categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

LUNA & UST Update of Events

by Henrik Andersson

Introduction

This article will be covering the events that lead to the de-pegging of Terra’s (LUNA) native stablecoin UST and, ultimately the sharp and swift devaluation of Terra’s governance token LUNA of -99.99% over the past three days.

Before deep-diving into the events, it is helpful to understand how Luna and UST operate. UST is an algorithmic stablecoin native to the Terra ecosystem, and LUNA is the native governance token. Both have a symbiotic relationship whereby they operate on a 1:1 redemptions system. UST can be minted by burning the LUNA token, or the LUNA can be redeemed by converting the UST back. Reliance on the market value of the LUNA and UST requires self-reciprocating faith in both the algorithmic stability and the governance token. It is important to note that Terra’s native borrowing and lending platform, Anchor, has been offering DeFi users a ~20% APY on deposited UST for the past 14 months.

UST De-Pegging

On May 9th, a significant outflow occurred with ~$5B worth of UST withdrawing from Anchor. To get ‘out’ of UST in this situation, investors had three options;

- Use the algorithmic minting function whereby they burn $1 of UST to redeem $1 of LUNA.

- Swap out of UST using Curve’s 3CRV liquidity pool, which had roughly 550M liquidity

- Deposit onto a centralised exchange and swap directly

With the reserves for the LUNA algorithmic minting function capped at ~300M per day out of the ~2B in total reserves and the 3CRV pool being ~550M in total liquidity, billions of UST were forced onto centralised exchanges to be sold. The tremendous selling pressure caused UST to de-peg significantly, trading at $0.61 on May 10th.

With a significant disparity between the reserves needed to maintain the UST peg outweighed by the billions of UST wanting to exit the ecosystem, UST has not been able to recover its peg after May 9th.

LUNA Capitulation

As a result of UST de-pegging, traders began using the algorithm as an arbitrage opportunity. This is precisely how the algorithm is intended to function. However, in this instance, it contributed to a significant downward spiral for the price of LUNA.

The algorithmic function to assist in stabilising the price of LUNA and UST is built so that arbitragers can sell UST when one unit is worth less than $1 to redeem $1 worth of LUNA, thereby increasing the LUNA supply and diluting the price of LUNA holders. This function works very well during normal market conditions to maintain UST’s peg.

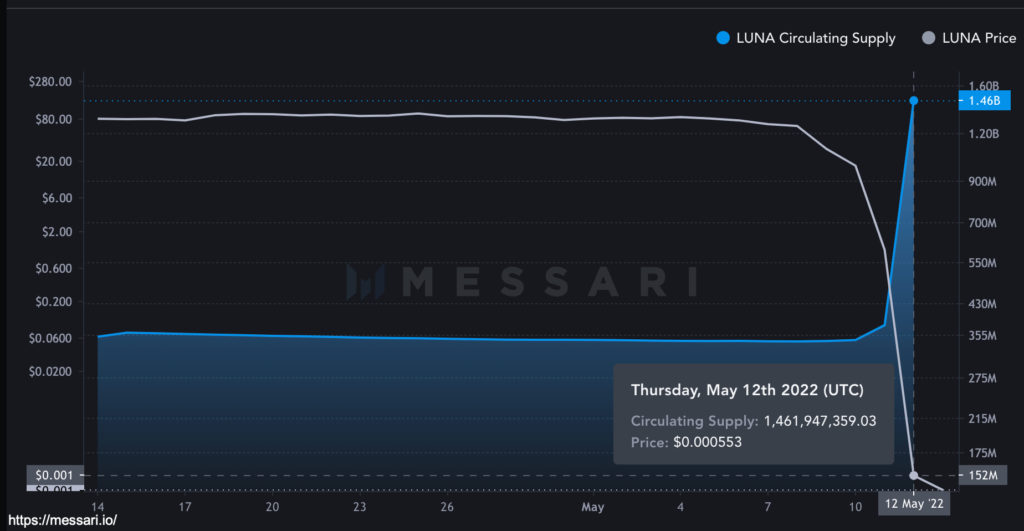

By May 12th, we can see a dramatic acceleration in the supply of LUNA, causing a strong decline in its price. It is worth noting that LUNA’s supply is infinite under these tokenomics.

Effects on Apollo

Unfortunately, these events have been felt across all Apollo’s Funds, which has caused a loss of approximately ~5% in both our long funds holding LUNA and ~9% in the market neutral funds holding UST. We are grateful that our risk management framework has contained the losses.

The events over the last three day can be likened to a “black swan” event. Over the past 12 months, the Terra ecosystem has developed into a thriving DeFi ecosystem with significant backing from some of the most reputable institutions and investors in the crypto asset industry.

The Apollo team has reacted by successfully selling the majority of any UST positions at 80c. While this realises a 20% loss on these positions, it has proven to be a prudent trade as UST now trades closer to 0. The Apollo team has sought to de-risk exposure in the market neutral funds and has exited other stablecoins that might carry similar risks to UST.

As always, we continue to monitor market developments very closely and will keep investors informed.