categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Pocket Network Investment Highlight

by Matthew Harcourt

Pocket Network is quickly establishing itself as a core part of Crypto and Web3 infrastructure. Before Pocket Network, the builders of decentralised applications (dApps) and wallet providers had no choice but to use centralised providers for critical infrastructure services. The infrastructure service that Pocket Network provides can simply be described as ‘fetching real-time data from a blockchain’. DApps, users, and wallet providers can now opt out of using a centralised provider like Infura for this real-time data and instead use Pocket Network’s decentralised network of node operators. The benefits of this decentralised alternative will be explained throughout this post.

The Centralisation Problem

As active investors in crypto assets, we are constantly looking for decentralised solutions to the problems that centralisation can cause. The current sector, Infrastructure-as-a-Service (IaaS), has been dominated by a centralised entity called Infura for the past five years and is ripe for disruption. Infura, a subsidiary of the blockchain technology solutions conglomerate ConsenSys, provides developers with the tools and infrastructure to alleviate the burden of running their own ‘data feeding’ tools so that they can instead focus on building their applications. The most popular crypto asset wallet, Metamask, is another product in ConsenSys’ product suite.

While Infura has played a vital role in enabling the development and function of DAaps on Ethereum and other smart contract platforms, it has encountered several issues over the past 24 months. These issues include several outages due to the increasing demand for bandwidth across blockchain ecosystems, and their involvement in censoring certain users from accessing their Metamask wallets.

In November 2020, Infura lagged behind the rest of the Ethereum node network by not updating to the latest node client and subsequently suffered a significant outage. This shouldn’t have even come close to impacting the wider network; however, because of Infra’s scale and importance, the event caused the Ethereum blockchain to fork. As a result, forked exchanges halted deposits/withdrawals, and the popular wallet, MetaMask, could not be used. While the issue was resolved without any lasting problems, it highlighted some of the issues surrounding Ethereum’s overdependence on large centralised infrastructure services providers such as Infura.

Infura and Metamask also came under fire in March of this year when they accidentally blocked Venezuelan users from accessing their digital wallets. The outage of these wallets occurred when Infura changed specific settings too broadly by applying certain geoblocks after the US had announced new sanctions due to the ongoing conflict between Russia and Ukraine. The Venezuelan geoblocks were accidentally included in these setting updates leaving many Venezuelan users locked out of their digital wallets. Events like these draw attention to the flaws of a centralised service provider and the tremendous power that Infura possesses in the IaaS market. We believe dAaps and their smart contract builders will elect to utilise products that can offer 100% uptime and censorship-resistant solutions within the IaaS space. These are two features that are core to Pocket Network’s value proposition.

Pocket Network Explainer

Pocket Network is a blockchain data ecosystem for Web3 applications. It is a platform built for applications that use cost effective economies to coordinate and distribute data at scale. Today, the Pocket Network distributes data feeds to numerous dApps across 40 networks, including Ethereum, Polygon, Solana, Algorand, and Harmony. These data feeds are vital to the functionality of the dApps. They include any relevant information on a blockchain a certain dApp may require. For example, MyCrypto, a crypto asset wallet provider, will use Pocket Network to retrieve token prices, ticker symbols, contract addresses, gas prices, and other data.

Pocket Network’s tokenomics and consensus mechanisms are based on a Proof-of-Stake model, ensuring the data it relays is decentralised, and node operators are sufficiently incentivised. Today it has approximately 40,000+ nodes, which compute an average of 3 billion weekly relays to dApps across 40 networks seamlessly and securely.

