categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Can Solana Flip Ethereum?

by Quinn Papworth

Blog Summary:

- In the last 18 months after the collapse of FTX, Solana has bounced back impressively by outperforming the market in performance, mindshare, and user activity. Developers continue to build on Solana, tokens are being traded at record numbers, rivalling the volumes seen on Ethereum, and the number of active users on the network has increased exponentially. This begs the question, is Solana a serious competitor to Ethereum and if so what obstacles will it need to overcome?

- Solana’s distinct advantage is a straightforward user experience with low fees and fast transaction times. This is in contrast to Ethereum’s current narrative that has introduced more complexity due its modular design choice & roll-up centric roadmap.

- Solana’s smooth and cost-effective nature makes it a likely candidate for a popular consumer application that onboards retail users. Due to this factor and the understanding that Solana’s core design is built to handle high activity and stay scalable over time, we believe that Solana could be positioned for a period of high growth.

- However, Solana still faces challenges of institutional hesitance and a lack of node decentralisation due to intense computational requirements to run the network. As a result, in order for Solana to possibly overtake Ethereum’s dominant 59% market share it likely needs a standout consumer application that onboards the masses, high continued growth, and improvements in its network reliability and decentralisation.

Solana’s Background

Solana stands out as a high-performance Layer 1 blockchain, utilising an integrated monolithic approach to achieve low transaction fees and sub-one-second block times. It currently ranks as the second-largest smart contract platform by market capitalisation, trailing only the Ethereum Network. Founder Anatoly Yakovenko envisions Solana to “move fast and break things,” aspiring to reach an impressive 71,000 transactions per second, rivalling the speed of centralised compute systems utilised by networks such as VISA. The Solana Foundation’s unified strategy has effectively navigated challenges with remarkable efficiency. Solana is currently Apollo’s largest holding outside of Bitcoin and Ethereum and we hold high conviction in its future.

Over the last 18 months Solana has outperformed the market as it has experienced considerable growth in activity and mindshare. It now begs the question is Solana able to flip the leading smart contract platform Ethereum and if so why?

Solana’s Growth

Solana was devastated by the collapse of FTX in November 2022, seeing a -96% drawdown from it’s all time high largely due to the contagion effects of FTX and FTX having previously held a position of 55.8 million SOL tokens. It was both championed and inadvertently damaged by previous FTX founder Sam Bankman-Fried. However, since the lows seen in December 2022, Solana has experienced incredible growth.

- In the last 12 months developer growth has increased 14% to roughly 3000 monthly active developers on Solana

- TVL has increased in the last 12 months with a 1652% increase from US$266 million to US$4.66 billion. This TVL is primarily made up of liquid staking protocols and various DeFi protocols.

- Over the last year more than 2.2 million individual SPL tokens have been created on Solana, primarily made up of memecoins.

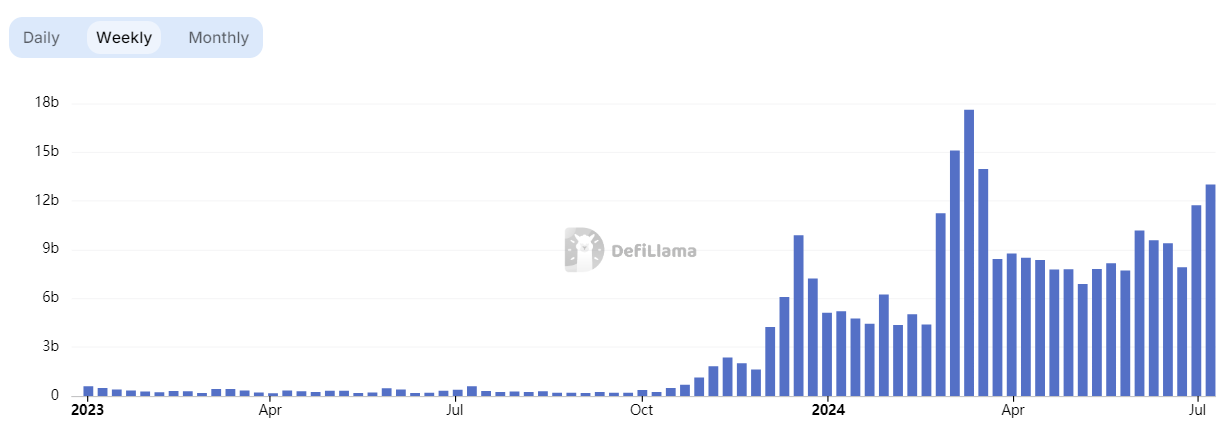

- Decentralised Exchanges (DEXs) on Solana are seeing roughly US$13 billion a week in volume, this is currently larger than the DEX volume on the Ethereum mainnet at US$10.5 billion despite the fact that Solana only captures 18% of Ethereum’s market cap and 8% of it’s DeFi TVL.

