categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

PayPal Joins Crypto

by Matthew Harcourt

Last week, one of the largest Financial Technology (FinTech) companies, PayPal, announced the launch of an Ethereum based stablecoin named PayPal USD or PYUSD. The announcement came as a surprise to most crypto asset investors but did not have a material impact on asset prices. In this blog we will explore why PYUSD has exciting potential in the medium to longer term as well as discuss some reasons why the announcement did not result in bullish price action.

What is PayPal USD?

PYUSD is a centralised stablecoin that is issued by Paxos Trust Co, the same company that issues USDP (506 million circulating supply) and BUSD (over 22.5 billion circulating supply before a crackdown on Binance, current supply is 3.3 billion). PYUSD is primarily designed to be used for payments in order to drive efficiencies and improve customer experience. Initial usage of PYUSD may be siloed in the PayPal wallet and ecosystem in order to limit potential regulatory challenges until greater clarity is provided.

Users and Merchants

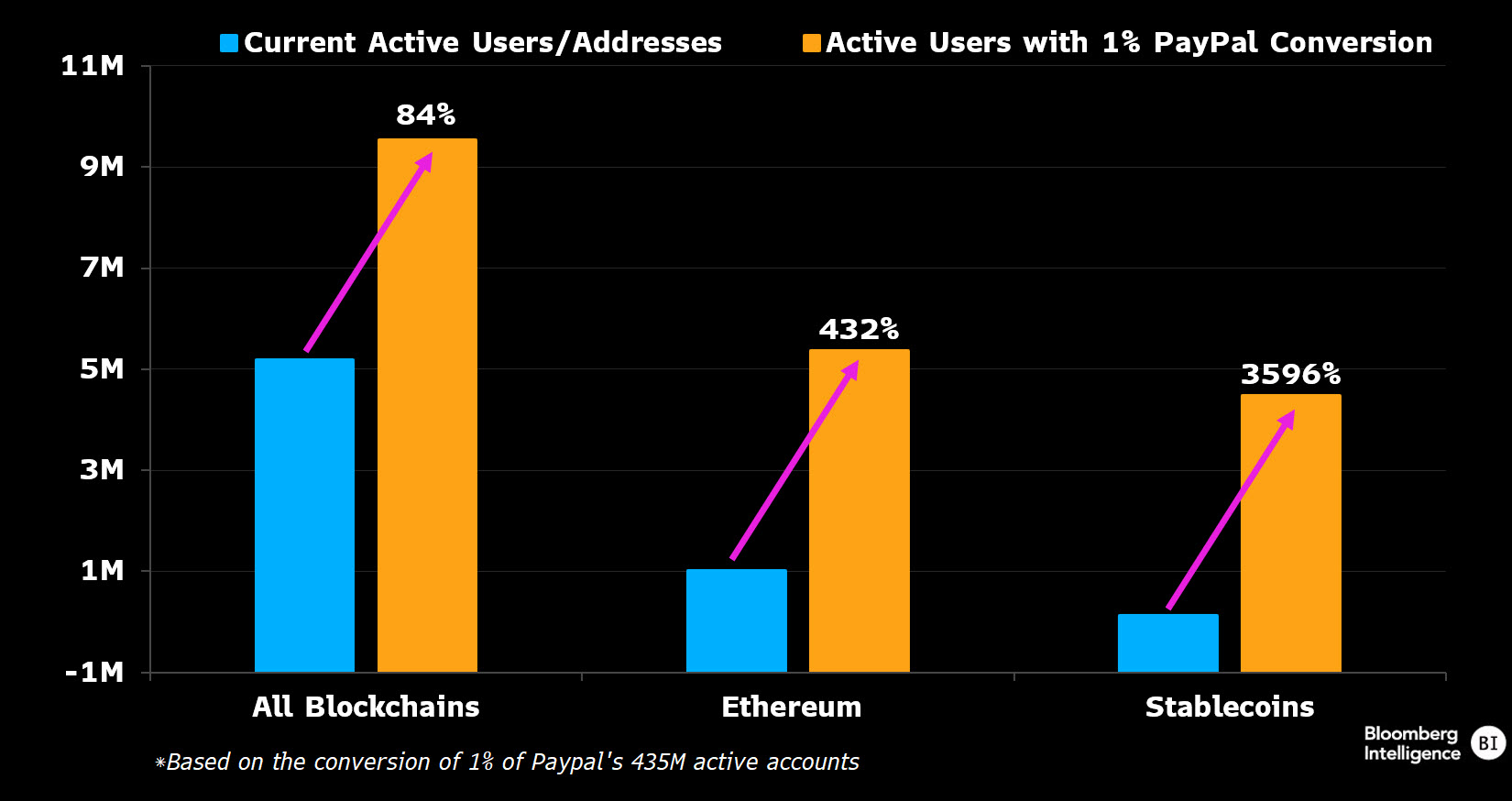

PayPal is one of the earliest and most successful internet financial services companies with 430 million users and 29 million merchants, PYUSD will gradually be rolled out to this entire user base. This provides an exciting opportunity for crypto asset adoption in terms of exposure, reach and user experience. The chart below demonstrates just how significant this user reach could be for the industry, a 1% conversion rate of PayPal users would result in massive increases in adoption of crypto as a whole.

Source: Bloomberg Intelligence

What’s in it for PayPal?

The two main motivations for PayPal in creating PYUSD are:

- Profit. Tether Holdings reported a $1.48 billion net profit in just the first quarter of 2023, demonstrating the immense profitability potential of stablecoins.

- Increasing payment efficiencies and remaining competitive through innovation. Chief Executive Officer Dan Schulman stated that “The vision over time is that this becomes a part of the overall payments infrastructure,“. Up until now, the utility of stablecoins has mostly been their ability to move and keep assets in the crypto asset ecosystem, rather than real world payment opportunities.

Why did this announcement not move the market?

It may be surprising to avid crypto supporters that this announcement did not have a large impact on crypto asset prices, even when the stablecoin is to be built on the Ethereum blockchain. Some reasons why this did not have a short term impact include:

- In a deep bear market, news has less effect on the market due to the lack of short term market speculators;

- The short term impact of the stablecoin is hard to predict as initial announcements were quite vague;

- There is no shortage of stablecoins already in the market, PYUSD is mostly targeted at a retail payment solution and crypto native market participants are not necessarily excited by this use case; and

- While PYUSD is built on Ethereum, the stablecoin will likely have limited utility outside of the PayPal ecosystem to start with, meaning less value accrual to Ethereum.

PayPal has long been viewed as a trusted and respected player in the FinTech industry, their move into the stablecoin industry will have a favourable impact on the public perception of crypto assets. We are only at the beginning of this process and PayPal will not risk reputational damage by rushing the rollout and adoption of PYUSD, we believe the greatest effects of PYUSD will be noticed over the medium to long term.