categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Crypto Payments: A Catalyst For Adoption?

by Quinn Papworth

With the major announcement that payments goliath Stripe was re-entering the crypto payments space, this blog focuses on the current state of crypto payments adoption.

Why Crypto Payments?

With large companies like Stripe, Visa, Mastercard, and PayPal building crypto payment infrastructure, it first begs the question why are they adopting crypto as a form of payment?

This can largely be attributed to the wider increase in use cases and demand for crypto products. The growth in crypto payments is because they now offer a genuinely compelling alternative to traditional payment systems due to their fast trustless nature and global reach. Stripe’s president John Collison recently stated “crypto is finding real utility, transaction speeds [are] increasing and costs coming down, we’re seeing crypto finally [make] sense as a means of exchange”.A report by Future Market Insights supports this view suggesting that crypto payment gateways could grow at a rate of 9.3% a year until 2033.

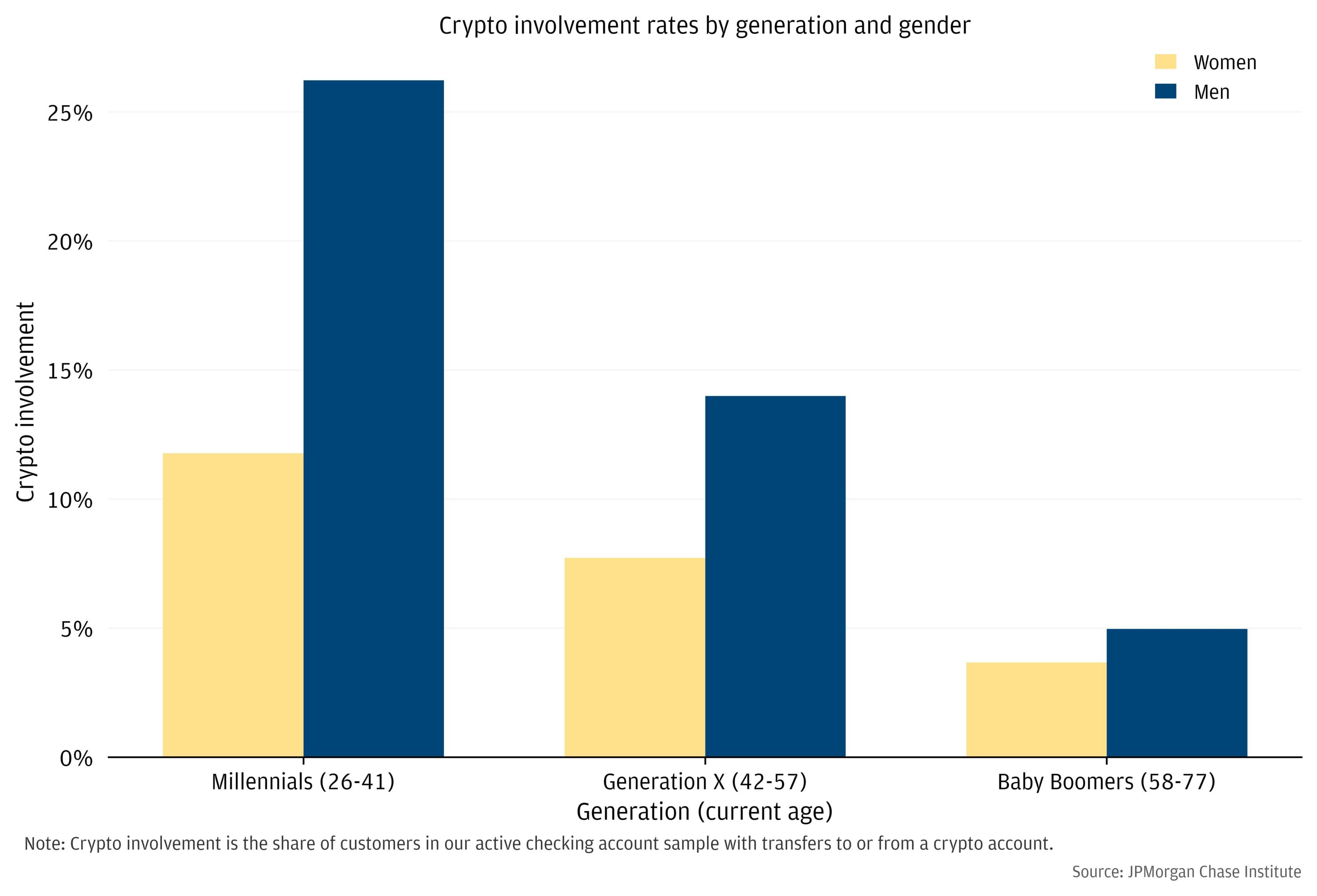

An intriguing metric that further supports the potential for growth in crypto payments is the popularity of crypto among younger demographics. Quite simply, as time goes on wealth will continue to transfer to newer generations who have a larger appetite for crypto than previous generations.

