categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Pump.fun Soars to Success

by Quinn Papworth

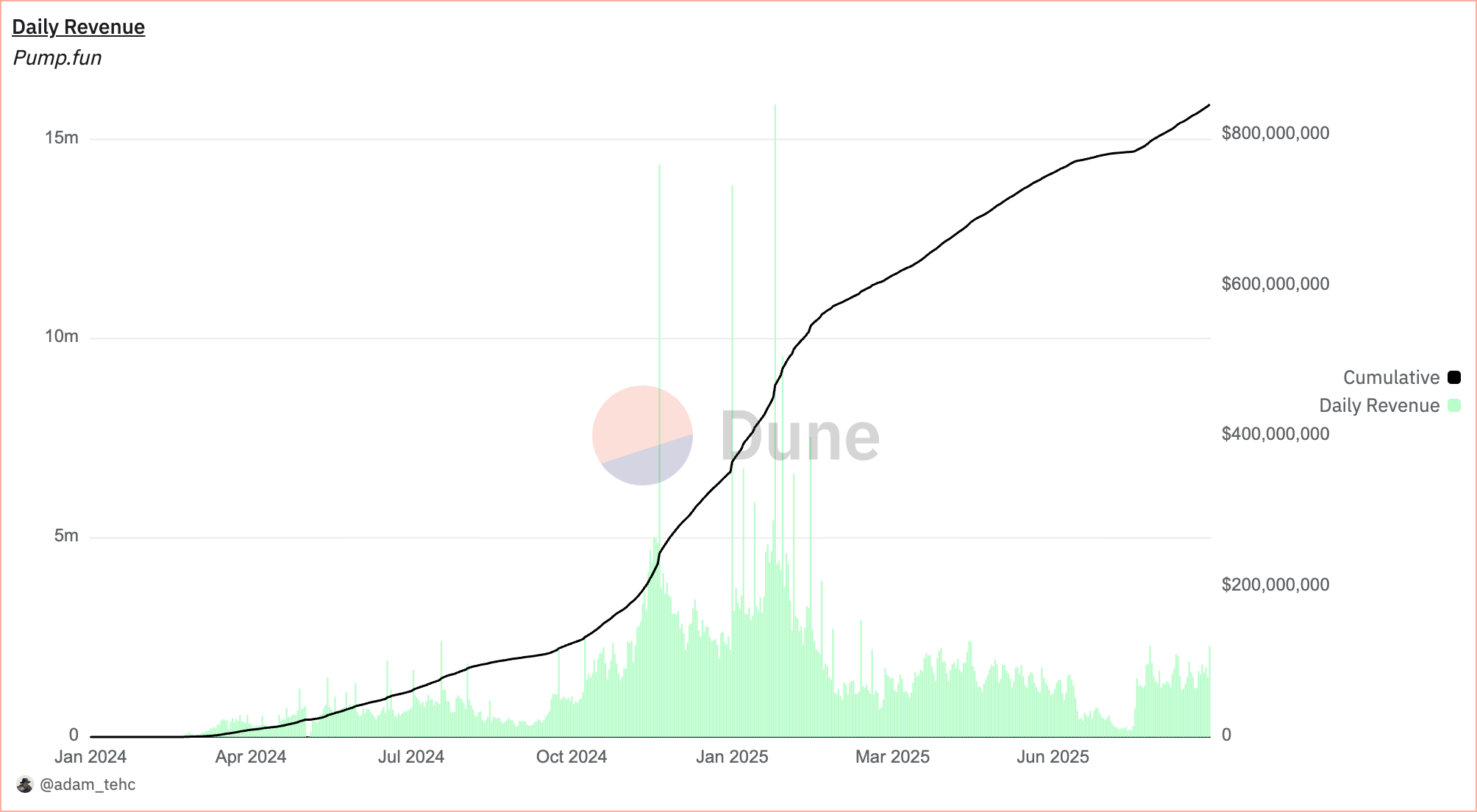

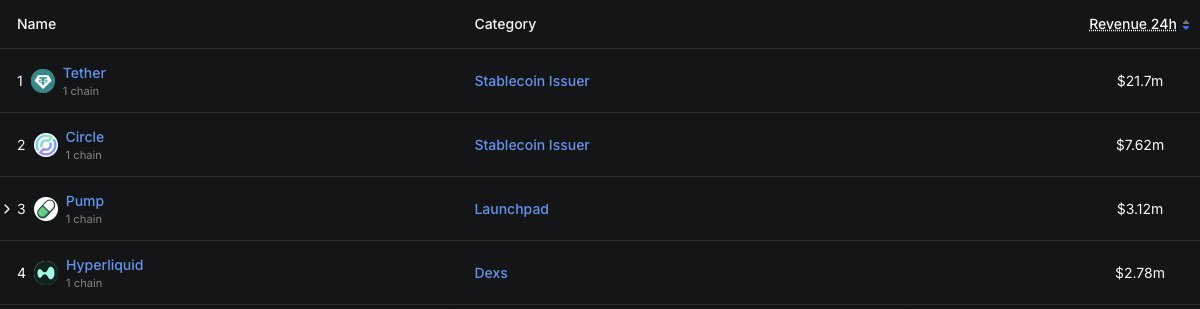

Since its launch in January of 2024, memecoin creation platform, pump.fun, has generated more than US$841 million in lifetime revenue. Recently the platform has been capturing significant amounts of attention following the launch of its ‘project ascend’, a major update introducing a dynamic, tiered creator fee for token creators. This update has driven a substantial amount of attention as streamer activity on the platform has increased. In the last 24 hours alone the protocol has recorded more than US$3.1 million in daily fee revenue placing it as a leader among revenue generating crypto protocols.

What is it and how does it work

Pump.fun offers a unique launchpad platform for creating and launching coins, emphasising fairness with no pre-sales or team allocations. Users can launch a coin instantly for under $2 with a single click. Unlike traditional order books, Pump.fun utilises a bonding curve to determine token prices, rewarding early investors as demand increases. When a coin reaches among the highest current market caps on the site, it achieves “about to graduate” status and is prominently featured on Pump.fun’s front page, boosting its visibility and growth.

Once a coin’s market cap hits US$69,000 it loses bonding status and ‘graduates’ to a traditional AMM, US$12,000 in liquidity is deposited into a PumpSwap AMM and burned. This transition to a DEX pair on PumpSwap often results in a significant increase in trading volume, as the coin becomes accessible to a broader market beyond Pump.fun’s initial bonding curve participants.

What’s Driving Pump.fun’s Success?

