categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Exploring Real World Assets (RWA)

by Henrik Andersson

Opportunities and Challenges with Real-World Assets in Crypto

Real World Assets (RWA) have emerged as a new narrative in the dynamic world of cryptocurrencies. Websites like rwa.xyz are diligently monitoring the developments in this space, sparking curiosity and conversations. As we delve into this subject, let’s hark back to the beginnings of crypto and reflect on the monumental innovation it brought – the ability to transact without trusted third parties.

Transactions in the crypto realm encompass a broad spectrum, ranging from simple value transfers involving Bitcoin and NFTs to more intricate financial dealings within the Decentralised Finance (DeFi) ecosystem. The common ground is their desire to minimise exposure to trusted third parties.

Many observers wonder if the crypto space would reach greater heights if real-world assets are brought on-chain, beyond just the native digital assets. However, doing so would necessitate compromising the core tenet of trustless transactions that underpins this groundbreaking innovation. Yet, despite this obvious contradiction, it is essential to acknowledge that there are still potential benefits in tokenising certain real-world assets on-chain.

Among the early explorations in RWA on-chain were Gold and Real Estate with fractionalised real estate akin to on-chain REITs.

Tokenising any security on-chain, however, is no easy feat, presenting a host of challenges. Tokenised Real Estate has so far failed to gain any meaningful traction. Perhaps surprisingly, Gold has seen significant traction in the crypto space, with PAX Gold and Tether Gold boasting a combined value of around $1 billion. The popularity of Gold in the crypto space sparks curiosity, considering Bitcoin is widely regarded, at least among crypto natives, as a superior digital version of the precious metal.

Arguably, centralised stablecoins, like USDC, have become the most prominent category within RWA. These stablecoins trade freely on-chain, enabled by KYC processes at the minting and redeeming end-points. Opening an account with platforms like Circle allows users to mint or redeem USDC for a fixed value of $1. Stablecoins’ success can be attributed to people’s familiarity with fiat currencies, enabling seamless transitions between traditional and digital currencies.

While many stablecoins remain centralised and part of the RWA category, decentralised variants, such as LUSD, prove that ‘trusted third parties’ are not a prerequisite for their functionality. Decentralised stablecoins have demonstrated their ability to operate autonomously, further enriching the crypto ecosystem.

