categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Rewriting the Protocol of Society

by Henrik Andersson

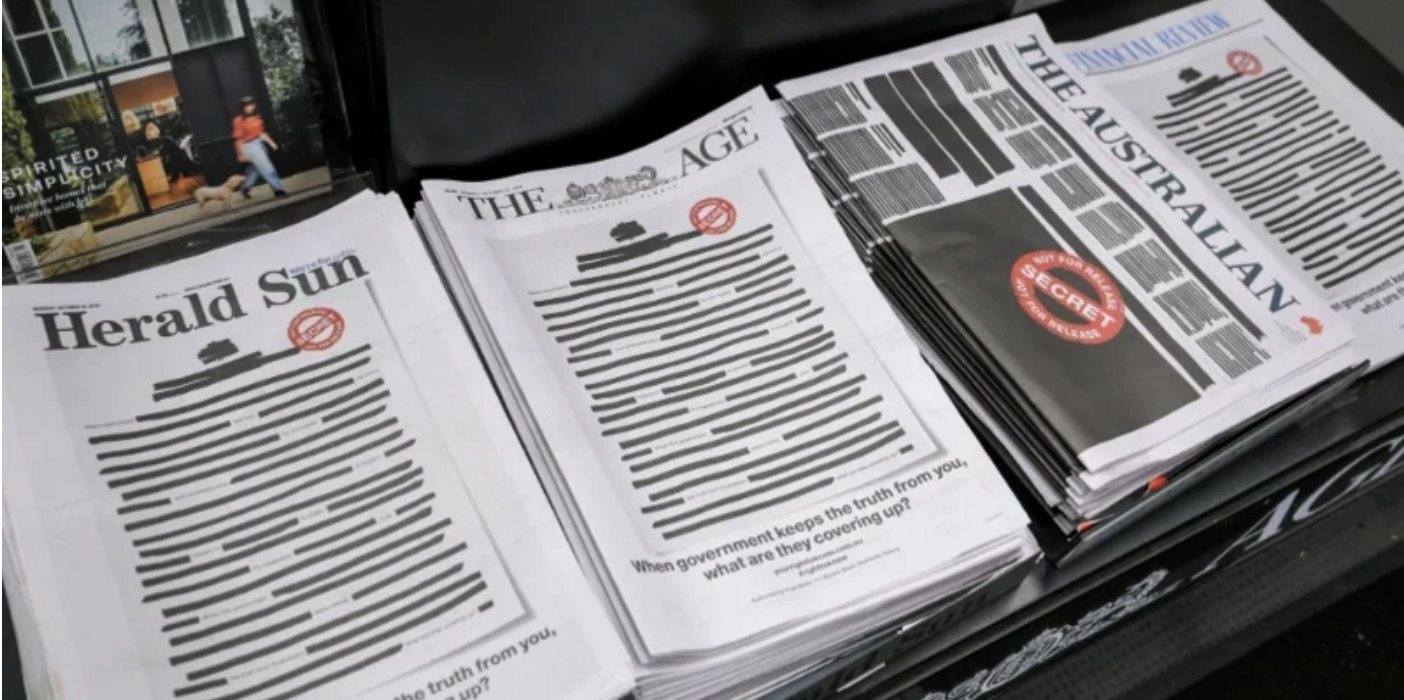

Front page of Australian newspapers October 21, 2019

In Computer Science a protocol is a specification of the rules of a communication system — it’s a foundational standard that we can lean on and build more complex applications on top of.

In Western democracies, the fundamental rights, or put another way, the protocol of a society is enshrined in its constitution. The United States is well known to have strong protections for press freedom and free speech in its Bill of Rights. Likewise, many other democracies such as Britain and Sweden have strong protections for free speech. Australia is the Western democracy standing out in this regards, and not for a good reason. Australia is without strong press freedom or free speech protected by its constitution. In fact, recent years have seen a deterioration in that regard. We have recently seen a journalist and a news agency being raided by the federal police, an ATO whistleblower is facing jail time, a gag order put on media in relation to the Catholic cardinal sexual abuse case, and perhaps the most systematic dangerous of them all, an encryption bill weakening our communications. This is what the press is protesting about in Australia by for one day censoring their first page.

