categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Apollo Crypto’s ETF Scenario for the Coming Cycle

by Henrik Andersson

Bitcoin and crypto markets have been moving upwards in 2023. While far from the only factor, one major driver is the anticipation of the first spot Bitcoin ETF approval in the US. The chance of approval went up as the SEC lost a case against GBTC, the Grayscale Bitcoin Trust, in their efforts to convert to an ETF.

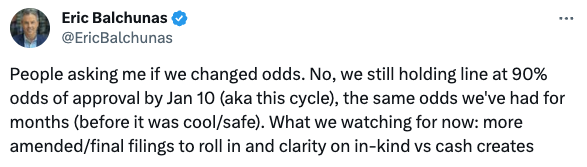

Many observers believe an approval could happen as early as January 2024. Eric Balchunas, senior Bloomberg ETF analyst, predicted in a post on X.com on November 30 that there is a 90% chance of an approval by January 10.

Some of the largest asset managers in the world are looking to list Bitcoin spot ETFs, most notably investment giants BlackRock and Fidelity:

In our view, it is likely that the SEC won’t give preferential treatment to a single ETF issuer; therefore several of them are likely to get approval at the same time.

To be able to ascertain the direct supply/demand effect of Bitcoin ETFs getting approved, we need to estimate two things: 1) New money inflow to Bitcoin ETFs; and 2) The so-called multiplier effect. Once we have estimated the effect on Bitcoin, we will use this information to forecast what it will mean for the second largest crypto asset, Ethereum.

Inflow Estimate

ETFs will ease the restrictions for a new class of investors such as wealth managers, retirement funds and institutions to gain Bitcoin exposure without having to custody Bitcoin. They can buy an ETF like any other investment in their portfolio without having to worry about custody, private key management, or a myriad of other things that make it difficult to buy crypto directly.

In order to size up the market, we look at statistics from SIFMA, which is the leading trade association in the US for broker-dealers, investment banks, and asset managers.

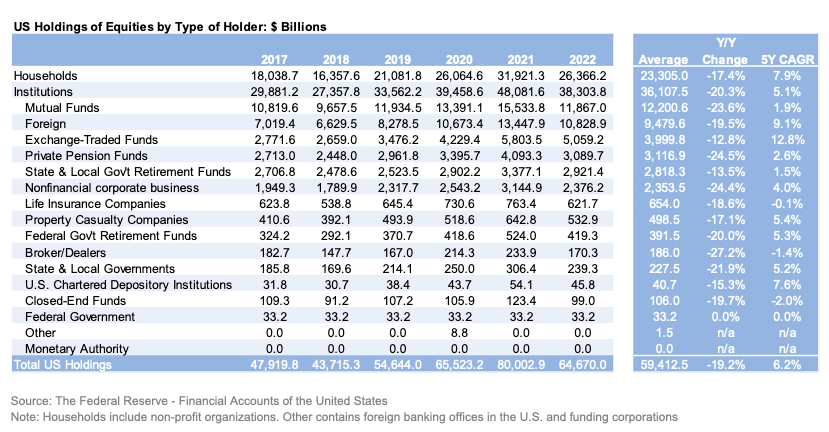

We believe investors in general put Bitcoin in the same bucket as liquid risk assets. In our view, the most relevant risk asset in the context of crypto is equities.

As we can see from the table above, the total size of US holdings of equities is US$64.7 trillion. Assuming on average that 10% of these investors will allocate 1% to Bitcoin ETFs gives us an inflow number of US$65 billion.

We sense-check this number against the size of the total US ETF market, which is US$6.5 trillion. We think it is reasonable that Bitcoin ETFs will capture 1% of the ETF market over time; again that gives us US$65 billion in potential inflow.

Bitcoin Multiplier

The Bitcoin multiplier refers to how much every dollar in inflow increases the total market cap of Bitcoin. If there are relatively few sellers, that will make this multiplier higher.

Over time, Bitcoin is becoming increasingly scarce as there is a reduction in the number of newly minted coins. This is called Bitcoin’s “Halvening”. Bitcoin’s Halvening is programmed in the software with the next event due to take place in April 2024. This will lead to a further reduction in the new supply of Bitcoin. Bitcoin Halvening means that the number of Bitcoin emitted per block is reduced to half of the number before the Halvening.