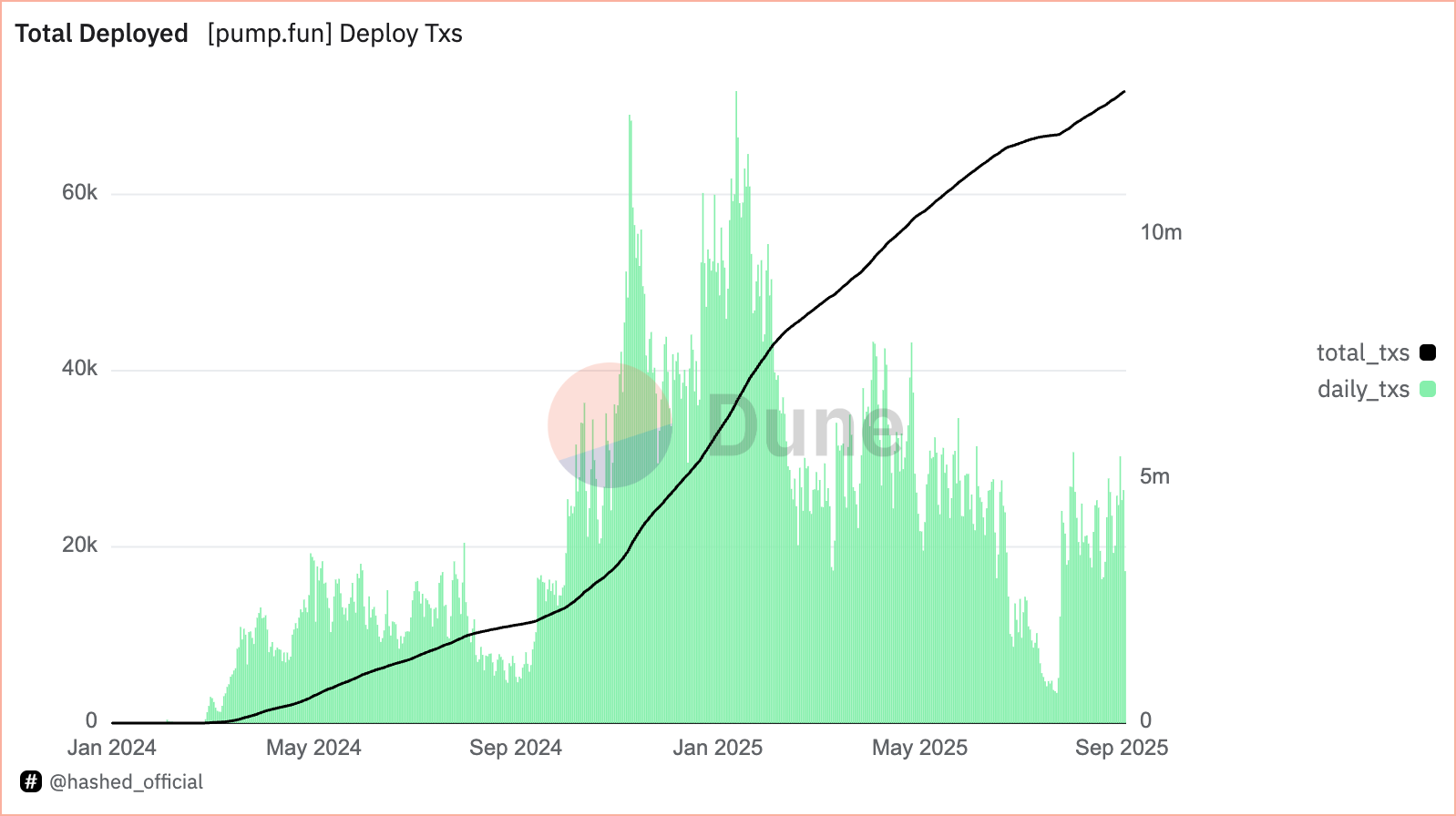

The platform has seamlessly tapped into the existing memecoin culture that exists on Solana, offering a product-market fit that appeals to speculators seeking a more transparent and fair investment process. By also significantly lowering the barriers to creating a memecoin, Pump.fun has facilitated the creation of over 12.9 million coins to date, driving a substantial increase in on-chain displays of culture, because of this speculative interest has followed.

This ease of access and fair approach has resonated with the memecoin community, fueling the platform’s rapid growth and traction. This is in stark contrast to previous opacity around memecoin launches where pre-sales would occur through twitter posts with only a contract address available for sending funds. All one has to do is remember the Slerf incident to see how much of an improvement a platform like pump.fun really is.

A Better Alternative for Content Creators?

