categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Apollo Crypto & S&P Digital Asset Indices

by David Angliss

We are excited to share that we have adopted the S&P Digital Asset indices for monthly reporting and benchmarking. As we constantly strive for enhanced transparency, robustness, and credibility in our operations, this decision underscores our commitment to you, our esteemed investors. One of the most significant indicators of institutional adoption of cryptocurrencies is the development and introduction of financial products surrounding this emerging asset class. The decision by S&P Global to provide a suite of Digital Asset indices is a testament to this adoption.

Why Have We Transitioned To S&P Global Cryptocurrency Indices?

The decision to select an index for benchmarking or investment purposes is paramount. It shapes how one measures performance, risk, and overall market sentiment. The S&P crypto index offers a distinct set of advantages from an investor’s perspective;

Institutional Acceptance: With increasing institutional interest in cryptocurrencies, there’s a preference for benchmarks backed by known entities in traditional finance. Institutions are more likely to recognise and trust an S&P index over lesser-known alternatives, fostering trust and acceptance that benefits all investors.

Renowned Credibility: S&P Global is a household name in the financial world, boasting a legacy that spans over a century. The trust and credibility associated with S&P’s name offer unparalleled reassurance to investors. Lesser-known indices, though potentially valuable, don’t weigh such a longstanding reputation backing them.

Consistent Methodology: S&P indices, including their crypto offerings, are known for their rigorous, transparent, and consistent methodologies. They are based on deep market research, rigorous data analysis, and expert oversight. For investors, this ensures that the index reflects the market accurately and isn’t prone to anomalies or biases.

Broad Market Representation: S&P’s approach is comprehensive, aiming to capture the broader market movements and trends. While indices like Crypto 20 offer a snapshot of top cryptocurrencies, the S&P crypto index might provide a more encompassing view of the market, which is crucial for informed investment decisions.

Liquidity and Rebalancing: S&P’s index methodologies often factor in liquidity considerations, ensuring that the assets within the index are readily tradable. Regular rebalancing also ensures that the index composition remains relevant and reflects current market conditions.

Education and Resources: S&P Global provides indices and offers a wealth of educational resources, market insights, and analytical tools. For investors, this is an added layer of value, ensuring they’re not just passive observers but informed participants.

Are We Able To Define Beta In crypto?

Defining beta in traditional financial markets pertains to gauging the volatility of an individual security or portfolio relative to the broader market, typically represented by a benchmark index. The idea behind beta is to measure the risk arising from exposure to general market movements.

In the cryptocurrency world, the concept is indeed more complex due to the nascent nature of the market, its inherent volatility, and the lack of established benchmarks in the past. However, as the market matures and benchmarks like S&P cryptocurrency indices become more widely accepted, defining beta becomes increasingly feasible.

That said, capturing the actual ‘market’ in the decentralised world of crypto is challenging. Crypto assets can exhibit wide variances in liquidity, adoption, technological promise, regulatory treatment, and market sentiment. Hence, defining beta would require a robust and widely accepted market representation, which we are getting closer to as the industry matures.

The use of the indices in our monthly reporting is to provide a comparison on how our two discretionary long funds, the Apollo Crypto Fund and Apollo Crypto Frontier Fund performance compare against the S&P Broad Digital Market Index and S&P BDM Ex-MegaCap Index, respectively.

Apollo Crypto Comparisons

S&P Cryptocurrency Broad Digital Market Index

Bloomberg Ticker: SPCBDM

The S&P Cryptocurrency Broad Digital Market Index is designed to track the performance of digital assets listed on recognised open digital exchanges that meet minimum liquidity and market capitalisation criteria. The index is meant to reflect a broad, investable universe. As the flagship fund, the Apollo Crypto Fund is designed as an ‘all-around’ fund for crypto exposure. We will use SPCBDM comparatively against the Apollo Crypto Fund.

