categories

All Categories

- Bitcoin

- Centralised Exchanges

- Crypto

- Crypto Asset Volatility

- Crypto Correlations

- Crypto Governance

- Crypto in the Portfolio

- Crypto Valuations

- DeFi

- ESG

- Ethereum

- Investment Highlight

- Regulation

- Security and Privacy

- Social Media Influence

- Stable Coins

- Traditional Finance and Crypto

- Uncategorized

- UNSDG

- Web 3.0

Authors

All Authors

Future of Crypto Wallets & Vultisig Investment Highlight

by Quinn Papworth

Traditional self-custody crypto wallets are integral to the core values of cryptocurrency, such as disintermediation, privacy, and self-sovereign control. Self-custody wallets empower users through direct ownership with the powerful benefits of:

- Increased security – Isolation of assets in separate wallets provides enhanced security compared to pooling of funds in a centralised exchange.

- Privacy – Users can maintain their privacy as they are not required to provide their personal details to a custodian.

- Zero counterparty risk – No reliance on a third party means immunity from exchange hacks, insolvency and other operational failures.

- Full access to DeFi – Self-custody wallets allow users to have full access to decentralised finance applications in a composable manner.

However, the current landscape of traditional crypto wallets still leaves much to be desired…

- Potential loss of assets with no recourse – Loss of private keys results in a permanent loss of funds and there is no recourse available in this event.

- Operational complexity & increased user responsibility – Managing a self-custody wallet involves additional operational complexity and security measures. This can become challenging and time consuming for retail users.

- Poor User Experience – The current crypto landscape can be fragmented requiring actions such as bridging and using multiple different types of wallet providers, this provides for a poor user experience. Performing simple actions across different crypto ecosystems can take a long period of time and introduce additional complexities to the user.

The Need For Change

The complexities and poor user experience of current wallets are a meaningful enough barrier that there is a need for significant change. It is currently too difficult for the general public to use wallets on-chain and this can make onboarding a laborious task. This friction currently serves as an inhibitory barrier to the growth of viral consumer applications and hampers crypto’s viral traction as a whole. As Jesse Pollak of Coinbase puts it, ‘the best onboarding is no onboarding’.

The Pioneering Wallet Solutions

Coinbase Smart Wallet

Coinbase’s smart wallet offers users an incredibly streamlined entry into the world of DeFi. Users can create a smart wallet in under 10 seconds by using a passkey as the private key, bypassing the traditional hassle of key management through using a seed phrase.

This means no storage of users keys but rather that the passkey itself is being validated for onchain signing of transactions. For those using iCloud or Google password managers, these passkeys are automatically backed up, remaining encrypted and secure.

Coinbase’s smart wallet, being a smart contract wallet, introduces several innovative features that enhance the user experience:

- Paymasters: These enable the sponsorship of gas fees through smart contracts, allowing for gasless transactions for users. This is a significant step toward reducing friction in DeFi participation.

- Transaction Batching: This feature allows multiple transactions to be bundled into one, streamlining processes such as decentralised exchange (DEX) activities. For instance, the ‘approve’ and ‘swap’ transactions can be executed as a single, efficient transaction.

