categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Battle of the Bitcoin ETFs

by Quinn Papworth

On January 10th 2024, ten spot Bitcoin ETFs received approval in a pivotal moment for the cryptocurrency industry. Given this significant development, we thought it would be appropriate to conduct an in-depth analysis to evaluate the performance of these funds. Our aim is to determine if these ETFs have lived up to their expectations and truly influenced the market as initially predicted.

What Is An Exchange Traded Fund?

An Exchange Traded Fund (ETF) is a financial instrument that allows investment funds to exist as products that can be traded on exchanges such as the New York Stock Exchange (NYSE). In the case of Bitcoin ETFs it gives investors exposure to a fund essentially indexed to the performance of Bitcoin. Early this year spot Bitcoin ETFs were finally approved and they have since allowed investors to gain exposure to Bitcoin through their typical brokerage accounts. In simple terms it allows buyers to get exposure to Bitcoin through the US stock-market without having to worry about self-custody or going through a crypto-specific exchange.

Why Is A Spot Bitcoin ETF Significant?

The approval of the spot Bitcoin ETFs is a significant event for both the crypto industry and traditional financial industry as it marks the SEC’s acceptance of Bitcoin. This confirms Bitcoin’s status as a non-security and indirectly approves the asset class for institutional allocation. This pivot was off the back of Grayscale’s monumental victory in court over the SEC where they set the precedent that a spot ETF approval could not be denied on claims of potential manipulation when a Bitcoin futures ETF already exists. This sets an important precedent for a potential spot Ethereum ETF in the future.

The ETF approval provides much needed regulatory clarity to Bitcoin and is a huge win for the wider crypto industry. As a result, since the spot ETF approval we have seen enormous uptake by institutional bidders and have seen bitcoin allocation from some of the worlds largest funds, notably Fidelity and Blackrock are now allocating to their Bitcoin ETF in other investment products managed by the company. Institutions are no longer afraid of the potential regulatory backlash from the SEC in regards to Bitcoin.

Have The Bitcoin ETFs Been Successful?

The debut of the spot Bitcoin ETFs has exceeded expectations thus far, achieving levels of success within the first two months that are typically seen after years of operation in a conventional ETF launch. This remarkable achievement is evident across a range of performance metrics, demonstrating the unprecedented momentum of these ETFs.

Net inflows:

