categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Bitcoin’s Ascent: Assessing Future Catalysts

by Quinn Papworth

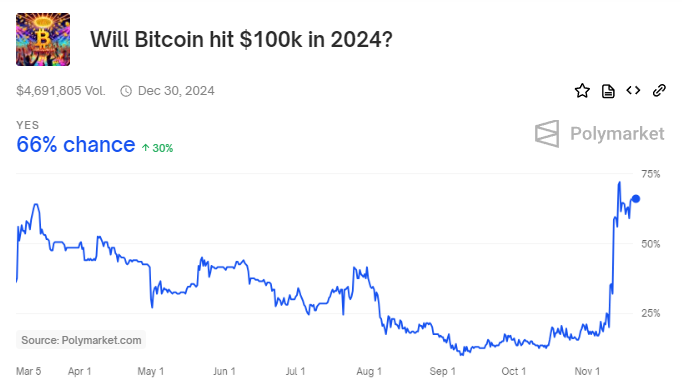

Bitcoin has experienced a remarkable surge, climbing from US$68,000 to $90,000 within a week of Donald Trump’s US election win. Polymarket data suggests a 66% chance that the cryptocurrency will surpass US$100,000 by year-end. This rally has raised the question: why is the market so bullish and where to from here?

Key Drivers of Future Bitcoin Growth

1. MicroStrategy’s Aggressive BTC Accumulation

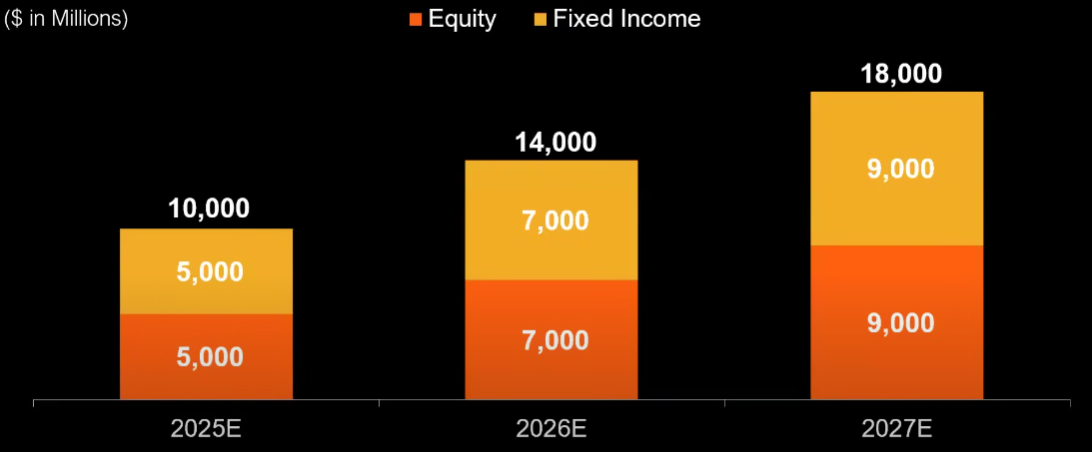

Michael Saylor, through MicroStrategy, continues to demonstrate unwavering confidence in Bitcoin. His bold plan to acquire $42 billion worth of BTC by 2027 represents a significant demand boost. The funding strategy involves a 50/50 split between equity and fixed-income instruments, with phased raises as follows:

- 2025: US$10 billion

- 2026: US$14 billion

- 2027: US$18 billion

If successful, Saylor’s purchases could absorb substantial selling pressure from Bitcoin miners, providing price support and stability for bitcoin.

2. Bitcoin as a Sovereign Reserve Asset

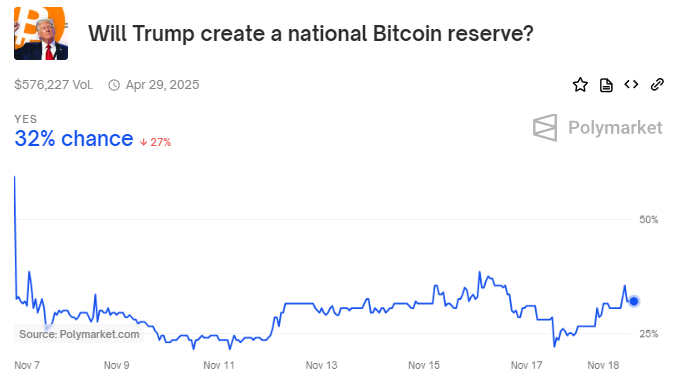

One of the most important outstanding questions is: will the U.S. actively stockpile new bitcoin, or simply hold existing seized bitcoin? According to Polymarket the odds of the US Govt holding any amount of Bitcoin in its reserves before May 2025 is 32%. If we assume the market is acting rationally than these odds reflect the U.S simply holding the existing seized Bitcoin as a reserve asset.

