categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

DeFi Total Value Locked Boom

by Matthew Harcourt

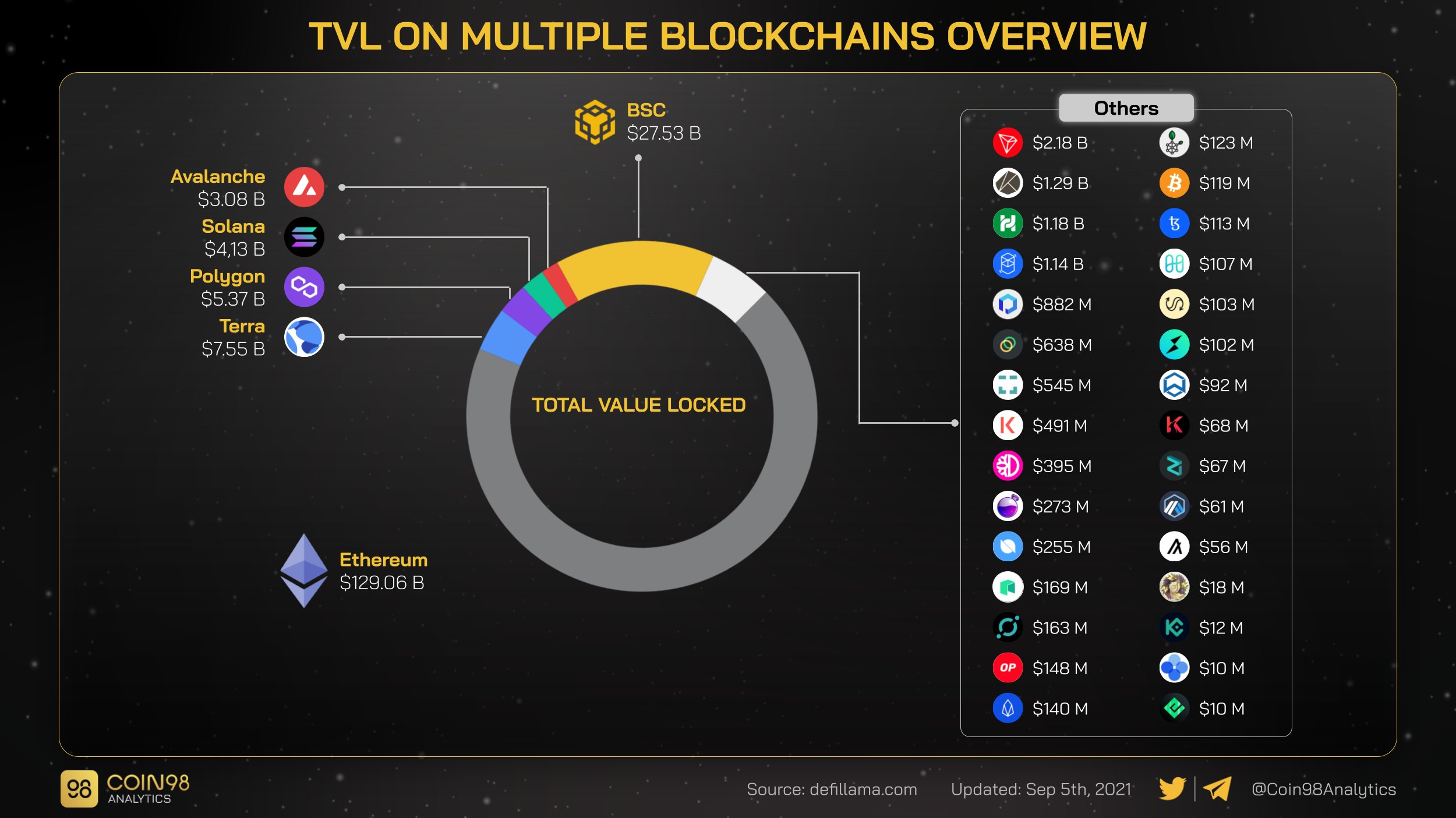

Over the past few months the crypto asset market has witnessed considerable Total Value Locked (TVL) growth across multiple blockchains. While Ethereum is still the leading DeFi ecosystem by a considerable margin, Layer 1 blockchains such as Binance Smart Chain, Polygon, Solana and Terra have been gaining market share. Smaller investors are continually opting out of Ethereum in search for cheaper and faster transactions on these competing platforms. Large-scale protocol wide incentive programs are also driving growth with several protocols allocating considerable portions of their treasuries to liquidity mining on their native DeFi projects.

