categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Ahead of Markets

by Henrik Andersson

In the last few days, we have seen a major sell-off in crypto assets and stocks. This has global financial rout was triggered by two developments last week:

- Weak economic data out of the US, coupled with a number of weak earnings reports;

- Japan hiking interest rates, causing an unwinding of the Yen-Dollar carry trade.

Weak Economic Data

Last week, US economic data showed that employers added far fewer jobs in July than expected. This sparked fears of a recession in the world’s largest economy. The tech heavy Nasdaq has seen a stellar year, fuelled by investor’s excitement over AI. The surprising jobs data, combined with weak earnings reports from Amazon and Intel saw the Nasdaq sell off.

Intel has mainly missed out on the AI revolution from the likes of Nvidia, and is now trading at the same level as before the dot-com boom in 1997.

With the weaker than expected economic data, yields are plummeting and bonds are rallying. There is an increasing feeling that the Fed is behind the curve; it has been too slow to cut interest rates.

Billionaire hedge fund manager Bill Ackman believes the Fed has been too slow to act.

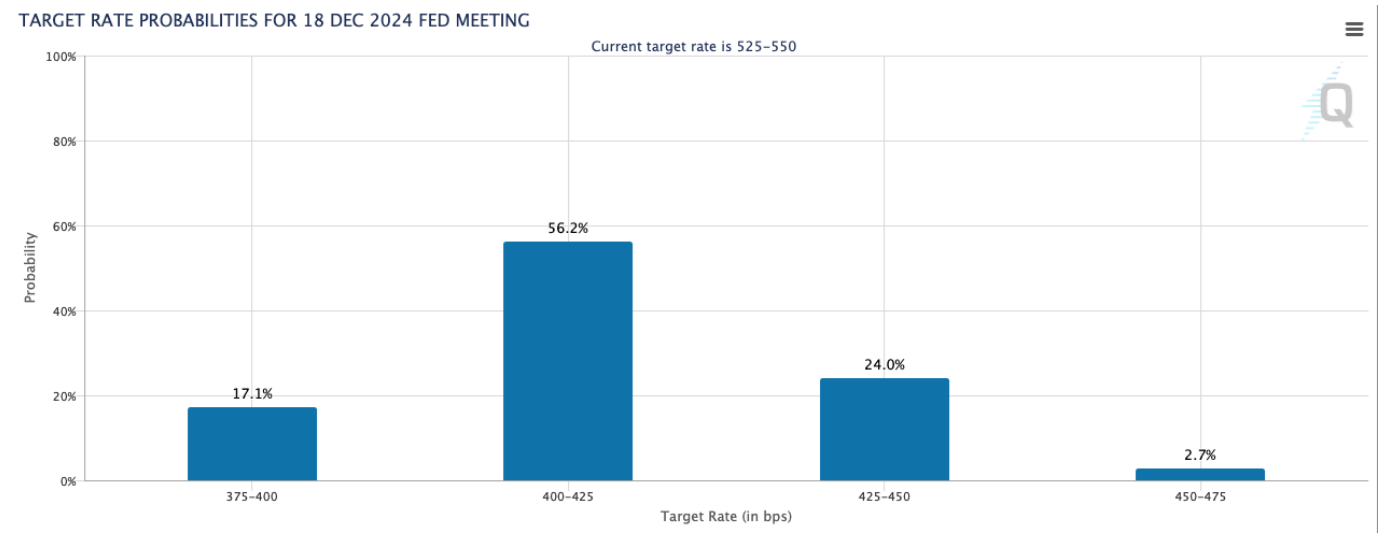

Looking at CME’s FedWatch, the market now prices in three interest rate cuts this year, 50bps in September, 50bps in November, and another 25bps in December.

For Australia, all speculation that the RBA would increase interest rates should be off the table now. Two of the four Australian big banks now believe we will see a cut before the year end. The speculation that Australia as one of the only central banks in the world would be increasing rates didn’t make much sense to us in the first place.

Japanese Policy Rates

In March this year, Japan raised its policy rate for the first time since 2007 from -0.1% to 0.1% as inflation finally came back to the country. Last week, they increased the rates for a second time this year to 0.25% as the bank felt confident in the recovery of the economy coupled with their concern for a weak yen.