Solana DEX Volume

Will Solana Flip Ethereum? – The Bull Case

A Clear Narrative

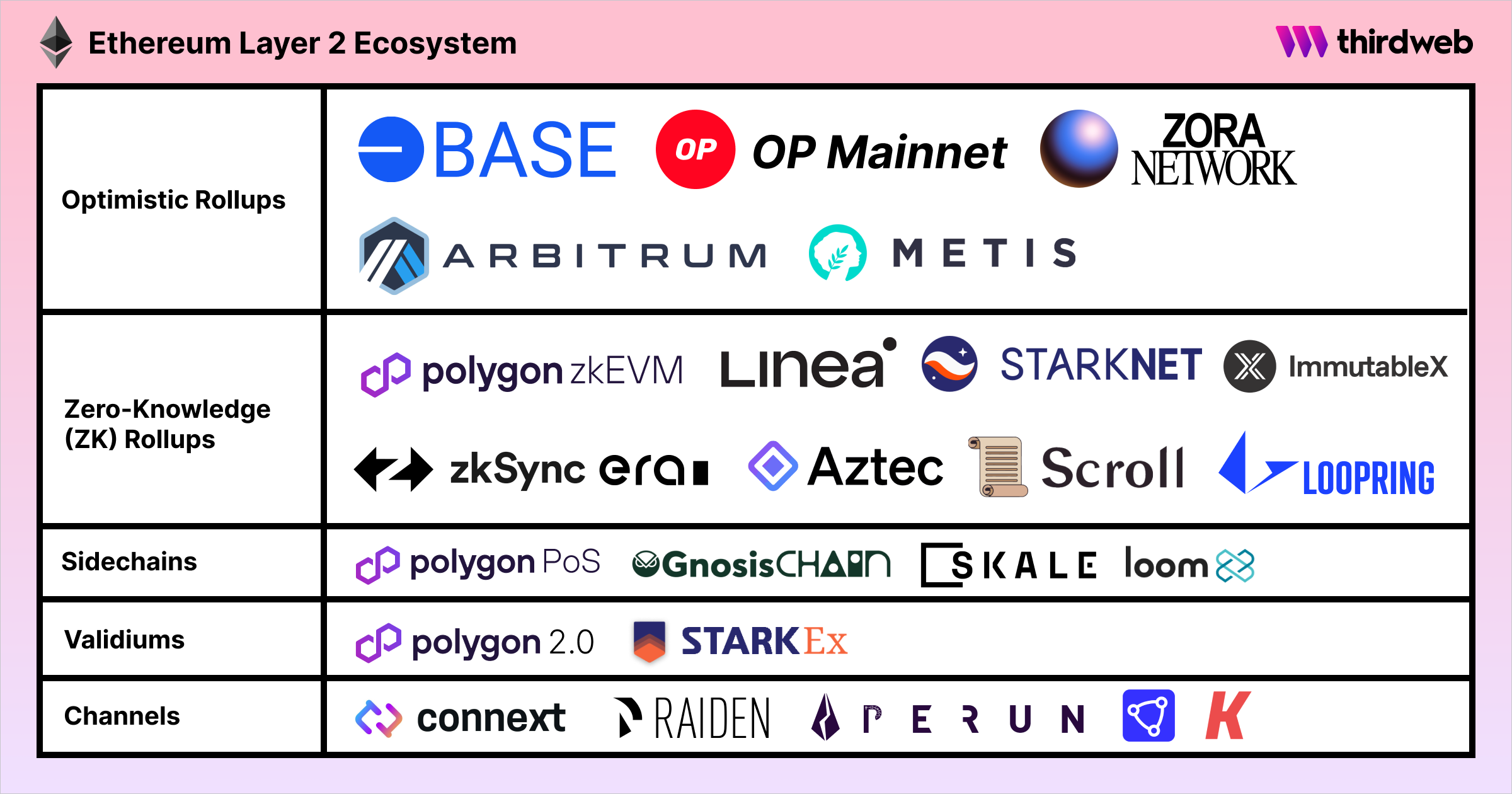

A more critical view of the current Ethereum experience and narrative is that it is not straightforward and fragments both attention and value. If a user wants to use the Ethereum network they need to consider whether they want to use the Ethereum mainnet, or one of many different layer 2s or even a modular blockchain borrowing aspects of Ethereum’s security. While this provides the user with many choices it also presents many different ways to express a bullish view on the Ethereum network, essentially cannibalising some of the value accrual to ETH the asset along the way. Additionally, as of right now this means users will experience a more fragmented ecosystem where they will need to bridge assets between layer 2 networks and the mainnet resulting in a more complex and timely user experience.

