categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

RWA Ecosystem Update

by Quinn Papworth

Why RWA Tokenization?

First it is diligent to ask the question, why are we interested in RWA tokenization in the first place?

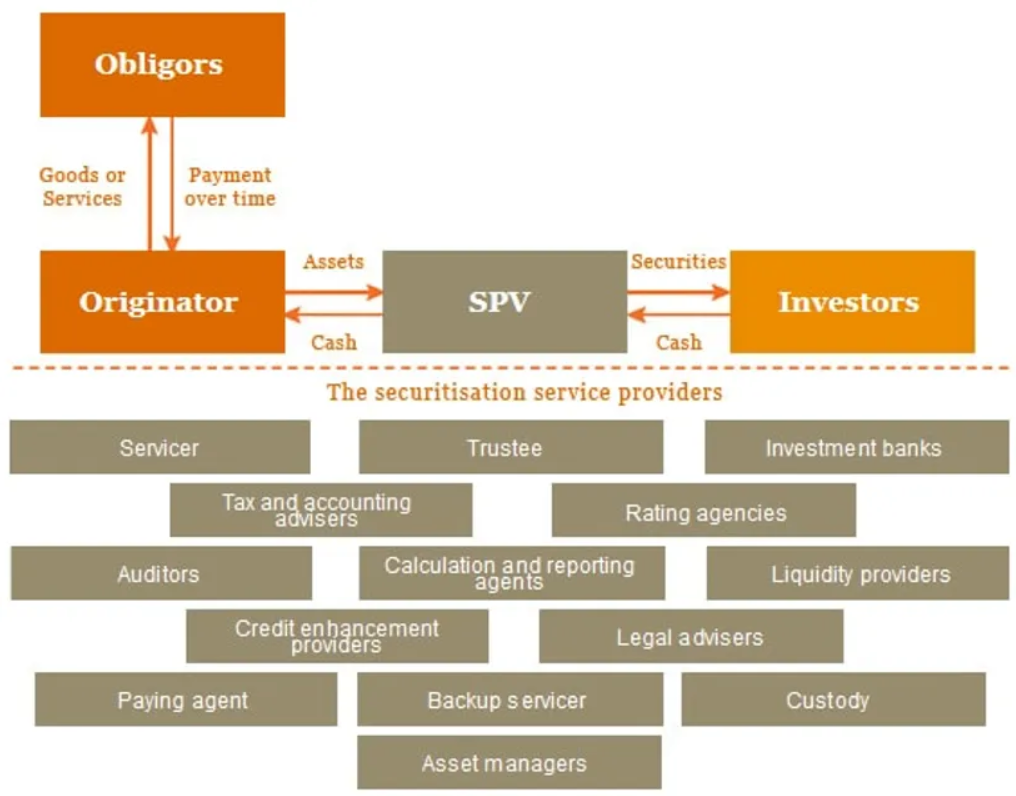

I find that the most compelling argument is that traditional securitization has simply reached its efficiency limits. In traditional finance, “if/then” decisions often rely on human judgment, leading to inefficiencies and information asymmetry. By contrast, trustless smart contracts can automate many of these decisions—reducing costs, enhancing transparency, and improving overall outcomes. This evolution strengthens the core principles of securitization: scale, liquidity, and targeted market access.

A fully on-chain RWA tokenization system has the potential to unlock global capital. It enables direct targeting strategies without relying on brokers, who may delay trades in pursuit of their own margins. Automation via trustless smart contracts to reduce overhead costs and streamlines the process of establishing trust—a costly endeavor in the current multi-intermediary system where too many hands are in the cookie jar taking a cut.

Moreover, enhanced transparency boosts regulatory compliance and reduces associated analytics costs. Ultimately this results in lower borrowing costs for end users and greater capital efficiency for liquidity providers. While marginal savings may seem modest on an individual level, their cumulative effect in large debt markets can stand to be substantial.

However, it’s important to note that unfortunately many RWA tokenization models today in their current form still run in parallel to traditional financial systems. This hybrid approach serves as a necessary bridge until strong regulatory frameworks allow for fully native on-chain securitization.

