categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

An Altcoin Season on the Horizon

by Quinn Papworth

Recently crypto assets have rallied significantly, with Bitcoin leading the charge following the election of pro-bitcoin president Donald Trump. However, even though Bitcoin recently broke the historic US$100,000 mark. If you’ve been looking at crypto asset prices recently, you’ve probably noticed one thing — altcoins are starting to heat up. In fact the altcoin market recently posted its best weekly performance against bitcoin for this entire cycle. This leads us to an analysis of prior ‘altcoin seasons’ and whether we can expect such a movement again in the current cycle under current conditions.

Historical Alt Cycles

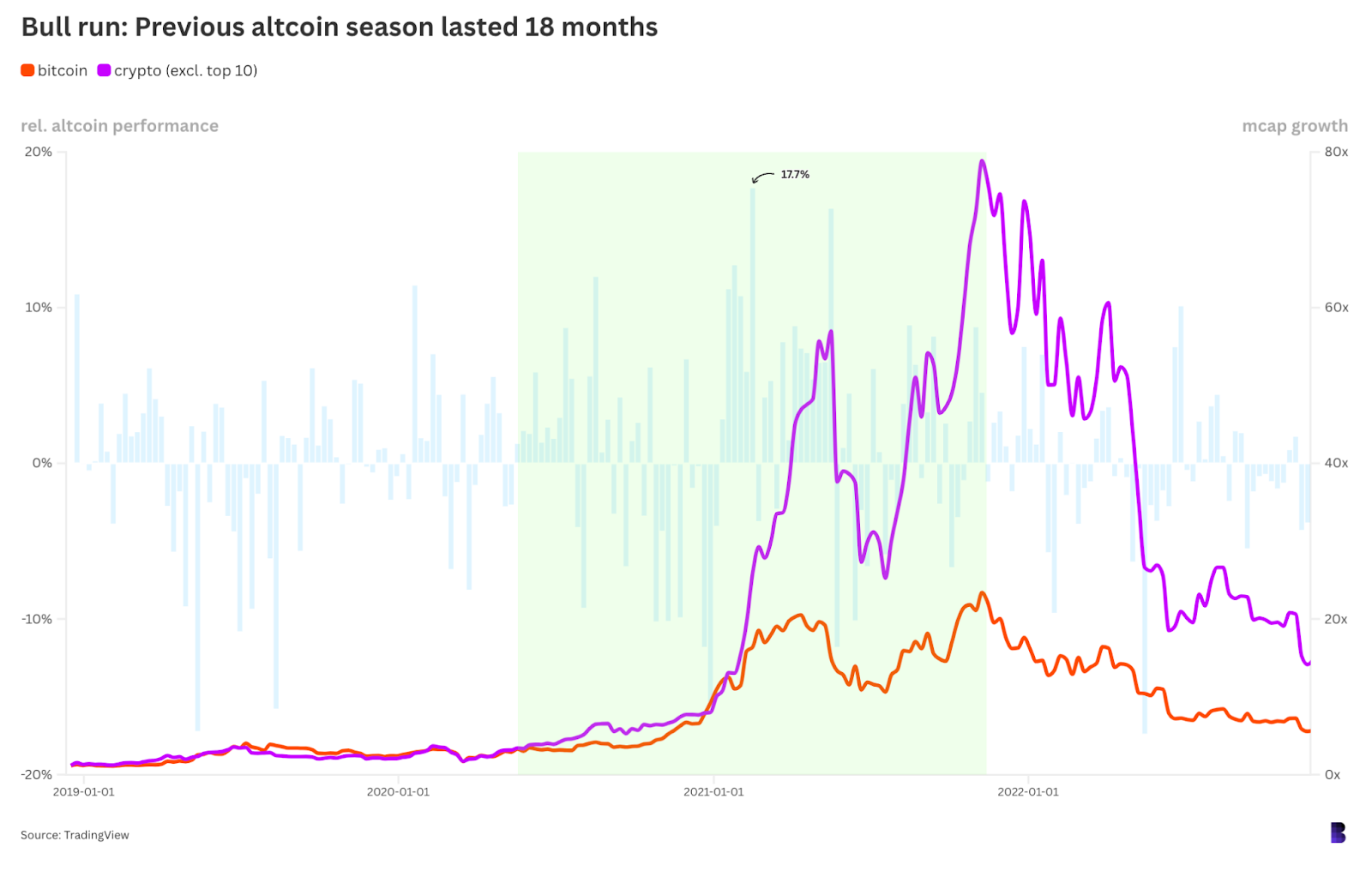

Crypto bull cycles have historically followed two distinct phases.

Phase 1 – marks the early stage of the rally, where Bitcoin typically outperforms the rest of the market. During this period, Bitcoin’s dominance increases, reflecting its status as the most liquid and widely recognized crypto asset.

