categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Crypto Developers Report 2022

by David Angliss

The crypto industry is off to an impressive start in 2023. Total market capitalisation and Ethereum and Bitcoin have all seen an increase of over 30%, marking a return to the bullish trend last seen in 2021. The events of 2022, such as the Luna, 3AC and FTX collapses, have purged the market of excessive leverage, helped remove bad actors in the space, and now provide opportunities to enter the market at discounted prices, which Apollo Crypto has.

At the outset of 2023, it is crucial to assess the fundamental indicators of the crypto market. One such metric is the health of the developer community, which provides insight into the staying power of certain crypto assets. Our analysis of the data indicates that crypto is a here-to-stay investment opportunity and that this year presents a compelling opportunity for investors.

The engagement of developers is a fundamental contributor to the success of new platforms and technologies. This is because they create valuable applications that attract users, causing a positive feedback loop of increased developer quality and quantity, driving further growth. This trend can be seen in the crypto industry, where the growth of the developer community has been a key driver of its success.

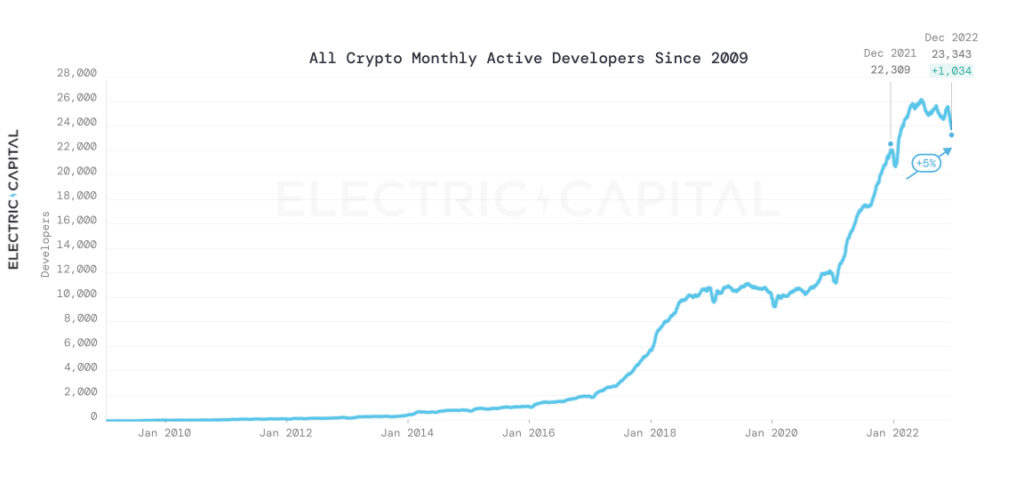

A recent report published by Electric Capital highlights all of the advancements made in the crypto developer community. It found that crypto developers increased by 5% YoY for 2022 despite a 70% decline in asset prices.

https://www.developerreport.com/

This is reflected in the increasing number of developers building on the largest blockchains and the increase in full-time developers. In recent years, the number of crypto developers has grown significantly. For example, there has been a 297% increase in monthly developers since 2018.

https://www.developerreport.com/

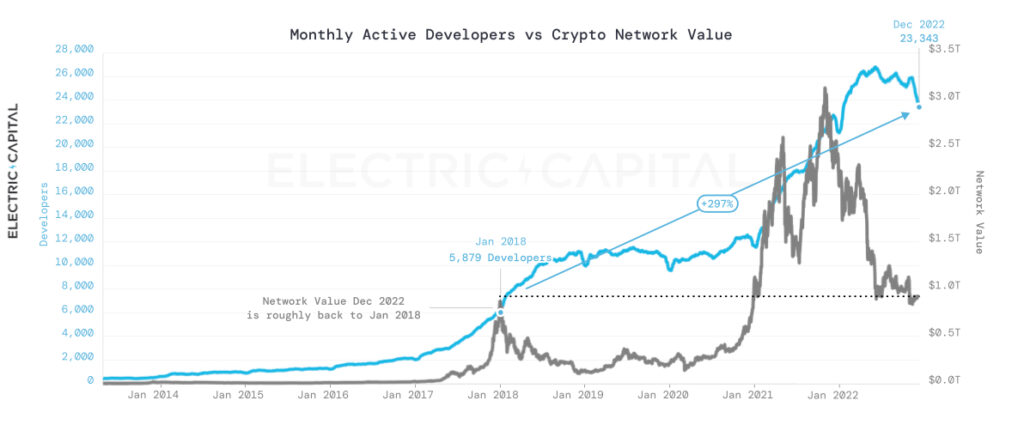

This intersection of developer growth and network value is a testament to the need for considering metrics beyond simply the price when evaluating the health of crypto assets. Despite a decline of 70% in network value from December 2021 to December 2022, the enthusiasm and engagement of developers in the industry has undergone a substantial increase of over three times during this four-year span.

