categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

An Update On The State of Tokenisation

by Quinn Papworth

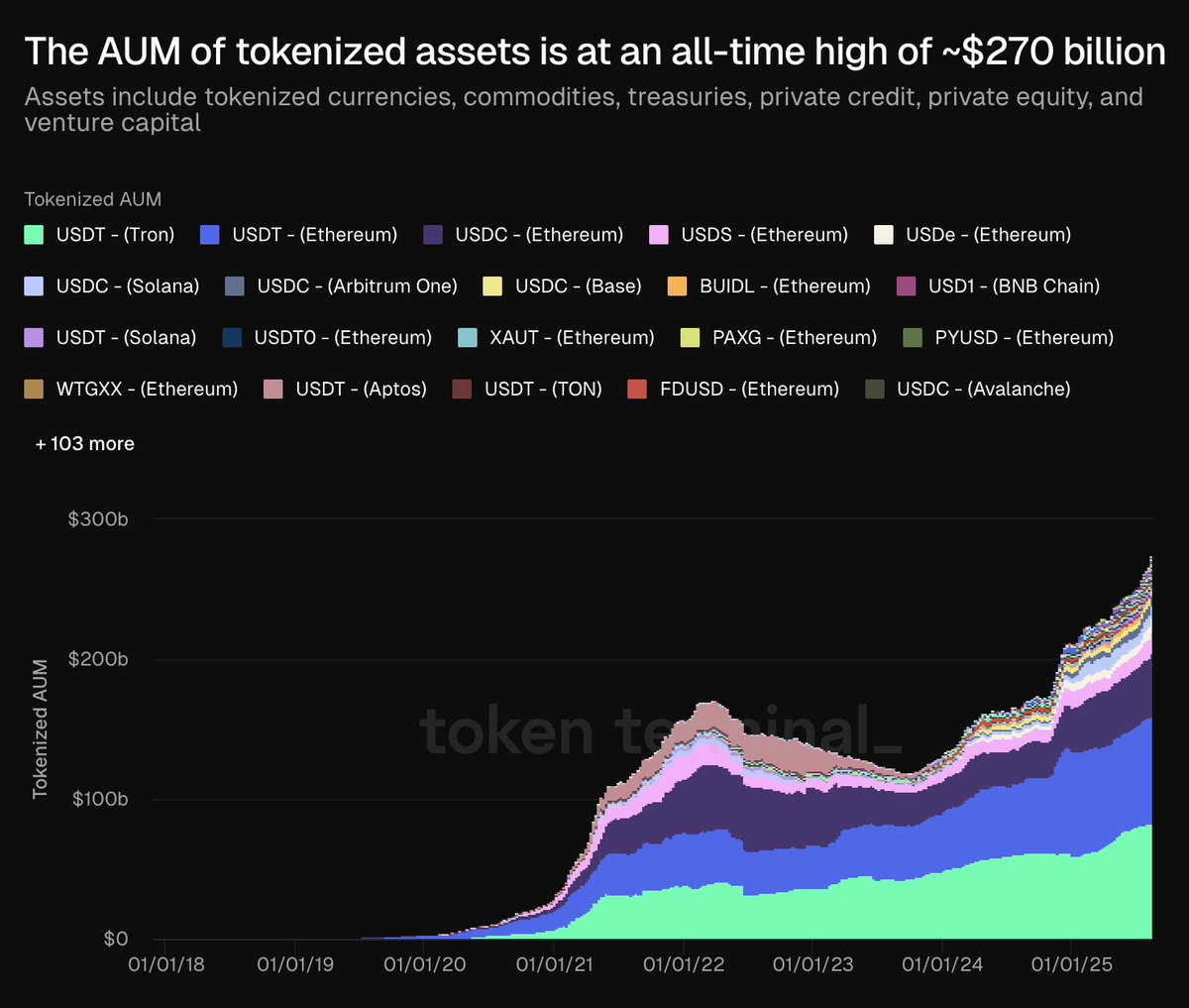

Just yesterday we saw the AUM of tokenised assets hit a new all time high of US$270 billion. At the same time we have seen a seemingly endless stream of strong headlines in recent weeks with the likes of Coinbase, Etoro, Kraken and Robinhood all racing to offer tokenised stocks and assets amid regulatory clarity. We last provided an update on the state of RWA tokenisation in February, since then we have seen many new entrants and significant AUM growth. Let’s take a look at what’s been driving the growth and how the ecosystem is shaping up.

Why We Tokenise

Before we take a look at the regulatory support backing this growth and the resultant ecosystem lets remind ourselves, why is it that players are rushing to tokenise in the first place, what are the unique advantages of tokenisation?

For me it comes down to three key factors: Accessibility, Velocity and Composability.

- Accessibility:

Tokenisation lowers the barrier to entry for markets allowing fair access to any investor worldwide with no set amount of starting capital required. This democratises access to investment opportunities as well as providing the obvious benefit of driving liquidity through 24/7 global markets.

- Velocity:

Tokenising assets enables incredibly cheap and fast transfers when compared to the traditional underlying assets, this gives tokenised assets greater ‘velocity’ and eliminates silos of capital spread across multiple systems with high inertia due to their difficulty in being moved and used productively. This essentially allows for a meaningful reduction in opportunity cost.

- Composability:

One of the greatest advantages of tokenisation is that it allows assets to become composable within decentralised finance (DeFi) and programmable with other assets through smart contracts, enabling capital efficient use of assets such as drawing a loan against your tokenised assets in a fully permissionless manner. This allows for infinite potential opportunities for your capital to be used in heterogeneous free markets all while cutting the costs of middlemen. This is the core reason that I believe the future of structured finance will belong on-chain.

