categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Everyone Is Launching a Stablecoin?

by Quinn Papworth

Stablecoins are seemingly at peak mindshare among crypto market participants in recent months as many of the regulatory barriers have been unbridled and we have seen continuous headlines of institutions looking to openly embrace stablecoins. As such I thought it would be prudent to have a high-level look at why exactly this is and the bigger picture for stablecoins.

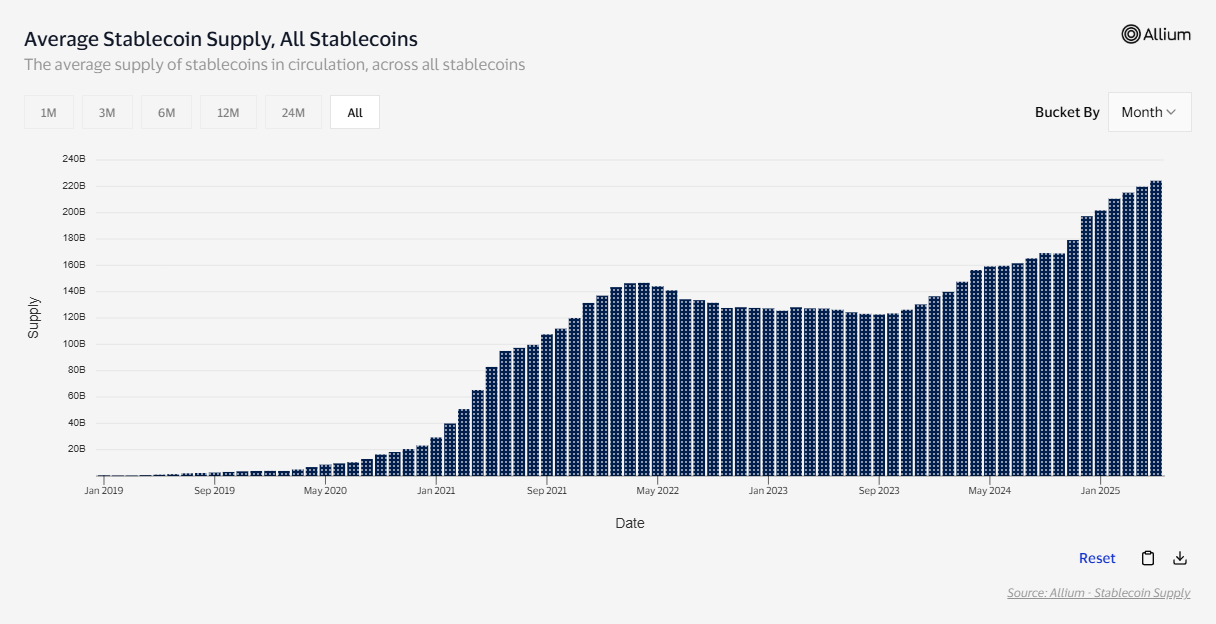

By the numbers stablecoin supplies have seen tremendous growth in the last ~6 months with a more than US$50 billion increase since December. This puts the stablecoin supply on track to have its largest nominal growth year on record.

But beyond this impressive growth there is a wider trend occurring that could be missed by just only looking at the numbers. Increasingly we are seeing fintechs and traditional payment networks in the process of widely embracing stablecoins. The sheer amount of news surrounding this front we have seen in the last month alone is staggering. Indulge me with a few notable highlights here:

- Mastercard announcing end-to-end support for stablecoin payments.

- Payments giant Stripe introduces new ‘stablecoin financial accounts’ feature following their $US1.1 billion acquisition of ‘Bridge’, allowing users to send and receive funds on crypto rails

- Meta is exploring stablecoins to reduce payment costs years after selling off their previous crypto attempt Libre/Diem

- Donald Trump-tied World Liberty Financial has seen their USD1 stablecoin market cap grow to over US$2 billion.

- The likes of Circle, BitGo, Coinbase and Paxos reportedly plan to apply for U.S bank charters or licenses.

- Citigroup predicting in a recent report that stablecoin supply could hit $3.7 trillion by 2030

- Robinhood is reportedly interested in using blockchain rails to trade U.S. assets.

These are honestly just a few of the many headlines that can be seen surrounding stablecoins in recent weeks. This is a mind boggling paradigm shift when we consider just how much the confidence in stablecoins has risen in a short period. Two years ago 80% of crypto builders saw regulation or compliance as a barrier, now we have some of the biggest names in finance openly embracing us.