Growth of the Ecosystem

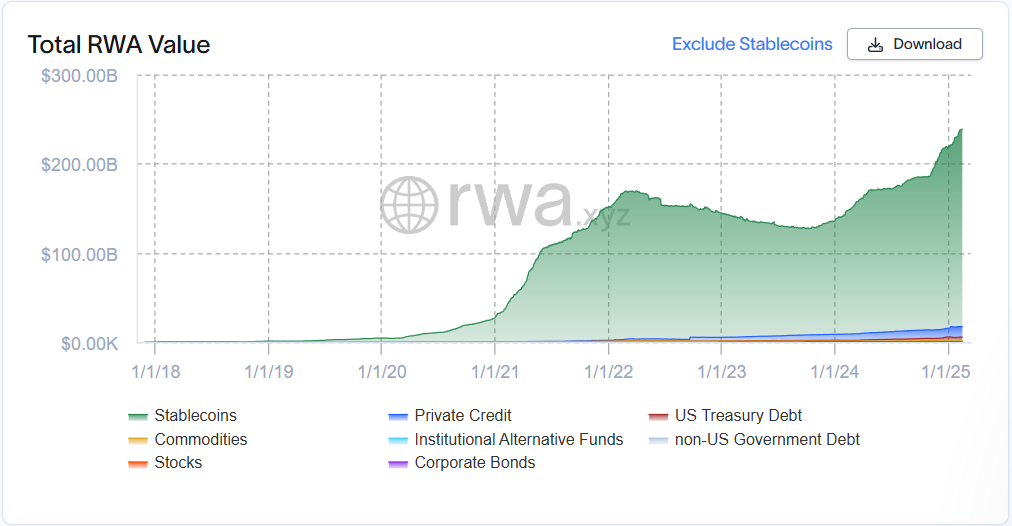

In 2024, the total RWA value—excluding stablecoins—increased by an impressive 79%, marking the most significant nominal growth year the sector has seen to date. When we zoom out and include stablecoins in the mix, the growth becomes even more striking: a staggering 5,300% increase over the past five years, driven largely by the expanding acceptance of stablecoins within DeFi.

Beyond just the value figures, the wider concept of RWA has captured significant mindshare over the last few years. A 2024 Coinbase Fortune 500 executive survey revealed that 70% of respondents are exploring stablecoin use cases, 86% recognise the potential benefits and 35% are already at least planning tokenization projects.

Current Landscape

At present, stablecoin issuers like Tether (USDT) and Circle (USDC) dominate the RWA landscape—a trend likely to persist as on-chain demand for the U.S. dollar intensifies with further financialization of blockchain technology.

Outside of stablecoins, a few category leaders are shaping the market:

- Ondo Finance: Specializing in tokenizing fixed-income products such as bonds, Ondo’s tokenized U.S. bonds are among its most popular offerings. The company recently announced a purpose-built blockchain to host institutional-grade, compliant RWAs, partnering with advisors from Franklin Templeton, BlackRock, PayPal, and Morgan Stanley. This initiative aims to resolve ecosystem fragmentation and offer native DeFi support—boosting both composability and capital efficiency.

- Tokenization Platforms: Leaders like Securitize and Superstate are making significant inroads by focusing on providing the architecture to tokenize institutional funds. As a result they provide access to a diverse range of investment opportunities—from credit and venture capital to private equity and crypto. For instance, Apollo Global recently launched one of its credit funds on the Securitize platform, joining other financial giants like BlackRock & Hamilton Lane.

One to watch:

- PrePO: PrePo is an Apollo Crypto early-stage investment set for a full launch in 2025, PrePO enables users to gain exposure to pre-IPO stocks through on-chain tokenized versions of the private stock. With tokenized access to companies like SpaceX, PrePO is democratizing investments to the wider public that were once exclusive to a select few. The team plans to expand its pre-IPO offerings further throughout the year into other highly demanded pre-IPO stocks. We are (with bias) watching the team’s progress with anticipation as they look to ramp up their offerings and distribution throughout the year.

Catalysts for Growth

2024 was a breakthrough year for RWAs, fueled by both industry and regulatory catalysts and this is continuing into 2025, some catalysts include:

- Institutional Momentum: Heavyweights like BlackRock, Citi, and Franklin Templeton ramped up tokenization efforts by converting institutional funds into digital assets.

- Regulatory Developments: Senate and House hearings on tokenization, along with supportive stablecoin bills and initiatives from payment giants like PayPal and Stripe, paved the way for greater on-chain activity. Global tokenization frameworks in regions such as Hong Kong and the Middle East further highlight this trend.

- U.S. Leadership: Key lawmakers, including House Financial Services Chair French Hill and Senate Agriculture Chair John Boozman, have emphasized the importance of maintaining U.S. leadership in crypto innovation. Industry figures like David Sacks have echoed these sentiments, urging the country to seize the inevitable digital transformation of financial assets.

- Policy Moves: Recent moves, such as the publication of a draft stablecoin bill in the U.S. House and the rescission of the SEC’s SAB121 by the Trump administration, signal a more welcoming regulatory environment. These steps not only facilitate greater bank involvement in crypto but also greatly increase the odds of tokenized RWA offerings. Additionally, the Trump admin banning the creation of CBDCs has been net positive for the industry as this allows stablecoin issuers to offer more heterogeneity to investors depending on their wants and needs.

Conclusion

Stablecoins continue to dominate the RWA tokenization space, capturing over 90% of the market share. Yet, other sectors—ranging from tokenized debt and commodities to institutional funds—are rapidly gaining traction as major players enter the arena. With influential voices like crypto czar David Sacks championing a “golden age in digital assets” and BlackRock CEO Larry Fink heralding tokenization as “the next generation for markets,” the stage is set for significant innovation and growth in the RWA ecosystem over the coming years under a deeply positive regulatory backdrop.