categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

How the US Aims to Lead the Global Crypto Landscape

by Quinn Papworth

Over the past nine months we have covered countless positive regulatory developments for the crypto asset class on the Apollo Crypto Insights. While a break from this topic might be overdue, indulge me once more, as the US has delivered yet another wave of encouraging regulatory news this past week.

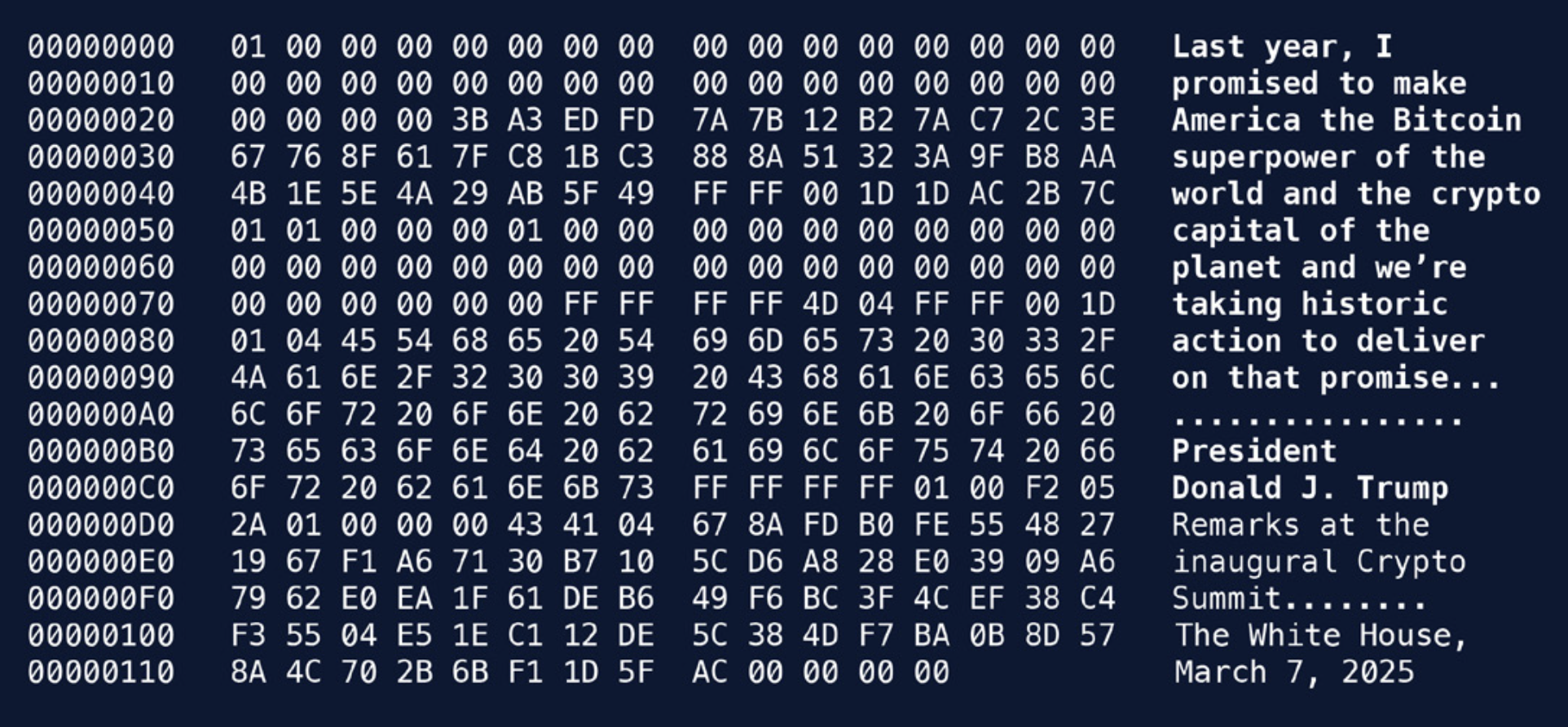

This blog will explore the key insights from the White House’s 166-page report, “Strengthening American Leadership in Digital Financial Technology,” published last week, alongside SEC Chairman Paul Atkins’ recent “Project Crypto” speech on crypto regulation in the US.

Looking Back

Before exploring last week’s positive regulatory developments, it’s worth pausing to reflect on how far the crypto industry has come by revisiting the regulatory landscape of just one year ago.

Democratic party members had taken a very active approach to their anti-crypto stance, namely Gary Gensler (SEC Chair) & Elizabeth Warren (Senator from Massachusetts).

Such an approach included:

- Repeatedly stating the majority of crypto assets are securities while providing businesses with no process to comply with registration rules.

- Suing and issuing wells notices to many of the largest crypto businesses in the US with no oversight or regulatory clarity.

- A coordinated effort to de-bank crypto businesses and individuals through Operation Choke Point 2.0 without any clear legal justification.

- Warren’s efforts to drive an “anti-crypto army” with an aim to tighten regulations on crypto to the point of imposing unworkable compliance burdens on crypto businesses.

- Biden exercising a veto against the key bipartisan overturn of SAB121

- Hostile public statements associating crypto with illicit activities without acknowledging the industry’s efforts to comply in order to justify aggressive regulatory actions.