Phase 2 – occurs in the later stage, as attention shifts to altcoins. Investors begin seeking higher growth opportunities in sectors such as alternative layer-1 blockchains, DeFi assets, and other emerging narratives. In this phase, altcoins have historically outperformed Bitcoin, delivering greater overall growth during the cycle. This dynamic results in altcoins capturing a larger share of total market gains as the cycle progresses.

In the last cycle, altcoins were able to outperform Bitcoin for almost 5 months straight. During this time, the top 100 altcoins gained 174% while BTC gained just 2%. As a result, Bitcoin’s market dominance collapsed from 61.9% at the start of February 2021 to as low as 40% in mid-May 2021.

Where Are We In This Cycle?

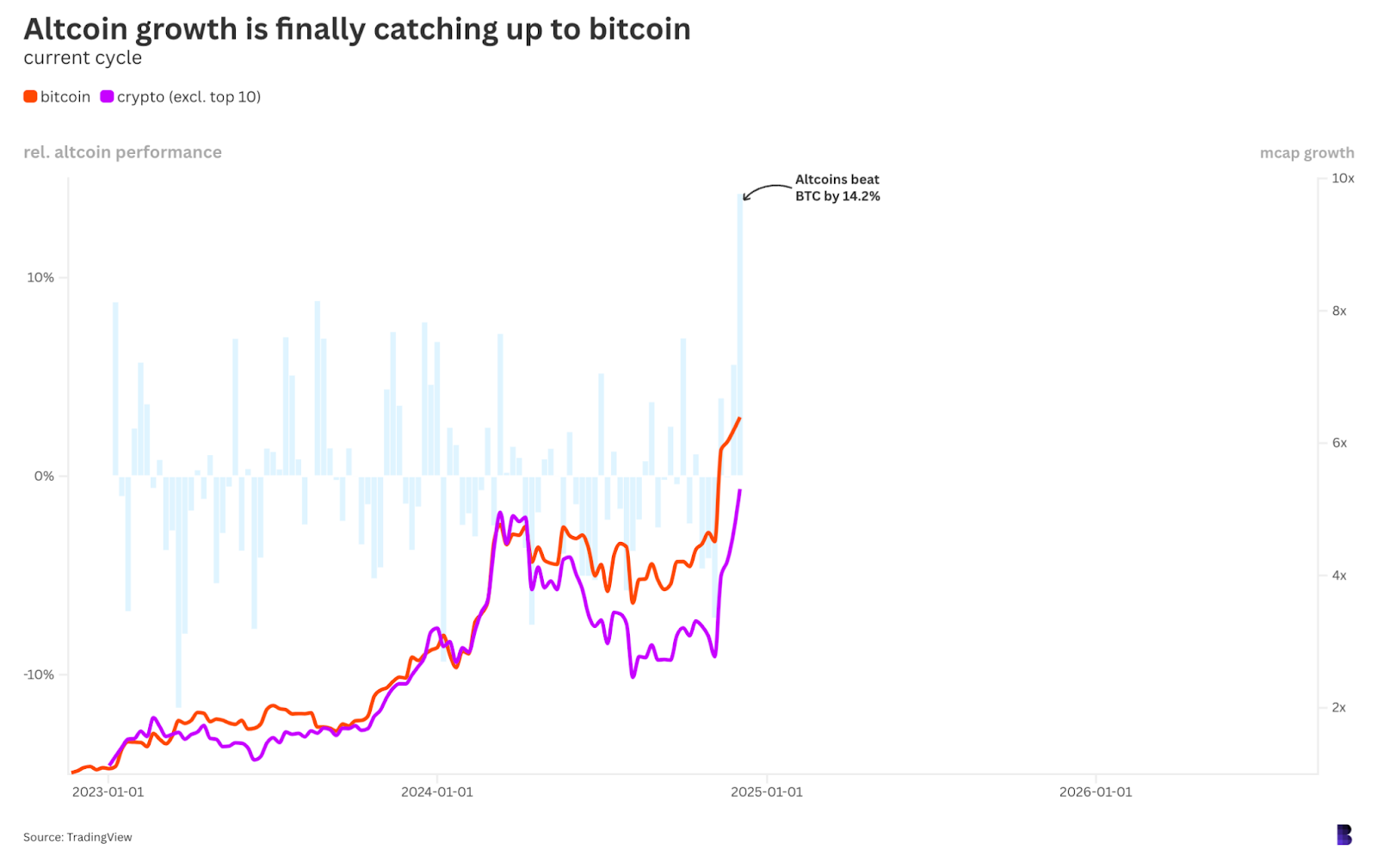

This begs the question, are we on the cusp of beginning another ‘altcoin season’ this cycle? Although not definitive, we have started to see early signs of an alt season with a majority of altcoins outperforming Bitcoin over the last 90 days. In fact in the last week of November the altcoin market posted its best weekly performance against Bitcoin so far for in the cycle as measured from November 2022. As a result we have started to see altcoin returns start to catch up to that of Bitcoin in a relief rally after slowly trending downwards over the last 9 months since its peak in Feb-March.

