categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Weathering the Global Macro Winter

by Michael Armitage

The recent correction in financial asset valuation had been a reckoning many global macro focused investors warned about for years. The long-feared QT and interest rate normalisation have impacted liquidity and a re-rating of financial assets.

To date, central bank action has been limited relative to market expectations. However, sticky inflation numbers and central bank recognition of their slow response have increased expectations for sizeable action over coming periods.

The first signal of a changing of the guard began in February 2021, as long-term interest rates began to rise. That month, the US 10-year rate increased from 1.17% to 1.67%. The technology darlings, often without any positive earnings, were in the firing line. For example, ARKK fell 34% by May 2021 and by June 14, 2022, it had dropped 76% from its Feb 2021 high. Understandably, long duration equities are expected to deliver a higher proportion of future cash flows in the distant future and can be expected to suffer in a rising rate environment.

More generally, as interest rates have increased since January 2022 (US 10-year yield from 1.68% to 3.48%) the SP 500 has fallen over -22.1% from all time highs, and US government bonds (TLT -20 year) have lost -24.3% YTD (both in US$).

Crypto and digital assets, also considered a disruptive technology, have suffered in this environment. As of 20 June 2022, BTC/USD has fallen 70.1% from its 2021 peak, and the Crypto10 index (Top 10 crypto assets by market cap) has fallen 81.5% from its November 2021 highs.

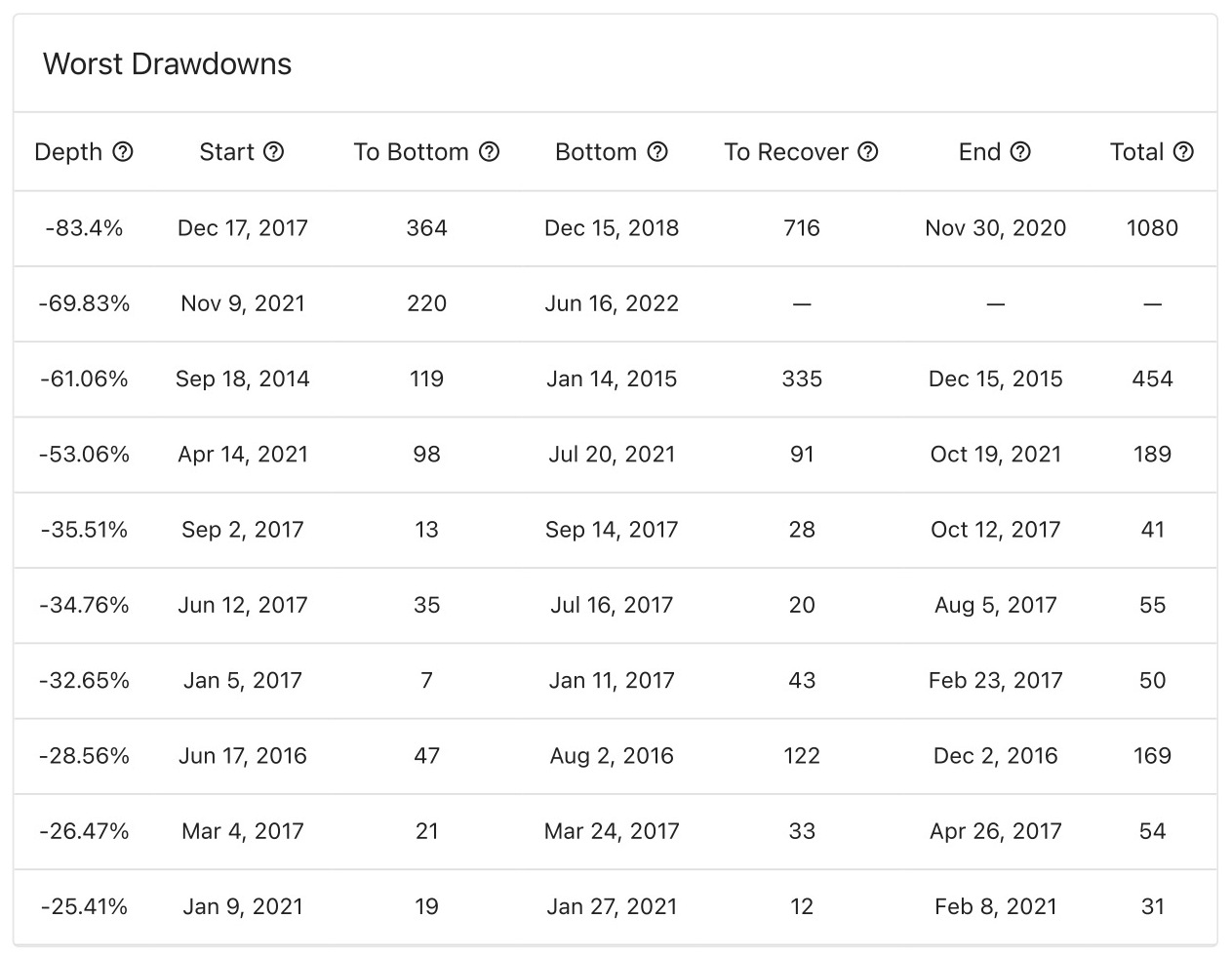

While many headlines promote the demise of innovative technology and crypto with their price falls, the long-term participants in small cap technology and crypto environments have experienced frequent falls of significant magnitude in the past. The table below highlights the volatility and price swing potential in BTC/USD.