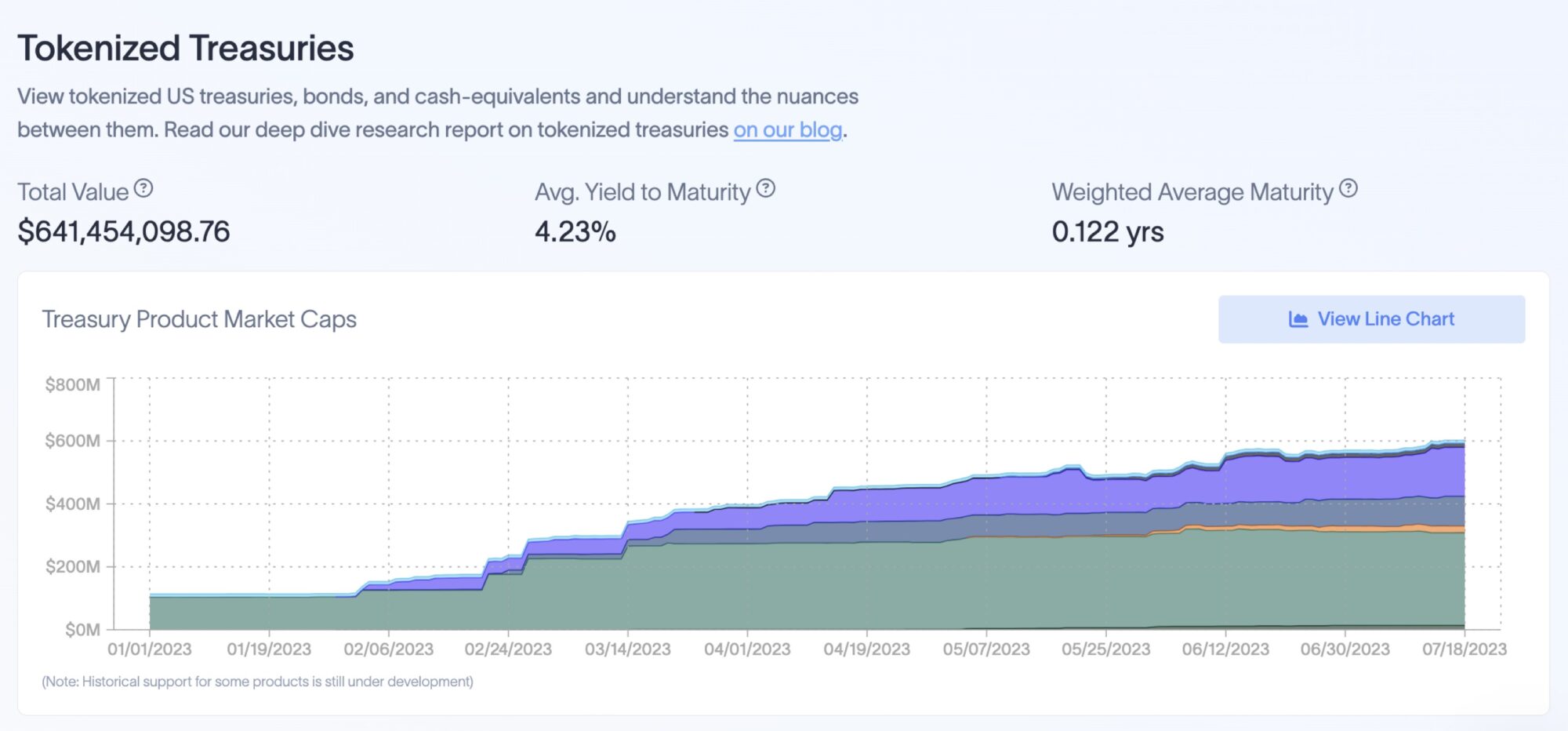

The latest surge in interest surrounding RWA stems from tokenised US treasuries, traded on siloed, whitelisted, KYC platforms. The interest has coincided with the closing of the gap of the difference of yield in the DeFi space and in traditional finance. Despite not embodying the trustlessness associated with native cryptocurrencies, these assets allow the growing capital in the form of crypto to explore new investment opportunities without converting to fiat.

Source: RWA.xyz

As the global crypto wealth grows, it increases the allure to make investments and payments in crypto. Besides facilitating investments, the acceptance of crypto in various online markets is a compelling use case. Success stories in accepting crypto as payment, such as gift cards, phone refills, and travel services, have emerged. The success of US treasuries on-chain can be seen in this light, as yet another asset available to be acquired using crypto.

However, not all tokenised securities are readily accessible on-chain. Franklin Templeton’s on-chain money fund currently makes up two-thirds of tokenised US treasuries. Their offering necessitates going through an intermediary, Benji, an investment app only available in the US. The supposed benefit of on-chain record-keeping, which Franklin Templeton argues for, raises questions about the advantage over using a traditional database. Nick Szabo’s insight on blockchain’s trade-off between technological scalability and social scalability holds merit. Franklin Templeton’s decision to tokenise the fund without seeking social scalability challenges the use of an inferior database (blockchain) for record-keeping.

RWA has demonstrated promise, especially in stablecoins, gold, and US treasuries. However, some of the hype shares similarities with past trends like Enterprise Blockchains and Security Token Offerings (STOs), which eventually waned.

The call for RWA often stems from a belief that only physical assets possess “real” value, a notion that stands far from the truth. The digital realm is rapidly expanding, and the crypto space can achieve tremendous success without necessarily delving into the realm of physical assets. By staying true to its roots and embracing the endless possibilities within the digital landscape, the crypto space can continue its trajectory of innovation and growth with or without RWA.