The White House Report

The President’s Working Group on Digital Asset Markets, chaired by David Sacks, was created to develop regulatory and legislative proposals.

Members include high-ranking officials like the Secretary of the Treasury, Attorney General, and SEC/CFTC chairs, with input from agencies like the Federal Reserve and FDIC.

The group was tasked with submitting a report within 180 days to advance these policies as a result of Trump’s executive order “Strengthening American Leadership in Digital Financial Technology”.

Last week they delivered a 166 page report detailing the state of the crypto industry in the US and their recommendations to lead growth, here are some of the key takeaways:

Market Structure

- Congress should affirm individuals’ rights to self-custody digital assets and engage in peer-to-peer transactions.

- The CFTC should gain clear authority to regulate spot markets for non-security digital assets, streamlining licensing for market participants.

- Regulators should embrace decentralized finance (DeFi) by assessing factors like asset control, modifiability, and compliance capability when determining regulatory treatment.

Banking

- The report criticizes past policies like “Operation Choke Point 2.0” and calls for banking regulators to adopt technology-neutral risk management practices.

- Ensure non-discriminatory access to banking services for lawful digital asset businesses.

- Develop capital requirements that reflect the actual risks of digital asset activities.

Stablecoins

- U.S. dollar-backed stablecoins are seen as critical for modernising payments and maintaining U.S. financial dominance.

- Promote private-sector leadership in cross-border payment technologies and international standards.

- Enact legislation to ban CBDCs in the U.S. and discourage their adoption globally.

Countering Illicit Finance

- The report emphasises targeting illegal activities without infringing on lawful uses of digital assets.

- Congress should clarify the Bank Secrecy Act’s (BSA) application to foreign actors based on their impact on the U.S.

- The Treasury should enhance public-private information sharing to target illicit actors.

- Propose a “hold law” offering safe harbor for institutions temporarily freezing assets during investigations, with transparency and consumer protections.

- Amend laws to strengthen enforcement against digital asset-related crimes and improve victim compensation.

Taxation

- The report calls for tax policies tailored to digital assets’ unique characteristics.

- Treasury and IRS should issue guidance on issues like unrealised gains/losses, wrapping/unwrapping transactions, and de minimis receipts.

- Review existing guidance on staking and mining income for potential updates.

- Congress should include digital assets in wash sale rules and amend tax reporting requirements.

SEC Chairman Paul Atkins’ Vision: Project Crypto

On July 31 Sec Chairman, Paul Atkins delivered a speech discussing what he calls “Project Crypto”, the SEC’s north star in helping President Trump to make America the “crypto capital of the world”.

Take a look at some of the absolutely gleaming messaging coming from the mouth of Atkins:

“Today, I would like the world to go on notice that under my leadership, the SEC will not stand idly by and watch innovations develop overseas while our capital markets remain stagnant. To achieve President Trump’s vision of making America the crypto capital of the world, the SEC must holistically consider the potential benefits and risks of moving our markets from an off-chain environment to an on-chain one.”

“We are at the threshold of a new era in the history of our markets. As I mentioned earlier, today I am announcing the launch of “Project Crypto”—a Commission-wide initiative to modernize the securities rules and regulations to enable America’s financial markets to move on-chain.”

“The SEC welcomes all market participants who are hungry to innovate”

The gravity of this messaging cannot be understated, especially when juxtaposed with the sentiment we were seeing just 12 months ago. It is the complete and utter polar opposite of what we saw under the Biden/Gensler administration. Make no mistake, this is a total and complete regulatory embrace of crypto.

Project Crypto’s Key Plans:

Onshoring Crypto in the US

- Establish a U.S.-based framework for distributing crypto assets and bringing them back onshore

- Confirmation that the majority of crypto assets do not qualify as securities, moving away from the earlier expansive application of the Howey test enforcement approach.

- SEC to issue clear classification guidelines (securities, stablecoins, commodities, collectibles etc.), reducing ambiguity for issuers and innovators over whether the crypto asset will be under the purview of the SEC.

Enhancing Freedom in Custody & Issuance

- Enable self-custody and modernise requirements for institutions custodying on individuals’ behalf

- Launching tailored disclosure requirements and safe harbors for token distributions (i.e. airdrops) and ICOs in the US

Facilitating “Super-Apps”/ Horizontal Integration of Crypto Products

- Allow registered platforms to offer trading in both security and non-security tokens under one license

- Develop a framework to enable securities and non-securities to trade side by side with a “minimum effective dose of regulation necessary to protect investors

- Enabling tokenised securities and DeFi operations on SEC‑regulated platforms via public notice‑and‑comment rulemaking

Protect Developers in the US

- Ensure onchain software has a home in U.S. markets by protecting code & developers, drawing clear lines between regulated intermediaries and non-custodial actors (a clear move away from the prior SEC office)

- Create workable frameworks for DeFi systems like AMMs (automated market makers), rather than making them adapt to traditional regulatory burdens

Innovation Exemption

- Consideration of an “innovation exemption” to allow builders to get to market faster with models that don’t necessarily fit into existing frameworks.

The future for crypto continues to look increasingly optimistic with every passing day under the current administration regime in the US. Trump’s vision of a “Golden Age of Crypto” is coming to fruition and I eagerly await to see the fruits of SEC actively working with innovators in the space come to fruition as the growth of crypto products are finally supported and encouraged.