But Why?

But this begs the question, why are so many of these fintechs & institutions excited about getting involved with stablecoins? For many fintechs, stablecoins exist as a way to offer genuinely compelling services to their customers through faster settlements and incredibly low fees. Beyond this strict upgrade it also allows for global accessibility to US dollars and expansion into new markets while offering users programmability in what they can do with their money.

However there is a larger underlying factor here as to why everyone is launching a stablecoin. I believe it is gaining ownership of the stack and developing sticky products. Let me explain this with an analogy.

Have you ever wondered when selling something to a store front (let’s say a pawn shop) you will always receive a better offer in store credit rather than cash? This is because the money never actually leaves their ecosystem this way and they get to make future profits on another item sold. As long as the shop has items you need it is a win win for both parties involved.

Now let’s look at a classic fintech such as Paypal. Paypal has a great product offering but faces one prevalent issue, the chief use case by users once receiving funds in Paypal is to then just send that money back to a bank.

But what if you can instead convince users to stay with a compelling set of upgrades compared to traditional banks (instant global transactions at near zero cost) while being interchangeable with M1 money all while gaining ownership of the entire stack. Stablecoins are the store credit of the fintech where they get to capture value as money stays in their ecosystem (through the traditional bank model of getting yield on customers assets). Following this logic I believe we will rapidly see more and more that Merchants will essentially become banks and strive to have further ownership over the stack as they no longer want to leak value. Stablecoins increasingly allow them to keep the money in their ecosystem and reap the benefits all while lowering costs and offering users better products.

A Regulatory Boost

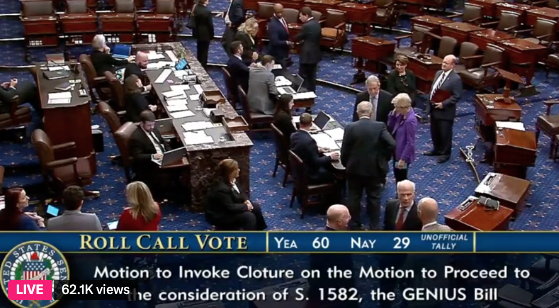

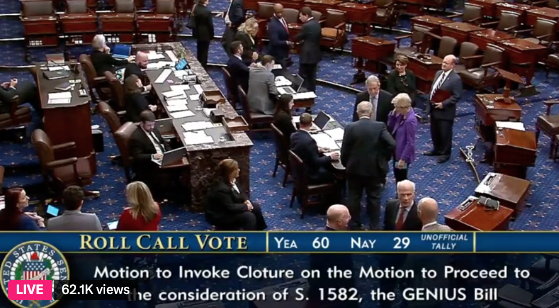

As of the time of publication the GENIUS bill just passed the Senate vote in America which will rapidly help to build out the above vision. The GENIUS bill is a piece of stablecoin legislation that establishes a framework for ‘payment stablecoins’ and allows them to be integrated into traditional finance as legitimate financial products. This is another huge win for Stablecoins that could see integrations continue to grow deeper with stablecoins in essence becoming a form of M1 money (if the bill continues to pass).

Why Should We Care?

But why should we care from a crypto investment perspective? Many reading may ask what the implications are for your crypto investments as stablecoins aren’t necessarily an investable front with many of the growth stories we have seen being privatized.

Fundamentally the stablecoin vision of stable assets maximizing for decentralisation has changed and the new opportunity for stablecoins is instead the trillion dollar vision of capturing a significant portion of the global M1 supply.

The GENIUS bill is the first step here towards rapid stablecoin growth and acceptance and is a large net positive for crypto, specifically DeFi names, as stablecoin growth has often been associated with an increase in network/token values. Beyond this I expect the increased adoption of stablecoins to make onramping within crypto a significantly better experience for end users over the next few years as more payment networks integrate them as legitimate assets natively.

However, beyond just increasing liquidity conditions and improving the user experience the legitimisation of stablecoins also act to enhance consumer trust through protections allowing for crypto to shed negative connotations and be fostered into mainstream adoption more widely while mitigating systemic risks we have previously seen in the stablecoin ecosystem (such as Luna Terra). In my opinion this is still more of a sore spot in crypto than many would like to admit and these advancements are a huge step in the correct direction towards fixing past wrongs.