categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Lyra Finance and Arbitrum Update

by Matthew Harcourt

Lyra Finance is a leading decentralised options protocol where users can buy and sell ETH and BTC options on Optimism and Arbitrum. In this blog, we will discuss Lyra Finance and its latest developments and give a primer on Arbitrum, Ethereum’s leading layer two solution.

Introduction to Lyra Finance

Lyra Finance was co-founded by University of Sydney graduates Nick Forster and Michael Spain in March 2021. Nick has a background in equity options trading while Michael has years of experience as a crypto engineer at Synthetix and Block8. The duo announced their first substantial round of funding in July 2021, successfully raising US$3.3 million from an array of notable names in the crypto space, including ParaFi Capital, Framework Ventures, Kain Warwick (Synthetix co-founder), Stani Kulechov (Aave founder), and Apollo Crypto.

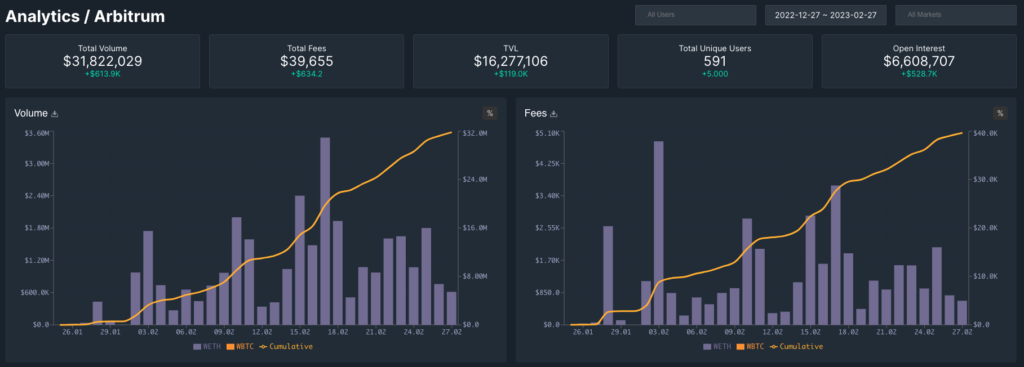

Lyra Finance was one of the first projects to launch on Optimism. Optimism is one of the leading ‘Optimistic Roll-ups’ for Ethereum alongside Arbitrum. Lyra has had one major upgrade, named ‘Avalon’, since launching in August 2021 and is gearing up for the next step forward in evolving the protocol with ‘Newport’. Lyra recently successfully launched on Arbitrum, attracting over US$10 million of deposits in less than two weeks and supporting over US$30 million of volume during February.

https://stats.lyra.finance/

On the Lyra Finance platform, users are able to:

- Long or short, both call and put options on BTC and ETH;

- Provide liquidity to ‘Market Maker Vaults’ that use your funds to make options markets on your chosen asset.

Lyra allows users to buy and sell options that are priced with the first market-based, skew-adjusted pricing model. This means that each strike price and expiration date is priced algorithmically as users buy and sell from the on-chain market. Lyra has achieved over US$1 billion in total trade volume across their Optimism and Arbitrum based markets and across multiple versions of the product.

https://stats.lyra.finance/

Avalon Upgrade Primer

For the average user, one of the core benefits of decentralised finance is the opportunity to provide liquidity to ‘vaults’ and liquidity pools to earn yield, effectively acting as a market maker. The Avalon upgrade improved the user experience by creating single stablecoin vaults (sUSD) that are highly liquid and high yielding. Liquidity providers are able to deposit and withdraw from the market maker vault at any time with a short cooldown period. The upgrade also saw the advent of partially collateralised options selling, meaning that traders were able to sell 3-5 times as many options with a given amount of capital. The protocol utilises a decentralised exchange like Synthetix to hedge out the protocols exposure to the market, and ensure that liquidity providers remain market neutral. This model is a novel design in the on-chain options space. Lyra’s early success is a testament to the underlying innovation of the protocol.