Similar to the prior cycle we have started to see a breakdown in BTC’s dominance and a rise in altcoin dominance. This growth movement can be seen clearly when you compare BTC dominance and the total crypto market cap excluding top 10 (OTHERS) dominance. Here we can see that the altcoin market cap is actively growing and taking share away from Bitcoin.

While these are not definitive signs of an ‘altcoin season’ yet occurring we do believe that this cycle will follow historical trends and see capital flow into alternative crypto assets once again. I think a sustained outbreak of the altcoin sector’s relative performance compared to BTC will likely mark the beginning of a new alt season. It’s important to remember that such shifts can happen swiftly, as demonstrated by the recent rapid growth in the total altcoin market cap, which has grown by multiples over the past few months.

“History never repeats itself, but it often rhymes”

We believe the market for alternative crypto assets is at a pivotal turning point moment. The emergence of a more crypto-friendly regulatory environment—the most favorable we have ever seen—opens the door for projects to innovate and deliver value to token holders in ways that were previously constrained by regulatory hurdles. Over the past few years, the prevailing US administration’s anti-crypto stance has stifled such opportunities.

While Bitcoin has dominated the spotlight regarding regulatory headlines recently, the implications of recent pro-crypto political shifts are arguably much more significant for alternative crypto assets, where active development and innovation continue to shape the future of the products and is therefore highly consequential. Part of Apollo Crypto’s strategy is to maintain consistent exposure to altcoins that have fundamental reasons to appreciate multiples more than Bitcoin moving into a bull market. Historically altcoins have outperformed Bitcoin throughout the length of a cycle even though they make the majority of their gains over more rapid periods.

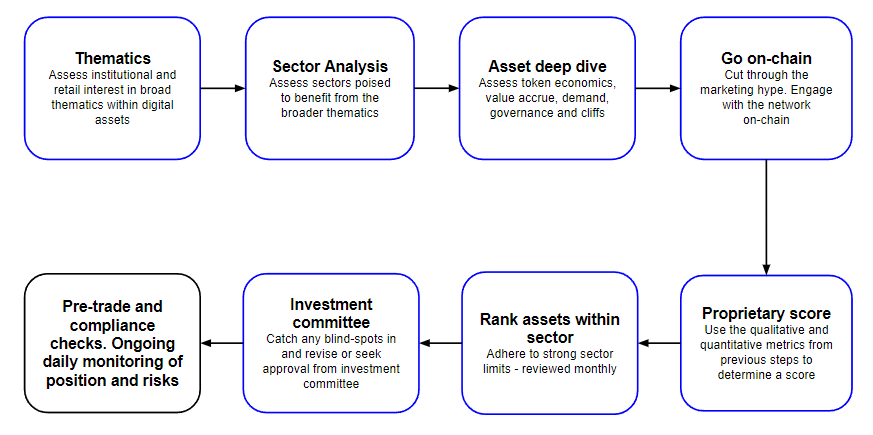

Our approach involves evaluating crypto assets using a range of analytical techniques to identify and invest in the highest-quality assets across the leading sectors. This rigorous process ensures we are well-positioned to fully capture emerging opportunities. We are particularly excited about crypto projects that have successfully transitioned from the experimental stages of previous cycles, achieved compelling product-market fit, and are ready to thrive in the next phase of the bull market with fundamental strength.

This report (‘Report’) has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security of financial product or service. This Report does not constitute a part of any Offer Document issued by Apollo Crypto Management Pty Ltd (ACN 623 059 227, AFSL 525760) or Non Correlated Capital (ACN 143 882 562, AFSL 499882), the Trustee of the Apollo Crypto Fund. Past performance is not necessarily indicative of future results and no person guarantees the performance of any Apollo Crypto financial product or service or the amount or timing of any return from it. This material has been provided for general information purposes and must not be construed as investment advice. Neither this Report nor any Offer Document issued by Apollo Crypto or Non Correlated Capital takes into account your investment objectives, financial situation and particular needs. The information contained in this Report may not be reproduced, used or disclosed, in whole or in part, without prior written consent of Apollo Crypto. This Report has been prepared by Apollo Crypto. Apollo Crypto nor any of its related parties, employees or directors, provides and warrants accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. You should obtain a copy of the Information Memorandum, issued by Non Correlated Capital before making a decision about whether to invest in the Apollo Crypto Fund.