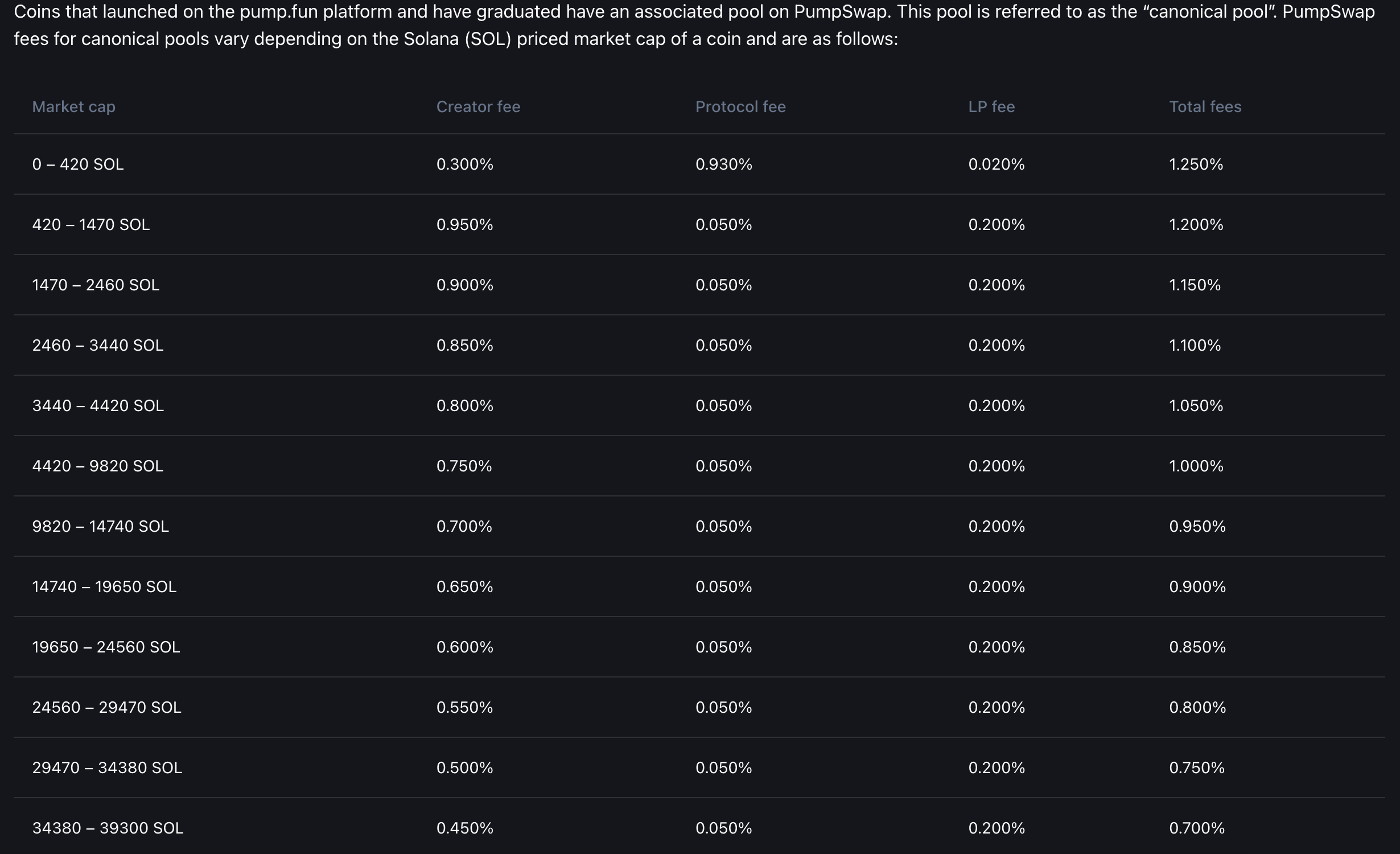

Following the launch of ‘project ascend’, pump.fun token creators have seen significant improvement in creator rewards with the roll out of the tiered creator reward fee structure on pump.fun’s AMM PumpSwap. What this means is that creator Fees are tiered by market cap, meaning that the higher the market cap of the coin, the lower the Creator Fee.

This fee structure has given rise to livestreamers migrating to the pump.fun platform and using the platform’s native livestreaming functionality in order to better monetize their content, on Sep 15 the pump.fun platform paid out over US$4 million in creator rewards.

The results of this have been extraordinary to witness with many crazy individual stories of creators making significant rewards after just one stream. One such amusing example is the story of Oscar (GoPro Cat) which is a live stream of a GoPro attached to a cat. The stream creator has raked in more than US$77k in just one day from creator rewards as viewers have speculated on the token.

Resultantly these types of stories have created a whirlwind of creators flurrying to the website in order to try and cash in on the significant creator rewards and has created many entertaining viral moments. While I expect the creator rewards for the average streamer to decrease as more content creators come to the platform and it becomes more competitive, it does pose the question, does pump.fun sit as a legitimate threat to the existing livestreaming platform titans such as Twitch and Kick by offering better monetization of content? According to pump.fun co-founder, Alon, the platform has already taken 10% of Kick’s market share as measured by concurrent viewers on the platform.