Last week’s effect on the yen was dramatic as USDJPY got crushed. At the same time, the Japan equity indices plummeted, down the most since 1987.

The carry trade has been a popular trading strategy where investors borrow yen at a low interest rate and purchase assets like bonds and equities in countries with higher interest rates, mostly in US dollars. This trade works especially well when the yen is weakening as these traders are short the yen. With increasing yen interest rates, coupled with a stronger yen, investors closing the carry trade exacerbate the recent moves.

Crypto Markets

So what does all this mean for the crypto market now and going forward? Firstly, crypto is not immune to macro events. All risk assets are selling off, and crypto remains a risk asset. It is also an asset that trades 24/7 with global liquidity and participation, meaning crypto is often the asset that reacts the quickest to macro movements.

We see the current market reflecting a reset for too high short-term expectations in certain segments of the market like AI. Weak economic data was the trigger for the reset in the market. Now, we are firmly on the path to lower interest rates (including for Australia!), which should ultimately be good for risk assets. The bigger question is if we will see a soft or a hard landing in the economy – that is too early to say. To put things in perspective, investment bank Goldman Sachs just increased the odds for a US recession from 15% to 25% – still a modest probability.

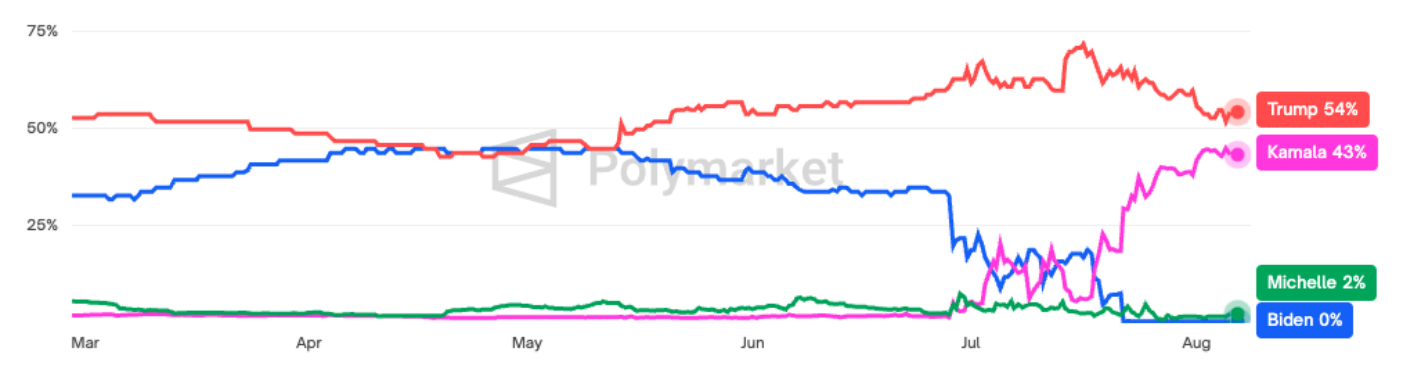

As former president Trump is seen as significantly better for crypto policy than presidential candidate Harris, the recent tightening of the race has also had a negative impact on prices.

