categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Bitcoin Ordinals Value Explodes

by Matthew Harcourt

Introduction

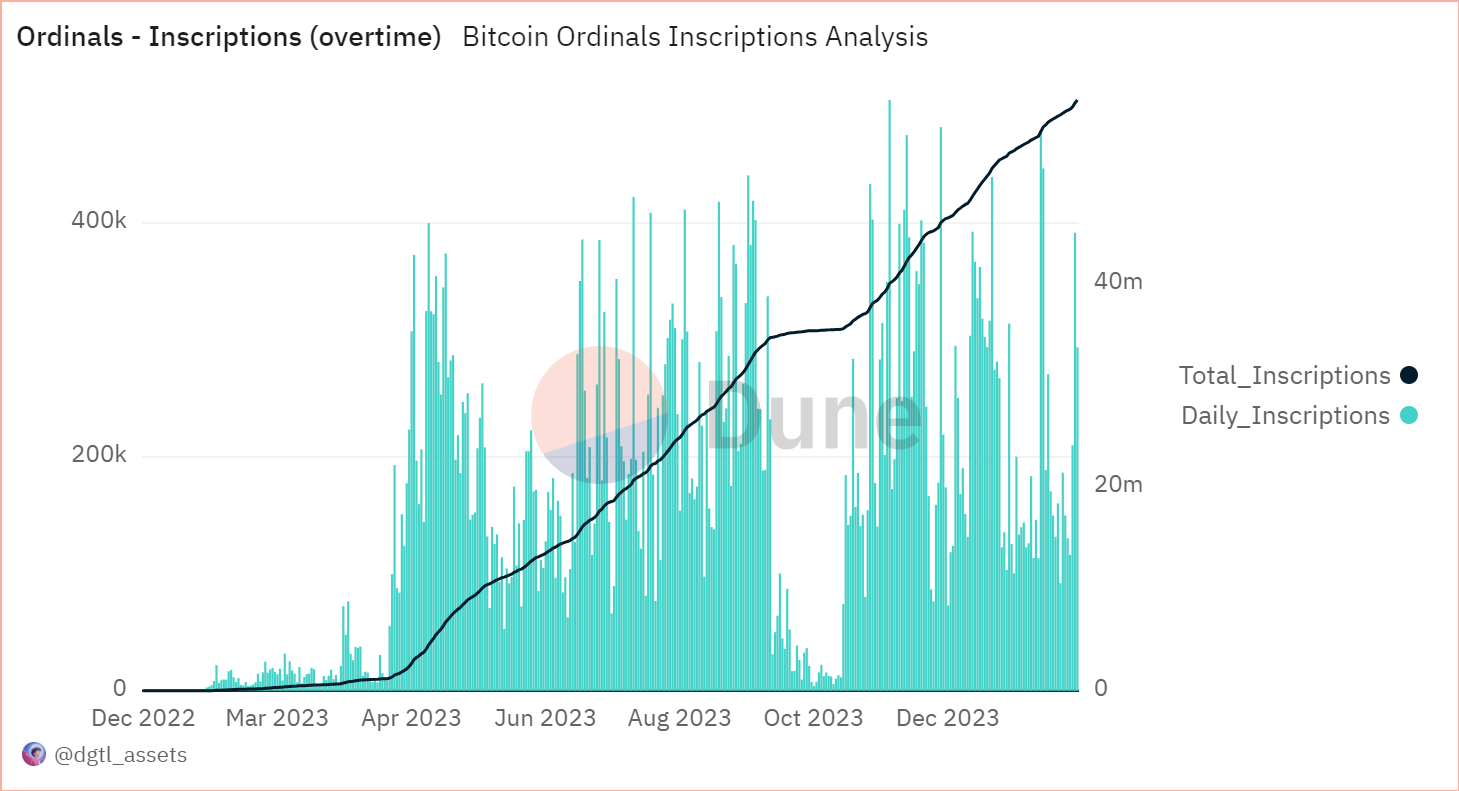

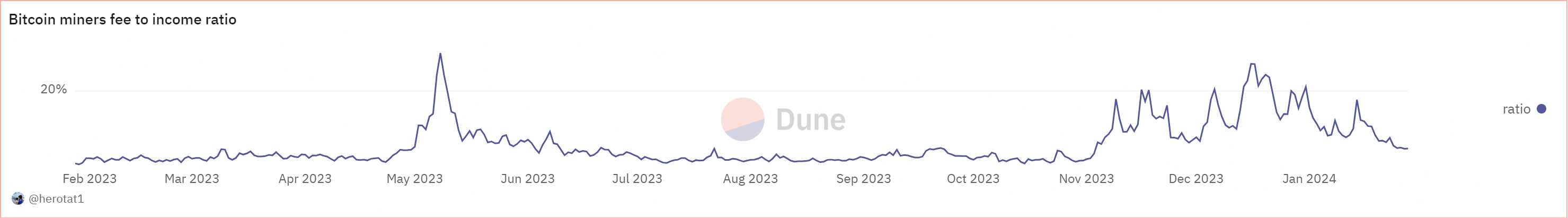

In a May 2023 blog post we wrote about the burgeoning Bitcoin ‘Ordinals’ ecosystem. At the time, Ordinals were only around 5 months old and had experienced an acceleration in growth throughout April. Since this blog post we have seen the total number of inscriptions increase from 3 million to over 56 million. This has resulted in US$242 million of fees being paid to miners directly from inscriptions. With this significant increase, we thought it was timely to provide an update on Bitcoin Ordinals.

What are Ordinals?

Historically Bitcoin has been utilised as a store of value and as a payment currency, however, the emergence of Bitcoin Ordinals has expanded this perspective. This has paved the way for artists, creators and developers to utilise Bitcoin for a variety of new applications who look to further the potential of the network.

The creation of an Ordinal is achieved by taking data and assigning it to an individual Satoshi/Sat (smallest fractional unit of Bitcoin) through a process called ‘inscription’ allowing unique information and content to be stored within. This allows the individual Satoshi to be turned into a distinct digital artefact stored on-chain. This process is akin to the concept of Non-Fungible Tokens (NFTs) on other blockchains such as Ethereum, where unique data is associated with a specific token. Ordinals were first inscribed in December 2022 and have since seen significant growth with users looking to take advantage of Bitcoin’s strong network effect.

What are BRC-20 Tokens?

BRC-20 is a token standard on the Bitcoin blockchain which allows the mint and transfer of fungible tokens using Ordinal inscriptions onto individual Satoshis. This has allowed for users to create fungible tokens on Bitcoin in a similar way that allows users to create ERC-20s on Ethereum. This innovation has led to large adoption by users with more than 18,279 BRC-20 projects now minted on-chain with infrastructure and wallet services now integrating BRC-20s.

Growth of the Ecosystem

Since our last update on the Ordinals ecosystem adoption has continued to grow rapidly with more than 55 million Ordinals being inscribed to date. An impressive 1856% growth since May 2023.