Alternatively Solana provides a more straightforward narrative and experience to users. Solana’s integrated monolithic approach combined with its low fees and fast finality provides a smoother user experience and is therefore likely to be better positioned to capture new participants to the crypto ecosystem. This propensity to capture retail attention has largely been proven already by Solana becoming the go-to chain for memecoins.

High Data Throughput

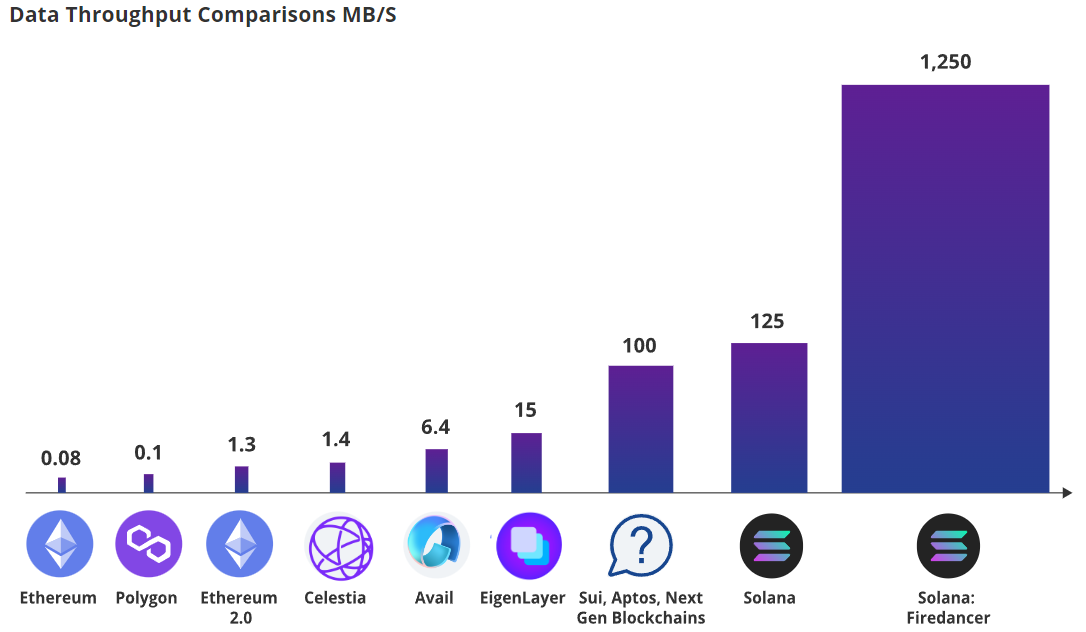

Solana currently has the highest data throughput (an efficient measure for network capacity) of all blockchains in existence with a data throughput of 125 MB/s. Comparatively, Ethereum mainnet only has a throughput of 1.3 MB/s while its scaling solutions have a throughput of up to 15 MB/s. Jump Crypto is currently building a new validator client for Solana known as ‘Firedancer’ that is planned to go live in 2025, the client aims to improve Solana’s current throughput by a further 10x to 1250 MB/s.