Total Value Locked in DeFi

Despite the Ethereum blockchain being unusable for small investors, TVL has continued to grow at a high rate. The quality of projects on Ethereum continue to be the highest in the industry, and considerable capital in the form of ETH is constantly looking for new protocols. Because of this, building on Ethereum is still attractive for leading developers. Developments in layer 2 scaling technologies such as Arbitrum and Optimism are fuelling excitement from the community, although TVL growth on these solutions is yet to boom.

Total Value Locked in Ethereum

The Binance Smart Chain was the first competitor to Ethereum to witness explosive TVL growth. This growth was catalysed by an extremely smooth user onboarding experience as well as the general shift away from Ethereum layer 1 due to transaction fees. The quality of projects on this chain remains very low with scams, hacks and exploits being commonplace.

In April 2021, Polygon was the first blockchain to launch a protocol layer incentive scheme. This scheme involved US$40 million of MATIC rewards being allocated to DeFi projects in an attempt to bring reputable Ethereum projects to the Polygon blockchain. This scheme was incredibly successful and resulted in explosive TVL and MATIC price growth.

Total Value Locked in Polygon

Solana and Terra are the most differentiated blockchains out of these top DeFi ecosystems as they are not EVM compatible, meaning it is harder for native Ethereum users to migrate liquidity onto the chain. Despite this, investors have been consistently adopting these chains over the course of 2021 and DeFi activity is thriving. Solana and Terra have not launched protocol wide incentive programs and are witnessing more organic TVL growth.

Total Value Locked in Solana

Due to a robust blockchain and a well timed liquidity mining incentive regime, the layer one blockchain Fantom (FTM) has seen solid growth in price and TVL over the past month, with its price appreciating 410% and current TVL standing at $1.29B . Their incentives are different from the common incentive scheme. Instead of rewarding users for using protocols, they are rewarding the builders of the protocols, to sustain and grow their TVL on their respective protocols. Once rewarded, how the builders want to use them is up to their discretion. For example, they could run liquidity mining programs to entice more users and adoption on their platform, or run ‘bug bounty’ programs to have their code reviewed and sharpened.

Rewarding builders creating products with strong market fit will ensure that the stickiness for those platforms will stay high, which is contrary to the typical outcome of a liquidity mining reward incentive schemes, that see users logically jump to the most enticing incentivised programs. By incentivising protocols, teams can come up with creative ideas for user retention and the better they perform, the higher the rewards. The Apollo Capital Opportunities Fund is currently enjoying the rewards being offered on Fantom via the Curve protocol.

Total Value Locked in Fantom

Avalanche is another blockchain that has announced a liquidity mining program recently, coined the ‘Avalanche Rush’, the Avalanche Foundation has pledged $180M in crypto assets to be distributed to users interacting with DeFi on the Avalanche Ecosystem. These funds are being accessed via the Avalanche Foundation’s treasury. The goal of the program is to ‘showcase the power of Avalanche and allow users to dive into a vibrant community at the cutting edge of decentralised finance’ said by Gün Sirer, Director at the Avalanche Foundation.

Total Value Locked in Avalanche

The recent strength in Layer 1 blockchain assets has been fuelled by healthy Total Value Locked growth and fundamental value appreciation. The continued roll out of these protocol wide incentive schemes will drive higher yields and make DeFi even more attractive for new and old crypto investors. The competitive landscape that Ethereum finds itself in today is increasing the pressure on the blockchain to scale. The Eth2.0 developments over the next 6-12 months will be critical for the medium to long term success of the current number 2 crypto asset.