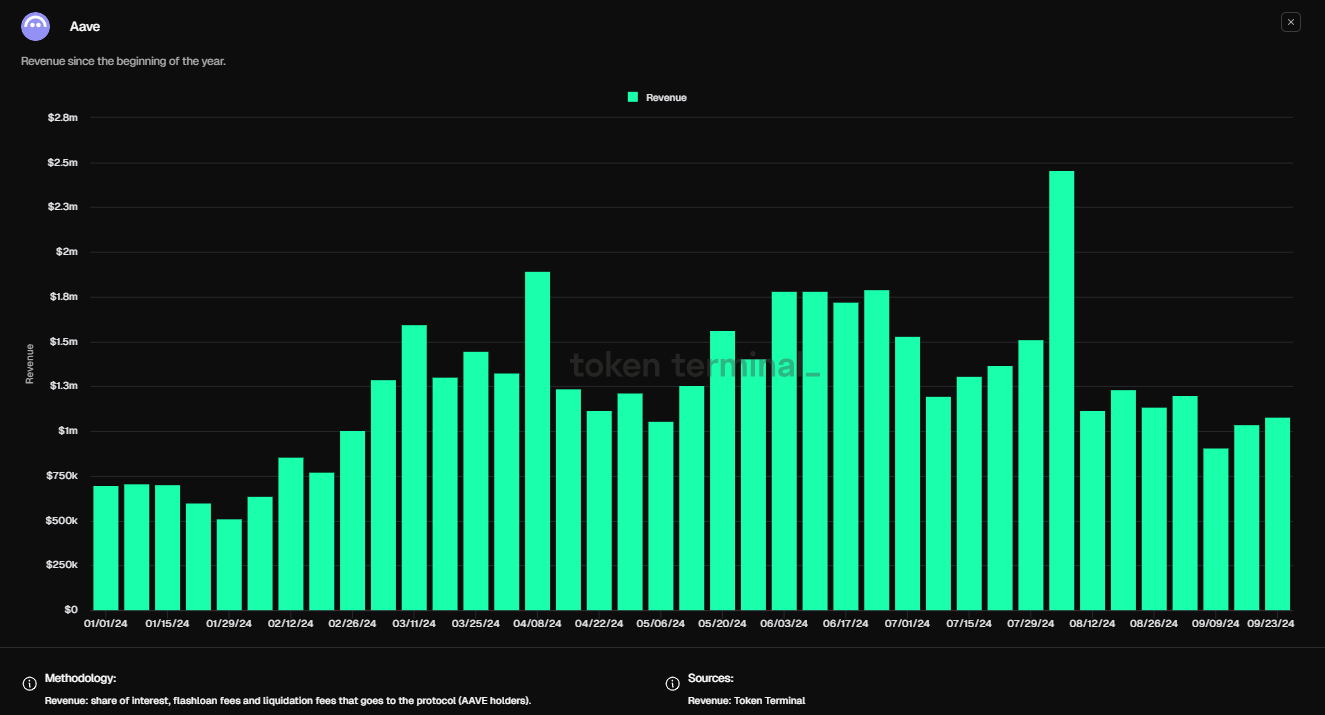

Aave – Aave has been a strong performer this year with strong fundamental metrics and has established itself as the go-to decentralised lending market. The protocol currently holds roughly 66% of the active loan market share, its quarterly revenue growth rate has eclipsed that of its peak 2021 bull market metric despite having significantly less token incentives and its weekly active borrowers just hit a new all-time-high. All of these metrics indicate that the protocol is experiencing continued natural growth, because of this fundamental growth Aave’s price-to-sales ratio was recently trading at its lowest multiple seen in over 3 years.

Core Aave Dao delegate, Marc Zeller, recently proposed in a governance temperature check an overhaul to Aave’s tokenomics including a proposal to enable revenue sharing of the protocol fee’s back to AAVE token holders. The proposal was met with overwhelming support and it is highly likely we will see Aave sharing revenue with token holders in the future. Aave currently has an annualised revenue (30d%) of US$ 55 million.

