categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Euler’s Identity: DeFi’s Hidden Gem

by Quinn Papworth

Euler’s History

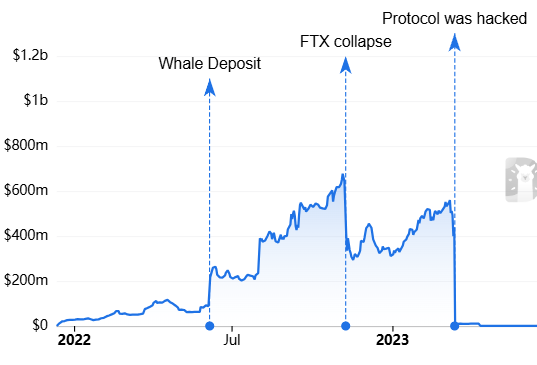

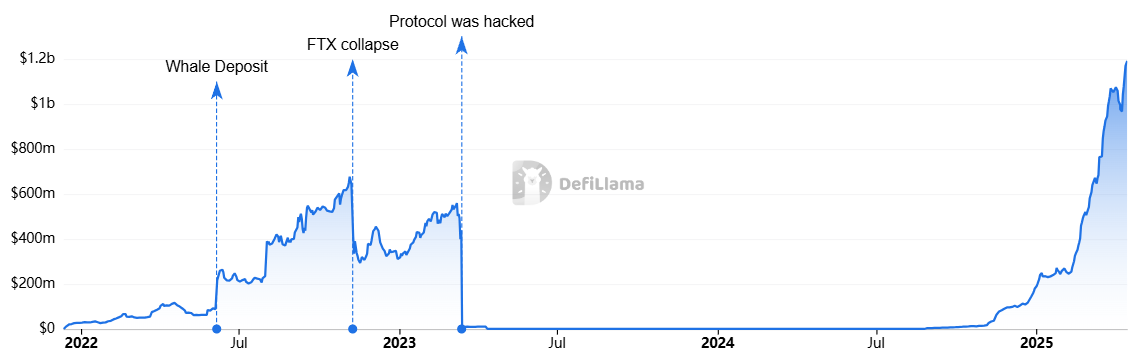

Euler is a decentralised lending protocol that first launched its v1 product in December of 2022. Euler found relative success in 2022 reaching a peak TVL of US$643m, however the music stopped for the team after suffering a devastating exploit which saw the protocol hacked for ~US$200m in assets. At this time the Euler team had already begun to ideate on their next step for the protocol, the v2 product. So after successfully tracking down the exploiter and returning the hacked funds to users, Euler closed down its v1 product to focus their efforts solely on building out their future vision for Euler v2.

But the story doesn’t just end there. From March 2023 the Euler team stayed strong working on their vision for a ‘modular’ lending protocol over the next 18 months through the depths of a bear market. This effort culminated in the full launch of their v2 product in September of 2024 and something magical to follow. Don’t call it a comeback.

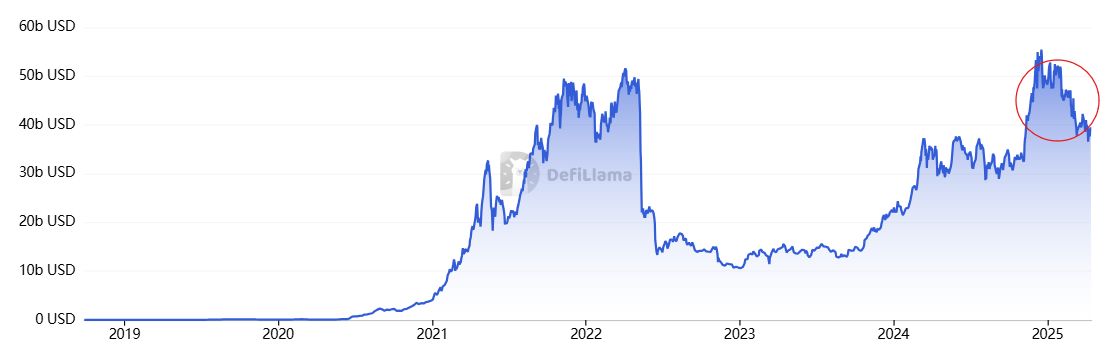

Euler’s Growth

Then something beautiful happened, organic growth the likes of which could make a grown man cry and a chart so beautiful it could be seen hanging in the Sistine chapel. Additionally compared to its competitors Euler was able to incentivize the use of its platform with minimal token rewards with a decent amount being burned as part of their fee flow system. Now as of the time of writing, Euler boasts over US$1.19 billion in total deposits, more than 1000% TVL growth in just 4 months, deployment to eight different chains across the EVM and significant price appreciation in its token, EUL.

It also achieved this in some of the most volatile and choppy conditions for DeFi protocols we have seen in the last few months. Particularly lending protocols had suffered, with many competitors seeing their TVL in steep decline since December of 2024 as wider market conditions cooled off and market participants’ demand to borrow decreased. Euler stands alone as a lending protocol that has displayed significant dominance in growth over the last 4 months.

But why? How is Euler differentiated from other lending protocols?

Ok so why has Euler’s growth been so strong that it has attracted more than 1 billion in deposits despite difficult market conditions where all of its competitors have frankly been struggling in the last few months? More than anything else it is due to one aspect, its unique modular architecture, a completely unique take on lending markets.

The modular approach – the EVC and EVK.