Understandably, the volatility and risk of capital loss would dictate sizing within a portfolio to be relatively small. For example, a typical allocation may be .50% to 3.0% of a total portfolio, with crypto enthusiasts holding a higher level.

Figure 1 BTC/USD Historical Worst Drawdowns

Asset Allocation and Re-Balancing

In our view, overall portfolio asset allocation should be constructed for all economic environments. This macro winter’s fall in bonds and equities highlights the flaws of 60/40 portfolio allocation and an overreliance on historical correlation.

Instead, allocations for growth, recession, inflation, and deflationary periods (see Permanent Portfolio or Artemis’s Dragon Portfolio) are more fundamentally diversified portfolios, enabling rebalancing when markets present opportunities. This includes selling winners and re-balancing regularly.

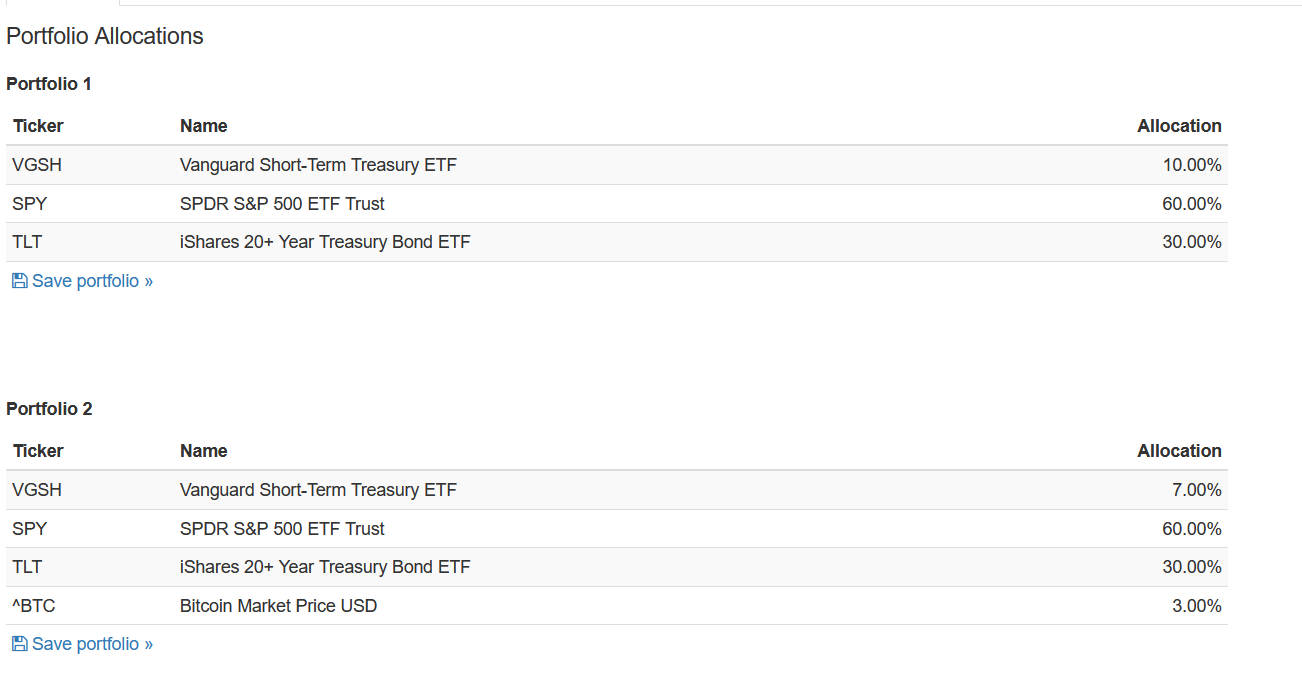

In evaluating the impact of a 3% BTC-USD allocation to a 60/40 portfolio from 2017 to the end of May 2022, investors would still be significantly ahead. Importantly, BTC has faced three significant ‘crypto winters’ in this 5-year period, falling over 50% on each occasion. (Dec 2017-Dec 2018 fell more than 83%)

