categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Bitcoin’s Current Cycle

by Matthew Harcourt

With crypto markets roaring back to levels not seen for years, it is natural for investors to wonder whether now is the time to buy or sell. Crypto markets have historically been very cyclical in nature, meaning that it is important to have an understanding of where the market currently stands in the cycle when making investment decisions.

To analyse where the market stands in the traditional cycle, we will generalise the crypto market by looking specifically at Bitcoin and look back at what has historically occurred around two events:

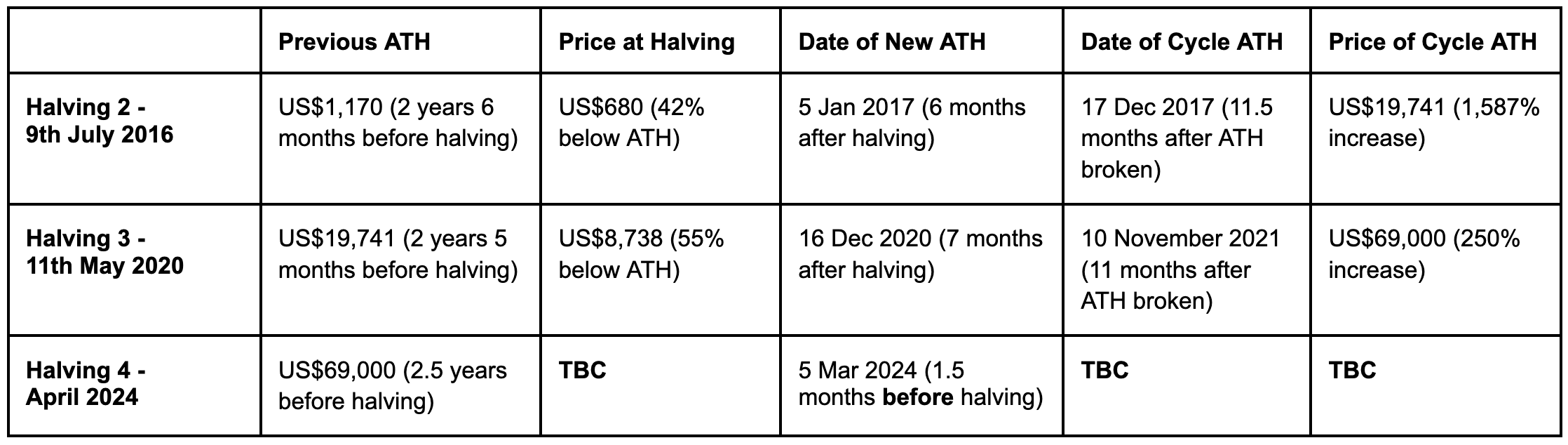

Bitcoin briefly touched its ATH on the 5th of March and currently sits well above US$70,000. This all-time high shows a clear pattern break in the history of Bitcoin’s cyclical price action with this cycle around 7 to 8 months ‘ahead of schedule’.

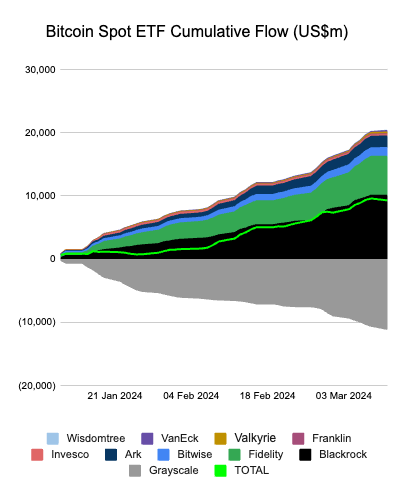

Using the previous Bitcoin price at the time of the halvings and comparing it to the cycle highs, we can extrapolate an estimated cycle high of US$150,500 for Bitcoin.

Why is Bitcoin ‘ahead of schedule’?

In my opinion, there are two clear reasons:

- Bitcoin ecosystem growth and excitement e.g. Ordinals, BRC20s & Bitcoin L2’s, and

- Bitcoin Exchange Traded Funds (ETFs) in the United States.

Bitcoin ecosystem growth is pioneering new interest in the asset for both new and old crypto investors alike. Bitcoin no longer represents simply a ‘digital gold’ asset, but instead something that is generating activity and fees. Ordinals and BRC20s have generated over US$230 million worth of fees for miners in the last 12 months. This activity fundamentally shifts the value accrual of the asset, and thus will impact the cyclicality of the asset.