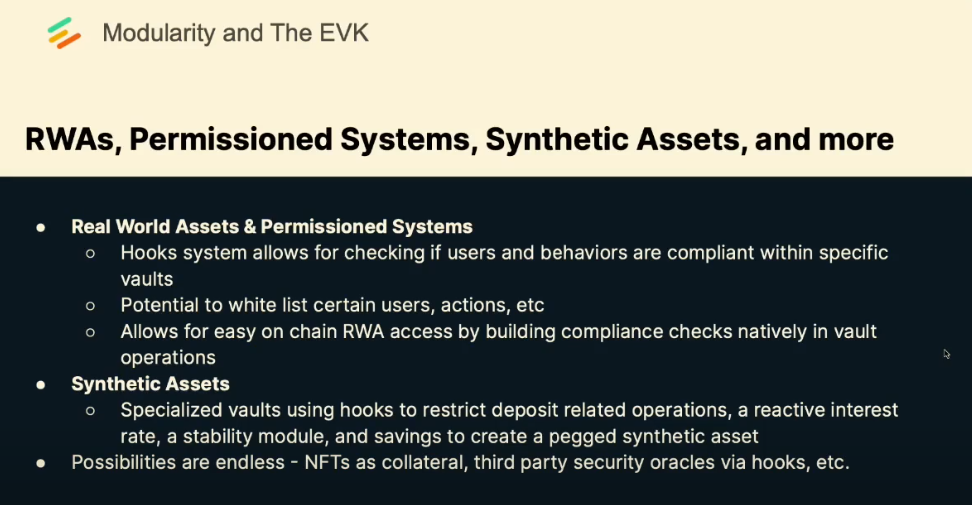

At the core of Euler’s innovation is its modular approach which comprises two key pieces of architecture, the Ethereum Vault Kit (EVK) and the Ethereum Vault Connector (EVC).

The EVK uses the ERC-4626 standard and essentially allows users to build permissionless vaults where builders can decide all of the details down to the assets, collaterals to borrow against it, hook functionalities for customizable parameters, pricing oracle used, etc.

Now that we have this standard for vaults we need a way for them to communicate with each other. Cue the EVC, now you can easily piece different vaults together due to their uniform standard and design them together however you would like. The beauty in this is that you can introduce as much risk as suitable to your appetite and build infinite different types of combinations of vaults and clusters of vaults. Simply find vaults that match your risk appetite, and if they aren’t there you can build your own or combine existing vaults in different combinations.

Due to this flexibility any of the pre-existing lending products on the market such as Aave, Silo, Morpho, Compound etc. can all be built within the Euler ecosystem using EVK and EVC combination without introducing fragmentation. Additionally, because of this interoperability it allows builders to bootstrap their lending protocol by recognizing existing deposits as collateral. This allows for the existence of nested vaults, vaults that use another vault as its underlying asset, which essentially allows you to wrap any other existing vault and add additional yield layers on top.

This creates a system where a user no longer has to take on the trade offs between the monolithic structure of a protocol like Aave which is highly capital efficient but only as strong as its weakest asset. While also not having to settle for isolated pairs systems such as Morpho either which can only get you so far due to their capital inefficiency. Euler allows the people to make markets for everything in the middle, servicing whole groups of the market that are currently unserviced. Ie. strategies that are less or more risky than Aave.

Due to its modular structure I also believe that Euler is one of the protocols best placed to accommodate RWAs and scale DeFi to a trillion dollar industry. It is able to introduce new complex assets with ease due to the modularity of parameters while also allowing for permissioned systems through using hooks to build things such as compliance checks natively into vault operations.

Another factor that has contributed to Euler’s growth is due to the softer liquidation conditions it offers which provide favourable conditions for borrowers to use Euler over competitors such as Aave and Morpho, this protects borrowers from suffering from the brutality of complete liquidations.

This has given rise to Euler holding one of the highest borrowed deposits to TVL ratios. Indicating that borrowers are much more comfortable with taking on risk within the Euler platform due to its more favourable liquidation conditions while still allowing many more long tail assets than any other competitors. Additionally, Euler offers a high average LTV ratio of 90%, when combined with its soft liquidation mechanisms this creates a great environment for borrowers where they are able to take on maximal risk with less exposure to downside.

Conclusion

Apollo first identified Euler last year when the team were in the midst of building their v2 product, with zero TVL, and a <$50m market cap. It has been an absolute joy to follow the success of the Euler team and the truly world class team they host. I personally remain extremely positive on Euler and the rate at which they have been shipping integrations and upgrades is a continual testament to the team. Beyond Euler specifically, I think they have identified a strong emerging mega trend in DeFi and that we will continue to see more and more of DeFi trend towards modular structures which enable permissionless, freedom maximizing markets that will accelerate the pace of innovation through new use cases made possible by deep customisability by nature.

Disclaimer: Apollo Crypto holds EUL

This report (‘Report’) has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security of financial product or service. This Report does not constitute a part of any Offer Document issued by Apollo Crypto Management Pty Ltd (ACN 623 059 227, AFSL 525760) or Non Correlated Capital (ACN 143 882 562, AFSL 499882), the Trustee of the Apollo Crypto Fund. Past performance is not necessarily indicative of future results and no person guarantees the performance of any Apollo Crypto financial product or service or the amount or timing of any return from it. This material has been provided for general information purposes and must not be construed as investment advice. Neither this Report nor any Offer Document issued by Apollo Crypto or Non Correlated Capital takes into account your investment objectives, financial situation and particular needs. The information contained in this Report may not be reproduced, used or disclosed, in whole or in part, without prior written consent of Apollo Crypto. This Report has been prepared by Apollo Crypto. Apollo Crypto nor any of its related parties, employees or directors, provides and warrants accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. You should obtain a copy of the Information Memorandum, issued by Non Correlated Capital before making a decision about whether to invest in the Apollo Crypto Fund.