categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Crypto Week Recap: US Lawmakers Go Big on Blockchain

by Quinn Papworth

Intro

Last week, the US House of Representatives focused on advancing crypto-related legislation with an initiative dubbed ‘Crypto Week,’ a historic push to regulate digital assets. From stablecoins to wider market structure, lawmakers passed bills helping to shape regulatory clarity for crypto assets in the US, backed by President Trump’s bold vision to make America the ‘crypto capital of the world.’ With Bitcoin soaring up to new all-time-highs and the overall crypto market cap hitting $4 trillion last week, it feels as if the stakes have never been higher.

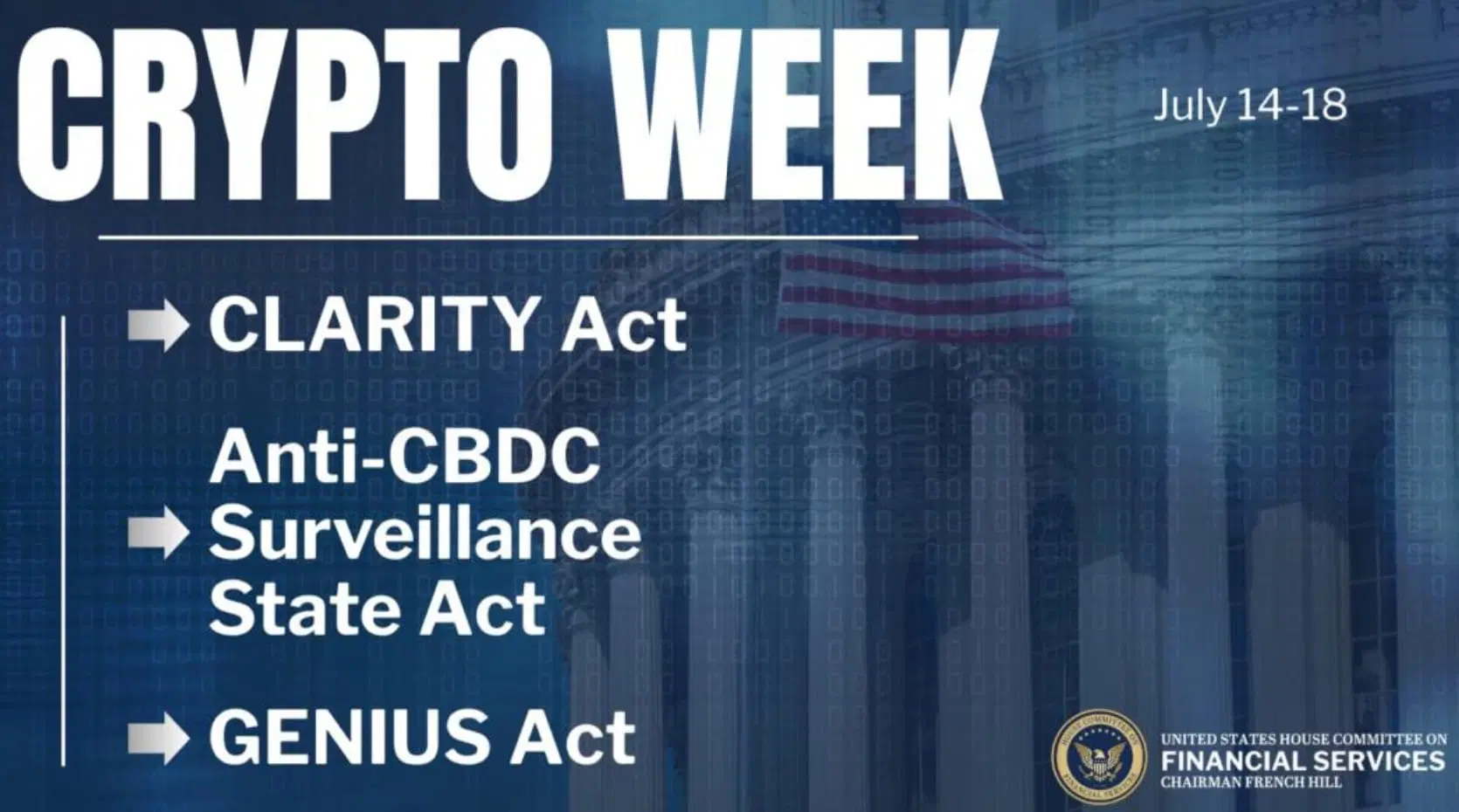

From July 14-18, the House-led ‘Crypto Week’ initiative took place at Capitol Hill, spearheaded by Republicans like French Hill and GT Thompson. The week focused on advancing or passing crypto-related legislation. This involved a legislative focus on three specific acts, the GENIUS Act, the CLARITY Act and an anti-CBDC Act. This was supported by President Trump’s vocal support of the bills and his influence in pushing the republican party towards action.

The Key Legislation Passed

Over the past week, Congress passed some long awaited legislation that establishes critical regulatory frameworks for cryptocurrencies.

| Act Name | Vote Count | Key Provisions |

| GENIUS Act | 308-122 |

|

| CLARITY Act | 294-134 |

|

| Anti-CBDC Act | 219-210 |

|

In addition to the above acts we saw additional positive regulatory developments with Trump indicating support for a “de minimis” tax exemption for crypto transactions as well as preparations to sign an executive order allowing 401(k)s to invest in crypto assets.

