categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Happy 5th Birthday Apollo Crypto

by Tim Johnston

Tomorrow marks the five-year anniversary of the inception of the Apollo Crypto Fund.

As we celebrate an important milestone, it gives reason to pause and reflect.

We reflect on the journey we have had within crypto. Henrik started following crypto markets in 2013 as a hobby while working on Wall Street. I fell into crypto at the start of 2017, initially sceptical and struggling to understand its premise. Many other team members also discovered crypto in 2017 and followed it personally before making it the focus of their careers. Over the journey, both personally and professionally, we have seen several cycles. Indeed, launching at the start of a brutal ‘crypto winter’ at the start of 2018 was a steep learning curve. Apollo Crypto now has 10 team members, three funds with around A$100m under management and investors from over 20 countries.

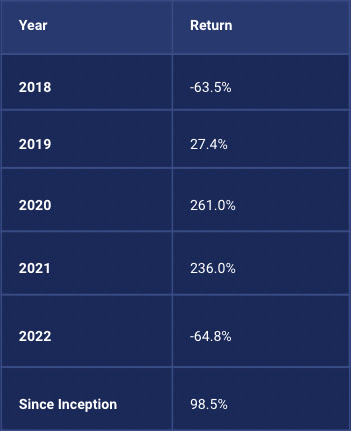

Annual Returns of the Apollo Crypto Fund

While the outlook for both crypto and traditional markets is impossible to predict, our experience means we are prepared for all outcomes. It doesn’t mean we’ll avoid negative returns and negative outcomes, but it does mean our process and discipline will not waiver.

Lately, I have been reading a great deal about generative AI. I have heard from no less than a dozen VCs talking about the promise of generative AI and the amazement of ChatGPT. And while some may simply be offering commentary, I question what experience these people have in AI. Have they been following AI advances for the past decade? Have they been investing in AI companies and developing a framework for distinguishing the merits of each? Or are they simply trying to capitalise on the latest trend, the latest hot topic?

We have seen the same in crypto. It comes as no surprise that since 2021, and in particular 2022, a number of new crypto funds have come to market in Australia and abroad. I ask the same questions; do these managers have experience, or are they simply trying to capitalise on the latest trend? Crypto markets will come around again. We don’t know when and for how long, but crypto again will be fashionable. For me, it pays to be able to identify those that have been involved when it wasn’t.

We have seen enormous change over the last five years, but in many respects, a great deal remains the same:

-

Investment Opportunity – the crypto asset investment opportunity is largely the same as it was five years ago, offering high growth potential with low long-term correlation to traditional markets.

-

Optionality – crypto assets offer optionality; it’ll likely either be a huge success or not.

-

Volatility – we expect crypto to be volatile for a long time to come.

-

Polarising – crypto assets are still a polarising topic. The events of the past 12 months will surely convince some that “crypto is a scam” or “I told you crypto was a passing fad.” Crypto is often tarred with the same brush when participants engage in fraud, excessive leverage, and in some cases, outright criminal activity. It is crucial to realise that crypto assets are separate; the Bitcoin blockchain is oblivious to the vicissitudes of markets. Unfortunately, crypto markets have and will continue to attract dishonest actors. It’s our job to try and avoid doing business with them.

-

Retail-driven – crypto markets are still retail-driven. While we see more and more institutional interest, opportunities abound for savvy crypto investors.

As we celebrate our fifth birthday, we say a big thank you to our investors. We realise that it takes a degree of courage to be invested in our funds and crypto markets (as it does to be the investment manager!) We thank you for your support and look forward to the next five years.