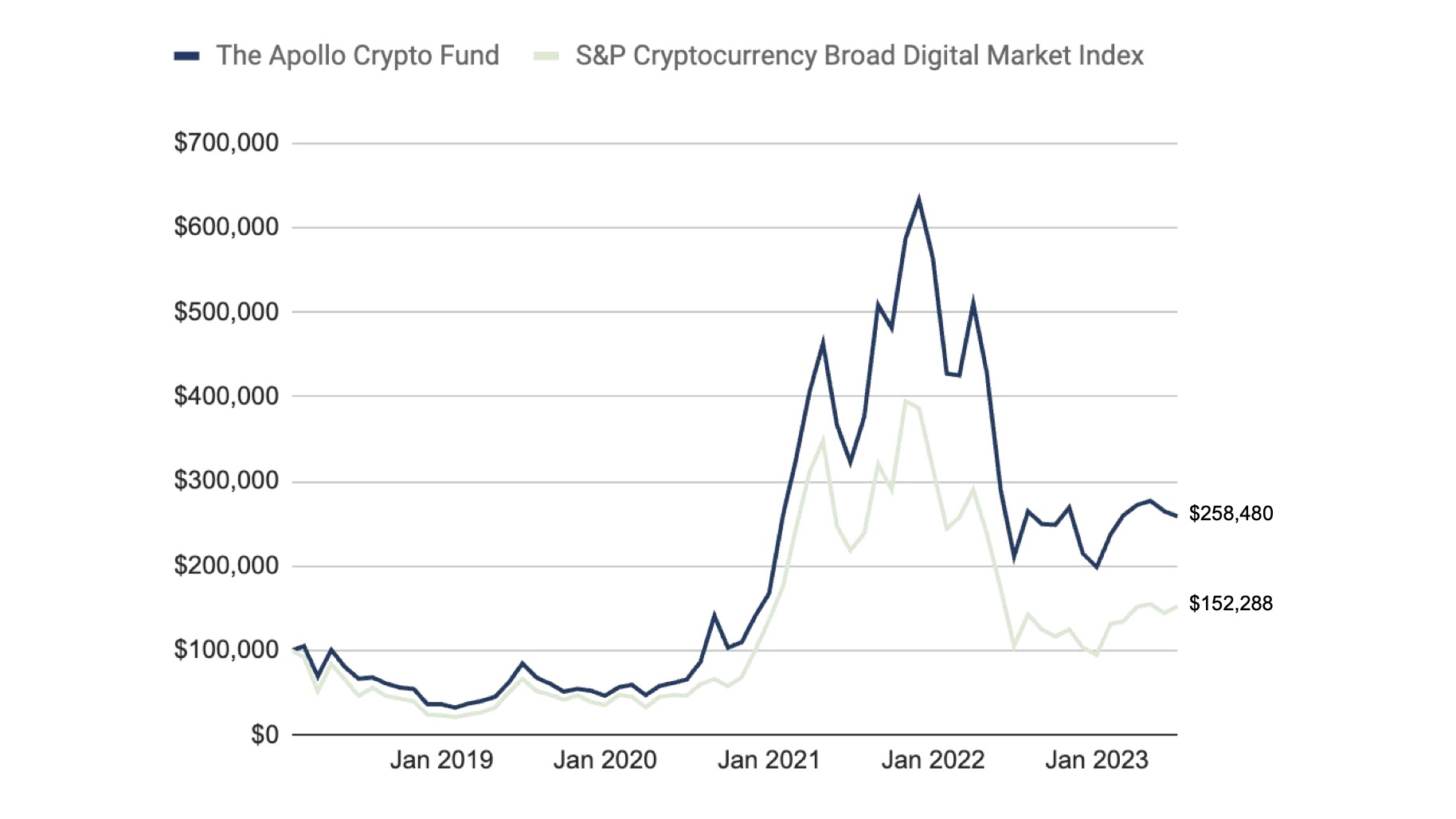

Since its inception, the Apollo Crypto Fund has returned 158.5%, and the S&P Cryptocurrency Broad Digital Market (BDM) Index 52.3%.