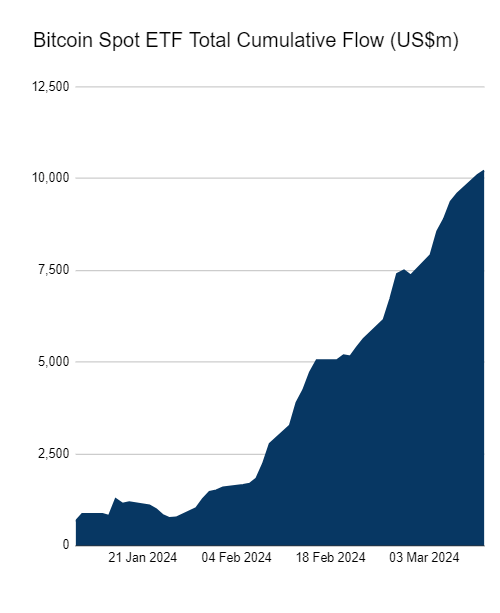

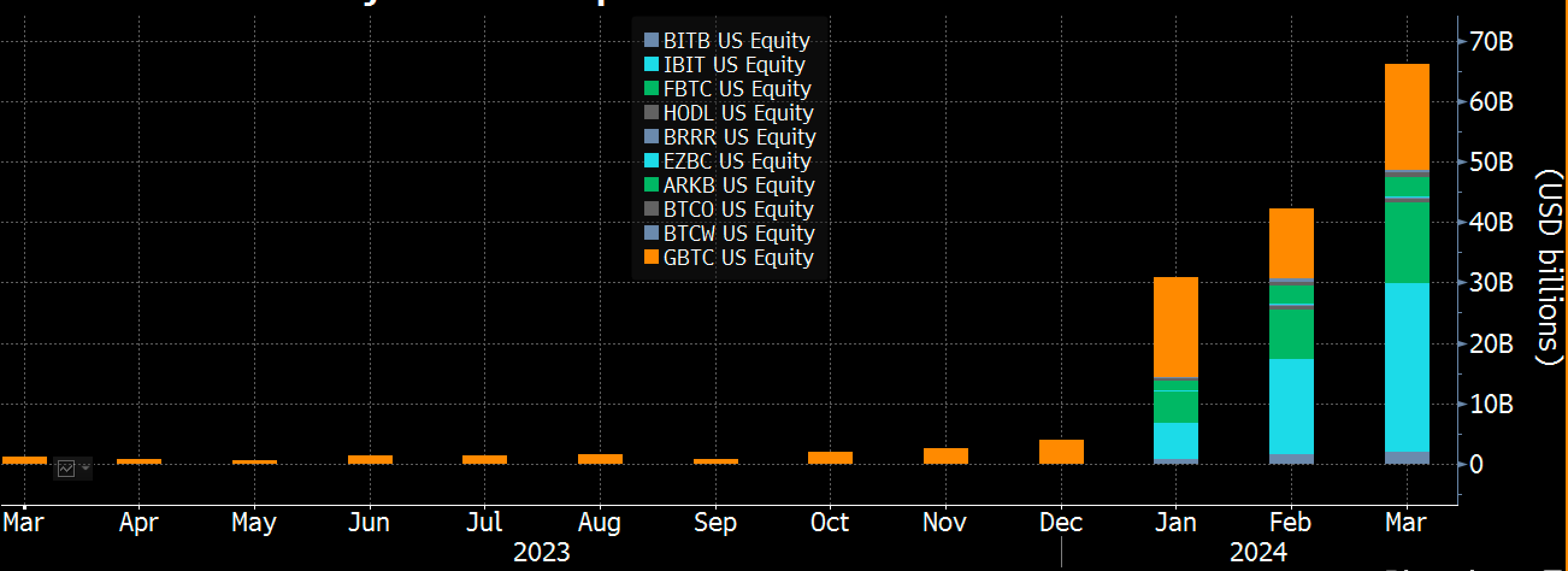

The spot Bitcoin ETFs have seen total daily net inflows across all of the funds of roughly US$ 270 million daily. This is highly impressive especially when considering that Grayscale’s ETF (GBTC) has had an average daily outflow of US$ -262 million. Blackrock’s ETF (IBIT) has seen the largest amount of inflows by a significant margin at US $ 278 million in daily flows with Fidelity’s fund (FBTC) trailing behind at a daily flow of US$ 153 million. Overall the spot Bitcoin ETFs have seen an impressive total cumulative net inflow of US$ 12.16 billion as of the time of publication.

Assets under management:

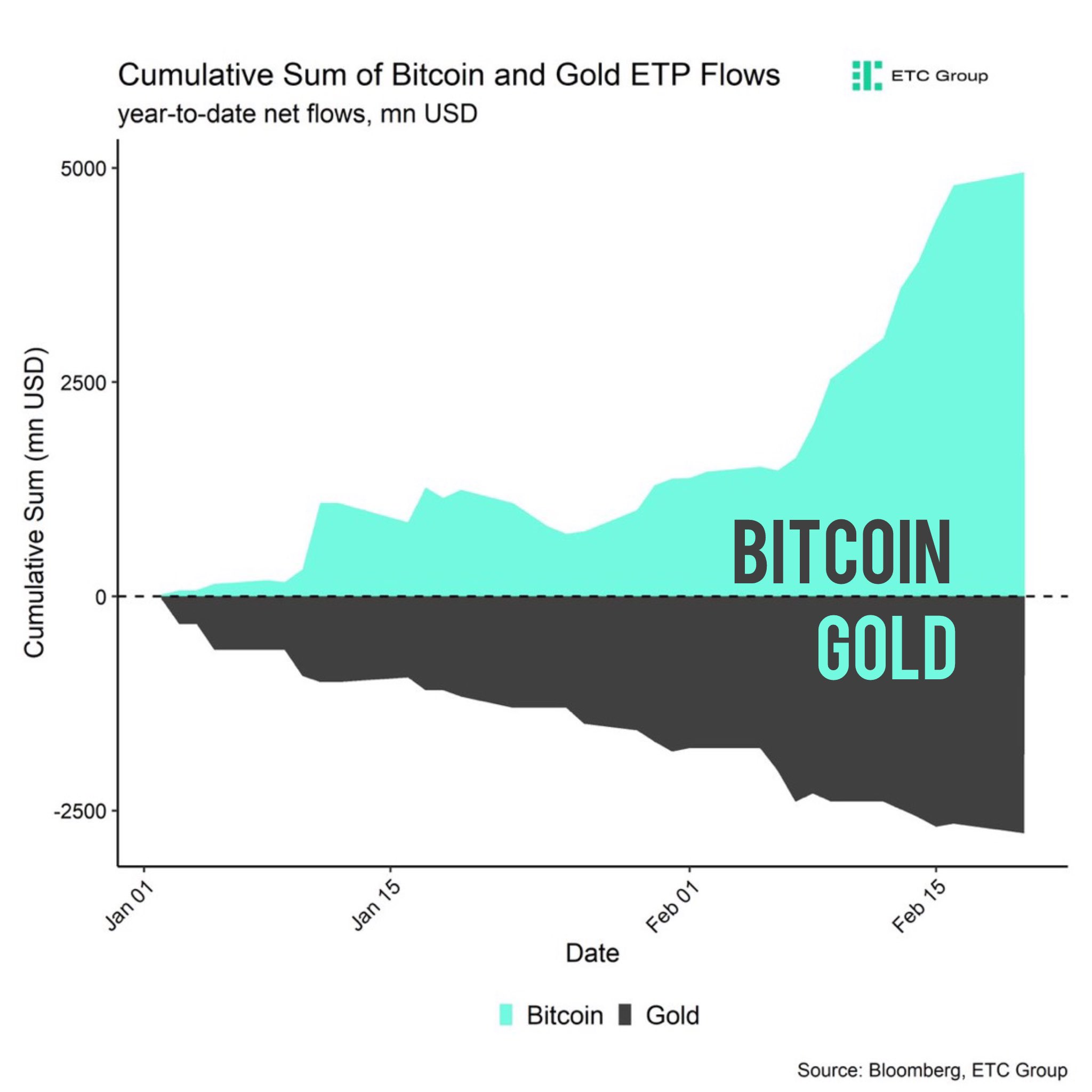

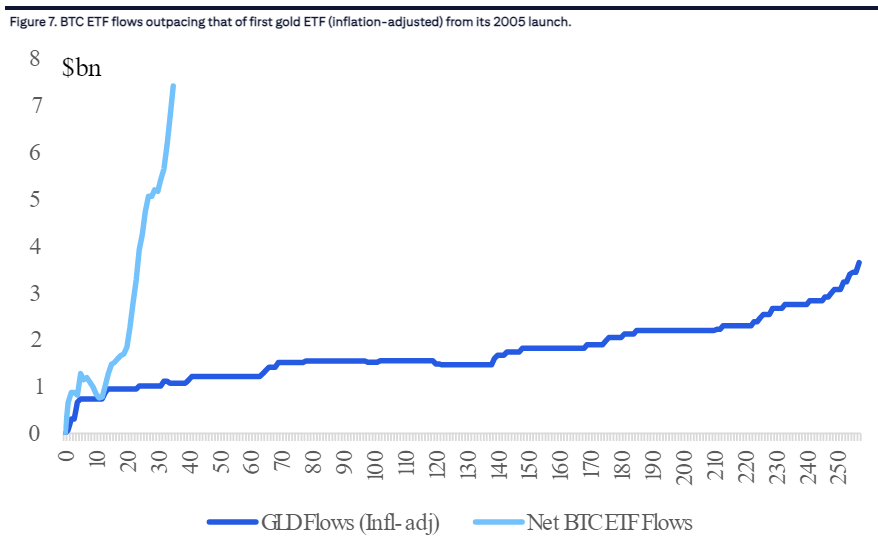

After just two months, spot Bitcoin ETFs (including GBTC) hold over US$ 58 billion in assets, representing nearly 4% of the total bitcoin supply in BTC terms and have done more than US$ 110 billion in volume. According to ETF analyst Eric Balchunas this places the Bitcoin ETFs on pace to pass Gold ETFs in just a few months rather than years. This looks especially promising with strong net outflows from Gold ETFs since the introduction of the spot Bitcoin ETFs. This may be signalling a shift towards Bitcoin becoming the store of value favoured by investors.