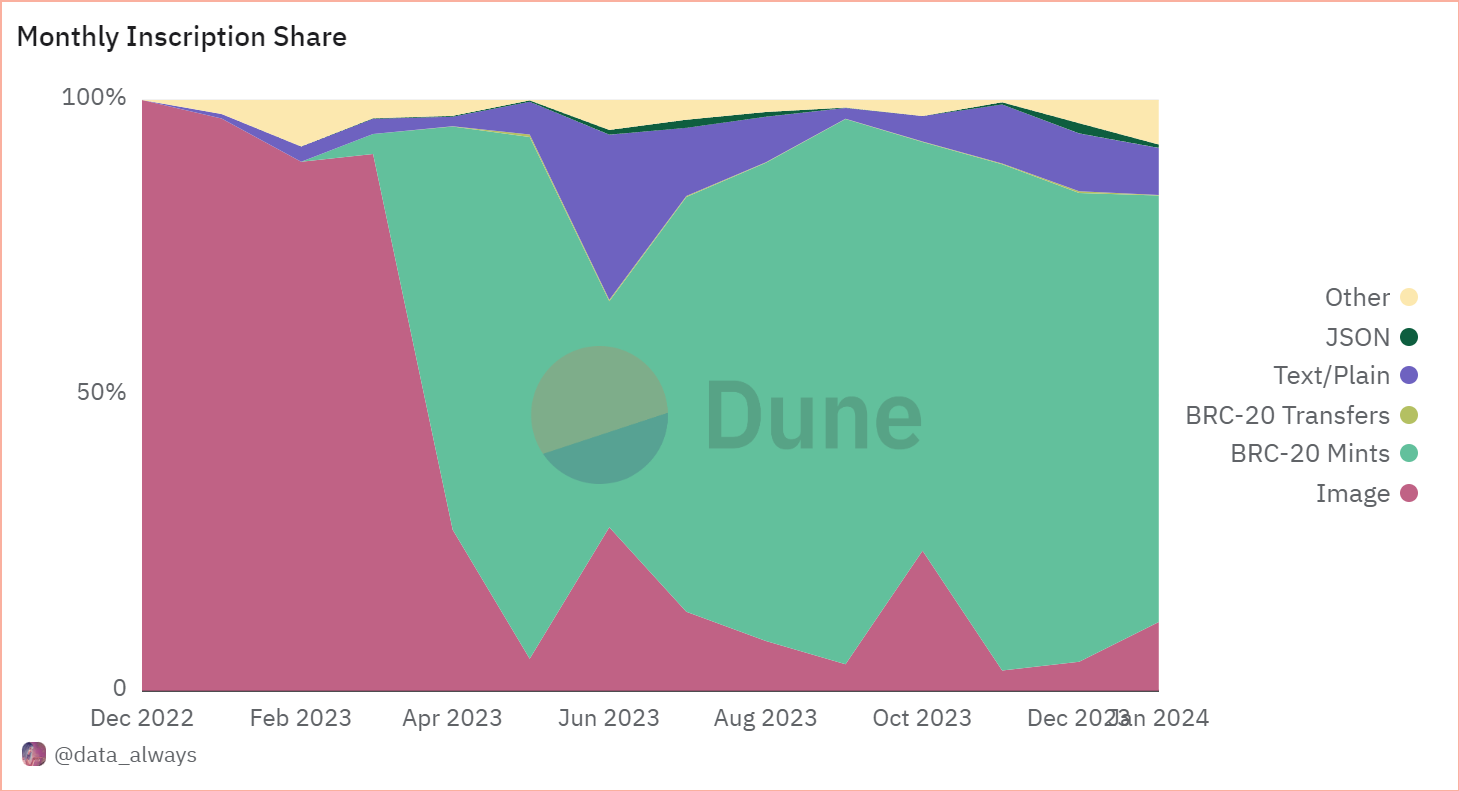

BRC-20s have continued to dominate the inscriptions market share with an average 67.59% share of transaction type since their inception. The ecosystem’s growth can be attributed to its novelty as well as Bitcoin’s dominant performance (102.63%) over the last year attracting further investment interest. With Bitcoin now hosting its own ecosystem for the first time, liquidity is able to flow directly into BRC-20s. As a result the BRC-20 ecosystem has now grown to a colossal US$2.4B market cap, an impressive increase from levels of only a few hundred million when we last reported in May 2023. Notably, two projects ORDI and SATS makeup US$2.1B of the total BRC-20 market cap.

BRC-20 usage continues to grow due to it leveraging the security and liquidity of the Bitcoin network bringing in large amounts of users who value its tenets. On top of this Ordinals are allowing for new functionalities and innovation on the Bitcoin network available to the masses for the first time fostering a vibrant ecosystem and a wider audience captured by the network’s sheer size.

Best Performers

BRC-20 token ORDI has a dominant market share (52.65%) in the BRC-20 ecosystem with a market cap of USD $1.1B. It has cemented its value as the first ever BRC-20 token created using the Ordinals protocol with a performance of 112% since its inception in May 2023.

Ordinals collection NodeMonkes has been a powerful force in the Ordinals ecosystem with 1,275 BTC (USD$55M) in volume and a floor price of 0.16 BTC (USD$6,675). The project’s value is derived from being the first original 10k collection inscribed on Bitcoin which boasts a thriving community and vibrant art, this is in contrast to alternative Ordinals projects where value is accrued based partly on the underlying rarity of the Satoshi (e.g. Ordinal Penguins). As a result the NodeMonkes collection all exist on ‘common’ Sats.

