categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Crypto Correlations Update January 2022

by Tim Johnston

Since launching Apollo Capital in early 2018, we have kept a keen eye on the correlations between crypto assets and traditional assets. Crypto assets have had a unique path. They are the first asset class that has started with retail participants, slowly working their way up to institutional investors. Almost always, a new asset class will start with the privileged elite, slowly making its way down to retail investors, if ever. This unique path has led to an independence of crypto assets – they are independent, by their nature, from traditional assets. We have long suggested that this independence should, in theory, lead to a lower correlation in performance. The data has generally backed up this theory, but as is with most matters relating to crypto, it’s an evolving story.

We last provided an update on crypto correlations in October 2020. In that article, we showed that crypto correlations had increased significantly as a result of the March 2020 sell off across almost all asset classes.

Crypto assets and equities are fundamentally different, but their recent correlation is a result of the ‘risk off’ attitude that was prevalent in the weeks following the initial market panic.

We thought it timely to re-run the data with a view to answering the question, do crypto assets correlate with traditional assets?

The Data

In calculating the correlations between crypto assets and traditional assets, we have used the Apollo Capital Fund’s monthly returns since inception on 1 February 2018. For traditional assets, we have used various Vanguard Exchange Traded Funds (ETFs) listed on the Australian Stock Exchange. All performance data is calculated in Australian dollars. To our increasingly global audience, we expect the key themes of this data will hold in different currencies.

If two assets are perfectly correlated, that is, their price action moves perfectly in sync, we can expect a correlation number of 1. If two assets are inversely correlated, that is, their price action moves in the exact opposite direction, we can expect a number of -1. If two assets are not correlated at all, we can expect a number of 0.

As an example, using the same data, Australian Equities have a correlation of 0.79 to International Equities – they are not perfectly correlated, but they tend to move in tandem.

We can see from the above table that crypto asset correlations have largely decreased since September 2020. The extra 16 data points (the months between Sep 2020 and Jan 2022) have seen crypto assets correlation to Australian Equities decrease from 0.39 to 0.26. International and US Equities have also decreased. At 0.26, we wouldn’t say that crypto assets are not correlated to Australian Equities, but we’d say they are largely uncorrelated. We could conclude that crypto assets are not correlated to Australian bonds, International Bonds and Gold.

Does this mean that crypto assets are correlating even less to traditional assets? Unfortunately, we don’t think it’s that simple.

The data in the table above is point to point – encapsulating all performance from 1 February 2018 to 31 January 2022. While we can draw valuable insights from a point to point comparison, it does not tell us anything about what happened along the way. It is also valuable to analyse rolling crypto correlations, how correlations have changed over a period of time.

Rolling Correlations

Rolling correlations are calculated by analysing performance data over a given length of time. As new data points become available, older data points drop off. For example, the twelve month rolling correlation on 31 January 2019 will only take into account performance data from 1 February 2018 to 31 January 2019. As we roll forward to 28 February 2019, the February data point in 2018 is discarded and updated with the February data point for 2019. We can perform this analysis for different rolling lengths of time, for example, 6 months, 12 months and 24 months. We would expect a smoother result for longer periods of time.

