categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Industry Leaders Predict Large Bitcoin ETF Inflows & Price Appreciation

by Matthew Harcourt

I am pleased to say that there is significant excitement as crypto asset prices have been soaring over the past few weeks. A main driver is the expectation that one or more Bitcoin ETFs will soon be approved in the United States. Today, we will look at some of the predictions from various market participants of the inflows into these ETFs and the subsequent impact on the price of Bitcoin.

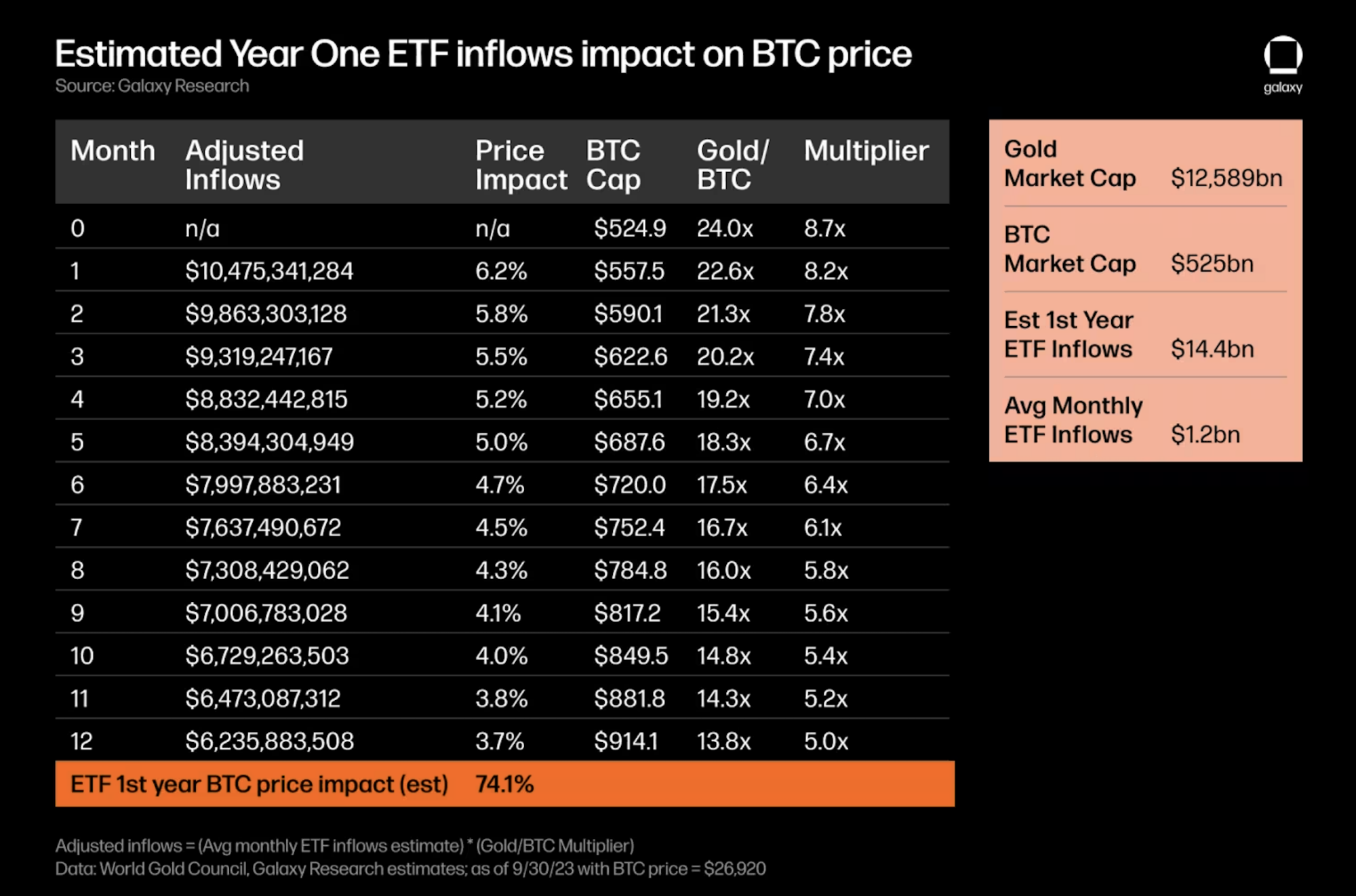

Galaxy Digital is a US-based digital assets firm whose services extend to trading, lending, advisory, Bitcoin mining, staking, and custody. Their recent report titled ‘Sizing the Market for a Bitcoin ETF’ estimates US$14 billion of inflows into a Bitcoin ETF in the first year, US$27 billion in the second year, and US$39 billion in the third year. This first year’s inflow of US$14 billion is expected to result in a 74% increase in the price of Bitcoin, according to the report.

Source: Galaxy – https://www.galaxy.com/insights/research/sizing-the-market-for-a-bitcoin-etf/

While Galaxy provides a detailed report with strong data to back up their claims, there have been notable individuals, who have come out with bolder predictions on the inflows and the impact of a Bitcoin ETF. One of these is Steven Schoenfield, a former Managing Director at BlackRock and current CEO of MarketVector Indexes. Steven told crowds at the London Digital Asset Summit in October that the impending approval of a spot Bitcoin ETF might attract $200 billion to Bitcoin investment products in the short-term.

With a more conservative approach, CIO Matthew Hougan of the crypto index fund manager Bitwise, speculated that US-based Bitcoin ETFs will receive US$55 billion of net inflows during the next five years in a panel held around the same time as Steven Schoenfield’s. This is a considerably lower estimate than Schoenfields, and speaks to the uncertainty and relative unpredictability of how inflows will truely play out. Hougan said his prediction is based on looking at flows into Bitcoin ETFs listed in other markets.

Bitwise CIO – Matt Hougan

Crypto exchange Matrixport used a different method for their prediction of US$12-24 billion worth of inflows. Their method was to assume that 10%-20% of Gold ETF investors will take a stake in a spot Bitcoin ETF. While this is a simple methodology for the prediction, it gives us some perspective on how much demand there might be from existing investors, who value the properties that both Bitcoin and Gold share. Matrixport also sees Bitcoin reaching between $42,000 and $56,000 off the back of these inflows.

Last but not least, analysts at AllianceBernstein have come out with the most bullish prediction of all. The analysts believe Bitcoin could reach a cycle high of as much as US$150,000 in 2025, driven by the so-called halving event and institutional inflow brought by bitcoin exchange traded funds. This prediction is in line with the 4 year cycle theory around Bitcoin, where the halving event that occurs roughly every 4 years is a driver of price.

Summary of predictions

| Predictor | Inflow Prediction | Price Prediction |

| Galaxy

|

Year 1: US$14 billion Year 2: US$27 billion Year 3: US$39 billion

|

74% increase in one year

|

| Steven Schoenfield (former BlackRock MD)

|

US$200 billion in the short-term

|

None

|

| Matthew Hougan (CIO of Bitwise)

|

US$55 billion over the next 5 years.

|

None

|

| Matrixport

|

US$12-24 billion

|

US$42,000 to US$56,000

|

| AllianceBernstein | None | US$150,000 |