The graph displays the performance of a portfolio investing $100,000 in the S&P Cryptocurrency Broad Digital Market Index and the Apollo Crypto Fund since its inception on the 1st of February, 2018.

Performance: Apollo Crypto Fund against S&P Cryptocurrency Broad Digital Market Index

Past performance is not a reliable indicator of future performance

S&P Cryptocurrency BDM Ex-MegaCap Index

Bloomberg Tickereye: SPCBXM

The S&P Cryptocurrency BDM Ex-MegaCap Index is designed to track the constituents of the S&P Cryptocurrency BDM Index, excluding the constituents of the S&P Cryptocurrency MegaCap Index, meaning the most significant crypto assets left out of this index. The Apollo Crypto Frontier Fund is similar to the flagship fund minus the exposure to Bitcoin and Ethereum; this is a fitting index to compare performance against.

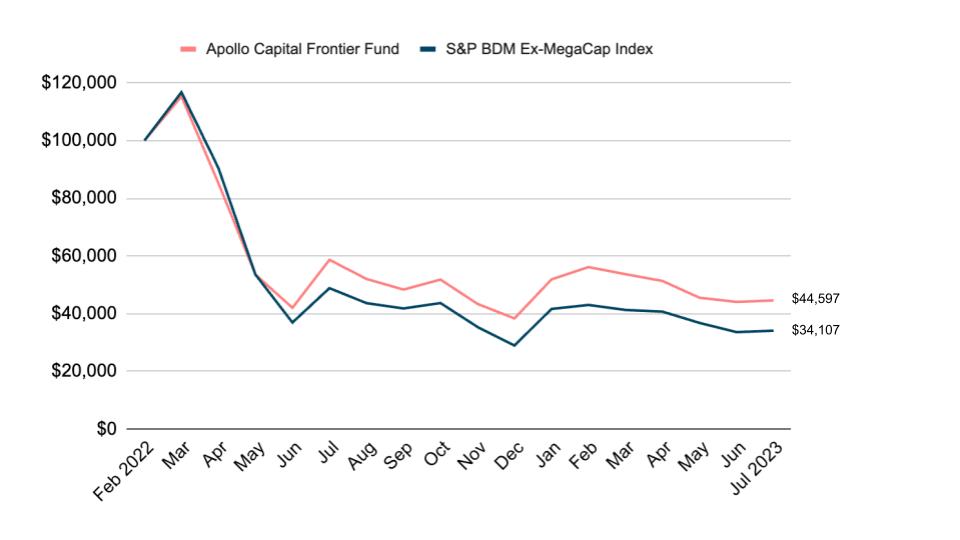

Since its inception in March 2022 (the beginning of the downward cycle), the Apollo Crypto Frontier Fund has returned -55.4%, with the S&P Cryptocurrency BDM Ex-MegaCap Index returning less at -65.9%.

The graph displays the performance of a portfolio investing $100,000 in the S&P Cryptocurrency BDM Ex-MegaCap Index and the Apollo Crypto Frontier Fund since its inception on the 1st of March 2022.

Performance: Apollo Crypto Frontier Fund against S&P Cryptocurrency BDM Ex-MegaCap Index

Past performance is not a reliable indicator of future performance

Disclaimer:

The S&P Broad Digital Market Ex-MegaCap (“Index”) and associated data are a product of S&P Dow Jones Indices LLC, its affiliates and/or their licensors and has been licensed for use by Apollo Crypto Management. © 2023 S&P Dow Jones Indices LLC, its affiliates and/or their licensors. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“SPFS”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Neither S&P Dow Jones Indices LLC, SPFS, Dow Jones, their affiliates nor their licensors (“S&P DJI”) make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and S&P DJI shall have no liability for any errors, omissions, or interruptions of any index or the data included therein.