categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Ordinals: NFTs and BRC-20s on Bitcoin

by Matthew Harcourt

Introduction

Bitcoin has long been viewed as a digital version of gold that’s key feature is its predictability into the future. Bitcoin advocates take comfort in the predictability of the network and the fact that the future supply increases are scheduled and utility will remain constant. For a long time, Bitcoin’s value has been driven by this thesis. However, this view is being challenged with the recent development of ‘Ordinals’ or ‘Ordinal Theory’, and excitement about the future usefulness of the Bitcoin network has propelled the asset into the spotlight.

High Level Overview of Ordinals

In essence, an Ordinal is a Non-Fungible Token (NFT) that is stored on the Bitcoin blockchain. Ordinals are a surprise development to Bitcoin as core contributors to the Bitcoin network never intended for NFTs to come to the Bitcoin blockchain. Ordinals were first inscribed (minted) in December 2022 after being developed by Casey Rodarmor, Ordinals are a numbering scheme for satoshis (the smallest increment of a Bitcoin) that allows tracking and transferring of individual satoshis (sats). An NFT like asset is created when a satoshi is linked to arbitrary content through a process called inscription, users can inscribe a satoshi by submitting a transaction containing their desired content on the Bitcoin blockchain. A more in-depth technical overview of Ordinals can be found here. While Ordinals can be compared to the NFTs that live on smart contract platforms such as Ethereum, there are some key differences that distinguish them from each other.

Comparing to NFT’s on Ethereum

In the case of most NFT’s on Ethereum, the file and the actual crypto asset live in two separate environments. The file (artwork, collectable, image, video, etc.) might be hosted on a ‘centralised’ cloud server like Amazon where the server is controlled by the project that created the NFT minting tool used by the creator e.g. Opensea. Whereas the crypto asset, an ERC-721 token, lives on the Ethereum blockchain. The content and the token are linked because there is a reference to the live file added into the ERC-721. If that file is compromised in any way, that crypto asset would no longer reference the NFTs content. This results in this common NFT implementation being censorable and far from immutable.

Ordinals differ because they are permanently stored on the blockchain, Ordinals can be text, image, video, sound or even interactive in the case of Inscription 466. This fully on-chain approach results in Ordinals being significantly more immutable and censorship resistant than most Ethereum based NFTs. While it is entirely possible to store content on-chain on Ethereum, this is not the common approach and an average user will find it much harder to do when compared to inscribing (minting) an Ordinal.

Advantages of Ordinals:

The key advantages of Ordinals are:

- Highly decentralised and secure due to living on the Bitcoin blockchain

- Hard to censor

- Immutable

- Sequential

- Fully on-chain by nature

Traction

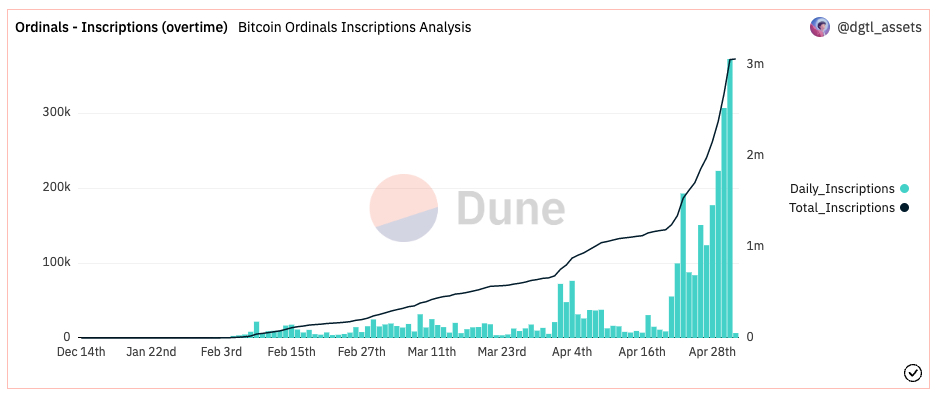

In contrast to Ethereum based NFTs, Ordinal inscriptions are numbered in consequential order. The lower the inscription number, the older the Ordinal is. We can see from the chart below that there are currently 2,991,101 inscriptions on Bitcoin, with this number rising rapidly over the course of 2023 according to this Dune Dashboard.

Dune Analytics Dashboard 02/05/23

BRC-20 Tokens

As shown in the chart above, the number of daily inscriptions has been increasing at an exponential rate, this growth can be attributed to the creation of the BRC-20 token standard in early March 2023. This token standard aims to bring fungible tokens onto the Bitcoin blockchain, the same way the ERC-20 token standard brings fungible tokens to the Ethereum blockchain. Each deployment, mint and transfer of a BRC-20 token is recorded as an inscription.

The token standard’s founder, Domo, describes BRC-20’s as “a fun experimental standard demonstrating that you can create off-chain balance states with inscriptions. It by no means should be considered THE standard for fungibility on bitcoin with Ordinals, as I believe there are almost certainly better design choices and optimization improvements to be made”.

Despite Domo’s comments on the future of BRC-20, the current market cap of the top BRC-20’s is well over US$100 million, demonstrating a high level of excitement and speculation.

Closing Thoughts

Ordinals represent an exciting development in the Bitcoin ecosystem when compared to the previously rigid plan for the blockchain. Ordinals may play a key role in solving Bitcoin’s longer term security problem in regards to using fee revenue only to pay miners once block rewards become insufficient to incentivise the network. This is because Ordinals are driving transactions and thus fees on the Bitcoin blockchain. While it is hard to predict the future value of early Ordinal inscriptions and BRC-20 tokens, there is no doubt that these assets may hold significant historical value if Ordinal adoption and innovation continues to grow.