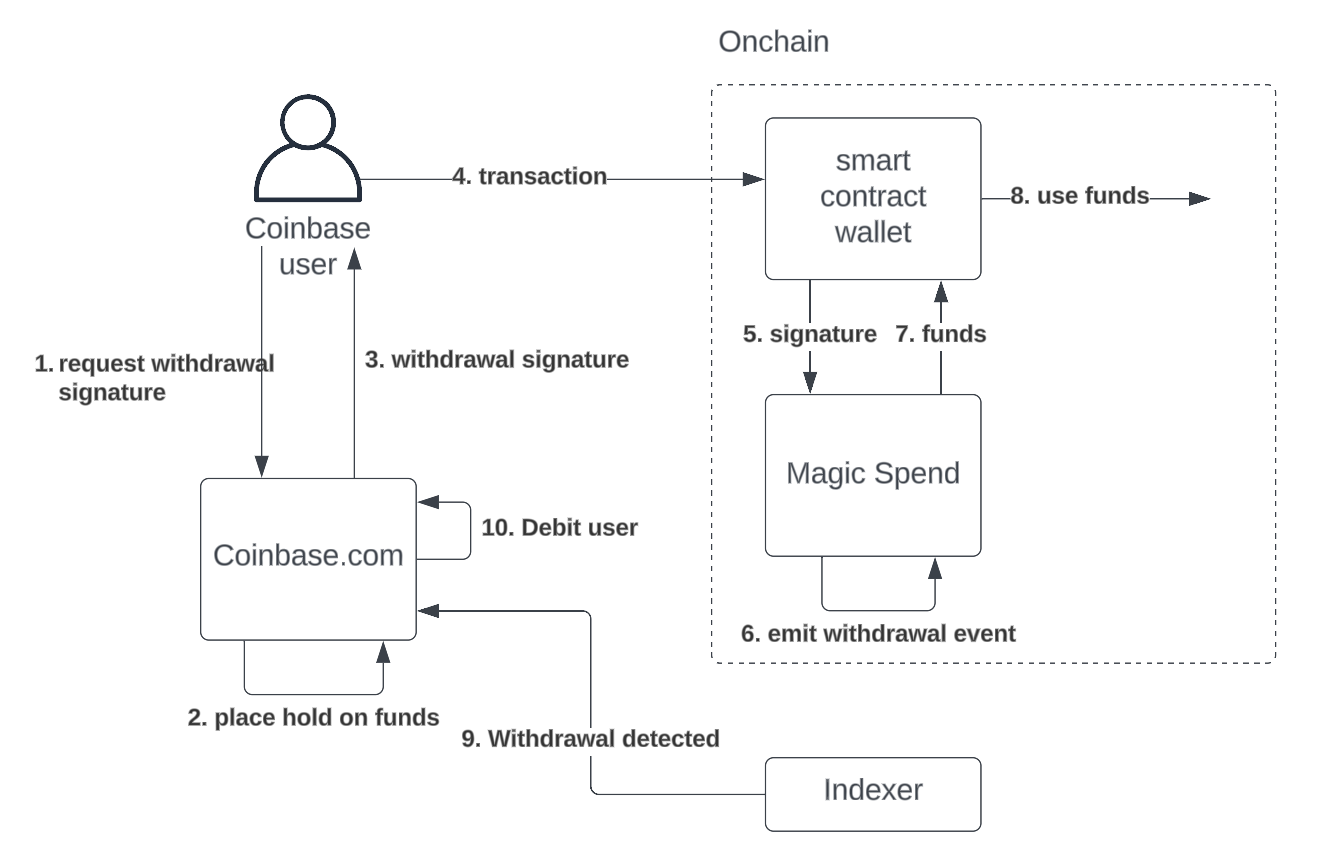

- Magic Spend: This functionality lets Coinbase users tap directly into their exchange balance (ETH) within the smart wallet, eliminating the need for manual transfers. It simplifies access to funds, making the DeFi experience more fluid and user-friendly.