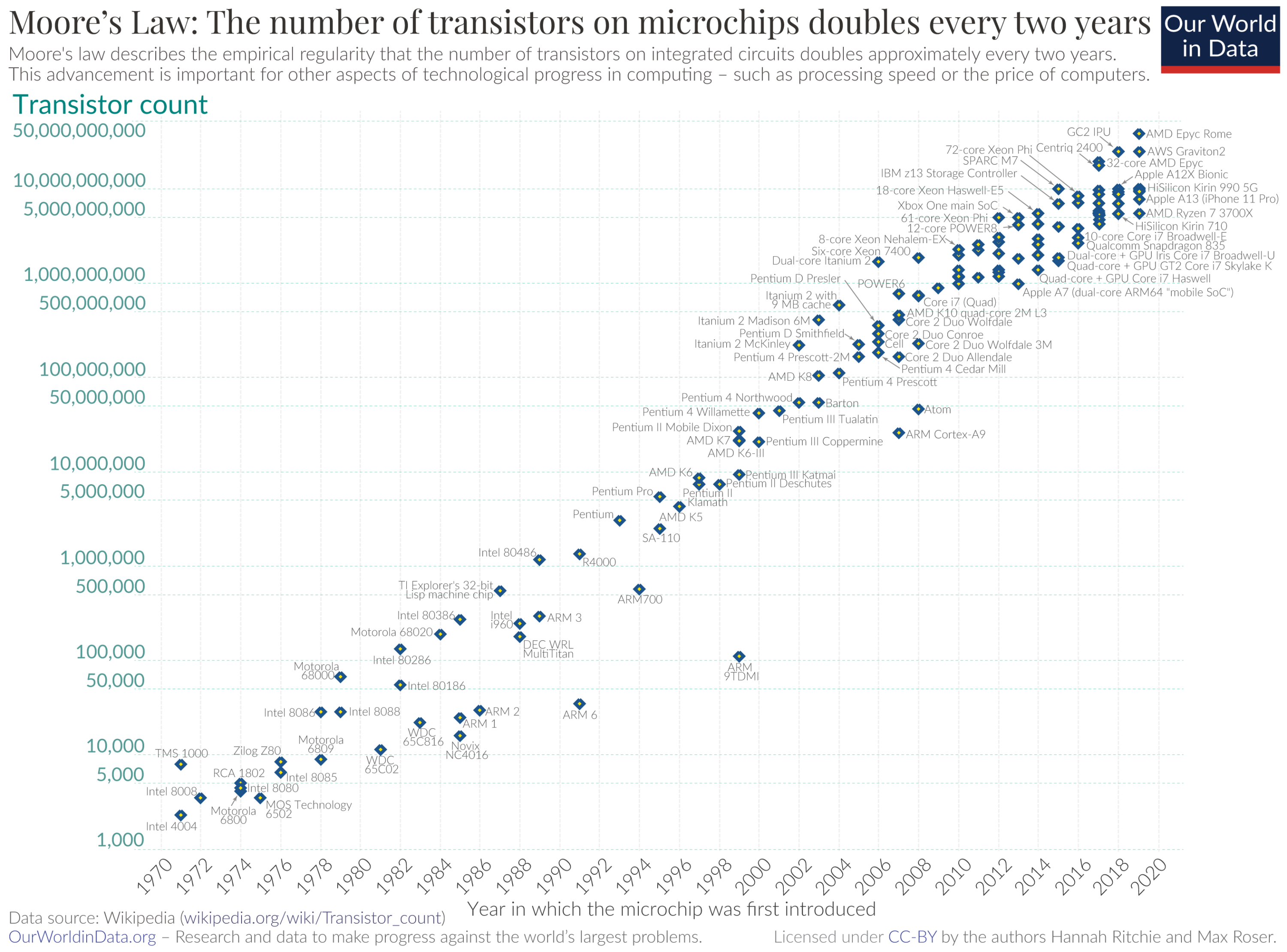

Additionally, Solana is engineered with Moore’s Law & Nielsen’s Law in mind. Moore’s Law is the observation that the number of transistors on an integrated circuit will double every two years with a minimal rise in cost. Similarly, Nielsen’s Law is the observation that a high end user’s connection speed increases by 50% every year. As a result of building with this front of mind, Solana is likely to be much more resilient as a protocol than people give it credit for as its technological architecture should be able to scale efficiently into the future and not be replaced easily by new-gen blockchains.

Killer Consumer App Potential

The mass adoption of blockchain technology remains difficult, primarily because many existing platforms are cumbersome and predominantly focus solely on value exchange. Solana, with its focus on a seamless and cost-effective user experience, stands as a strong candidate to host a breakthrough consumer-focused application that could onboard the masses. If this scenario materialises, Solana’s value is poised to increase significantly due to the heightened activity.

“For crypto to achieve widespread adoption and growth, it needs to have a ‘so-what’ for people and businesses who are not decentralisation maxis or libertarian zealots,” says Matthew Sigel, Head of Research at Van Eck. Meaning that there needs to be a driving factor for retail to adopt a blockchain beyond simply being interesting technology.