SEC Chair Paul Atkins hailed ‘Crypto Week’ as a “historic milestone for crypto entrepreneurs, financial market participants, and everyday Americans.”

The GENIUS Act has now been signed into law by President Donald Trump, while the CLARITY Act and Anti-CBDC Act proceed to the Senate for additional discussion.

The Market Impact

Although the market impact of the CLARITY Act and Anti-CBDC Act remains uncertain pending Senate debates, the GENIUS Act’s passage offers an opportunity for analysis.

Some of the key impacts of the GENIUS Act as highlighted by The DeFi Report in their recent analysis are:

- Stablecoin issuers must back their tokens on a 1:1 basis with high-quality, liquid assets. Acceptable reserves include US currency and coins, insured bank deposits, money-market funds, or short-term Treasury bonds.

- Stablecoin issuers are prohibited from offering interest to holders, ensuring stablecoins serve solely as digital cash equivalents and avoiding characteristics of bank savings products.

- If an issuer goes bankrupt, stablecoin holders are granted priority access to the reserve assets, taking precedence over the issuer’s claims.

- Stablecoin issuers must adhere to a robust regulatory framework that mandates monthly reserve disclosures and regular audits for transparency, enforces strict AML and KYC and establishes oversight by both federal and state regulators (for issuers under $10 billion), with the US Treasury Department as the primary authority.

- Notably the Act also prohibits publicly traded companies that are not “predominantly engaged in financial activities” to issue their own stablecoins, barring media giants such as Meta.

The GENIUS Act’s provisions create clear winners and losers in the crypto ecosystem.

So who are the winners and losers under this new regime?

The Winners:

- Consumers & Investors

- The Act prioritises consumer protection by ensuring stablecoin holders have first claim on reserve assets in issuer insolvency. Transparent reserve disclosures, regular audits, and AML/KYC compliance enhance trust, making stablecoins safer as digital cash equivalents. The prohibition on interest payments also prevents risky yield-bearing products, further protecting users.

- Banks & Credit Unions

- The GENIUS Act provides a clear pathway for these institutions to enter the stablecoin market, offering digital payment solutions with lower transaction costs and faster settlement times compared to traditional systems. Additionally the exclusion of yield-bearing products in the Act is beneficial to Bank’s existing products.

- Compliant US based Stablecoin Issuers

- Issuers such as Circle stand to benefit from the clear guidelines of the act as they already meet many if not all of the requirements. As such Circle gains a sort of ‘regulatory imprimatur’ or headstart in order to make their stablecoin more attractive for institutional adoption right away.

- US Dollar Dominance

- By regulating US dollar-backed stablecoins, the Act reinforces the USD’s dominance in the digital economy, where over 99% of stablecoins are currently dollar-denominated. Clear rules attract global demand for US issued stablecoins and treasuries, strengthening the dollar’s reserve currency status. We have already seen this relationship in play where we have seen Stablecoin issuers emerge as the third largest buyer of US treasury bills in recent months.

The Losers:

- Foreign and Unregulated Stablecoin Issuers

- The Act prohibits foreign issuers from operating in the US unless they are regulated. This could act to hurt companies like Tether who have historically had opaque reserves and reporting practices as such they could face issues in meeting AML and audit requirements. However, that being said, the stablecoin market is much larger than just the US and we often see some of the largest uptake rates of stablecoins in emerging markets where Tether currently dominates.

- Small Fintechs

- The Act’s stringent compliance requirements impose significant costs that smaller fintechs may struggle to meet, this could lead to market consolidation favouring larger players.

- Big Tech/Social Media Companies

- The Act’s strict licensing and regulatory requirements effectively limit Big Tech’s ability to issue stablecoins. Democratic amendments ensure consumer protection laws apply, preventing tech giants from exploiting stablecoins for data tracking or market dominance. It seems companies like Meta have faced similar regulatory scrutiny here as they did years ago when working on their Libra/Diem project.

- Decentralised and Algorithmic Stablecoin Issuers

- The Act limits stablecoin issuance to approved entities and does not include DAOs, additionally the prohibition of interest bearing stablecoins acts to further restrict innovative DeFi models.

However while there may be individual winners and losers the GENIUS Act is undoubtedly a net positive for the industry. “The current stablecoin issuers can now breathe easier as the largest market in the world has given them a clear and achievable path to mainstream adoption of stablecoins” – Bill Hughes of Consensys.

What’s Next?

President Trump’s broader crypto agenda, showcased during the March 2025 White House Crypto Summit, aims to position the US as the global “crypto capital” through initiatives like the Strategic Bitcoin Reserve, which leverages $17 billion in seized Bitcoin to bolster digital asset adoption. The GENIUS Act’s passage in July 2025, regulating stablecoins, is a cornerstone of this vision, fostering innovation and mainstreaming crypto for payments.

However, Democratic skepticism, led by figures like Elizabeth Warren, voices concerns over consumer protections and regulatory gaps, particularly regarding potential conflicts of interest tied to Trump’s ventures like World Liberty Financial which offer their own stablecoin. Bipartisan cooperation will be crucial to refine the frameworks, ensuring robust safeguards while maintaining the US’ competitive edge in the $4 trillion crypto market. As the CLARITY and Anti-CBDC Acts await Senate debate, bridging these divides will be important in shaping America to become a crypto hub.