Strong Regulatory Support

As we touched on in the blog a few weeks ago we have seen immense regulatory support and clarity start to emerge from the US with open support for tokenisation from SEC chair Paul Atkins as he calls for tokenisation to become the ‘next step’ in modernising markets. This has opened up near perfect conditions for tokenisation in the US to clear regulatory hurdles and build momentum.

Allow me to explain why I’m bullish on the regulatory front when it comes to tokenisation:

- SEC chair Paul Atkins is actively calling tokenisation a focus/the future and is actively excited about new use cases for tokenised assets “such as the ability to participate in blockchain network consensus with tokenised equities”. In addition Atkins stated that companies are “lined up at [the SEC’s] doors with requests to tokenize” and as such the commission is actively working with firms looking to tokenize.

- Paul Atkins has blessed the existence of “super apps” where intermediaries can “offer a broad range of products (both crypto and non-crypto) under one roof”. As such I think we are naturally going to see an expansion of tokenisation as platforms look to offer additional services such as 24/7 trading through tokenised variants. This will not only provide end-users with better product experiences but also widen the reach of crypto products dramatically as we see crypto offerings infiltrate traditional venues more and more.

- The passage of the GENIUS Act has delivered decisive support for stablecoins, paving the way for the broader expansion of tokenised assets. Supported by the addition of strong investor interest around stablecoins, these developments are poised to drive a surge in stablecoin inflows and that capital will naturally shift toward tokenised assets as it seeks more productive opportunities. Put simply as more capital is ‘blessed’ to enter an onchain environment through stablecoins the demand for more tokenised assets is only accelerated.

The Ecosystem

Since our last update in February, tokenisation AUM has increased ~30% and we have seen a plethora of new types of assets come onchain through tokenisation.

Let’s take a quick glance at the ecosystem:

Tokenised US Treasury Funds

US Treasury bill funds continue to dominate the majority of the tokenisation space with Blackrock’s BUIDL fund now becoming the largest tokenised asset (excluding stablecoins) after its launch in March 2024.

Interestingly the fund has seen large uptake among ‘crypto-native’ companies such as DeFi protocols and stablecoin issuers looking for real world yields that are diversified from crypto-native yields.

Other notable mentions in this space include Franklin Templeton’s BENJI as well as Ondo’s multiple offerings.

Commodities

Tokenised gold continues to dominate the tokenised commodities market with Paxos and Tether’s offerings taking the lion’s share, these products exist to give onchain participants access to the price action of gold. Outside of gold we have yet to see any meaningful uptake of other commodities on-chain.

Stablecoins

We have recently seen the emergence of stablecoins that are backed by increasingly diversified sources such as Maple’s finance’s SyrupUSDC which is backed in part by overcollateralised loans. Or just recently the project ‘USD AI’ which offers a stablecoin overcollateralised by the compute power of AI companies. Increasingly we are also seeing stablecoin projects that have historically been backed entirely by onchain assets diversify with more RWA assets through tokenisation such as Sky’s USDS having exposure to SyrupUSDC and BUIDL.

Institutional Funds and Actively Managed strategies

Since February we have seen an increasing number of institutional funds and actively managed strategies enter the tokenisation space as well. One notable example is the platform midas.app, a platform which issues tokens that track the performance of funds, it has seen its total value locked (TVL) grow more than 10x since the beginning of the year. The leading player in this space still continues to be Securitize however these tokens often sit inside permissioned walled gardens requiring KYC rather than being freely transferable.

Tokenised Stocks

Trading platforms and crypto exchanges are currently vying for a share in the tokenised equities space. Since our last development we have seen headlines from the likes of Robinhood, Coinbase, Kraken and eToro joining the race.

As of right now Kraken has the majority of onchain volume around tokenised equities with their ‘xstocks’ offering on Solana allowing for tokenised stocks to be freely traded, this product has seen more than $2 billion in trading volume shortly after its launch.

We have also started to see more exotic offerings enter the market, Apollo Crypto early stage investment, Prestocks (formerly known as PrePO) recently took their suite of pre-IPO stocks live on Solana generating significant interest among market participants for exposure to companies such as SpaceX, Figure AI and Anduril that would have previously been unavailable to a large portion of public market investors.

Tokenisation is accelerating at a rapid pace, with AUM soaring to $270 billion, strong regulatory tailwinds from the SEC paving the way and unprecedented levels of institutional adoption. The unique advantages of tokenised assets are being captured increasingly day by day.

Disclaimer: Apollo has Exposure to PrePO/prestocks

This report (‘Report’) has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security of financial product or service. This Report does not constitute a part of any Offer Document issued by Apollo Crypto Management Pty Ltd (ACN 623 059 227, AFSL 525760) or Non Correlated Capital (ACN 143 882 562, AFSL 499882), the Trustee of the Apollo Crypto Fund. Past performance is not necessarily indicative of future results and no person guarantees the performance of any Apollo Crypto financial product or service or the amount or timing of any return from it. This material has been provided for general information purposes and must not be construed as investment advice. Neither this Report nor any Offer Document issued by Apollo Crypto or Non Correlated Capital takes into account your investment objectives, financial situation and particular needs. The information contained in this Report may not be reproduced, used or disclosed, in whole or in part, without prior written consent of Apollo Crypto. This Report has been prepared by Apollo Crypto. Apollo Crypto nor any of its related parties, employees or directors, provides and warrants accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. You should obtain a copy of the Information Memorandum, issued by Non Correlated Capital before making a decision about whether to invest in the Apollo Crypto Fund.