Solana is Maturing

One of the main points of contention around the Solana network is its lack of decentralisation and infamous network outages. While historically this might have been a significant factor it is trending towards becoming a non-factor. The last two Solana blockchain outages were in February 2024 and February 2023. While any outage is ultimately unacceptable for a blockchain network, Solana now has more than a 99.6% uptime. The largest issue currently facing Solana’s fault tolerance is a lack of validator client diversity. Currently there only exists two Solana validator clients, the base Solana Labs client and the Jito Labs MEV enhanced client, as a result, if the Jito Client encounters a critical bug and can’t operate the network will go down as more than 33% of validators are using the client. Because of this ideally Solana should have more than four clients with equal use among validators. However this is a very high standard for ANY blockchain to obtain, for context currently 55% of ETH validators are using the same execution client (GETH) representing a dangerous scenario for network fault tolerance in the ETH ecosystem as well.

Additionally the decentralisation of Solana has been slowly improving across many metrics, the total number of Solana validator nodes producing blocks now sits at 1517 and SOL has a nakamoto coefficient of 20 compared to ETH’s coefficient of 1. A nakamoto coefficient is defined as the measure of the smallest number of independent entities that can act collectively to shut down a blockchain/take 33.3% ownership.

Potential Hindrances to a Flippening

Lack of Institutional Adoption

While the reliability of the Solana network has improved significantly in recent times, historically this was not the case. Between January and February 2023 Solana had 7 different outages over the 13 months. As a result it is likely that Solana is still deemed unsuitable for serious institutional adoption. We have already seen Institutional actors such as BlackRock favouring the reliability of the Ethereum network to build out projects.

Lack of Sharding Support

A key criticism of Solana’s technological architecture is its reliance on a single-state system that does not support sharding. This approach hinges on the continued validity of Moore’s Law and Nielsen’s Law for sustainable scalability. If these assumptions falter, operating a node could become prohibitively expensive and more centralised due to the substantial hardware and bandwidth requirements. Over time, this scenario might mirror the limitations faced by other vertically scaled systems. For instance, consider the steam train, which attempted to scale by increasing the power of its singular engine but ultimately hit a physical barrier and was outpaced by electric trains utilising multiple engines in each carriage, exemplifying horizontal scaling.

Tech > Culture

While Solana’s focus on providing best in class tech is honourable, it does skip out on some of the original core tenants of crypto assets that were introduced by Bitcoin. Solana’s focus on high speeds means that in order to run a node it requires intense hardware requirements.

- 12 core CPU with 2.8GHz clock speed minimum

- 128/256GB of RAM

- 2-4 NVME drives of at least 1TB

- 10 Gbps Network

Because of these requirements it isn’t feasible for the large majority of retail users to run a node themselves and currently results in many nodes residing in data centres. This is problematic as Solana has sacrificed its decentralisation to achieve its current throughput and may find it hard to achieve decentralisation for the masses in a straightforward way in the near future as long as the node requirements of the Solana network continue to increase in order to host more activity.

Lack of DeFi Adoption

Despite Solana’s growth the amount of total value locked within DeFi applications on the network is still quite small. This can be examined by looking at the total value locked to market cap ratio (TVL : MC) of both Solana and Ethereum. Solana’s TVL : MC ratio is 6.7% while Ethereum’s ratio is 14.3%, this represents a higher uptake of DeFi applications on the Ethereum network and stickiness of liquidity on the EVM. This lack of adoption may be negatively impacted by previous chain halts as institutional users believe the chain is too risky to bridge assets to.

A Security Model Subsidised by Token Issuance

Until the fee revenue of Solana improves, Solana is ultimately an ecosystem whose ability to function in its current state depends upon the consistent introduction of new speculative capital to drive up the price. Solana’s current yearly staking rewards at 5.3% APY are US$2.263 billion a year. The last year of fee revenue generated on Solana was US$297 million, therefore there currently needs to be a ~7.6x increase in revenue to even out the effects of token inflation without the need for speculative capital but rather through the power of a productive asset producing revenue.