A late 2023 report by CoinSwitch stated that 75% of crypto investors were below the age of 35, JP Morgan’s 2022 study, echoes this sentiment with Millenials 4.2x more likely to use crypto products than Baby Boomers. As a result it makes sense that payment companies are enabling crypto payment infrastructure as sentiment has improved and will only continue to do so in the future.

The Benefits of Crypto Payments

It is evident there is a clear trend that crypto assets are gaining interest from investors, and will continue to as time goes on, but what are the actual benefits of using crypto for retail payments? Why are they considered by some to be the future of payments?

Fast Finality: Transactions using stablecoins can be completed with near instant finality on many networks, globally this is generally faster than traditional bank transfers which still take 1-3 days when occurring inter-bank.

Low Fees: The transaction fees for stablecoins are generally lower than those of traditional banking systems. For example, transfer fees on Solana costs only $0.0008 while remittances on average charge 6.2% of the amount sent.

Transparency and Security: The use of blockchain tech ensures that payments are secure, transparent, and tamper-proof. This allows users to have absolute certainty over their payments without the need for trust to be secured by an intermediary that charges additional fees and provides little to no transparency.

Financial Inclusion: Crypto payment gateways provide access to financial services for individuals and businesses in regions with limited banking infrastructure, offering an alternative to traditional banking systems.

Potential for Integration with Digital Economies: Stablecoins are well positioned for use in digital ecosystems such as online gaming and social media platforms. This will allow platforms to integrate payments natively through crypto wallets and capture unprecedented levels of economic attention.

How Are Crypto Payments Currently Being Implemented?

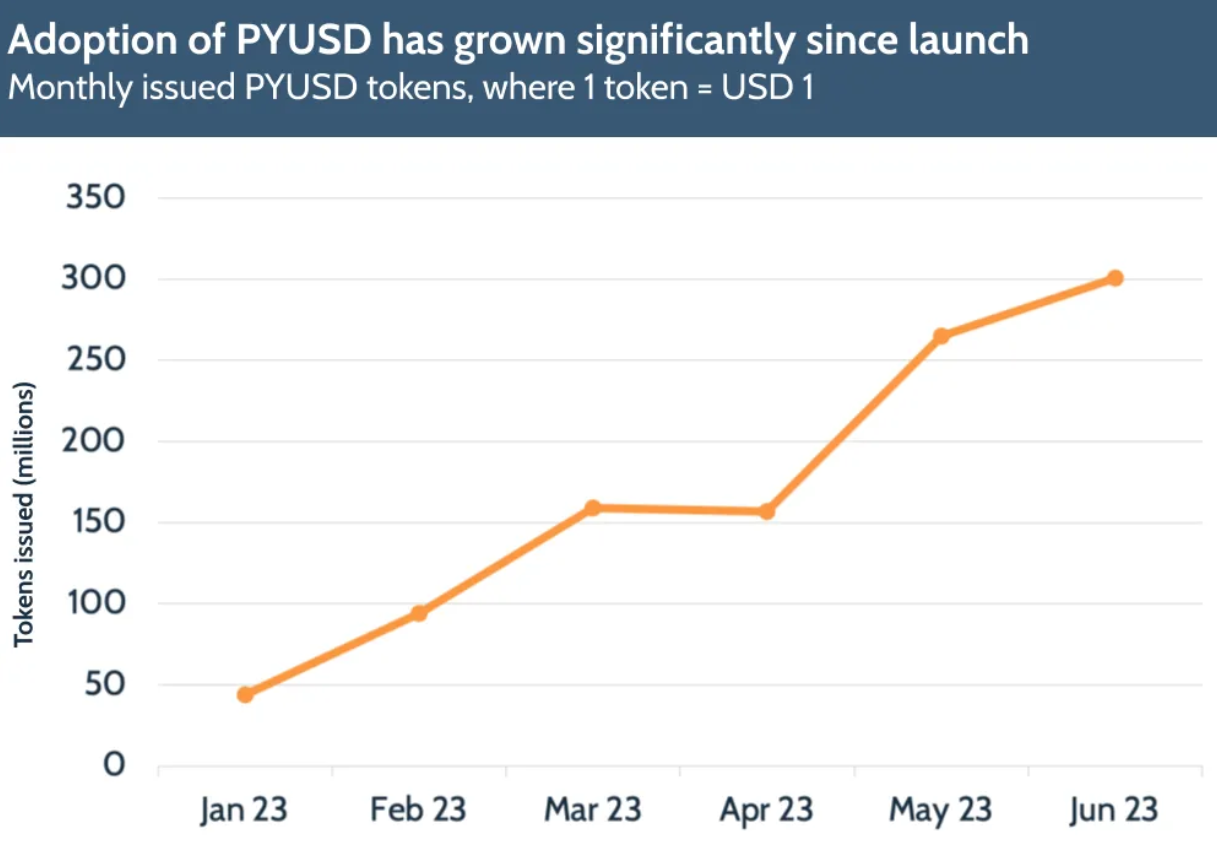

E-Commerce: Crypto has seen considerable increases in adoption among e-commerce merchants, a great example of this is PayPal. Entering the crypto industry in late 2020, PayPal has arguably become one of the leaders in e-commerce crypto payments due to their large network effect and continued adoption of their stablecoin PYUSD. This has enabled the large majority of online retailers worldwide (76.8%) to now accept crypto payments through PayPal.