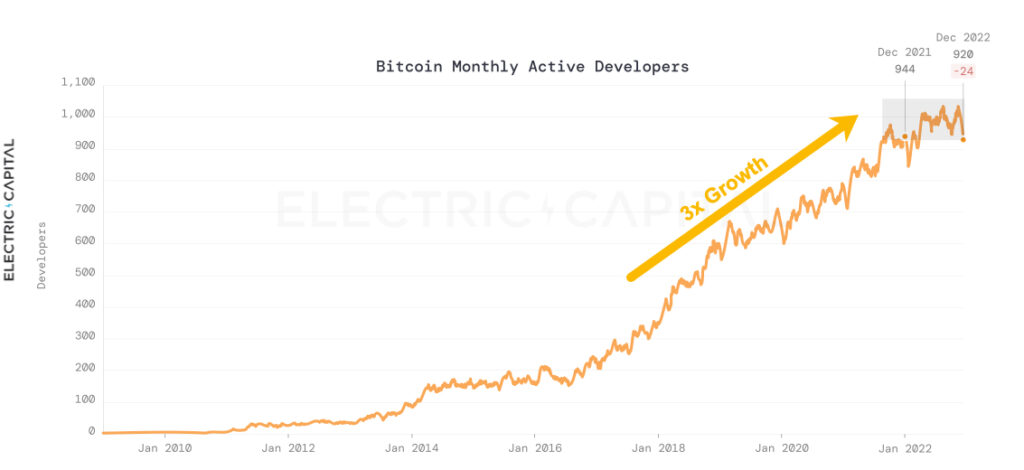

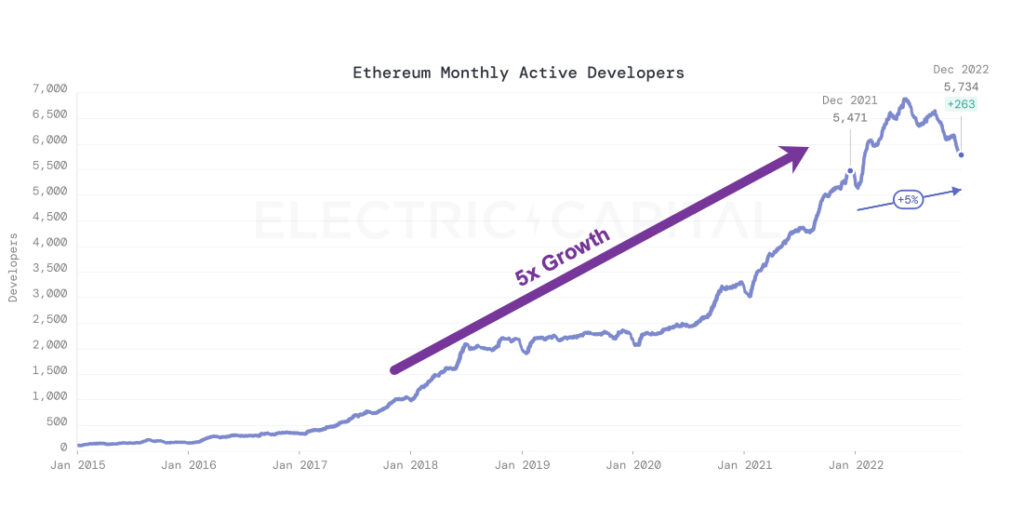

Apollo Crypto’s two top holdings in our Apollo Crypto Fund, Bitcoin and Ethereum, enjoyed monthly active developers growing by three and five times, respectively, since January 2018.