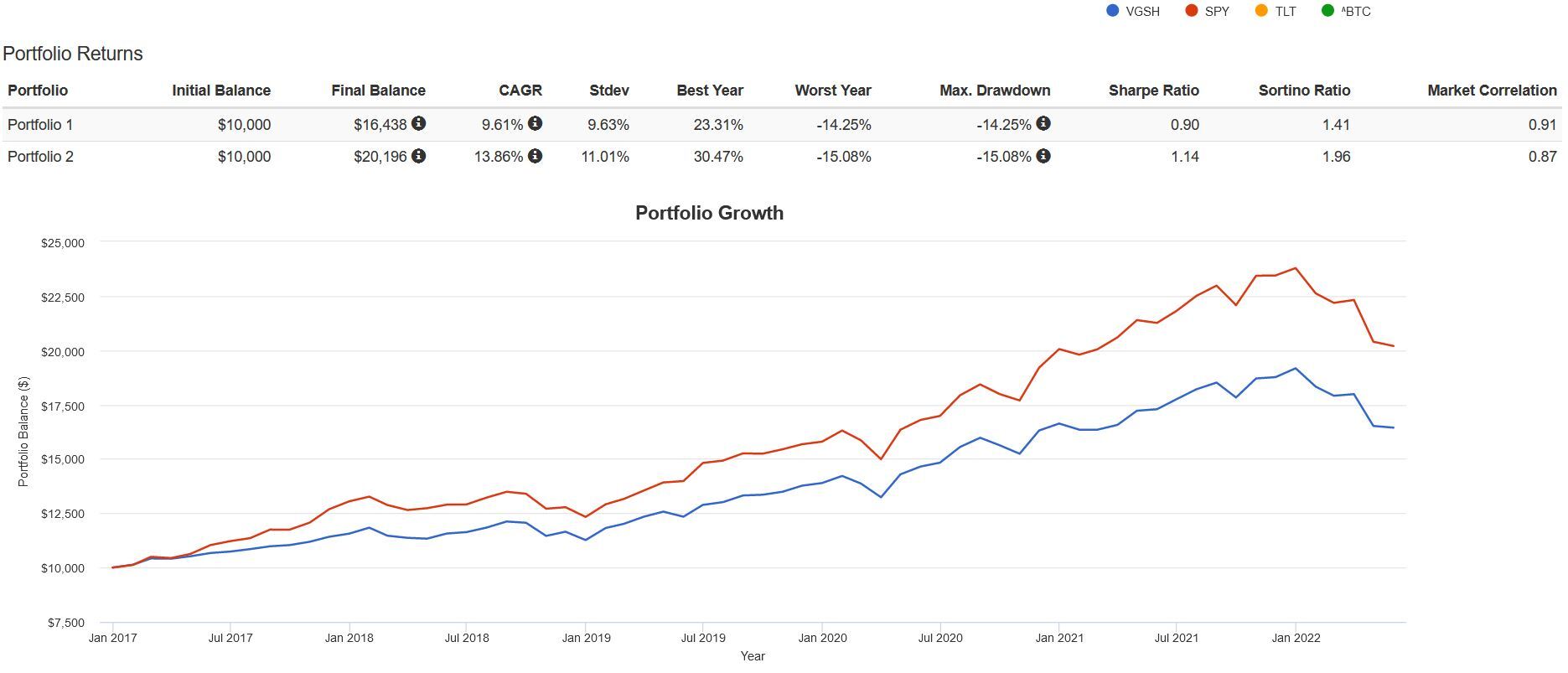

The following chart and table of performance include regular re-balancing (quarterly) of a portfolio comprised of 60% SP 500, 30% TLT (20-year US bonds) and 10% ST vanguard treasury compared with a portfolio of 60% SP 500, 30% TLT (20-year US bonds), 7% ST vanguard treasury, and 3% BTCUSD.

As highlighted above, SP 500 and TLT (20 year) have weighed heavily in the performance attribution in this macro winter. While crypto assets have not provided diversification in this environment, they certainly are not the main culprits of capital destruction.

Active portfolio management and the ability to take profit on the way up, rebalance, and conversely, in this environment, re-balance from cash and outperforming defensive assets into high quality risk assets at depressed pricing should continue to serve investors well.

Importantly, risk assets, including small cap innovative technology, have a role to play in prudent investment portfolios. While no one has 100% certainty on how long this macro winter will last or how far risk assets may fall, an environment for growth assets will return at some point in the future.

In our view, Bitcoin and Ethereum are credible innovative technologies that will exist and thrive as the adoption of blockchain, smart contracts and non-inflationary assets continue to grow. Other technology, including AAPL, AMZN, high-quality smaller cap technology companies and new digital assets, will go through a re-rating in this macro winter, and all survivors will build into the next cycle.

The sizing of higher volatile assets in a portfolio, especially within the nascent digital asset class, should be represented in small allocations. However, as illustrated, small allocations can have a meaningful positive asymmetric impact on portfolio returns and improved risk adjusted returns – especially for investors that re-balance regularly.

Disclaimer: This material has been prepared as educational material and is not intended to be used as investment advice. Instead, this information should be used as background information only and does not purport to make any recommendation upon which you may reasonably rely without further and more specific advice. The simulated strategies shown in this document are provided for illustrative purposes only. Simulated performance results have inherent limitations and are achieved by the retroactive application of a back tests designed with the benefit of hindsight. The simulated returns do not represent actual performance of any specific investment fund or strategy. Past performance (whether actual or simulated) is not a reliable indicator of future performance, and no representation or warranty, express or implied, is made regarding future performance.