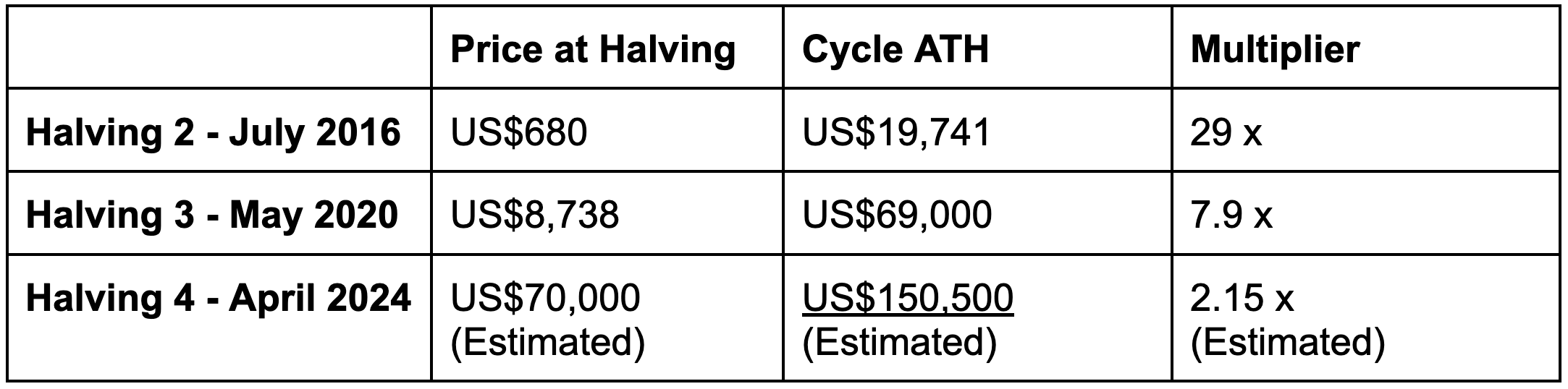

By all measures, the Bitcoin ETFs in the United States have been an outstanding success. According to Farside, there has been US$20 billion of inflows into these ETFs with net inflows of US$9.3 billion due to US$11 billion of outflows from Grayscales GBTC trust. The ETF’s were approved on the 10th of January 2024, since that date there have been 55,800 BTC supply emission by miners (144 blocks per day x 6.25 BTC per block x 62 days). Blackrock’s ETF (which accounts for around 50% of ETF inflows) alone currently holds close to 190,000 BTC, there is a clear shortage of Bitcoin on the market for current demand. This supply shortfall will be exacerbated by the BTC halving.

Far from the peak

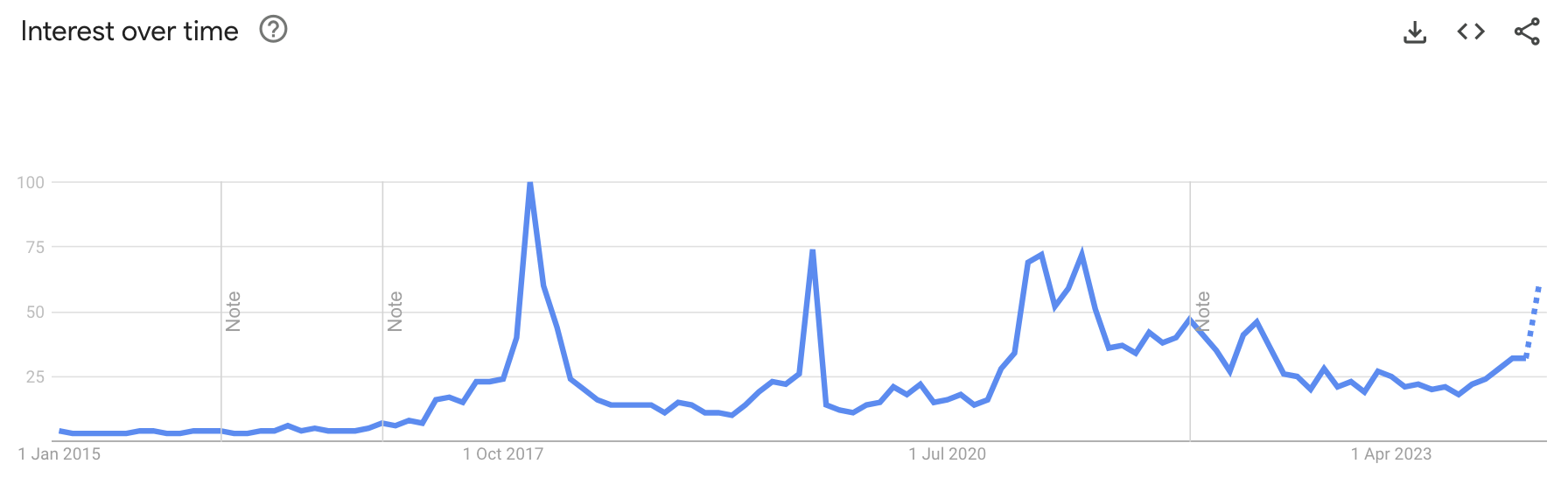

After breaking it’s long term ATH, Bitcoin has traditionally seen a further 11-12 months of positive price action before a new long term ATH is set, indicating that it is still early in the cycle. Another data point that indicates that retail interest in Bitcoin still has a long way to go is Google trends ‘Interest over time’ as shown below.

Bitcoin ‘Interest over time’ on Google Trends

Further to this, in speaking to leading Australian crypto exchanges such as Independent Reserve and Cointree, trading volumes from retail participants are still significantly below the levels seen in previous cycles.

In conclusion, this Bitcoin cycle has already proven to be quite different to comparable cycles throughout its history. We believe that the asset class is fundamentally maturing and is far more accepted by traditional financial institutions. When trying to predict where Bitcoin is heading over the next 12 months, investors are wondering whether “This time it’s different” or if “History doesn’t repeat, but it often rhymes”.