Beyond Ordinals and BRC-20s, Rare Satoshis continue to sell for increasingly large amounts of money with exceedingly rare and historical Sats sometimes selling for prices greater than a Bitcoin itself. This trend can be reflected in the price movement of floor prices for rare Satoshis increasing roughly 250% over the past 3 months as well as the large amounts of volume being moved in the pursuit of rare Satoshis by Bitcoin users. But what is a Rare Satoshi? Simply put it is a Satoshi that contains special attributes which contribute to its rarity. The term ‘Rare Satoshi’ is generally used in a loose manner, however the strict rarity of a Satoshi commonly follows the Rodarmor sat classification index which classes Satoshis under 6 categories (common, uncommon, rare, epic, legendary, mythic). For example an ‘epic’ Satoshi would be the first sat of each halving epoch marking a significant milestone in Bitcoin history. Beyond this there are other classifications known as ‘exotics’ where community attributed rarities are agreed upon as unique and desirable, such attributes include: ‘Block 78’ – Satoshis from the first block mined by Hal Finney and ‘Pizza Sats’ Satoshi’s attributed to the infamous transaction exchanging 10,000 BTC for two Papa John’s pizzas.

Mainstream Adoption?

In December, Shroomtoshi, a pioneering Bitcoiner artist, set a record at Sotheby’s Auction with the sale of his BitcoinShrooms collection, one of the earliest Ordinals projects. The three artworks sold for an astonishing USD$450,850, quintupling their combined estimated value.