Protocols are really hard to change — they’re in fact designed that way for a good reason, and sadly we don’t see strong protections coming to Australia anytime soon.

Richard Buckminster Fuller was an American architect, systems theorist, author, designer, inventor, and futurist.

However technology can perhaps provide some remedy. Below are some example of where cryptography is able to provide civil liberties independent of where in the world you happen to live.

1. Secure Communication

The cypherpunks, a movement started in the late 1980s., aimed to achieve privacy and security through proactive use of cryptography. Their manifesto reads: “Privacy is necessary for an open society in the electronic age. … We cannot expect governments, corporations, or other large, faceless organizations to grant us privacy … We must defend our own privacy if we expect to have any. … Cypherpunks write code. We know that someone has to write software to defend privacy, and … we’re going to write it.”

They realised early on that technology can create a place of freedom, some new ground that others can’t infringe on.

With the help of cryptography such as end-to-end encryption we can communicate freely and no one can eaves drop or censor that communication. Cryptography is a unique technology in that it is many orders of magnitude easier to protect encrypted messages than to attack the same. This asymmetry is also what crypto assets depend on.

Out of this movement we got things like encrypted email. Cypherpunk and cryptographer Phil Zimmerman created a new protocol for secure email communication called PGP.

2. Secure Assets

For assets, crypto offers an alternative to today’s dependency on centralised institutions. These are opt-in immutable networks with strong protections against censorship.

Nick Szabo, leading crypto though leader and polymath, recently introduced the concept of deep safety to assets:

We can think of today’s assets in three layers:

-

Digital centralised — these have poor deep safety. Examples would be money in your bank account, shares held by your broker, or a Gold ETF. Digital centralised assets are totally dependent on the goodwill of centralised organisations or companies. That trust has been abused throughout history in many places of the world. Countries with strong protections on the protocol level such as the US have been successful in fulfilling this trust.

-

Physical assets — better deep safety. Examples Szabo provides above include Real Estate and Gold. Physical assets have been the best protection throughout history because they were the best alternative. However they have the severe flaw being dependent on un-secure physical locality and local transactions. It is fundamentally hard to protect something physical.

-

Trust-minimised crypto networks — unprecedented deep safety. Examples include crypto assets such as Bitcoin. Cryptography gives us unprecedented security, once we encrypt something and we do it properly, in a probabilistic sense it is game-over for the attacker.

3. Secure Contracts

With the rise of smart contract platforms like Ethereum, agreements can be made purely based on computer code.

Lending platform Compound currently has $153M of capital earning interest across 7 markets. Implemented correctly, the lenders on these markets are not dependent on the solvency of a single financial institution — instead security is coded in algorithms. It is trust-minimised in the sense that access and security is not in the hands of humans.

Decentralised exchanges use smart contracts to remove the third-party risk in trading. Depositing assets on a centralised exchange exposes you to counter-party risk as you give up direct ownership of those assets. With smart contracts we can trade in a trust-minimised way with minimal third party risk. This brings unparalleled security to trading.

Conclusion

The trust-minimisation of crypto networks means we can place less trust in organisations and fallible humans and instead use software to create digital bearer instruments, transfer value peer-to-peer and create other, more complicated contracts running purely on unstoppable software. This increases social scalability as we can trade and make agreements with anyone in the world without having to trust a third party. This is what we call the Trust Revolution:

While we don’t have much hope of a top-down movement rewriting the protocol of the society, by reducing the amount of trust we have to place in our current institutions in the first place, their importance is likely to decrease over time. Crypto brings us a glimpse of hope as more and more people are opting in to this new way of transacting offering permissionless financial freedom to everyone in the world.