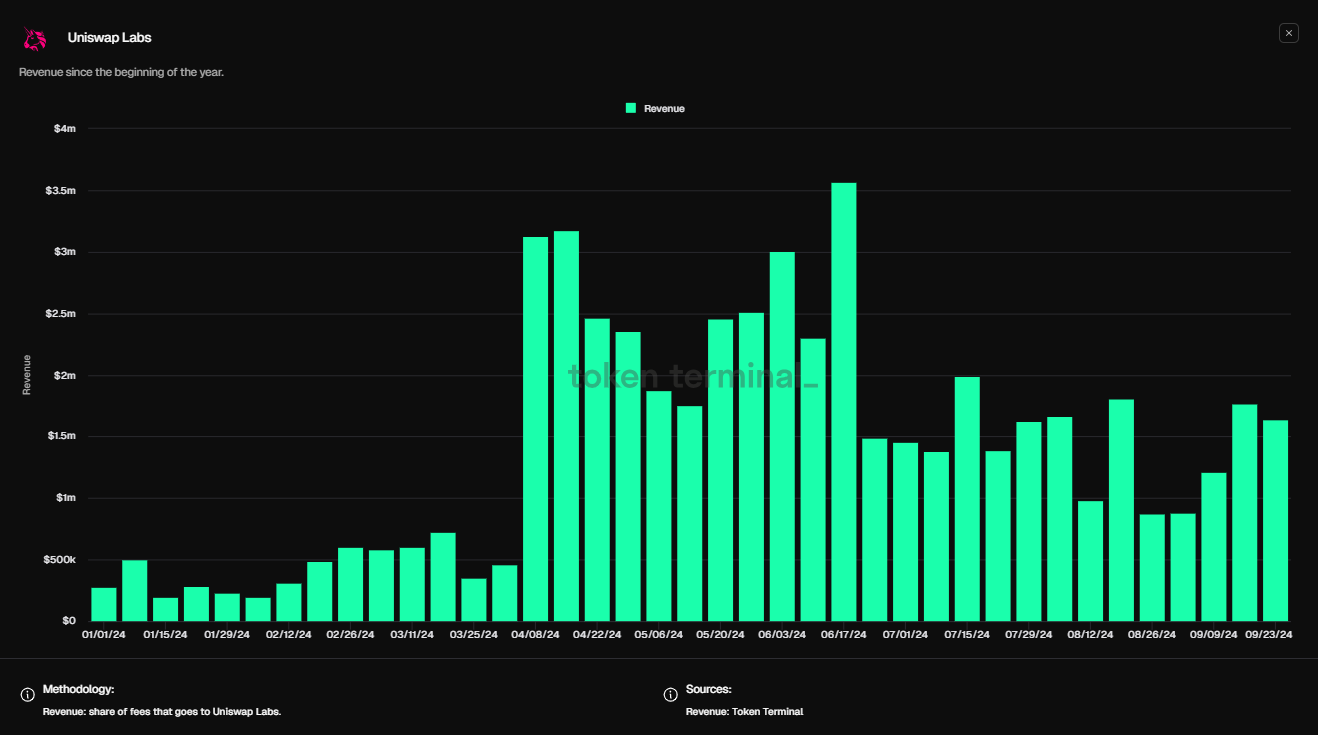

Uniswap – Uniswap has continued to hold its dominant position as the highest volume decentralised exchange. As such the protocol has continued to record consistently high revenue this year despite sideways market conditions. Uniswap is still actively innovating as well with the introduction of Uniswap v4 within the last year allowing for further flexibility with hooks. Additionally Uniswap continues to build out additional infrastructure such as new wallet and user interface solutions.

Earlier this year the token price of UNI surged after a proposal to enable revenue sharing with token holders was put forward. However this proposal has seemingly been put on indefinite hold due to the fact that Uniswap Labs was issued a wells notice by the SEC in April. However, it is my belief that the SEC’s scrutiny of Uniswap is short sighted and unproductive. Ideally we will see change in the SEC’s approach under the next US administration as the approach over the last few years to shoebox crypto assets into existing securities laws has been stifling for many crypto builders. Uniswap Labs annualised revenue currently sits at US$68.96 million.