Newport Upgrade Primer

As Lyra Finance surpasses $1 billion in notional volume traded, the team continues to build, iterate, and innovate. Newport will utilise perpetual derivatives to improve the capital efficiency of the Lyra Automated Market Maker (AMM), leading to tighter bid-ask spreads and an improved trading experience for users. Newport stands to substantially reduce the fees paid by liquidity providers when hedging the delta exposure of the AMM. Delta refers to the vault’s exposure to shifts in the price of the underlying asset. If traders are predominantly longing the market and buying call options, the AMM automatically hedges the potential losses incurred from a rising market by buying spot ETH and collateralising the options bought on the AMM. The Newport upgrade is set to have a 10-20x improvement on the amount of fees paid. Lyra Finance will be able to integrate with any perpetual exchange on any EVM compatible chain for collateralisation and delta hedge, increasing the modularity of the protocol.

We eagerly await the Newport upgrade and congratulate the team on successfully building market-leading innovative products in the decentralised finance sector. With much of the team based in Sydney, Lyra Finance is a wonderful example of the quality of protocols that are being built in Australia.

Arbitrum

Lyra Finance’s presence on both Optimism and Arbitrum Layer 2s is establishing a noteworthy standard for the future of decentralised applications built on Ethereum. As Ethereum shifts towards becoming the overarching “settlement layer” for the broader ecosystem of applications and layer 2s efficiently and affordably manage transactions for these Dapps.

The purpose of a Layer 2 scaling solution on top of the Ethereum network is to enhance its throughput and reduce its gas fees. This is achieved by processing transactions off the Ethereum mainnet and consolidating them on the Layer 2 platform more efficiently and cost-effectively. After a certain period, these bundled transactions are pushed back to the Ethereum mainnet and validated.

Given this approach, it would seem logical that most transactions would occur on Layer 2 solutions. However, this theory is proving to take longer than anticipated, with most Layer 2 platforms still in their early stages. Nonetheless, we acknowledge the success of one of the most promising Layer 2s, Arbitrum.

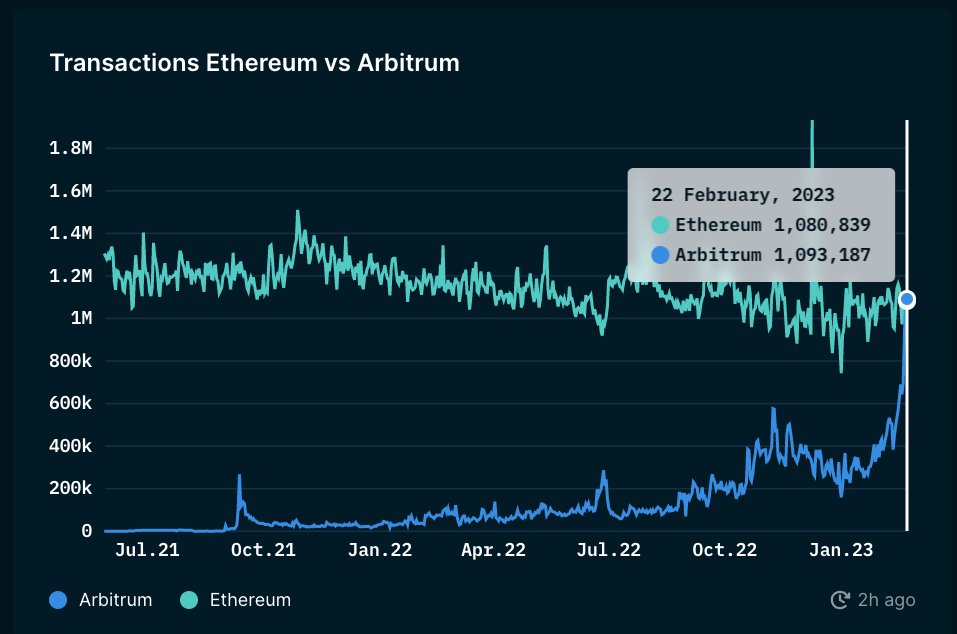

One of its most notable achievements has been surpassing Ethereum in total daily transactions on February 22, 2023, with over one million transactions.