However if a bill such as Senator Lummis’ BITCOIN act were to be passed the size of the resultant effect could be large as it could act to incentivize other G20 countries to start purchasing bitcoin as well.

3. Sustained Inflows from Bitcoin ETFs

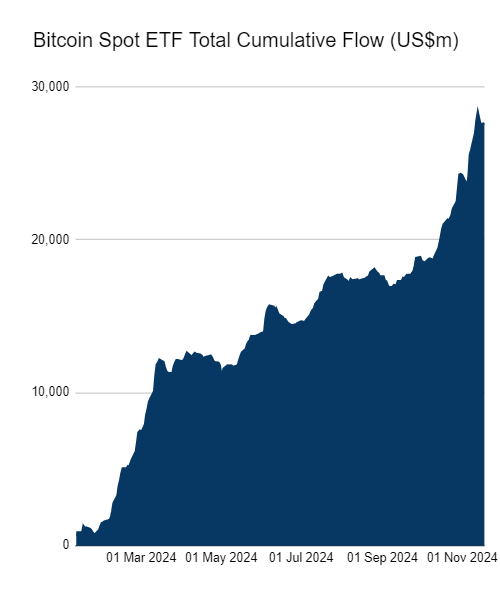

Bitcoin exchange-traded funds (ETFs) have exhibited strong momentum, with year-to-date daily inflows averaging US$130 million. If this trend persists, ETFs could become a consistent source of buying pressure that essentially eliminates much of the potential selling pressure from bitcoin miners.

Scenario Analysis: The Potential Impact of Combined Flows

The convergence of continued consistent ETF inflows, sovereign reserve purchases of BTC, and MicroStrategy’s BTC purchases could generate approximately US$60 billion in annual demand in 2025 at the current BTC price. After accounting for estimated miner selling pressure of US$15 billion and assuming a 50x Bitcoin multiplier effect, this could add US$2.25 trillion to Bitcoin’s market cap, lifting its price to roughly US$153,000 per coin.

Now lets get ultra bullish, If G20 nations collectively adopt Bitcoin as a reserve asset, matching their gold reserves on a market-cap-weighted basis, the inflows could swell up to US$214 billion. Applying the same multiplier, Bitcoin’s market cap could expand by US$10.7 trillion, pushing its price to an extraordinary US$627,000 per coin. While not a likely outcome in the near future it is an interesting thought experiment to see what the path to 500k+ BTC may possibly look like.