Blackrock’s IBIT fund alone achieved an AUM of US$ 10 billion after a mere 39 trading days. To give context to this achievement it took Gold’s first ETF (GLD) more than two years to achieve the same feat following its launch in 2004.

Volume:

The ten newly approved spot Bitcoin ETFs have seen US$ 142 billion in volume to date. This volume has primarily been led by Blackrock and Grayscale’s funds. IBIT and GBTC have been leading the charge in volume with IBIT dominating the buying volume with GBTC being the primary source of selling volume with US$ 11.8b in outflows to date. That being said it seems sell volume from Grayscale is starting to become exhausted as its outflows approach JPMorgan’s prediction of US$ 13 billion as a result of its comparatively expensive fee structure. Volumes for the Bitcoin ETFs are showing no signs of slowing down in March with record numbers being documented despite being only halfway through the month. Some of the smaller ETFs have been recording record breaking volumes so far in March indicating strength across the board.

Comparison To The Wider ETF Market

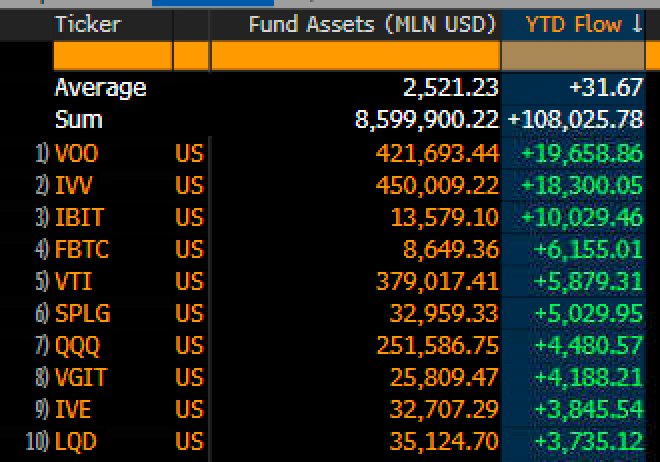

The spot Bitcoin ETFs have been outperforming when it comes to the wider ETF market as well. After just two months Blackrock’s IBIT and Fidelity’s FBTC sit at number 3 and 4 for YTD flows among ALL ETFs. This is an incredible feat when considering IBIT and FBTC are only trailing behind industry giants like VOO and IVV which represent investment vehicles that set the benchmark for a majority of investors.

Who Are The Big Winners?

