categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Crypto Assets Rebound After A Week of Bullish Sentiment

by David Angliss

Today’s blog post will be covering significant events that have occurred over the past week that are accelerating crypto assets’ quest for mainstream adoption. These were the “B-word” conference organised by the Crypto Council Of Innovation, news from Fidelity Digital regarding institutional demand for crypto exposure and lastly, announcements of Amazon’s new hiring remit for hiring blockchain experts in anticipation of setting up payment rails for cryptocurrency payments on the world’s largest e-commerce platform.

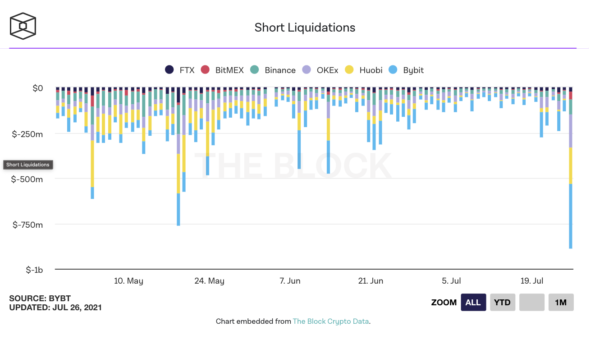

This chain of events has converged to produce large moves to the upside for crypto assets, with Bitcoin and Ethereum jumping 29.70% and 34.60%, respectively, from their weekly lows. While bullish news contributed to the start of the uptick in crypto asset prices, a large volume of ‘Short Interest Liquidations’ on the 27th of July pushed prices to weekly highs. The ‘short squeeze’ was a welcomed surprise for many crypto asset market participants such as Apollo Capital. A summary of the three events is provided below, with their significance on the crypto-asset industry described.

Institutional Recognition Growing

Crypto Asset’s mainstream adoption can only be made possible via institutional buy-in. As a result, investment banks and large funds have been slowly building their crypto trading, advisory and research capabilities and offering products to enable other wholesale and institutional investors exposure to digital assets. For example, earlier this month, Bank of America reportedly announced the inception of a new crypto research team.

More recently, there has been other bullish news for crypto’s asset recognition among the large institutions. Fidelity Digital has revealed the strong demand for advisors, family offices, pensions, hedge funds, and endowments worldwide to have crypto-asset exposure to their portfolio, with 7/10 confirming this sentiment. Additionally, 9/10 respondents also demonstrated their interest in digital assets by disclosing they expect to have crypto allocations in their clients or institutions portfolios over the next five years. Naturally, these surveys may have a sample bias as they have been inducted via Fidelity Digital Assets and juxtaposed Australia’s institutional investors. The results might tell a different story, however looking back up to 24 months, there is a distinct trend upwards in adoption. Nations are beginning to play a significant role in adoption too, as we know with El Salvador deeming Bitcoin legal tender and countries such as Canada and Europe contributing to adoption via their ETF offerings. This trend will continue as larger financial institutions slowly take on more exposure to crypto-assets as they become gentrified.

E-Commerce Giant Enters The Arena

Crypto tabloids are erupting on the news regarding Amazon and their newly advertised employment request for a ‘Digital Currency and Blockchain Product Lead‘ along with 70 other openings for blockchain specialists. The new role is for the payments acceptance and experience team, which will focus on ‘owning the vision and strategy for Amazon’s Digital Currency and Blockchain strategy and product roadmap’. Since this advertisement has been made public, the market has begun speculating on avenues the tech giant will take towards providing crypto assets as a form of payment, something it does not do today. An unknown source has stated Amazon claims to begin accepting Bitcoin by Q4 2021. On top of that, the source also disclosed, “Amazon is said to be exploring the creation of its Cryptocurrency’. Supporting this source were the actions Amazon took in 2017 by buying three cryptocurrency web addresses but did not disclose why at the time.

The concept of a corporation developing a native digital currency is not a foreign one and has picked up traction over the past few months. Earlier this month, an article, ‘We Were Looking At’, detailed the Federal Reserve’s interest in developing a digital currency after a meeting with Jerome Powell and Coinbase Global executives were made publicly available. Another tech giant Apple seems to be following suit with Amazon as they are now advertising for roles of a similar nature, e.g. Business Development Manager, Alternative Payments. Undoubtedly large tech companies incorporating crypto assets as payment rails and developing infrastructure to support it is a massive bull signal for the industry as a whole.

The B-word Conference:

The market knew they were not finished with seeing Elon Musk on a public stage talking about crypto assets. They were unsure about the angle he would take when asked about the longevity, fundamentals, ESG concerns and personal views on Bitcoin. Elon Musk’s previous public statements on Bitcoin have been inconsistent. The main event of the B-word conference was a moderated conversation consisting of Square Crypto Lead, Steve Lee, CEO of Tesla Motors and SpaceX, Elon Musk, CEO of Twitter Inc. and Square Inc, Jack Dorsey and CIO of ARK Invest Cathy Wood.

Overall the publicly streamed conversation was a bullish and educational discussion about Bitcoin. Below are some highlights from the conversation:

- Musk debunked some myths about his irrational crypto behaviour and perceptions.

- While the main topic of discussion was Bitcoin, Musk highlighted he owns Ethereum and Dogecoin.

- Musk claimed Tesla and SpaceX both have Bitcoin on their balance sheets with no plans to sell.

- Musk claimed Tesla will resume accepting Bitcoin if the network indicates proof of renewable energy usage in 50% of mining activity.

- Dorsey and Musk both had a friendly rapport when discussing Bitcoin.

- Wood said corporations should consider adding Bitcoin to their balance sheets, partly as a hedge against deflation.

The conference and its positive sentiments for crypto ownership confirm that all three panellists endorse Bitcoin. Looking back on the past week, it is clear the conference was a contributing factor to the Bitcoin’ strong price bounce off $US 30,000, where it has been fluctuating for the past two months.