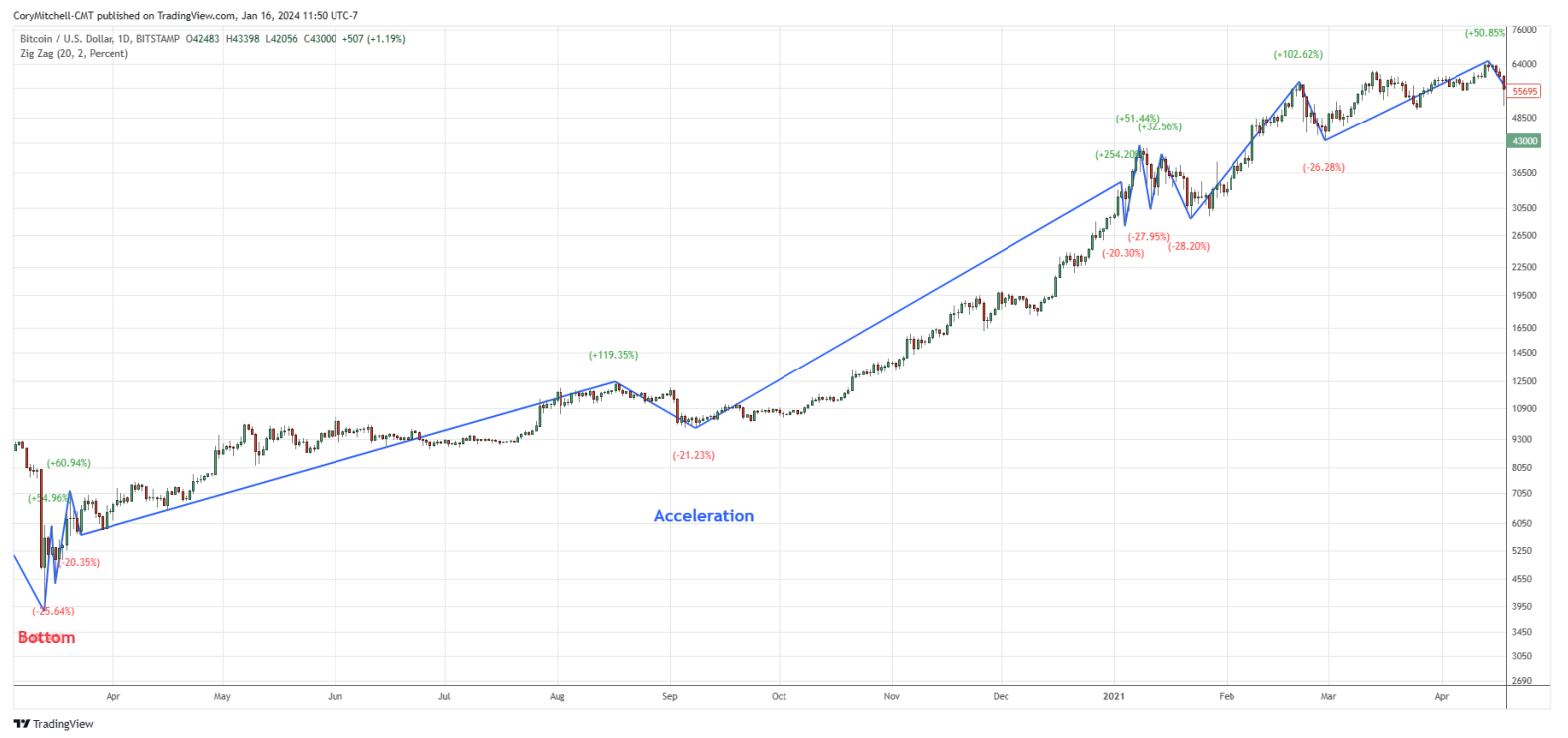

Zooming out, in six months from now, we might have locked in three interest rate cuts from the Fed, a pro-crypto president might have taken office in the White House, and inflows might again be flowing to the spot BTC and ETH ETFs. If this scenario plays out, we might look back at this event as yet another buying opportunity in our long term crypto investment thesis. After all, as we wrote in our newsletter on 9 July, sell-offs are common in crypto bull markets.

In the bull market that peaked in 2021 Bitcoin retraced more than 20% a total of 7 times.

This report (‘Report’) has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security of financial product or service. This Report does not constitute a part of any Offer Document issued by Apollo Crypto Management Pty Ltd (ACN 623 059 227, AFSL 525760) or Non Correlated Capital (ACN 143 882 562, AFSL 499882), the Trustee of the Apollo Crypto Fund. Past performance is not necessarily indicative of future results and no person guarantees the performance of any Apollo Crypto financial product or service or the amount or timing of any return from it. This material has been provided for general information purposes and must not be construed as investment advice. Neither this Report nor any Offer Document issued by Apollo Crypto or Non Correlated Capital takes into account your investment objectives, financial situation and particular needs. The information contained in this Report may not be reproduced, used or disclosed, in whole or in part, without prior written consent of Apollo Crypto. This Report has been prepared by Apollo Crypto. Apollo Crypto nor any of its related parties, employees or directors, provides and warrants accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. You should obtain a copy of the Information Memorandum, issued by Non Correlated Capital before making a decision about whether to invest in the Apollo Crypto Fund.