categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

An Analyst’s Views on Crypto in 2025

by Quinn Papworth

Happy New Year! Given we’re entering a fresh year and the crypto landscape is constantly shifting I thought it would be interesting to look forward and give my personal view as an analyst on what I think 2025 in crypto might look like.

BTC, ETH & SOL to Remain The Leading Blockchains

I believe BTC, ETH & SOL will continue to dominate at a fundamental level and will attract institutional flows as the most widely accepted blockchains. I believe we will see ETFs and options for all 3 assets over time giving institutions the most optionality to manage exposure within these assets.

I hold this view due to a multitude of reasons I will go on to explain but to be brief its because these assets are the blockchains most likely to benefit from the wider trends I expect to see in 2025.

Regulatory: Crypto Will Return to the US

As discussed in previous insights, the US is entering the most pro-crypto regulatory environment ever to be seen. This has bullish implications for all of crypto, and specifically the assets mentioned above due to their widespread adoption. I believe this relief will see a large uptake of crypto in the US again with many crypto companies returning to having a presence in the US after being forced overseas in prior years. I also believe we will see multiple crypto companies have an initial public offering under the Trump administration.

Bitcoin will continue to flourish as the uptake of its ETFs and options continue as it receives regulatory support from the Trump presidency and players such as Michael Saylor. DeFi will have strong growth and I think it will continue expanding into existing fintech and TradFi companies. Ethereum will be the biggest beneficiary as a result of this as it hosts the large majority of the total value locked in DeFi. I believe Solana will have its spot ETF approved and will launch in 2025, this is supported by current Polymarket data (although this is a low volume market).

I also think we will finally see Jump Crypto’s Firedancer client released in 2025 which will improve Solana’s transactions per second (TPS) to a supposed rate of 100k TPS. I believe this due to the fact that Firedancer client is already running in non-voting mode and Firedancer’s GitHub repository shows multiple code commits related to vote transactions within the last month. Additionally the Jump team worked on the client extensively in 2024 so expecting it to ship this year doesn’t seem far off.

I also believe we will see consolidation among L1 networks and a flight to quality in 2025 as a result of an abundance of blockspace and networks. I think this flight to quality will result in consolidation into chains with a unique identity/culture rather than solely technical superiority in the short term as the existing community of active onchain web3 users is still quite small. Although it should be noted that this paradigm can rapidly shift in the future if web3’s active user base grows rapidly.

Memecoins -> AI Agents

In 2025 I believe we will see a cool off in memecoin markets and this will shift to many investors instead speculating on AI agents and their personas instead. Ultimately this will not last forever as much of the value in the current shape of AI agents lie in their novelty and the attention they are able to capture rather than their technical capacity. That being said I still think over the next 6-12 months we will see huge growth in the crypto x AI sector, specifically focused around crypto AI agents. The mindshare of AI is currently dominating in crypto discussions being the topic of roughly ~50% of discussions on crypto twitter as of today, however it only makes up a small fraction of crypto’s total market cap. If 2024 has taught us anything with the overperformance of memecoins it is one thing. Attention is all that matters. As such I think the AI sector will swell and grow by multiples in 2025.

AI

I believe the AI sector will be highly beneficial to Ethereum (more specifically the BASE L2 due to its low costs and focus on AI culture) and the Solana ecosystems. This is due to the fact that as AI agents become fully autonomous and build their own software on blockchains they need strong datasets in order to do so effectively. The EVM and SVM are the only virtual machines with extensive and battle tested coding libraries for AI agents to be able to access and build coherent datasets from. If software is one of the key input costs for blockchain technology it makes sense that AI developers become one of the key use cases to accelerate development of decentralised applications in the future.

Another sector I believe that will continue to grow in 2025 as a result of AI is information markets. As more and more AI based content is generated it is possible information available widely will become more and more narrow and alternative views get lost in the noise. As a result markets are one of few ways to align incentives in order to maintain truly accurate outcomes around information, as such I expect prediction markets and futarchies will continue to grow in 2025.