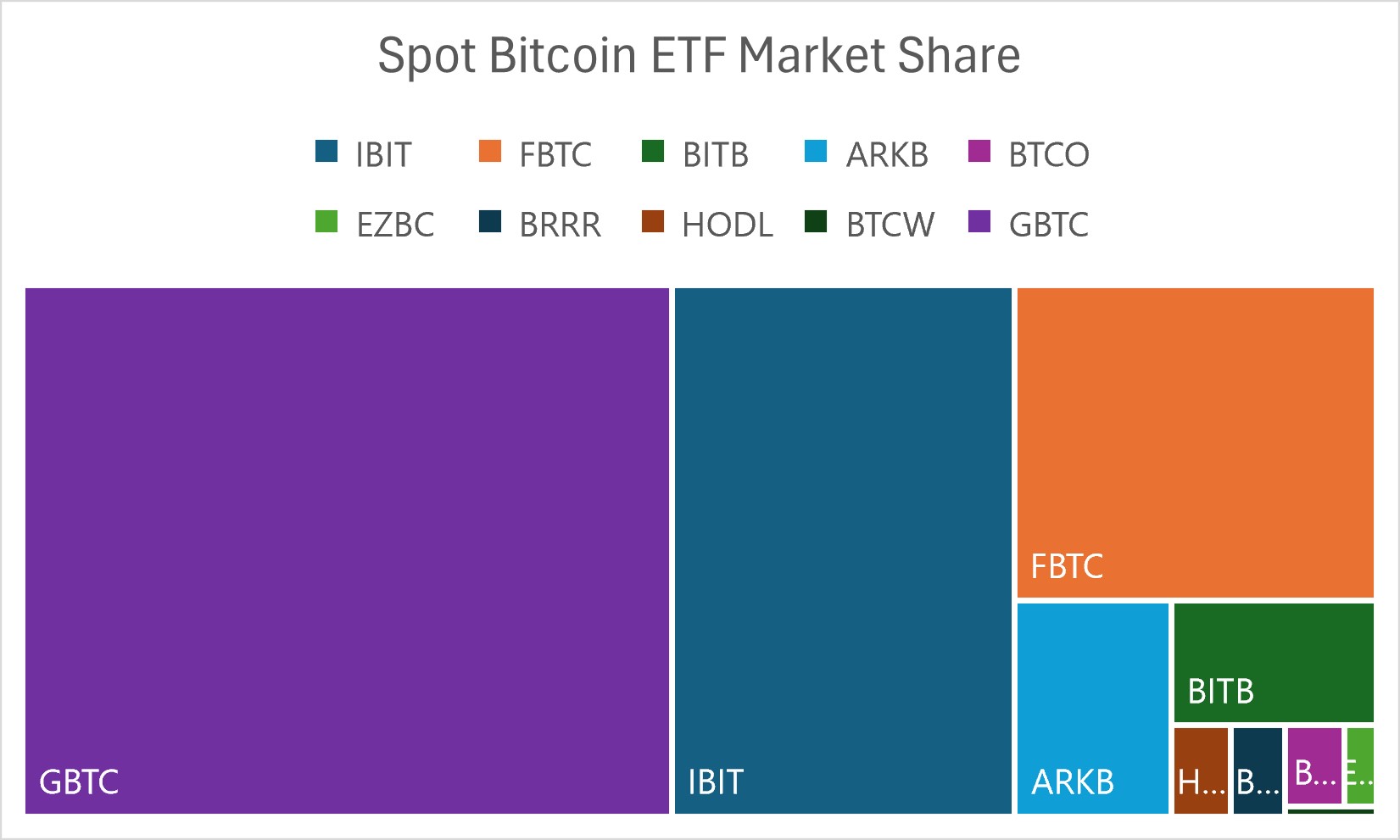

The biggest winners of the spot Bitcoin ETF wars are undoubtedly Blackrock and Fidelity. This is largely due to their existing strong network effect and reputation. Despite significant outflows GBTC still remains a winner with the largest market share among the ETFs due to its previous OTC trust offering before it was converted to an ETF in January.

Across the ETFs there are low fee structures across the board with almost all of the funds choosing a management fee of 0.25%, to stay competitive many funds are even choosing to waive this fee for an initial time period. GBTC has been the exception to this rule who have kept their comparatively expensive rate of 1.5%, as such this rate may explain some of the recent exodus from the GBTC product.

A surprise winner coming out of the success of the spot Bitcoin ETFs is Coinbase, Coinbase is the custodian for 8 out of the 10 ETFs and its stock is up roughly 60% YTD. Displaying its dominance as the preferred crypto custodian Coinbase stands to make a large sum as the total assets under management in the newly approved ETFs grow.

What Do The ETF Flows Mean For Bitcoin?