The Macro Backdrop: Liquidity and Policy Shifts

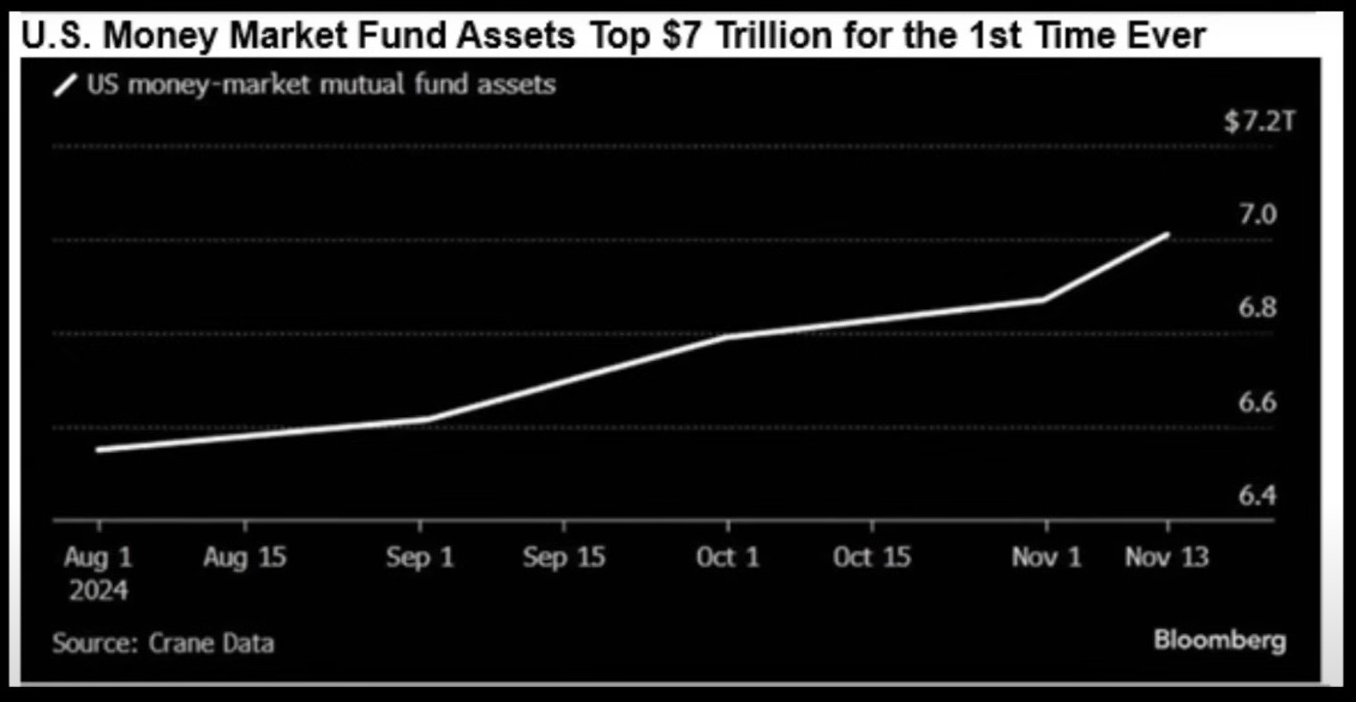

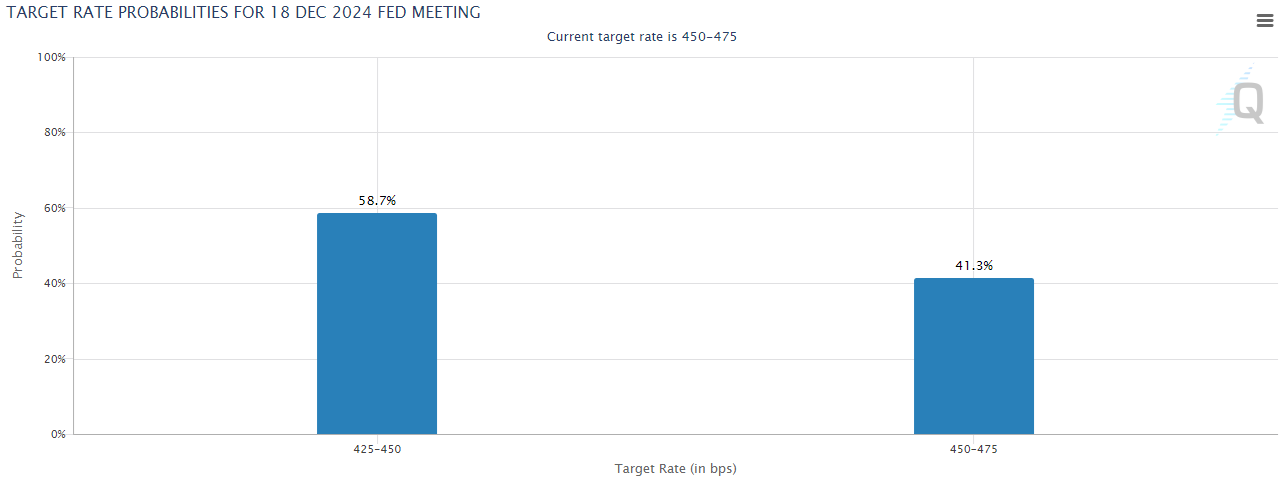

Record Money Market Levels

With global money markets swelling to US$7 trillion—an all-time high—and a 25-basis-point Federal Reserve rate cut anticipated by the majority of market participants in December, liquidity could become abundant. Bitcoin and other crypto assets could emerge as attractive alternatives to capture some of this excess capital.

Strong Potential Regulatory Momentum Under a Trump Administration

The potential approval of key crypto-related bills that were previously stalled under the Biden-Harris administration could further catalyse crypto adoption under the Trump administration.

- FIT21: A bill that aims to form comprehensive crypto legislation

- The Stablecoin Act: Aims to protect consumers by requiring stablecoin issuers to maintain one-to-one reserves and prohibits unbacked, algorithmic stablecoins

- The Anti-Surveillance CBDC Act: In line with Trump’s promise to never allow a CBDC this bill prohibits the use of central bank digital currency for monetary policy, and for other purposes.

- SAB121 Repeal: A repeal of SAB121 would eliminate the need for custodians to record customer crypto holdings as liabilities on their balance sheets, this would in turn allow banks to hold crypto assets for clients.