Apollo Investment

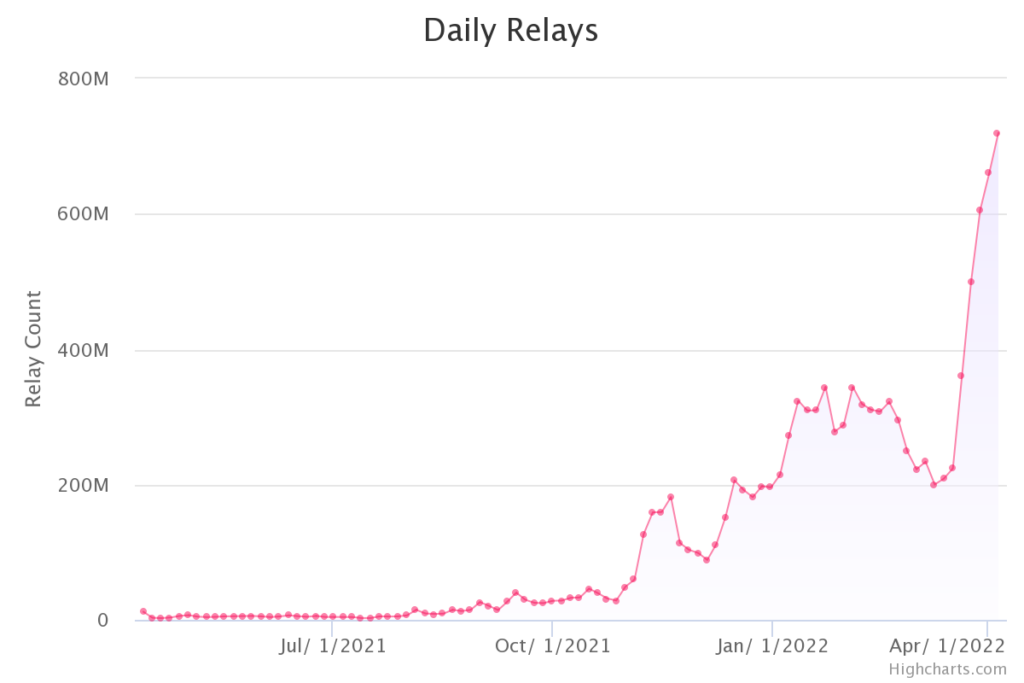

Following the fork caused by Infura in November 2020, we first spoke with Pocket Network Co-Founder and CEO, Michael O’Rourke, in January 2021. At that time, the network had averaged 23.25 million relays each week for the previous month and there were less than 1000 nodes on the network. In contrast, Infura was processing around 2 billion relays/API calls per day. Pocket Network had been quietly in development for over three years before we first spoke to the team. On the surface, it was hard to see the progress made over these 3 years due to the relatively low relays/API calls. However, after digging deeper, it was clear to us that Pocket Network had the potential to really shake up the sector. In February 2021, we proceeded to buy POKT tokens directly from the Pocket Network team for US$0.12 each, subject to a 12-month lock-up.

Following our investment, Pocket Network continued to be relatively underutilised and not very well known for a number of months. However, the network started to see increased traction and utilisation in Q4 2021 as the team added support for alternative Layer 1 chains such as Solana, Avalanche, Algorand and many more. In the four weeks from 22-2-2022 to 24-3-2022, the Pocket Network averaged 1.738 billion relays per week with 37,820 nodes participating in the network. This represents a 74.75 times increase in weekly relays from 14 months earlier.

In the middle of January 2022, the POKT token began trading on popular centralised exchanges; naturally this added to the excitement and hype surrounding the protocol. While the price chart below may not look favourable, the current valuation of POKT is an impressive US$918 million and significantly higher than our US$0.12 entry price. After seeing the network gain a level of traction, we directly purchased an additional tranche of POKT in December 2021 and began setting up staked nodes to increase our support for the network.

Apollo Node Operations

Operating a Pocket Network node requires a certain amount of POKT to be staked and a reasonable level of maintenance even with automation. In return for operating these nodes, we are rewarded with additional POKT in the form of both inflationary rewards and rewards driven by underlying network activity. Inflationary rewards refers to newly minted POKT; this increases the circulating supply of POKT and can have a negative impact on price if demand remains equal.

Our nodes currently represent 0.41% of the total network, this strategy is estimated to be generating a variable yield of around 100% APR on our total POKT staked. Apart from the minimum capital requirements, the main barrier to entry for running a node is the actual setting up of the nodes. We have leaned on the expertise of our in-house developer to activate and maintain these nodes.

Apollo Capital is proud to be supporting the Pocket Network as early investors and node runners. We are strong believers in the power of decentralisation and view Pocket Network as the key piece of the Web3 infrastructure required for blockchains to take another step towards complete decentralisation.