For the first time in the history of live streaming, pump.fun offers a stark difference in how viewers can interact with the streamer through tokenisation. In traditional streaming models, creators are able to monetize their content through two avenues: ad revenue and subscriptions (a monthly fee, typically $5, a user can pay to get rid of ads while watching the chosen streamer and support them). Pump.fun offers a new way to monetize through a token, this entirely changes the viewer experience as they can now speculate on the streamer’s growth and be rewarded for being an early fan. This allows users to speculate on the growth/entertainment value of their favourite streamers and receive financial incentives for doing so, all the while content creators are raking in more money than they ever could in traditional livestreaming models. This takes the viewer from a passive supporter to actively being part of the story.

Because of this we are seeing significant interest from both streamers and viewers in the pump.fun platform and I think we will continue to see growth for the platform until its live-streaming ecosystem matures and reaches equilibrium as more creators onboard and the environment becomes more competitive.

Criticism of the Pump.fun Platform

Despite its design to reduce the risk of rug pulls, Pump.fun faces criticism for being a breeding ground for scams by sophisticated market actors. Insiders have developed a framework to exploit the bonding curve structure, engaging in pump-and-dump schemes. The typical scenario unfolds as follows:

- Multiple wallets snipe newly launched coins, buying a significant portion of the supply (3-7%) at a low point on the bonding curve, artificially inflating the price.

- The coin garners interest on the Pump.fun website and reaches “about to graduate” status.

- As the bonding curve nears 100% of the $69,000 market cap and excitement is peaked, insider wallets simultaneously sell their tokens (often around 20% of the supply), causing the coin’s value to plummet as speculators panic sell.

This cycle undermines the platform’s intended fairness and transparency, highlighting a critical vulnerability.

Is Streaming Sustainable on the pump.fun Platform?

In addition to some of the inherent flaws that come with a fair launch platform as outlined above it does need to be asked whether the current level of streaming is sustainable. One key risk to pump.fun acquiring longterm market share in the live streaming industry is whether they can acquire some of the largest streamers. This could be problematic for the platform as it could play out that many of the largest streamers would be unwilling to touch pump.fun due to fear of reputational risk or backlash if the token experiences significant volatility/gets dumped and many viewers lose money. Another issue from this angle is that many of the largest streamers sign to platforms in exclusivity deals on multi year timeframes, as of right now it is unclear if pump.fun is exploring such avenues.

Another issue that could be encountered is related to the tiered creator reward fee structure. Skeptics argue that token creators are incentivised to keep the market cap low by selling tokens in order to capture more fees. However personally I think this will become a non-issue and viewers will be put off by such extractors over time, trying to actively grow your community as a creator in good faith will result in more long term fee capture and the greatest outcomes.

What Does This Mean for the pump.fun Token?