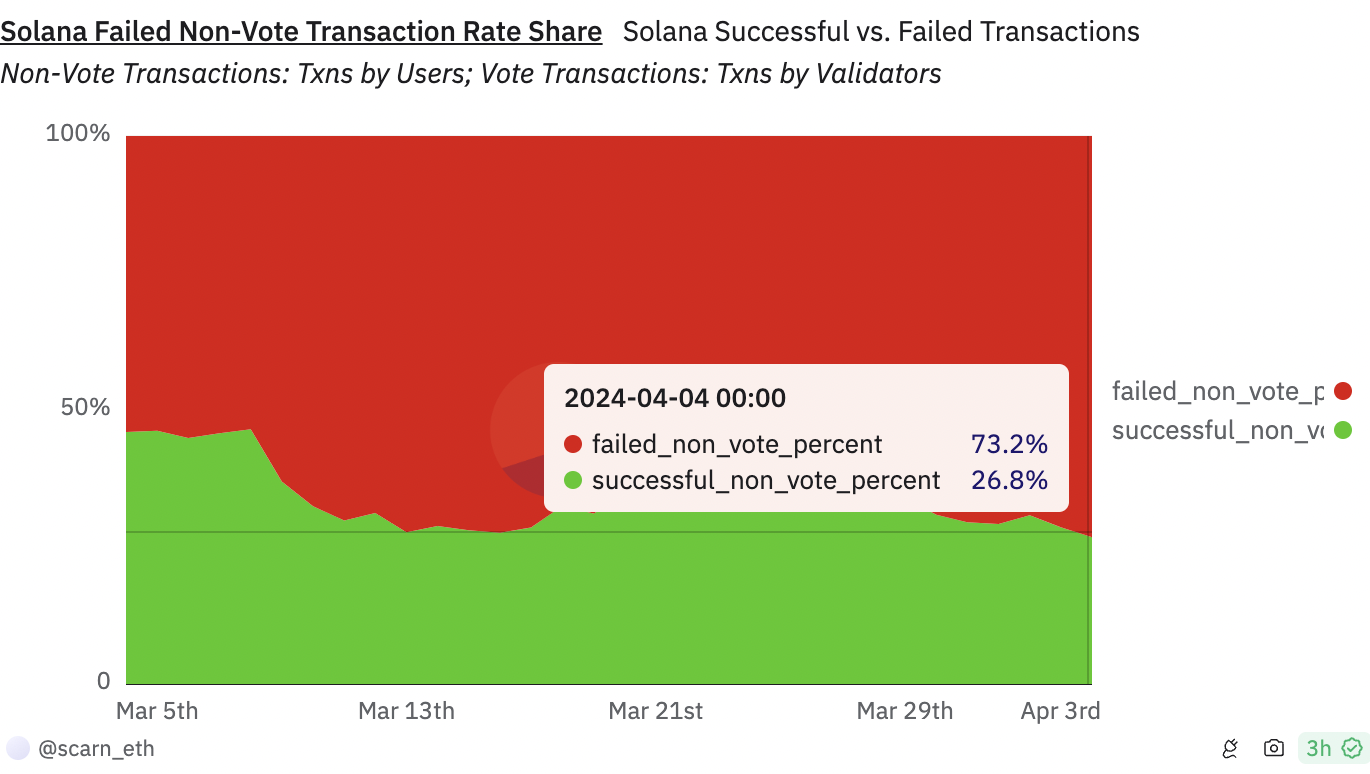

Susceptible to spam

If Solana’s fees are not higher than the economic risk of missing out on trades, regular users will inevitably face dropped or failed transactions. We saw this play out earlier this year briefly where spam bots caused more than 75% of user’s transactions to fail, essentially making Solana unusable. Solana’s core developers are aware of this problem and have implemented some fixes however they are urging more app developers to implement priority fees to price out bot activity. However, this strategy results in higher fees, slightly undermining one of Solana’s main selling points: low transaction costs. Despite this, priority fees on Solana remain significantly cheaper than those of any other popular alternative.

The Future For Solana

The future for Solana is optimistic with many positive features poising it for further growth. However we believe that Solana will need to see significant adoption, likely through a killer consumer focused application, for it to have a chance of flipping Ethereum in size in the short-medium term future. This is due to the fact that the majority of the developer base and crypto native liquidity is still hosted on the Ethereum blockchain and as such users will need a compelling reason to migrate to the Solana network. That being said, Solana is capturing impressive value and attention for its relative size and it is in a position to capitalise on this growth in the future due to its core architecture emphasising upgradeability.

Disclaimer: Solana (SOL) is a portfolio holding of Apollo Crypto