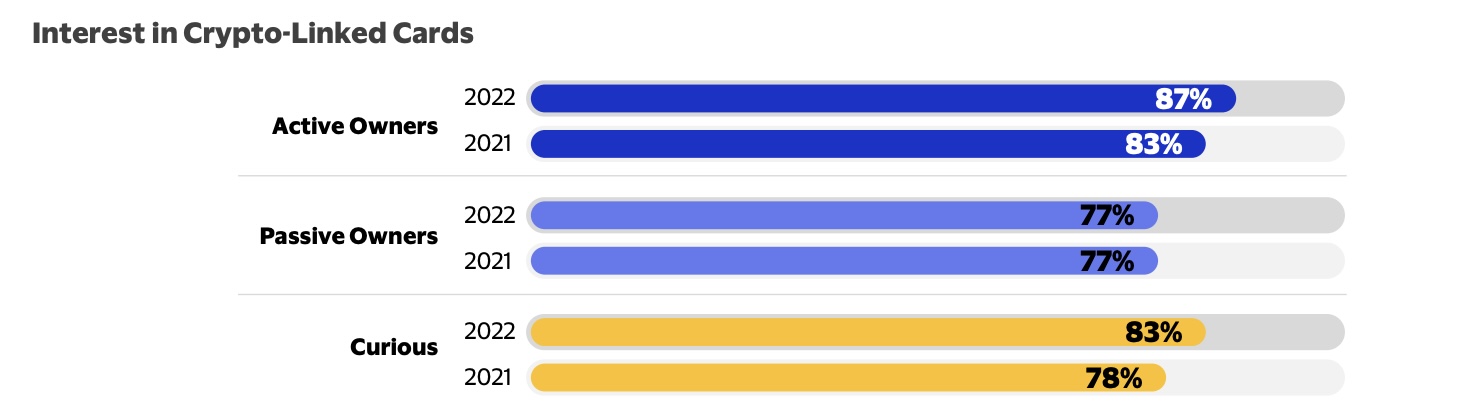

Point of Sale Solutions: Visa & Mastercard have partnered with centralised crypto exchanges to allow users to use crypto debit cards and access credit lines from their existing exchange funds. This solution allows for cryptocurrency to be used at a large number of locations where Visa & Mastercard are accepted. This is a significant unlock as it enables crypto to be used for payments outside of the digital realm in a familiar manner.

On-Chain Payments : Crypto exchanges such as Binance, Coinbase, and Crypto.com all offer their own solutions focused around peer-to-peer PayID systems and ‘scan to pay’ technology using QR codes.

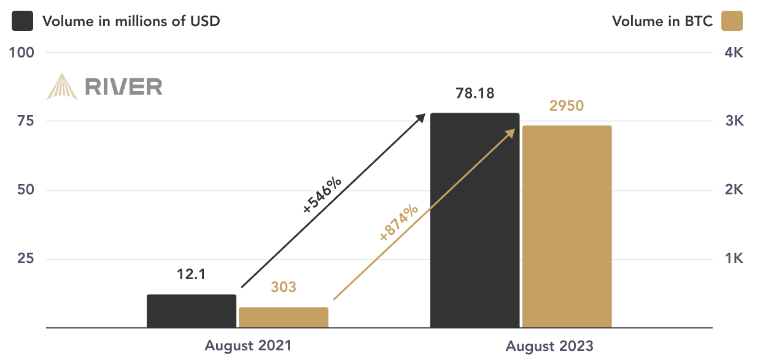

On the ground in El Salvador, a country where Bitcoin is accepted as legal tender, there has been widespread adoption of peer-to-peer wallet payments and the lightning network through government wallet, Chivo.

The Future Trends in Crypto Payments

As digital economies continue to grow we expect crypto payments to increase accordingly, we think it is likely that this growth will be led by the widespread expansion of stablecoins to facilitate payments in seamless experiences for users. We are keeping a close eye on the potential intersection between crypto payments and AI in the future and the possibility of AI agents using crypto rails to perform intents for end users. Additionally we expect crypto payments to eat away at the traditional payments space aggressively as crypto provides competitive fees, speed and trust while offering financial inclusion to the globe.

The Concerns Around Crypto Payments

While we are excited about the future of crypto payments and pleased to see traditional companies adopting crypto, there are still a number of barriers that need to be solved. A lack of regulatory clarity in the United States is stifling innovation for the entire crypto industry and payments are no exception, this results in a potential lack of consumer protection. As crypto adoption is still in its infancy, the usability and technical complexity is a barrier for many users. This has caused companies to compromise on offering fully on-chain payment solutions, and instead opting for an experience that is part crypto and part traditional payments.