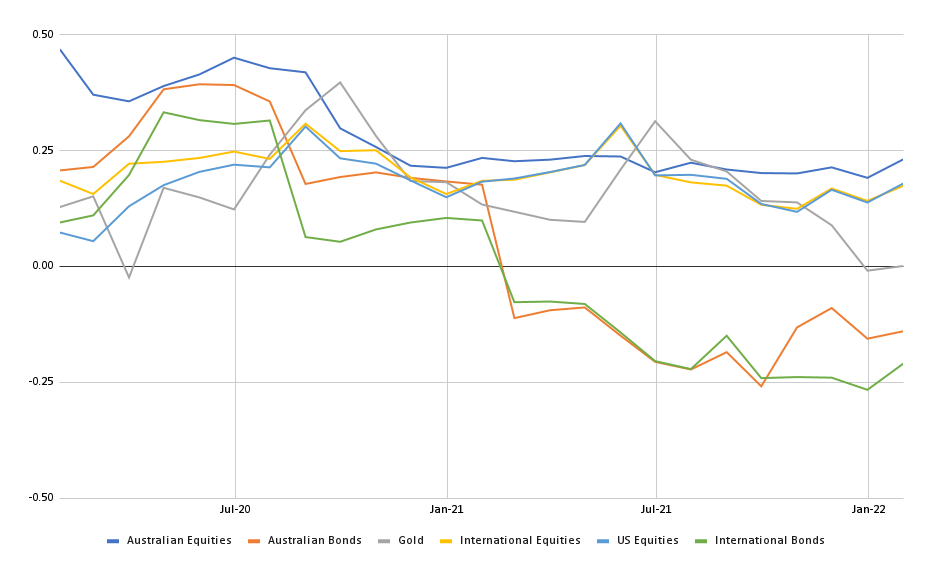

We start with the 24-month rolling period. The Equities Group is fairly smooth. Australian Equities starts at around 0.50 and over the past year has largely stayed around 0.20 – 0.25. International Equities and US Equities are fairly consistent around 0.20. The correlation with gold displays a little volatility. Interestingly, the correlation with Bonds goes from reasonably positive to reasonably negative.

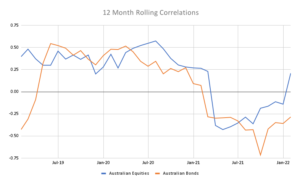

While the point to point comparison and the 24-month rolling period are interesting, they can often smooth over interesting takeaways. Let’s take a look at the 12-month rolling correlation. (We have removed a number of the asset classes, otherwise it’s very hard to follow).

Focussing on Australian Bonds and Australian Equities, we can see there is a larger degree of volatility in the correlations with crypto assets. Australian Bonds varies significantly, starting negative, before increasing to meaningfully positive, before decreasing to meaningfully negative. Australian Equities also shows a deal of volatility, as correlations increased after March 2020, before decreasing to meaningfully negative in mid 2021 and recently turning positive.

The last time we provided an update on correlations we concluded that in a ‘risk off’ environment, crypto assets were not spared. As equity markets began to price in the effects of Covid-19 in March 2020, crypto assets did as well. Equity markets then recovered, as did crypto markets. This appears to have been the case in recent months with interest rate hikes and market concerns over tapering.

We believe there are two key takeaways from this analysis.

Takeaway #1: crypto assets are not a short-term hedge

To describe crypto assets as a hedge against equity markets is unrealistic. Equally, we don’t think it is appropriate to describe a young technology as a safe haven asset class. It is unrealistic to view crypto assets as a safe haven asset class as well as a technological innovation with enormous upside potential. We believe this description of a safe haven asset class has come about due to the comparison of Bitcoin and Gold going too far.

We have two strong data points now in March 2020 and in January 2022 clearly showing that crypto markets will not perform well if there is widespread sell off in other asset classes. Perhaps we thought it might be the case a number of years ago due to crypto’s independent nature, but it would be naive to expect it going forward.

Takeaway #2: crypto assets are still largely uncorrelated to traditional assets

We can see from both the table above and the 24-month rolling correlation graph that crypto assets, over a long period of time, are still largely uncorrelated to traditional assets. If anything, it appears crypto assets have become less correlated over the last two years.

The difference between these two takeaways is timeframe. Over a short period of time, especially in a ‘risk off environment’, crypto assets will likely not perform well and correlation to equities in particular will increase. A simple explanation for this is in the ‘risk off environment:’ investors sell everything, including crypto assets, and move to cash and perhaps gold.

Over a longer period of time, we clearly demonstrate that crypto correlations are still relatively low. We believe this independence described in the opening paragraph still holds. Crypto assets are still largely independent from traditional assets. We believe an asset class with enormous potential and a low correlation to other assets is worth considering in the overall portfolio.

And this feeds back into our broader narrative at Apollo Capital: we believe there is a strong argument for a small allocation to crypto assets within the broader portfolio for long-term, patient investors.