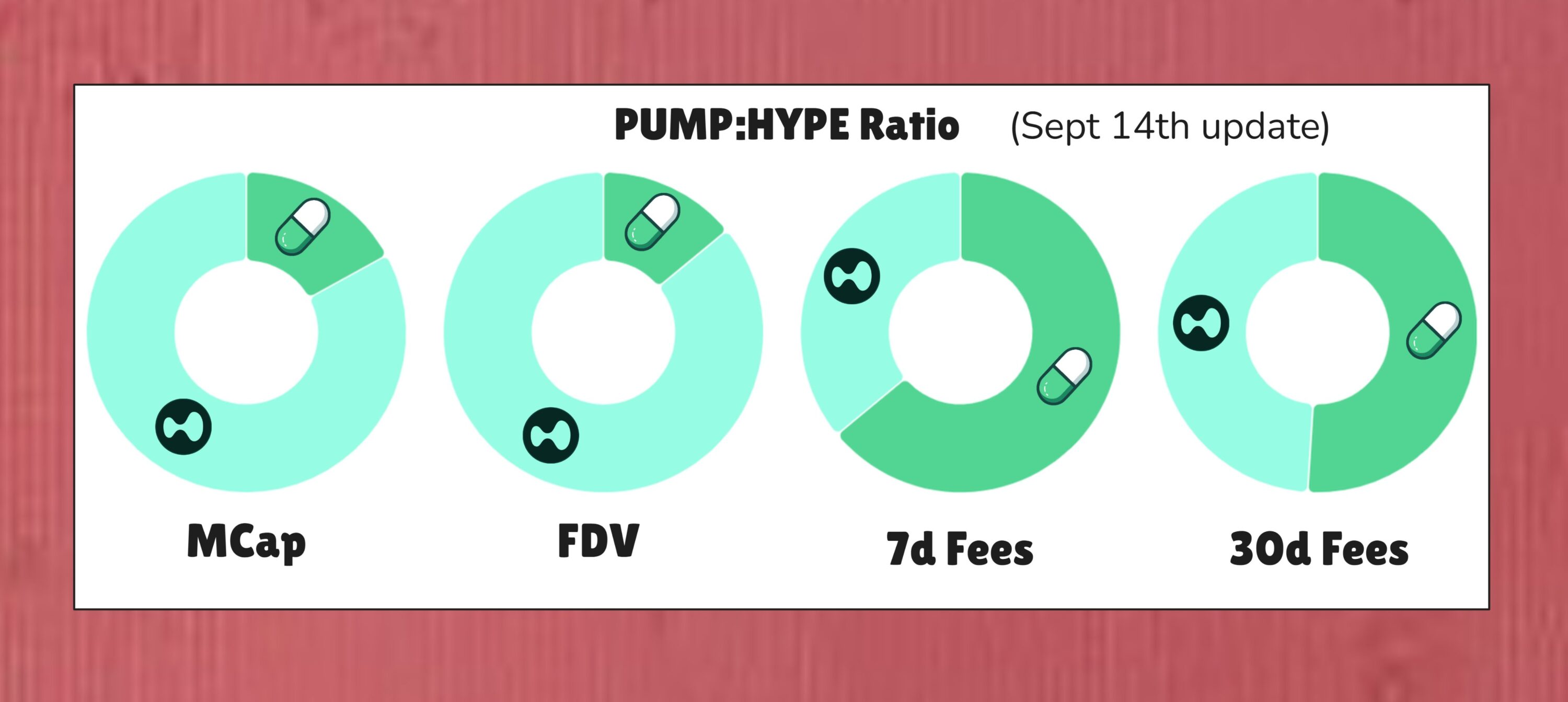

So you’re probably asking yourself, so what? Why should I care about the growth of the pump.fun platform? On July 15, 2025, the PUMP token was launched, finally offering investors direct access to the growth of the platform. Following the lead of Hyperliquid the pump.fun team have decided to use 100% of their daily revenue to buy-back the PUMP token on the market. As such this provides strong value accrual to token holders and has seen more than US$97 million PUMP purchased since the token’s launch two months ago, effectively offsetting 6.67% of the circulating supply. Recently we have seen the 24h revenue for pump.fun actually flip that of Hyperliquid and it has raised the question over whether the PUMP token is undervalued.

As of the time of writing PUMP currently sits at 20.62% of HYPE’s market cap and 15.77% of its fully diluted valuation. This is despite pump.fun leading in 7 day fees accrued and having slightly more fees over the 30 day timeframe. This raises the question that if pump.fun is able to hold on to its recent activity and continue its growth story is it being severely undervalued by the market? The pump.fun team currently sit on a roughly US$2 billion dollar treasury allowing them to push the limit of their product and find ways to continue their growth. Could we be seeing the emergence of a dominant new token in the era of buybacks?

Disclaimer: Apollo Crypto holds PUMP

This report (‘Report’) has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security of financial product or service. This Report does not constitute a part of any Offer Document issued by Apollo Crypto Management Pty Ltd (ACN 623 059 227, AFSL 525760) or Non Correlated Capital (ACN 143 882 562, AFSL 499882), the Trustee of the Apollo Crypto Fund. Past performance is not necessarily indicative of future results and no person guarantees the performance of any Apollo Crypto financial product or service or the amount or timing of any return from it. This material has been provided for general information purposes and must not be construed as investment advice. Neither this Report nor any Offer Document issued by Apollo Crypto or Non Correlated Capital takes into account your investment objectives, financial situation and particular needs. The information contained in this Report may not be reproduced, used or disclosed, in whole or in part, without prior written consent of Apollo Crypto. This Report has been prepared by Apollo Crypto. Apollo Crypto nor any of its related parties, employees or directors, provides and warrants accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. You should obtain a copy of the Information Memorandum, issued by Non Correlated Capital before making a decision about whether to invest in the Apollo Crypto Fund.