DeFi

Now that DeFi has become unencumbered under the upcoming Trump administration we have seen considerable growth and I expect to see this growth continue in the sector in 2025. As such I believe we will see the stablecoin market capitalisation hit US$300b in 2025. I believe this because I think institutions will continue to adopt stables or deploy their own stablecoins in order to boost margins and gain greater ownership over the entire stack of money within their systems. As such I would not be surprised by multiple fintechs rolling out their own stablecoins this year in a similar fashion to the way PayPal has. Additionally within DeFi markets I expect ‘productive’ stablecoins like Ethena’s sUSDe and protocols like Usual and M^0 Labs to continue seeing growth as overall DeFi usage continues to climb.

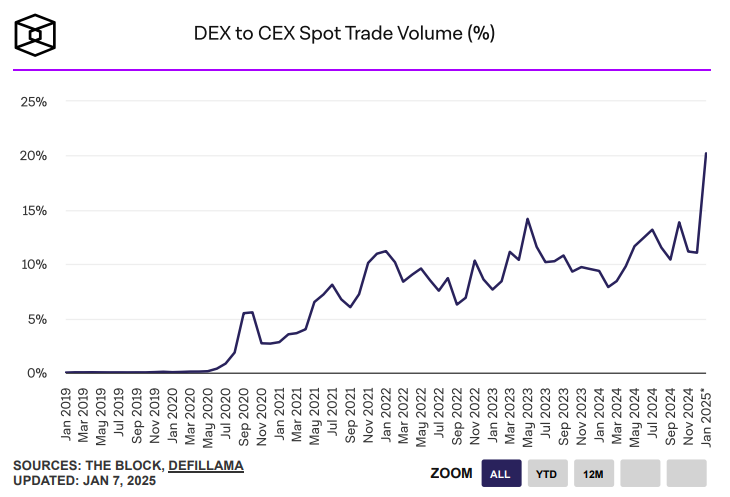

I also fully expect the DEX:CEX ratio to keep climbing in 2025 as we have seen projects gravitate back towards launching their tokens at a high float and low FDV. This style of token launch as well as the sheer number of tokens being launched as costs approach 0 is much more conducive to DEX growth as a centralised exchange simply won’t be able to keep up nor will it have as favourable terms for doing so.

DeFAI?

I also think the intersection between AI and DeFi will begin to change how value is accrued for protocols. I believe if AI assisted tech can create compelling intent based front ends for users this will result in much of the value accruing to front ends as they are able to create exclusive flow. As everything else is downwind from the front end markets will have to become more competitive in the rates they offer to fight for this exclusive flow. Consequently the majority of the value will likely be captured by the front ends as DeFi markets continue to mature, I think this is most likely to take place in the form of AI & intent enhanced crypto wallets.

2025 holds countless exciting catalysts on the horizon for the entire crypto ecosystem and I believe this growth will be supported by regulatory and technological advancements occurring at a rapid pace. I remain entirely optimistic about crypto markets heading into 2025.

This report (‘Report’) has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security of financial product or service. This Report does not constitute a part of any Offer Document issued by Apollo Crypto Management Pty Ltd (ACN 623 059 227, AFSL 525760) or Non Correlated Capital (ACN 143 882 562, AFSL 499882), the Trustee of the Apollo Crypto Fund. Past performance is not necessarily indicative of future results and no person guarantees the performance of any Apollo Crypto financial product or service or the amount or timing of any return from it. This material has been provided for general information purposes and must not be construed as investment advice. Neither this Report nor any Offer Document issued by Apollo Crypto or Non Correlated Capital takes into account your investment objectives, financial situation and particular needs. The information contained in this Report may not be reproduced, used or disclosed, in whole or in part, without prior written consent of Apollo Crypto. This Report has been prepared by Apollo Crypto. Apollo Crypto nor any of its related parties, employees or directors, provides and warrants accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. You should obtain a copy of the Information Memorandum, issued by Non Correlated Capital before making a decision about whether to invest in the Apollo Crypto Fund.