In addition, Sotheby’s recent auction ‘Natively Digital: An Ordinals Curated Sale’ had a number of Ordinals of interest which sold for impressive prices including:

- A rare Satoshi that sold for USD$107,950, its rarity derived from the fact that it was the first Satoshi in the first block (known as alpha) created after the mining difficulty adjustment (known as rare) in 2016 and is a “virgin” or uninscribed sat.

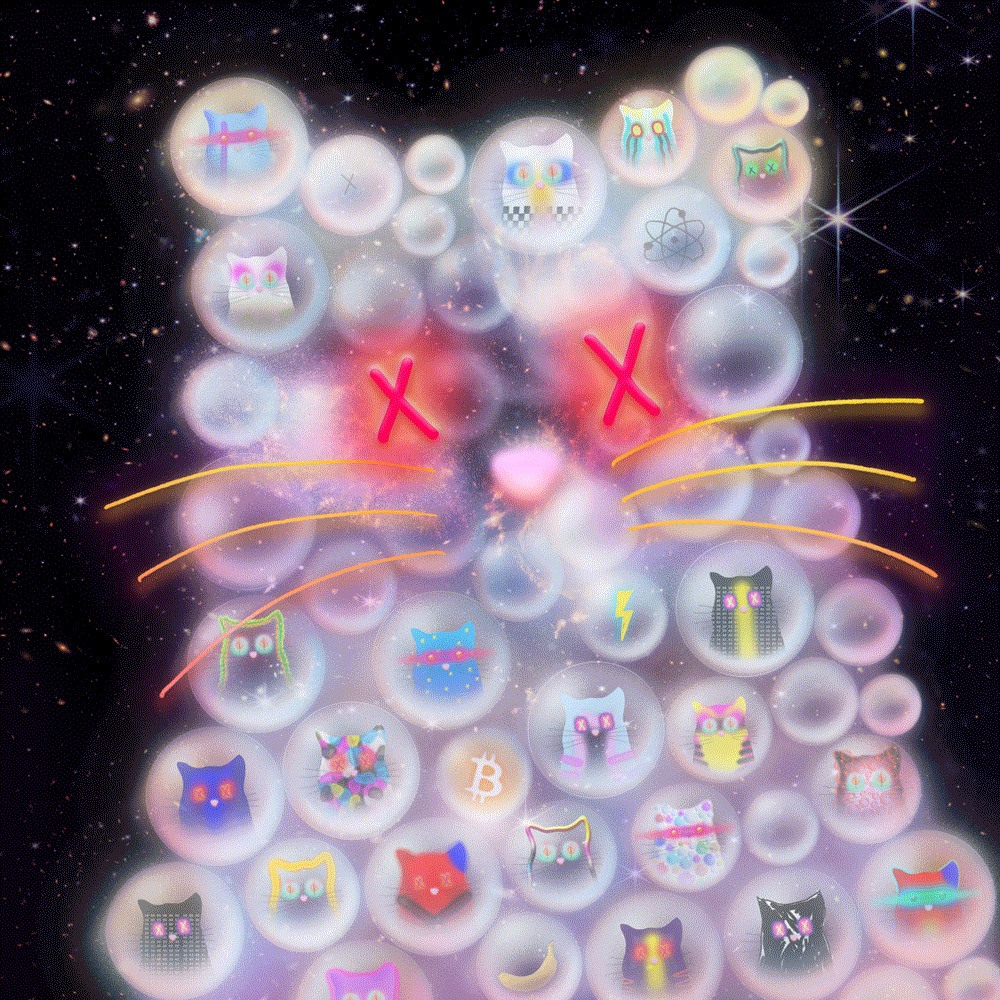

- “Genesis Cat” the 1/1 artwork from the upcoming Quantum Cat collection sold for an astonishing USD$254,000, the project is created by notable Ordinals pioneer Udi Wertheimer who created the wildly successful Taproot Wizards project and has been a loud proponent of the Ordinals protocol.

Closing Thoughts

The Ordinals ecosystem is in a position to continue its recent success, its native design allows for many of the timeless qualities we already attribute to Bitcoin such as its decentralisation, immutability and sequential on-chain nature to strengthen its uses. Ordinals look to add further value to the Bitcoin network and its long-term outlook at an opportune time as many strong tailwinds approach Bitcoin in 2024. We expect to see continued support for Bitcoin from ETF inflows, the upcoming halving event and possible liquidity injections into global markets. As such it is expected that Ordinals will have a bright future tied closely to the wider success of Bitcoin.

This blog post was written with the help of Apollo Crypto intern, Quinn Papworth.