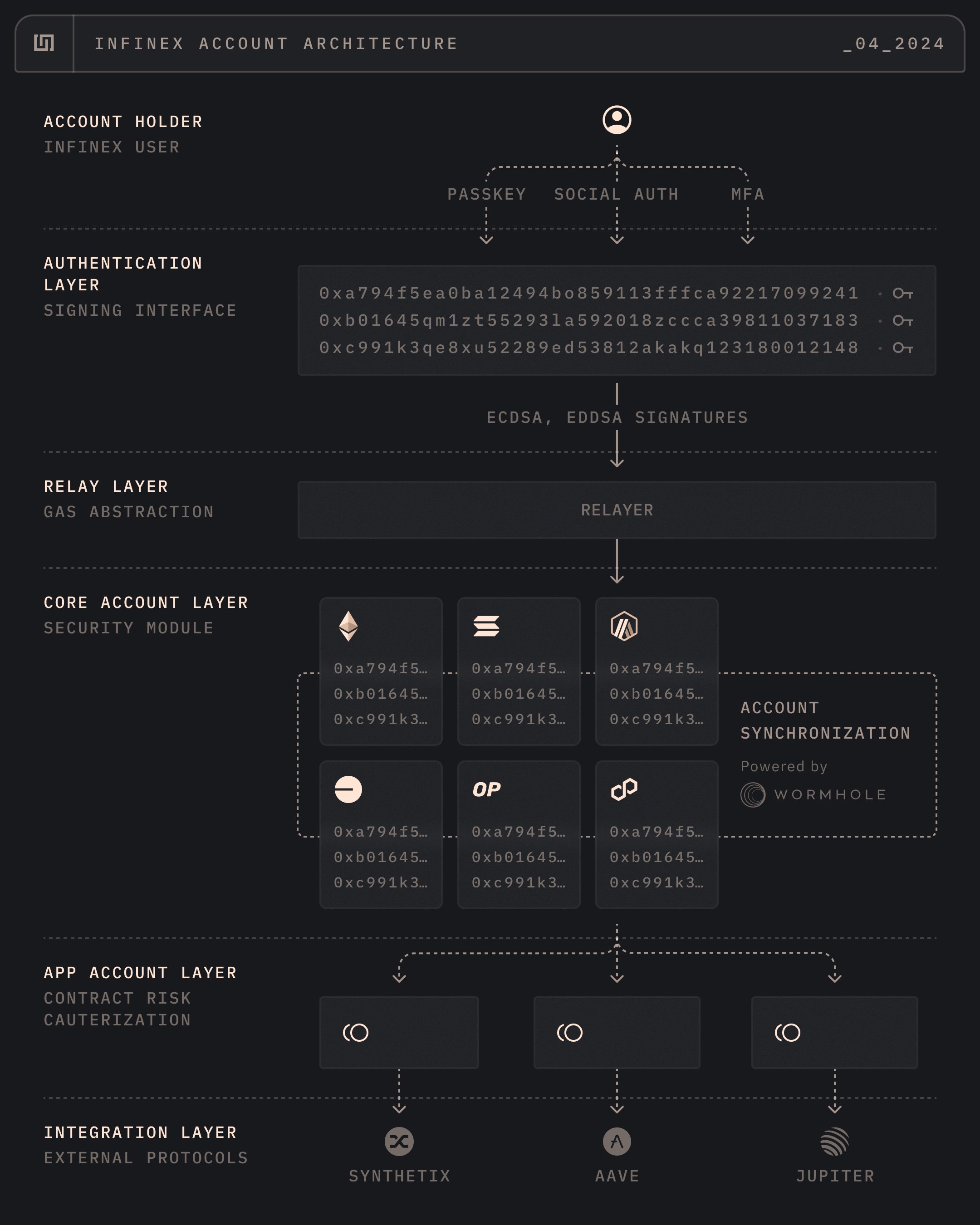

Infinex Account

Infinex positions itself as the safest gateway to DeFi, offering a unique approach to on-chain interaction. Through account abstraction, Infinex eliminates the usual hurdles of gas fees, wallets, bridging, and seed phrases, allowing users to access DeFi with unprecedented ease. In a similar fashion to Coinbase’s smart wallet, Infinex relies on passkey security, delivering a seamless, all-in-one platform for engaging with DeFi.

However, this streamlined experience comes with trade-offs. While Infinex simplifies the DeFi journey, it restricts users to a curated selection of protocols, meaning users are limited to interacting with a predefined set of DeFi options on the platform. This controlled environment enhances security and ease of use but at the cost of the broader, open-access potential that DeFi traditionally promises.