To find a proxy for how willing people are to sell their Bitcoin, we can look at the percentage of coins that have moved over the last year. As seen from the graph below, this metric has been trending downwards for many years and is now sitting at just 30%.

Chart: Percentage Of Active Bitcoin Supply (1 Year)

The multiplier is very hard to estimate since due to the nature of Bitcoin trading, we don’t have good data on net inflows.

In March of 2021, Bank of America (BoA) published a report titled “Bitcoin’s dirty little secrets”. Using a regression analysis they concluded that:

“Bitcoin is extremely sensitive to increased dollar demand. For example, we estimate that a net inflow of just $93 million would result in price appreciation of 1%, while the similar figure for gold would be closer to $2 billion, or 20 times higher”.

Using the Bitcoin price on the date of the report of $56,836 together with the circulating supply, we draw the inference that BoA estimates the multiplier effect to be 114x. We believe BoA’s 114x to be an upper band on the multiplier effect. If we see a considerable price increase in Bitcoin, there is a chance that the multiplier will decrease as an increasing number of investors take profit. For this reason we will discount this number by over 50% and apply a multiplier effect of 50x for our scenario.

Bitcoin’s Potential from ETF

Putting it all together leads us to believe that we could see US$65 billion in inflow to Bitcoin ETFs in the coming cycle. Applying a 50x multiplier effect leads to an increased market cap of US$3.25 trillion in which case we would see Bitcoin trading at US$200,000 per coin. We realise this is a bold estimate with a lot of uncertainty. Bitcoin at the time of this writing is trading at approximately US$42,000.

Flow on Effect on Ethereum

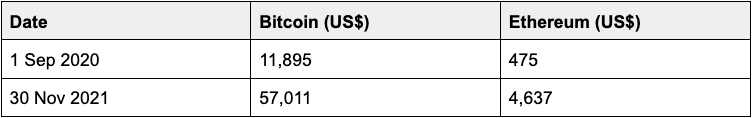

At Apollo Crypto, we fundamentally believe that the space is much larger than just Bitcoin. Ethereum is the second largest crypto asset. To get a sense of the potential impact on Ethereum from the above analysis, we look at the beta of Ethereum in relation to Bitcoin during the last Bull Market. We take September 2020 as the start date and November 2021 as the end date.

From this table, we can see that Bitcoin increased 4.8x while Ethereum increased 9.8x; Ethereum increased twice as much as Bitcoin during this time.

If the relationship holds for the coming cycle (admittedly a big if) and Bitcoin increases 5x (from US$40,000 to $200,000) then Ethereum would reach US$22,000.

Conclusion

While any attempt at forecasting is riddled with issues, we believe the above analysis at least gives us a sense of the potential magnitude that a spot ETF could have on Bitcoin and the wider crypto market. It is reasonable to believe that some of the effects of ETF approvals are already priced in. On the other hand, we have seen reflexivity in crypto before, meaning that positive price action leads to more interest, which leads to even more price action and so on.

We will end with a caveat; this is not meant to be a prediction, we leave that to others. As always, please remember that investing in crypto assets comes with inherent risks, and prudent decision-making is crucial. This is not personal financial advice. Please do your own research and consult your financial advisor before investing.

This report (‘Report’) has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security of financial product or service. This Report does not constitute a part of any Offer Document issued by Apollo Crypto Management Pty Ltd (ACN 623 059 227, AFSL 525760) or Non Correlated Capital (ACN 143 882 562, AFSL 499882), the Trustee of the Apollo Crypto Fund. Past performance is not necessarily indicative of future results and no person guarantees the performance of any Apollo Crypto financial product or service or the amount or timing of any return from it. This material has been provided for general information purposes and must not be construed as investment advice. Neither this Report nor any Offer Document issued by Apollo Crypto or Non Correlated Capital takes into account your investment objectives, financial situation and particular needs. The information contained in this Report may not be reproduced, used or disclosed, in whole or in part, without prior written consent of Apollo Crypto. This Report has been prepared by Apollo Crypto. Apollo Crypto nor any of its related parties, employees or directors, provides and warrants accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. You should obtain a copy of the Information Memorandum, issued by Non Correlated Capital before making a decision about whether to invest in the Apollo Crypto Fund.