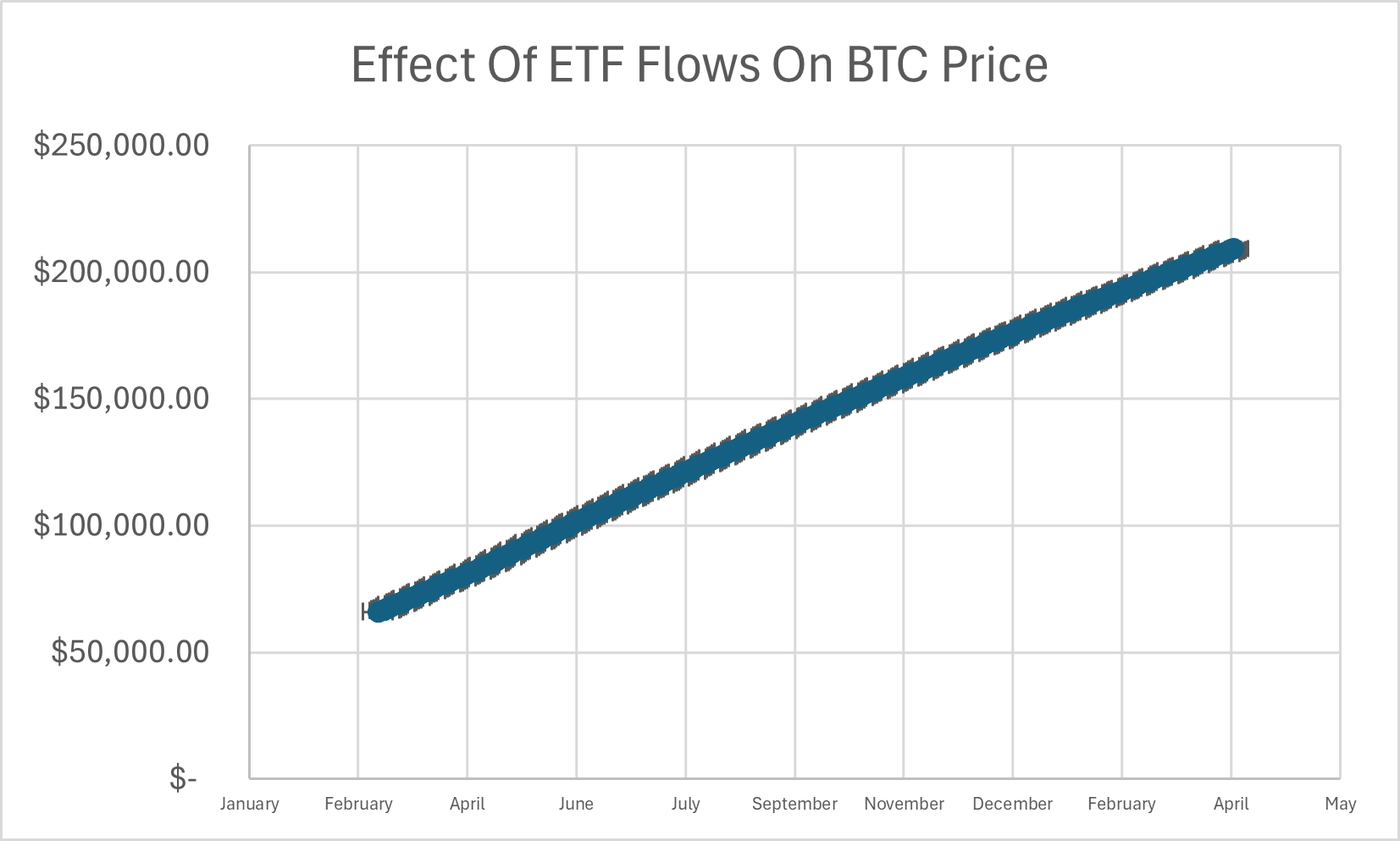

From the ETF data we have seen so far we can speculate on the price of Bitcoin if the current rates of inflows remain and we don’t see any significant amounts of selling. To do so we will base this off of three key figures, net daily inflows from the ETFs for which we will use the current rate of US$ 270 million, the maximum daily miner sell pressure which will be equal to the ‘price of bitcoin * daily BTC rewarded to miners’ and finally a price sensitivity multiplier of 50x (a conservative estimate derived from Bank of America’s regression analysis performed in 2021). By using these rates it can be predicted that Bitcoin will reach a price of roughly US$ 82,000 by the halving and US$209,000 365d post-halving even with the maximum daily miner selling pressure. While this is a very simplistic view that does not take into account many market factors and should not be viewed as a strict prediction it does successfully highlight just how impactful the support of the ETF flows are for the price of Bitcoin when all else is held equal.

In conclusion, the introduction of spot Bitcoin ETFs has marked a significant milestone in the financial industry. Their approval not only underscores a major regulatory shift but also solidifies Bitcoin’s position within the institutional investment landscape. The performance of the spot Bitcoin ETFs in the initial months following their launch has been nothing short of extraordinary, with substantial inflows of capital and an impressive accumulation of assets under management. Blackrock and Fidelity have emerged as the frontrunners in this new arena, benefiting from their strong market presence and competitive fee structures. Furthermore, the potential implications for Bitcoin’s price, driven by the sustained inflow from these ETFs, suggest a promising future for crypto markets.