Vultisig – Apollo Crypto Investment Highlight

Vultisig, is a cutting-edge multi-chain and multi-platform vault that empowers users to turn their existing hardware devices—like laptops, iPhones, and iPads—into secure transaction signers. Leveraging threshold signature schemes (TSS), Vultisig removes the complexities of private key management through the use of vault shares and zero knowledge proofs offering best in class security while offering users redundancy and ease of use.

How Does Vultisig Differ From Traditional Multi-Sig (MS) Solutions?

- Unlike conventional MS setups, Vultisig does not store private keys within the vault shares, instead zero knowledge proofs are combined to generate a signature. This design significantly reduces the operational complexity of vault security due to no private key storage.

- Multi-sigs have a low level of redundancy as lost keys cannot be reshared and the funds will need to be migrated to another MS in order to maintain security. On the other hand Vultisig vault shares have high redundancy as they can be re-shared and reconfigured while remaining secure.

- Vultisig vaults are also fully compatible with DeFi, offering broader functionality than a standard MS, which often lack integration whatsoever with DeFi.

Why Choose TSS Over Passkeys?

- While passkeys have gained popularity for their ease of use, they come with inherent drawbacks. Passkeys depend on centralised authentication platforms run by major corporations like Apple, Google, and Microsoft, raising concerns over data transparency and potential privacy risks. Additionally, passkeys present a single point of failure, an attack on the device holding the private key can lead to a complete security compromise.

- Passkeys only use a single signature for authentication, this may be problematic as it means the device holding the passkey can become a single point of failure if attacked.

- Passkeys are not inherently designed for use across multiple chains due to their architecture, as such they provide less interoperability across different blockchain networks.