https://www.developerreport.com/

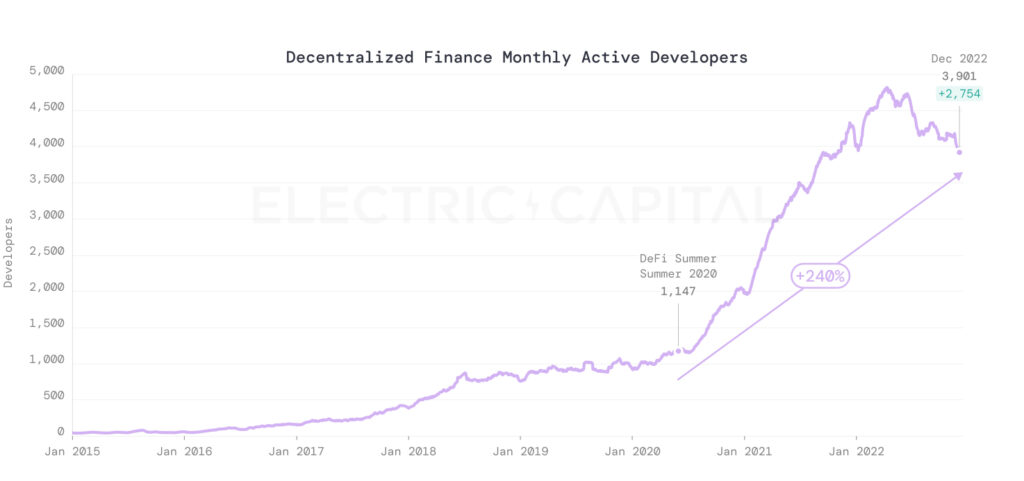

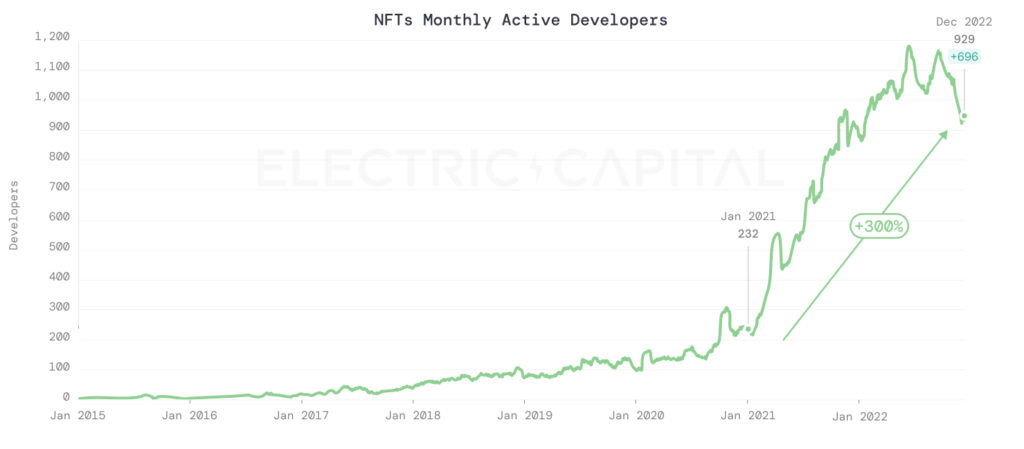

Furthermore, new ecosystems beyond Bitcoin and Ethereum are emerging, with 72% of monthly active developers working outside these two systems. The DeFi and NFTs sectors are two examples of areas that have experienced significant growth in developer activity in recent years with 240% growth in developers in DeFi over the past two years.

https://www.developerreport.com/

Following DeFi summer was the Cambrian explosion of NFTs, which saw a faster run-up in development activity by 300% over the past year alone.

https://www.developerreport.com/

These statistics demonstrate that the crypto industry continues to grow and evolve, driven by the contributions of developers and their growing involvement in the space.

In conclusion, the crypto industry has started 2023 in a bullish trend, after a year filled with ‘‘black swan” events. The macro conditions have improved, and the growth of the developer community is a testament to the staying power of crypto assets and highlights the importance of considering metrics beyond just price when evaluating investment opportunities. The surge in monthly active developers, the increase in full-time contributors, and the emergence of new ecosystems beyond Bitcoin and Ethereum all paint a picture of a thriving and evolving crypto market. This is further reinforced by the DeFi and NFT sectors’ growth, which drive innovation and attract developers in droves. The data suggests that this year presents a compelling opportunity for investors looking to tap into the potential of the crypto asset market.

Source: https://www.developerreport.com/developer-report

Feature Image: Mohammad Rahmani/Unsplash