- Further ETF Approvals: There is growing optimism around approval of ETFs for alternative crypto assets such as Solana and multi-token spot ETFs.

Cabinet Dynamics

The incoming Trump administration appears poised to reshape the crypto landscape. Key figures and developments include:

Treasury Secretary Contenders:

As of right now it is largely unknown who Trump will appoint as Treasury Secretary, previously Howard Lutnick was heavily favoured, however the market odds are rapidly changing and now Warsh is favoured at the time of publication. According to Polymarket the odds at the time of publication are as follows:

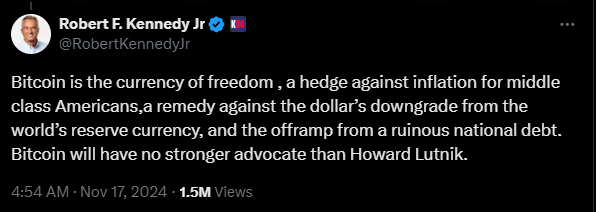

- Howard Lutnick (10% chance): Lutnick is a strong Bitcoin advocate whose firm, Cantor Fitzgerald, manages Tether reserves. The New York Times reported that several leading crypto executives, including Coinbase CEO Brian Armstrong have been in contact with Trump’s transition team, likely lobbying for Lutnick’s appointment. Interestingly it has just been reported today that Trump is to Meet Privately With Brian Armstrong. Additionally both Elon and RFK Jr have endorsed Lutnick.

- Kevin Warsh (44% chance): Previously on the Federal Reserve board of governors Warsh’s view on crypto is unclear as he has long been a proponent for the use of blockchain to create an American central bank digital currency (CBDC). Interestingly earlier in the year Trump assured that the U.S. would not create a central bank digital currency (CBDC), affirming the right to self-custody and guaranteeing no censorship of crypto transactions. As such this consideration appears slightly puzzling to many crypto natives.

- Scott Bessent (27% chance): A hedge fund manager and founder of Key Square Group, a global macro investment firm. While previously sceptical about crypto, Bessent stated in July that he is “excited about the president’s embrace of crypto” and “everything is on the table with Bitcoin.”

SEC Leadership: According to Fox News journalist Terret there is “chatter in DC circles” suggesting that Gensler will issue a statement sometime after Thanksgiving announcing his intention to leave his post in early January following Trump’s inauguration.

- Donald Trump’s pick for a new SEC chair is still unknown for now, however a few names have been circulating as possible replacements:

-

- SEC Commissioner Paul Atkins – a board member of the Digital Chamber of Commerce and supporter of digital assets.

- Robinhood’s chief legal officer Dan Gallagher – Although previously stated that he is unlikely to leave his role at Robinhood, Gallagher is another pro crypto choice operating a crypto arm under Robinhood.

- Lawyer Bob Stebbins – a former SEC general counsel, his stance on crypto is largely unknown but he has hinted at a balanced pragmatic approach towards crypto.

Broader Circle: Trump’s circle includes countless vocal crypto advocates like Elon Musk, Vivek Ramaswamy, RFK Jr., Vice President J.D. Vance, Pete Hegseth and his sons Eric and Baron Trump. With such a roster, the political environment for digital assets has never been more favourable.

The convergence of institutional interest, sovereign adoption, and favourable macroeconomic conditions positions Bitcoin for potentially historic growth. In this evolving macro and regulatory landscape, crypto’s future role remains an exciting and rapidly developing topic of debate. However, one thing is increasingly evident, it is clear that the political winds of change are shifting to favour candidates that are crypto positive.

This report (‘Report’) has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security of financial product or service. This Report does not constitute a part of any Offer Document issued by Apollo Crypto Management Pty Ltd (ACN 623 059 227, AFSL 525760) or Non Correlated Capital (ACN 143 882 562, AFSL 499882), the Trustee of the Apollo Crypto Fund. Past performance is not necessarily indicative of future results and no person guarantees the performance of any Apollo Crypto financial product or service or the amount or timing of any return from it. This material has been provided for general information purposes and must not be construed as investment advice. Neither this Report nor any Offer Document issued by Apollo Crypto or Non Correlated Capital takes into account your investment objectives, financial situation and particular needs. The information contained in this Report may not be reproduced, used or disclosed, in whole or in part, without prior written consent of Apollo Crypto. This Report has been prepared by Apollo Crypto. Apollo Crypto nor any of its related parties, employees or directors, provides and warrants accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. You should obtain a copy of the Information Memorandum, issued by Non Correlated Capital before making a decision about whether to invest in the Apollo Crypto Fund.