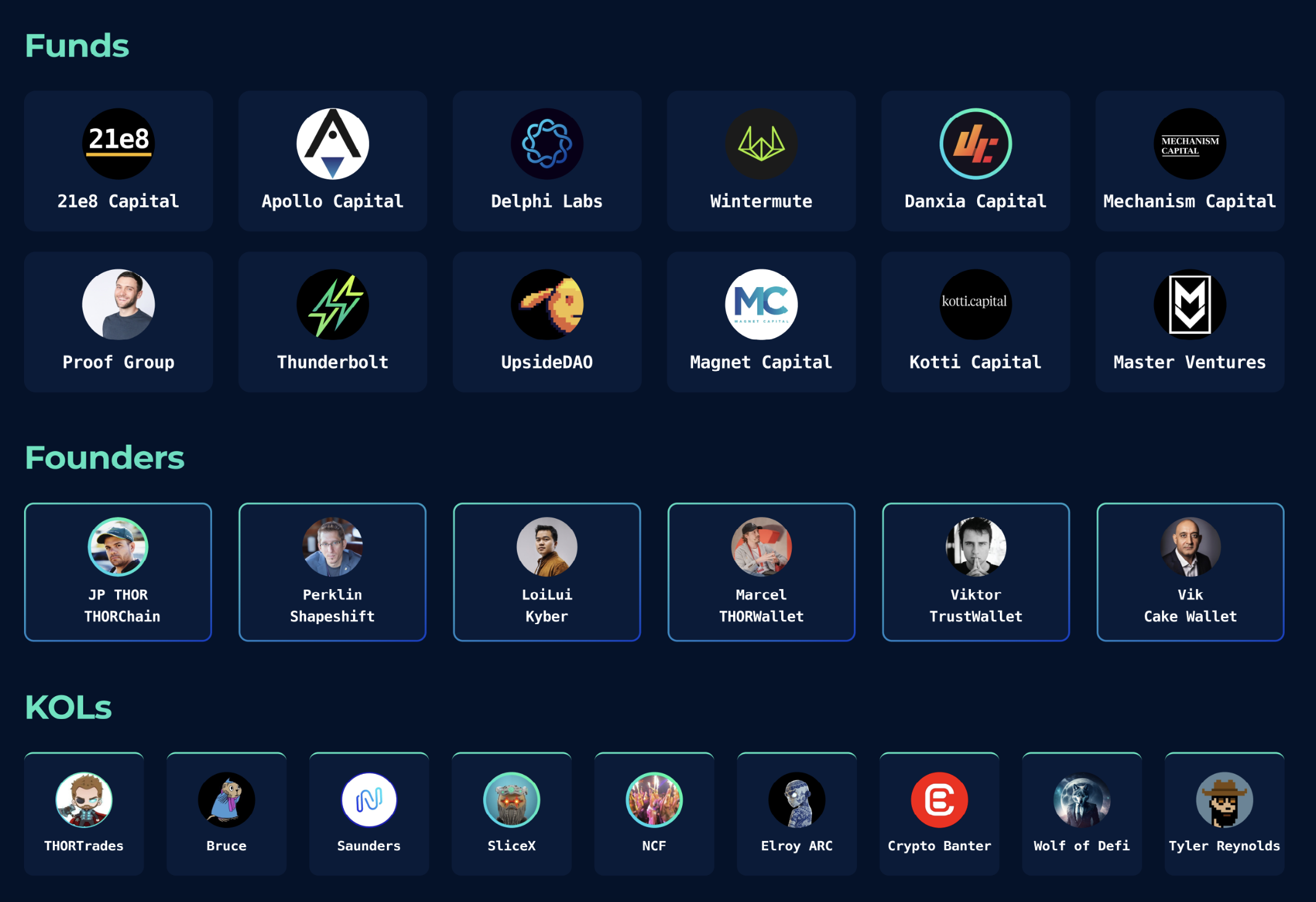

Apollo Crypto is pleased to announce we made an early-stage investment in Vultisig in May joined by other high profile investors. We hold high conviction in the project and its founder JPTHOR who has previously founded multiple successful crypto ventures including THORChain, which currently sits at a US$1.6 billion valuation. We believe Vultisig represents an improvement on popular multi-sig wallet Gnosis Safe (SAFE) and could therefore become a new standard in wallet security.

Moving Forwards

We anticipate continued growth in innovative non-custody solutions for crypto, with frictionless onboarding playing a crucial role in accelerating widespread adoption. Passkeys and threshold signature schemes (TSS) offer promising alternatives to traditional seed phrases, paving the way for sophisticated account abstraction where users may not even realise they are interacting on-chain. However, as non-custodial solutions like passkeys gain traction, it’s essential to elevate the conversation around ideal operational security practices. While security remains a cornerstone of discussion within crypto communities, it’s imperative that these considerations are extended to the broader public, especially as we continue to move deeper into a digital age.

Disclaimer: Vultisig is a portfolio holding of Apollo Crypto

This report (‘Report’) has been prepared for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any security of financial product or service. This Report does not constitute a part of any Offer Document issued by Apollo Crypto Management Pty Ltd (ACN 623 059 227, AFSL 525760) or Non Correlated Capital (ACN 143 882 562, AFSL 499882), the Trustee of the Apollo Crypto Fund. Past performance is not necessarily indicative of future results and no person guarantees the performance of any Apollo Crypto financial product or service or the amount or timing of any return from it. This material has been provided for general information purposes and must not be construed as investment advice. Neither this Report nor any Offer Document issued by Apollo Crypto or Non Correlated Capital takes into account your investment objectives, financial situation and particular needs. The information contained in this Report may not be reproduced, used or disclosed, in whole or in part, without prior written consent of Apollo Crypto. This Report has been prepared by Apollo Crypto. Apollo Crypto nor any of its related parties, employees or directors, provides and warrants accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. You should obtain a copy of the Information Memorandum, issued by Non Correlated Capital before making a decision about whether to invest in the Apollo Crypto Fund.