https://www.nansen.ai/

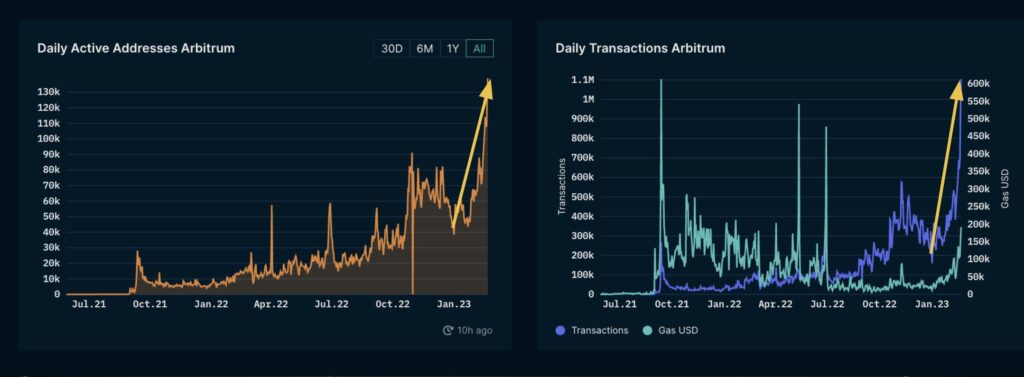

Another is Arbitrum’s sheer growth in users and active addresses. Despite the many obstacles faced by the crypto industry in the past year, Arbitrum has successfully attracted both end-users and top DeFi applications and their developers. Starting the year with only 10,000 daily active addresses, the platform has witnessed a significant surge in user activity, with the current number of daily active users totalling 78,000 – an impressive 7.8x increase from the same period last year. This remarkable rise in daily active addresses demonstrates establishing a solid user base, providing a strong foundation for developing decentralised applications (DApps) on the platform.

https://www.nansen.ai/

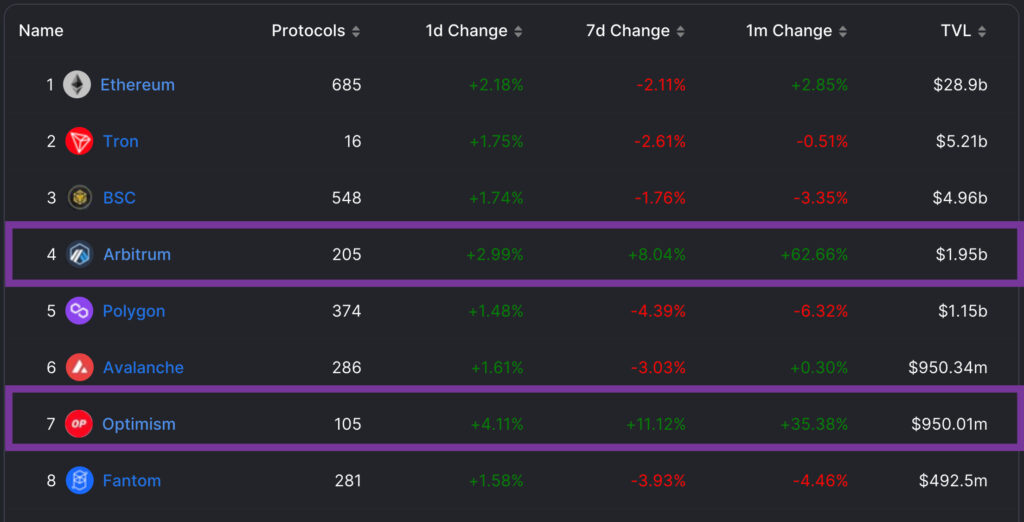

It would have been hard to fathom in 2021 that a Layer 2 solution constructed on top of Ethereum would possess a greater Total Value Locked (TVL) than some of the prominent Ethereum rivals, colloquially known as the ‘Ethereum Killers.’ However, the present scenario has taken a surprising turn, with Arbitrum and Optimism ranking among the top seven ‘chains’ regarding TVL within the DeFi ecosystem. Of particular significance is the fact that Arbitrum has achieved an impressive TVL and is the lone project on the list without its own

Largest Smart Contract Platforms by TVL

Defilama.com

In conclusion, while adopting Layer 2 scaling solutions on the Ethereum network may be slower than anticipated, the success of Arbitrum is a clear indication of this technology’s potential. The platform’s impressive growth in users, active addresses, and total daily transactions is a testament to its ability to provide a more efficient and cost-effective solution to the existing scalability issues faced by Ethereum. With the establishment of a solid user base and the growth of its TVL, Arbitrum has positioned itself as a significant player in the DeFi ecosystem, and its success bodes well for the future of Layer 2 solutions and decentralised applications on the Ethereum network.