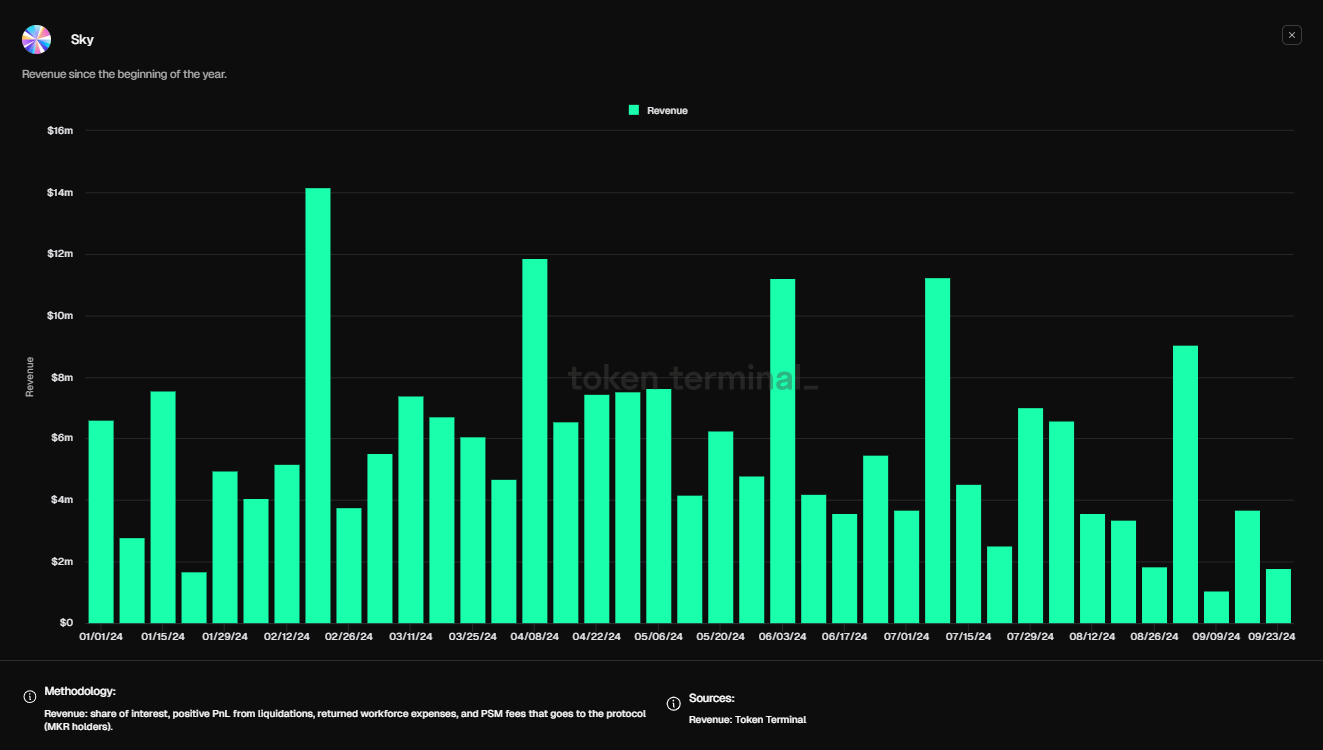

Maker/Sky – Maker, another lending platform best known for its decentralised and permissionless stablecoin, DAI, has recently rebranded itself to the ‘SKY ecosystem’ marking a start towards Maker’s ‘endgame’ strategy. The approach is looking to take a more retail-friendly and compliant line of action. With the MKR token now upgradeable for SKY and the decentralised stablecoin DAI upgradeable for USDS. The USDS token has a freeze function allowing Maker to become more compliant with authorities, however users will still have the option to keep using DAI which will remain immutable. Combined with plans to roll out the USDS token to multiple different chains, Sky ecosystem is seemingly trying to become more palatable and grow through distribution in a similar fashion to the way USDC did. USDS holders will be incentivized to hold through SKY token rewards. Maker has reported consistent revenue like many other stablecoin issuers. At the time of writing there are no current plans for revenue sharing to be enabled for SKY or MKR holders. However SKY tokens are being distributed to user’s who opt to lock up their existing SKY. Sky’s current annualised revenue sits at US$ 191.65 million, however the protocol has considerably more expenses than Uniswap and Aave.

As we witness the shifting tides of global monetary policies the potential for a DeFi resurgence is becoming clearer. With stronger infrastructure, a significantly improved user experience, and major players like Aave, Uniswap, and Maker continuing to innovate and collect revenue, the DeFi sector is well-positioned for a second wave of growth after having gone through an initial hype cycle and emerged as a proven concept finding market fit.